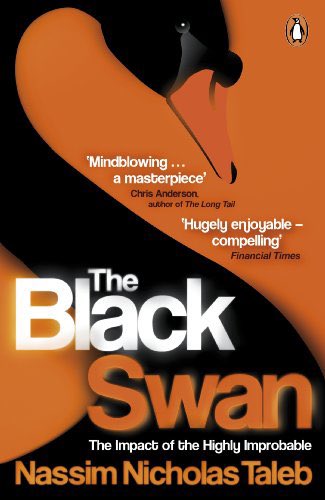

Nicholas Taleb popularized the concept of “Black Swan” in 2008.

What is a Black Swan (in a financial context) and what are two of the most famous black swans?

/THREAD/

What is a Black Swan (in a financial context) and what are two of the most famous black swans?

/THREAD/

1/ According to Nicholas Taleb, Black Swans have 3 main characteristics:

They are so rare that the probability of ocurrence is unknown

They are so rare that the probability of ocurrence is unknown

When they occur they have a catastrophic impact

When they occur they have a catastrophic impact

They are explained in hindsight as if they were actually predictable

They are explained in hindsight as if they were actually predictable

They are so rare that the probability of ocurrence is unknown

They are so rare that the probability of ocurrence is unknown When they occur they have a catastrophic impact

When they occur they have a catastrophic impact They are explained in hindsight as if they were actually predictable

They are explained in hindsight as if they were actually predictable

2/ The most recent black swan event is obviously the Coronavirus pandemic which caused the following declines:

• S&P500 fell 27.3%

• DJIA fell 36.4%

• Nasdaq fell 30.1%

Markets have fully recovered and people are predicting a bubble (surprise!)

• S&P500 fell 27.3%

• DJIA fell 36.4%

• Nasdaq fell 30.1%

Markets have fully recovered and people are predicting a bubble (surprise!)

3/ Another Black Swan ocurred in 2001 with the terrorist attack to World Trade Center.

Stock markets remained closed the day of the attacks and dropped sharply the following day.

Not long after, stock markets recovered from the sharp decline.

Stock markets remained closed the day of the attacks and dropped sharply the following day.

Not long after, stock markets recovered from the sharp decline.

4/ How should you deal with Black Swans? The answer is simple and it’s how investing should be done: Just stay invested.

Holding through black swans or taking advantage of them to invest has proven to be the most successful strategy.

It comes back once again to emotions. https://twitter.com/invesquotes/status/1338533881729921024

Holding through black swans or taking advantage of them to invest has proven to be the most successful strategy.

It comes back once again to emotions. https://twitter.com/invesquotes/status/1338533881729921024

5/ What and when will the next Black Swan occur? This question doesn’t have an answer so just stick to your investment strategy and you’ll do fine in the long run.

Remember that short term fluctuations are opportunities for the long term investor.

Remember that short term fluctuations are opportunities for the long term investor.

Read on Twitter

Read on Twitter