1/ Recency bias is a cognitive bias that makes us favor recent events over historic ones.

Also known as memory bias, it leads our brain into giving greater importance to the most recent events.

Examples of that in real life can be seen in court hearings.

Also known as memory bias, it leads our brain into giving greater importance to the most recent events.

Examples of that in real life can be seen in court hearings.

2/ Seasoned lawyers put great emphasis on their closing arguments before the jury convenes to agree on a verdict.

They know that the most recent arguments will have the biggest impact on the jury's thinking.

But how does this bias impact your investing decisions?

They know that the most recent arguments will have the biggest impact on the jury's thinking.

But how does this bias impact your investing decisions?

3/ In investing recency bias is manifested as "momentum" or "trend" thinking.

Investors focus on short-term performance which skews their perception and thinking.

Investors focus on short-term performance which skews their perception and thinking.

4/ During bull markets, they believe that stocks will keep rising infinitely making them more inclined to take risks.

In bear markets, they always think that the worst is yet to come and refrain from investing due to fear and lack of hope for the future.

In bear markets, they always think that the worst is yet to come and refrain from investing due to fear and lack of hope for the future.

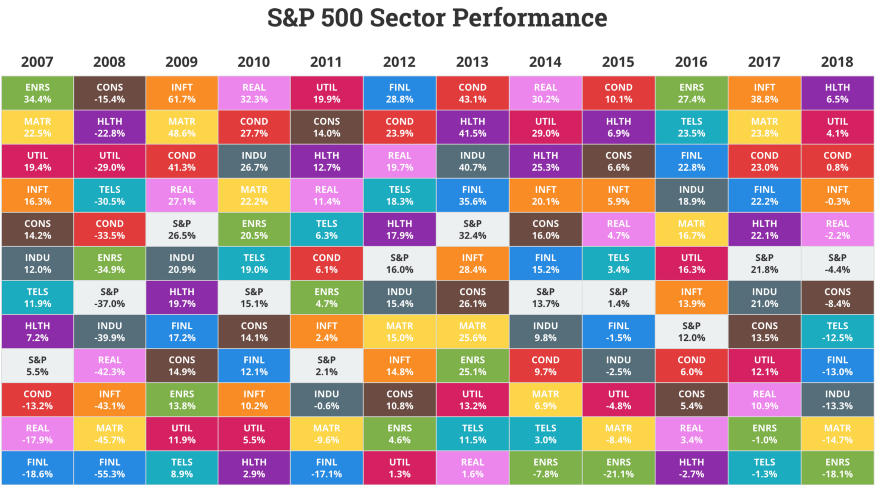

5/ Investors also tend to invest in sectors or funds with attractive performance in the last couple of years.

They don't take into account historic returns or future potential.

Usually, the top performers don't keep momentum in the following years, as can be seen below.

They don't take into account historic returns or future potential.

Usually, the top performers don't keep momentum in the following years, as can be seen below.

6/ However, there are solutions to combat our recency bias

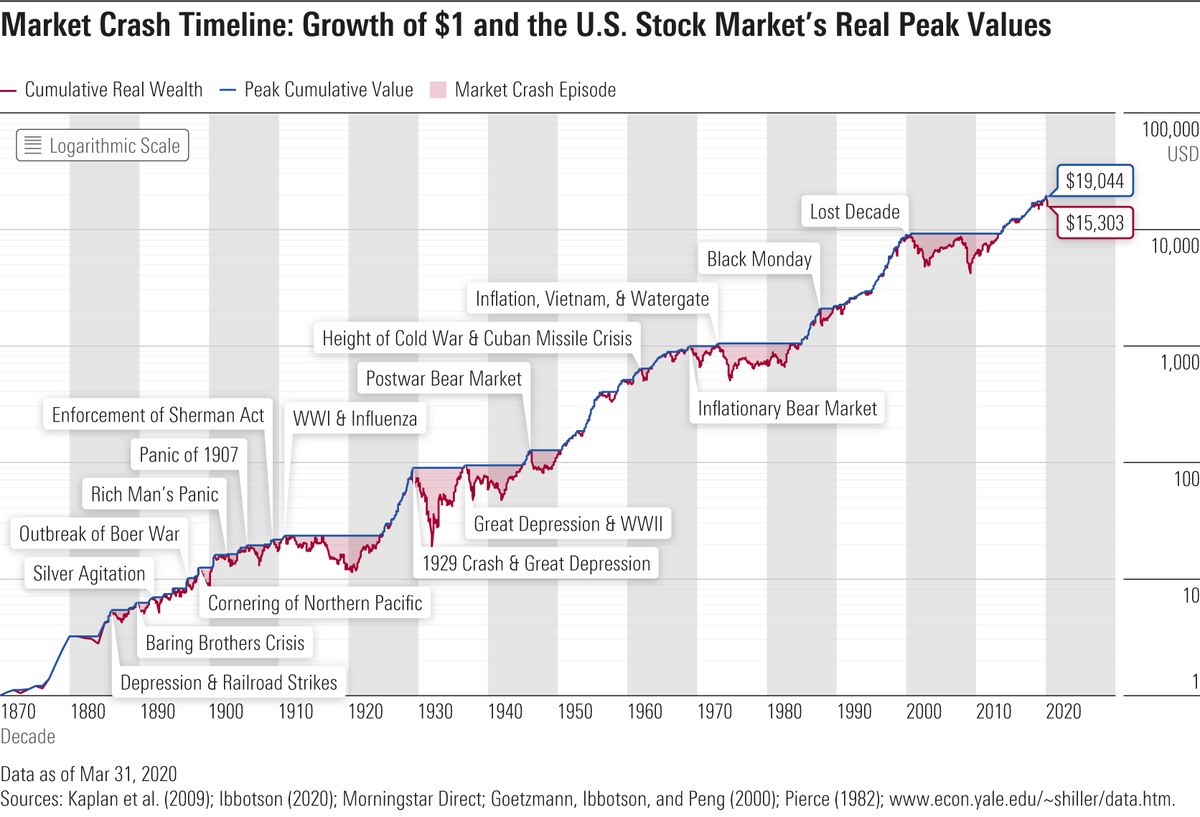

1. Understand market cycles

There are many expansions and recessions in economic history, which are all reflected in the stock market performance.

1. Understand market cycles

There are many expansions and recessions in economic history, which are all reflected in the stock market performance.

7/ If you know that, you can focus on long-term performance without being distracted by recent events.

For more on stock market history, see the thread below https://twitter.com/itsKostasOnFIRE/status/1356258067684458496?s=20

For more on stock market history, see the thread below https://twitter.com/itsKostasOnFIRE/status/1356258067684458496?s=20

8/ 2. Time in the market always beats timing the market

Time is your ally.

A 20-year holding period never produced negative returns. https://twitter.com/itsKostasOnFIRE/status/1346488622493691904?s=20

Time is your ally.

A 20-year holding period never produced negative returns. https://twitter.com/itsKostasOnFIRE/status/1346488622493691904?s=20

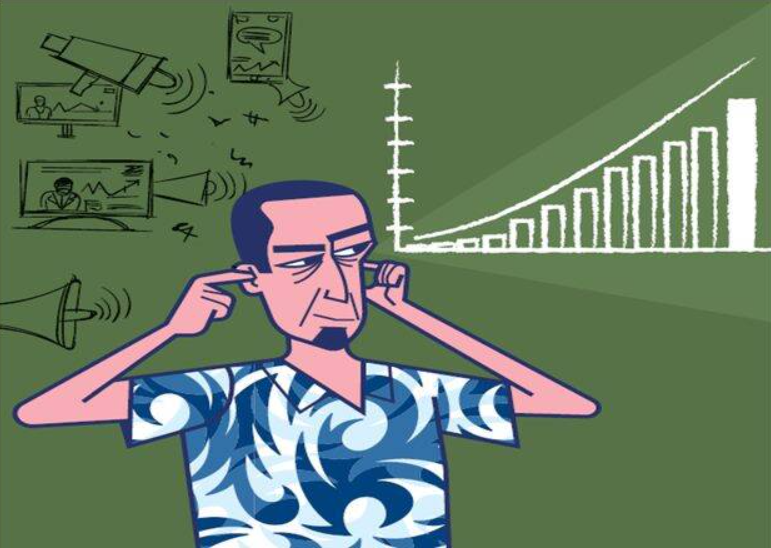

9/ 3. Mute the noise

Don't look daily to your portfolio or market news.

Unsubscribe from daily updates and news.

Check your portfolio once per quarter instead.

Don't look daily to your portfolio or market news.

Unsubscribe from daily updates and news.

Check your portfolio once per quarter instead.

10/ 4. Stick to your goals

Set your financial and investing goals for the long-term and stick to them regardless of current events.

Focus on the long-term performance of your portfolio and rebalance based on desired asset allocation.

Set your financial and investing goals for the long-term and stick to them regardless of current events.

Focus on the long-term performance of your portfolio and rebalance based on desired asset allocation.

11/ 5. Consider taxes

Every time you try to impulsively make a sale because of recent events and news consider the impact of taxes.

Capital gains taxes can eat up a big part of your investment if you sell frequently.

Every time you try to impulsively make a sale because of recent events and news consider the impact of taxes.

Capital gains taxes can eat up a big part of your investment if you sell frequently.

12/ 6. Provide a counter-argument

Consider why someone would pay for the assets you are selling.

What would you do if you were in their shoes?

Would you accept the offer?

Consider why someone would pay for the assets you are selling.

What would you do if you were in their shoes?

Would you accept the offer?

13/ 7. Ask yourself

Every time you feel overwhelmed or euphoric because of recent events ask yourself.

"Have I been investing during a time where I assume certain trends will continue forever?"

Every time you feel overwhelmed or euphoric because of recent events ask yourself.

"Have I been investing during a time where I assume certain trends will continue forever?"

14/ "Am I placing too much weight on recent events?"

"Am I extrapolating a recent trend into the future?"

"Am I extrapolating a recent trend into the future?"

15/ So now after this thread, you know how to deal with recency bias and how to make more objective decisions in your investing journey.

Try to go through this occasionally and rethink your investment strategies and decisions.

/END/

Try to go through this occasionally and rethink your investment strategies and decisions.

/END/

If you liked this thread click below and retweet the first tweet, and follow to stay updated. https://twitter.com/itsKostasOnFIRE/status/1356541263479255042?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

I hope you find my content on finance and investing for F.I.R.E. insightful and valuable

Feel free to support my efforts on financial education by buying me a slice of pizza here

here  https://www.buymeacoffee.com/ItsKostasOnFIRE

https://www.buymeacoffee.com/ItsKostasOnFIRE

Feel free to support my efforts on financial education by buying me a slice of pizza

here

here  https://www.buymeacoffee.com/ItsKostasOnFIRE

https://www.buymeacoffee.com/ItsKostasOnFIRE

Read on Twitter

Read on Twitter