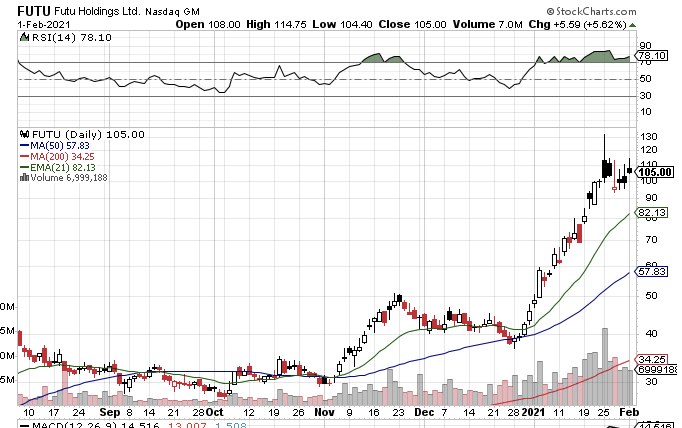

Looking to see if $FUTU is over its skis after a quick 100% run.

I think $FUTU is still OK up here?

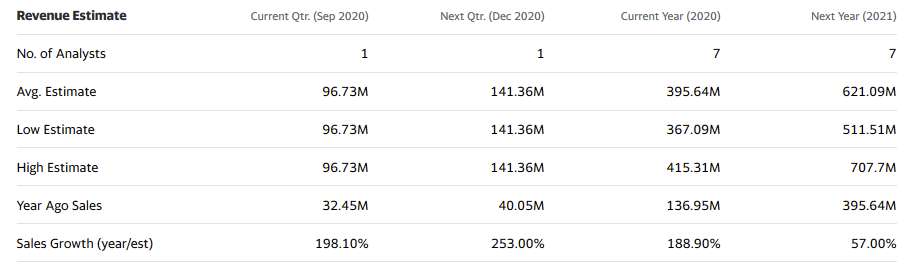

Analysts have $621M for `21 sales on a $14.3B Mkt Cap -> 23x sales. They have a lot of loans on the books for margin borrowing purposes so its difficult to get at the true EV.

I think $FUTU is still OK up here?

Analysts have $621M for `21 sales on a $14.3B Mkt Cap -> 23x sales. They have a lot of loans on the books for margin borrowing purposes so its difficult to get at the true EV.

Analysts are assuming 57% growth from '20 to '21 which would be a sharp taper from the current 200% growth. Plenty of room for upside estimate revisions.

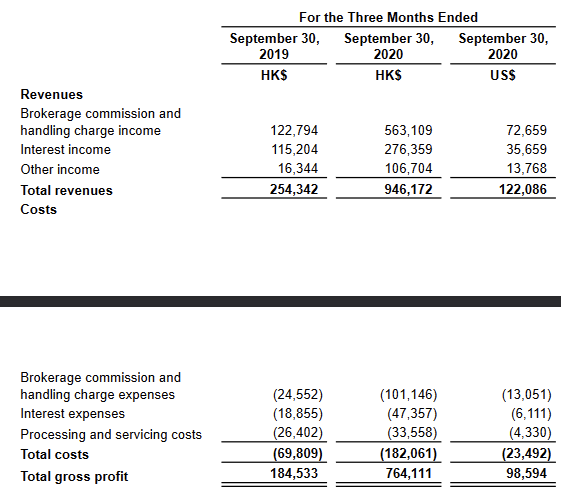

The kicker are their margins. 81% GMs on this revenue makes their Price/Gross Profit ratio only 28.4x. A hypergrowth company with high margins deserves a high multiple.

All of that said, I find myself a little queasy with the run-up so a potential trim may be in order. I started buying $FUTU because I thought it was painfully undervalued at barely >10x sales, not so clear anymore.

Read on Twitter

Read on Twitter