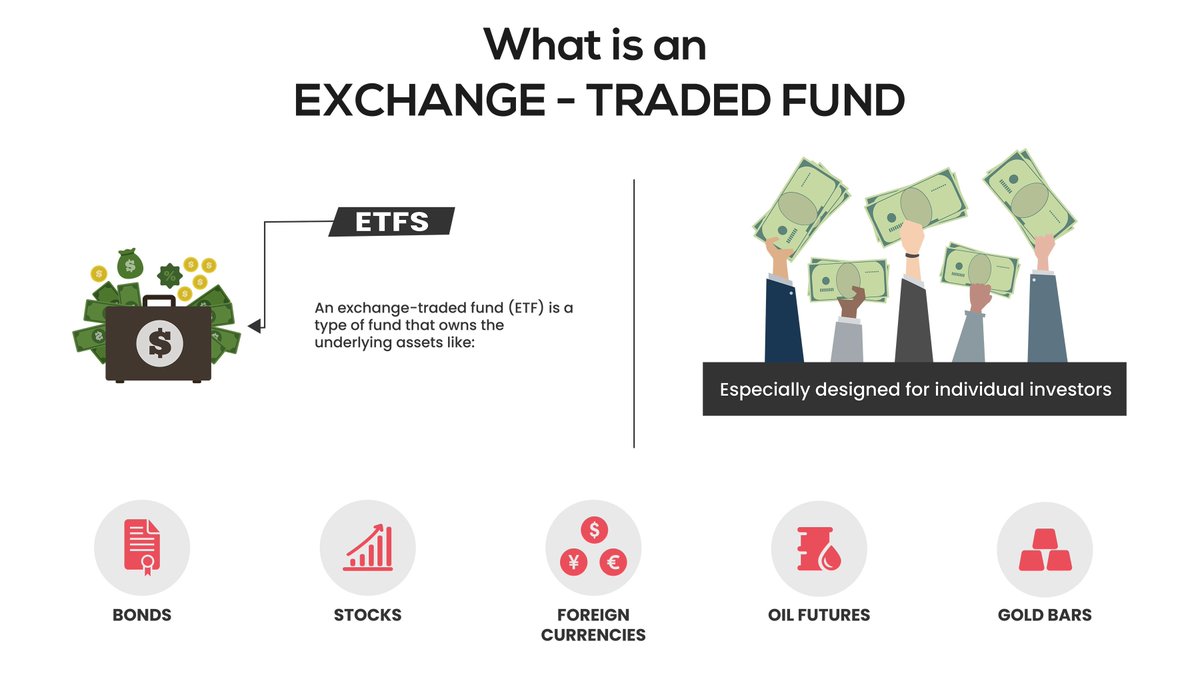

Exchange-traded funds (ETFs) are similar to mutual funds, but they offer some benefits mutual funds don't.

The ETF creation process begins when a prospective ETF

manager (known as a sponsor) files a plan with the U.S.

Securities and Exchange Commission to create an ETF.

The ETF creation process begins when a prospective ETF

manager (known as a sponsor) files a plan with the U.S.

Securities and Exchange Commission to create an ETF.

The sponsor then forms an agreement with an authorized

participant, generally a market maker, or large institutional investor.

The participant borrows stock shares, places those shares in a trust, and uses them to form ETF bundles of stock varying from 10K to 600K shares.

participant, generally a market maker, or large institutional investor.

The participant borrows stock shares, places those shares in a trust, and uses them to form ETF bundles of stock varying from 10K to 600K shares.

The trust provides shares of the ETF, which are legal claims on the shares held in the trust, to the authorized participant.

Once the authorized participant receives the ETF shares, they are sold to the public on the open market just like stock shares.

Once the authorized participant receives the ETF shares, they are sold to the public on the open market just like stock shares.

Read on Twitter

Read on Twitter