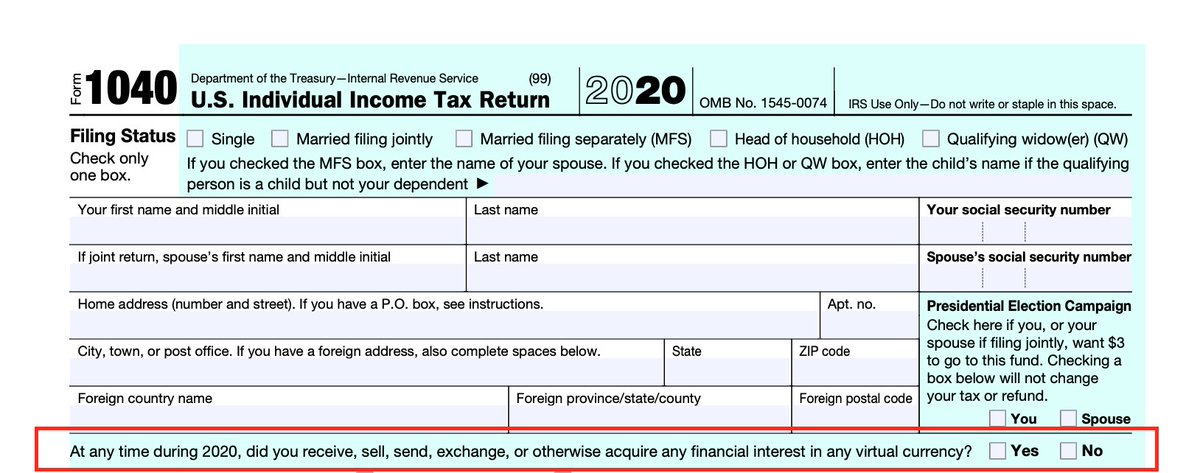

As many of you have noticed already, the first question on the 2020 tax return is, "At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?"

I was just reading the IRS guidance, and here's the scoop...

I was just reading the IRS guidance, and here's the scoop...

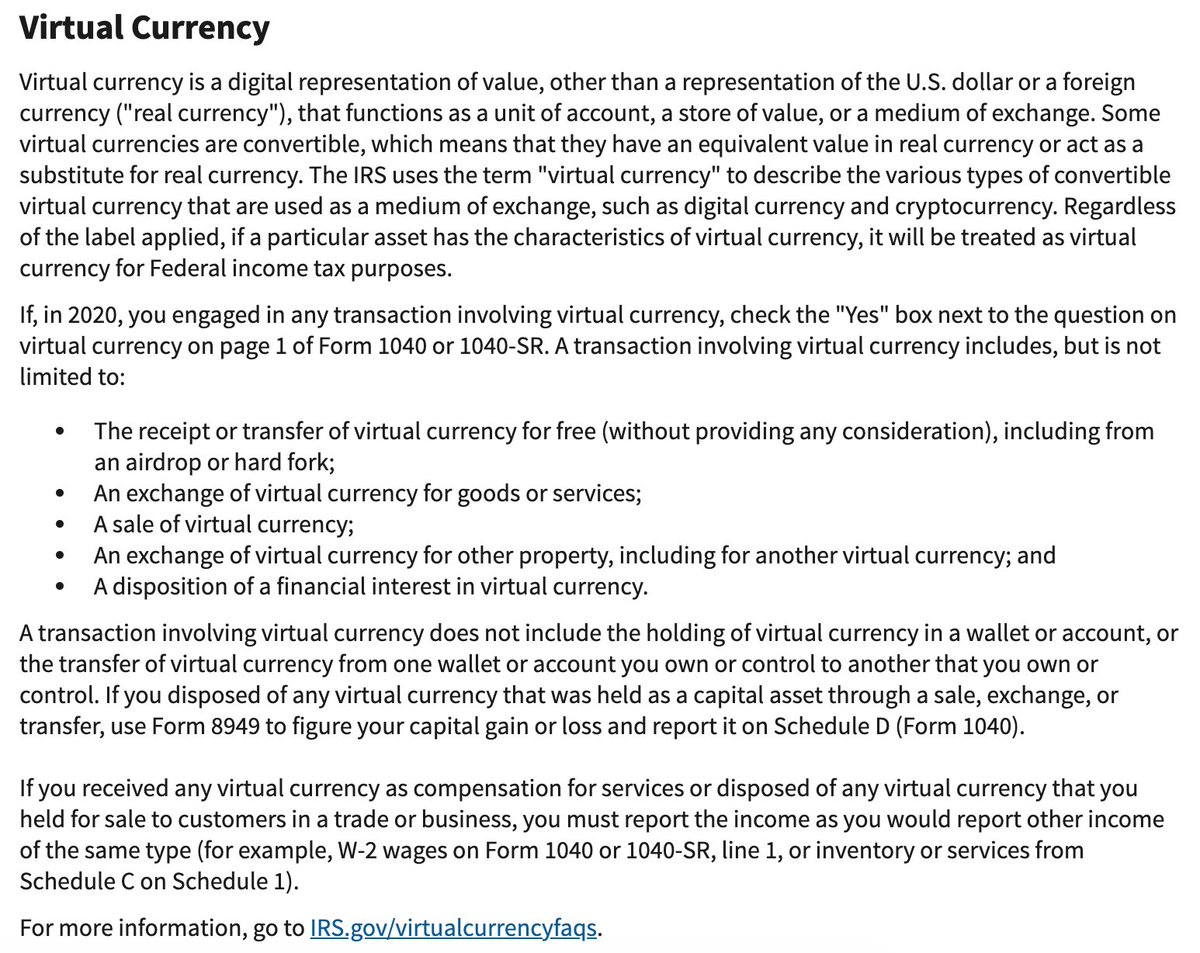

Answer YES if you:

- Sold crypto

- Traded crypto

- Spent crypto on goods or services

- Received an airdrop or fork

- Received staking, masternode, or other crypto rewards

- Received crypto as compensation

- Sold crypto

- Traded crypto

- Spent crypto on goods or services

- Received an airdrop or fork

- Received staking, masternode, or other crypto rewards

- Received crypto as compensation

Answer NO if you only:

- Bought crypto

- Held crypto

- Transferred crypto between wallets you control

- Bought crypto

- Held crypto

- Transferred crypto between wallets you control

So in short, if you're going to be reporting crypto elsewhere on your tax return (Form 8949, Schedule C, wages, other income, etc.), then answer "yes". If you don't have any taxable events to report, then answer "no".

Full excerpt from the IRS below ( https://www.irs.gov/instructions/i1040gi#idm140693662850112)

Full excerpt from the IRS below ( https://www.irs.gov/instructions/i1040gi#idm140693662850112)

Read on Twitter

Read on Twitter