1/18 Monthly #Bitcoin  market analysis

market analysis

This month, I'll share my thoughts on:

1. Where are we in the cycle?

2. Has the correction bottomed?

3. When next run-up?

with BPT, MVRV, Reserve Risk, Puell Multiple, SOPR, exchange balances, miner activity, reflexivity & more

with BPT, MVRV, Reserve Risk, Puell Multiple, SOPR, exchange balances, miner activity, reflexivity & more

market analysis

market analysis

This month, I'll share my thoughts on:

1. Where are we in the cycle?

2. Has the correction bottomed?

3. When next run-up?

with BPT, MVRV, Reserve Risk, Puell Multiple, SOPR, exchange balances, miner activity, reflexivity & more

with BPT, MVRV, Reserve Risk, Puell Multiple, SOPR, exchange balances, miner activity, reflexivity & more

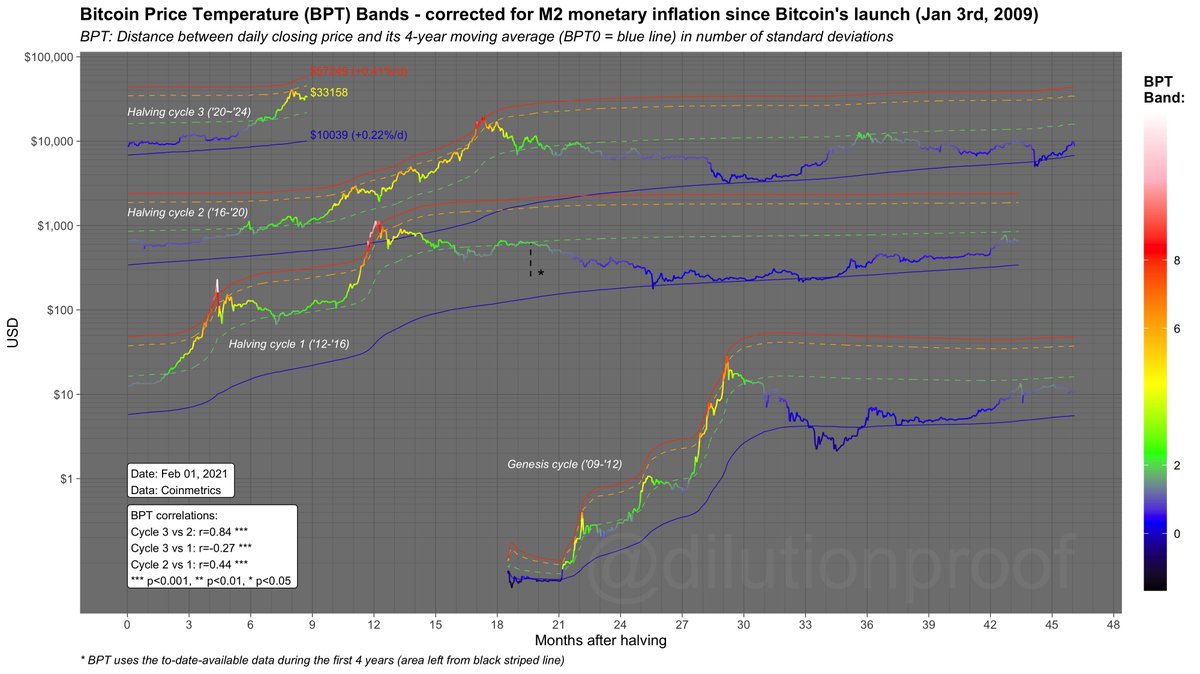

2/18 Based on the #Bitcoin  Price Temperature (BPT) per cycle charts, we are still early in the # of post-halving days and the maximum price

Price Temperature (BPT) per cycle charts, we are still early in the # of post-halving days and the maximum price  that was reached

that was reached

If you correct the BPT for M2 inflation; even more so

Want more BPT? Check out this thread: https://twitter.com/dilutionproof/status/1356218323835506690

Price Temperature (BPT) per cycle charts, we are still early in the # of post-halving days and the maximum price

Price Temperature (BPT) per cycle charts, we are still early in the # of post-halving days and the maximum price  that was reached

that was reachedIf you correct the BPT for M2 inflation; even more so

Want more BPT? Check out this thread: https://twitter.com/dilutionproof/status/1356218323835506690

3/18 If the #Bitcoin  Stock-to-Flow (S2F) or Cross Asset (S2FX) model is correct, we would also expect a further price increase over the next year or so

Stock-to-Flow (S2F) or Cross Asset (S2FX) model is correct, we would also expect a further price increase over the next year or so

In comparison to the long-term power law corridor of growth, we are a bit above the modeled value ($19.4k) though

Stock-to-Flow (S2F) or Cross Asset (S2FX) model is correct, we would also expect a further price increase over the next year or so

Stock-to-Flow (S2F) or Cross Asset (S2FX) model is correct, we would also expect a further price increase over the next year or soIn comparison to the long-term power law corridor of growth, we are a bit above the modeled value ($19.4k) though

4/18 Similar to the BPT, ratio between #Bitcoin  's market value and its realized value (the average price at which all existing coins last moved) recently peaked in the short-term, but hasn't reached previous overall market cycle highs yet

's market value and its realized value (the average price at which all existing coins last moved) recently peaked in the short-term, but hasn't reached previous overall market cycle highs yet

Chart by @PositiveCrypto

's market value and its realized value (the average price at which all existing coins last moved) recently peaked in the short-term, but hasn't reached previous overall market cycle highs yet

's market value and its realized value (the average price at which all existing coins last moved) recently peaked in the short-term, but hasn't reached previous overall market cycle highs yetChart by @PositiveCrypto

5/18 The Reserve Risk, which is another metric that leverages the on-chain information of the age of existing unspent transactions, also suggests that #Bitcoin  's long-term holders still have confidence in a potential further price increase

's long-term holders still have confidence in a potential further price increase

Chart by @PositiveCrypto

's long-term holders still have confidence in a potential further price increase

's long-term holders still have confidence in a potential further price increaseChart by @PositiveCrypto

6/18 The Puell Multiple, that represents the degree in which miners have been able to pump up the daily new #Bitcoin  issuance (often as the result of increased profitability due to a price rise), has been increasing - but also hasn't reached previous market cycle top levels yet

issuance (often as the result of increased profitability due to a price rise), has been increasing - but also hasn't reached previous market cycle top levels yet

issuance (often as the result of increased profitability due to a price rise), has been increasing - but also hasn't reached previous market cycle top levels yet

issuance (often as the result of increased profitability due to a price rise), has been increasing - but also hasn't reached previous market cycle top levels yet

7/18 The huge decline in #Bitcoin  exchange balances of 2020 has stagnated in 2021

exchange balances of 2020 has stagnated in 2021

Nonetheless; you usually see this *increase* during bull runs as an increasing number of holders take profits

Either 'it is different this time' or we're still early

Chart by @cryptoquant_com

exchange balances of 2020 has stagnated in 2021

exchange balances of 2020 has stagnated in 2021Nonetheless; you usually see this *increase* during bull runs as an increasing number of holders take profits

Either 'it is different this time' or we're still early

Chart by @cryptoquant_com

8/18 Finally (w.r.t. cycle analysis), when we look at the degree in which long-term #Bitcoin  holders have recently 'cashed out' their profits, the latest run-up is barely visible on the chart, illustrating long term HODLers' optimism

holders have recently 'cashed out' their profits, the latest run-up is barely visible on the chart, illustrating long term HODLers' optimism

Chart by @whale_map

holders have recently 'cashed out' their profits, the latest run-up is barely visible on the chart, illustrating long term HODLers' optimism

holders have recently 'cashed out' their profits, the latest run-up is barely visible on the chart, illustrating long term HODLers' optimismChart by @whale_map

9/18 So as for the question "Where are we in the cycle?", my suspicion is that we're well underway in a  market, just had our 1st serious correction but may have some gas left in the tank

market, just had our 1st serious correction but may have some gas left in the tank

(Leaning heavily on the assumption that we'll see another similar cycle off course)

market, just had our 1st serious correction but may have some gas left in the tank

market, just had our 1st serious correction but may have some gas left in the tank

(Leaning heavily on the assumption that we'll see another similar cycle off course)

10/18 Next: "has the correction bottomed?"

My favorite chart here is the daily Spent Output Profit Ratio (SOPR)

The SOPR has recently reset to 1, which means that most 'profit taking potential' has been cleared; we would need to sell at a loss to get <1

Chart by @whale_map

My favorite chart here is the daily Spent Output Profit Ratio (SOPR)

The SOPR has recently reset to 1, which means that most 'profit taking potential' has been cleared; we would need to sell at a loss to get <1

Chart by @whale_map

11/18 A group of #Bitcoin  stakeholders that do appear to be currently selling are the miners, as a relatively high numbers of BTC are leaving their wallets in comparison to the previous year(s)

stakeholders that do appear to be currently selling are the miners, as a relatively high numbers of BTC are leaving their wallets in comparison to the previous year(s)

stakeholders that do appear to be currently selling are the miners, as a relatively high numbers of BTC are leaving their wallets in comparison to the previous year(s)

stakeholders that do appear to be currently selling are the miners, as a relatively high numbers of BTC are leaving their wallets in comparison to the previous year(s)

12/18 Based on Technical Analysis (TA), there is confluence for a ~$30k bottom on this retracement

E.g., if you draw a Fibonacci retracement with the late 2017 top & late 2018 bottom, you get a ~$30k zone

Do this for the mid-2019 top & early 2020 bottom & you get the same

E.g., if you draw a Fibonacci retracement with the late 2017 top & late 2018 bottom, you get a ~$30k zone

Do this for the mid-2019 top & early 2020 bottom & you get the same

13/18 The combination of the reset SOPR, the confluence for a ~$30k support that was successfully tested twice & the overall bullish outlook make me pretty confident that the bottom of this dip is likely in

If you are mid- to long-term bullish, IMO this is not where you sell

If you are mid- to long-term bullish, IMO this is not where you sell

14/18 During this weekend's 'Elon pump', ~17k more #Bitcoin  were deposited on than withdrawn from exchanges (investor skepticism?)

were deposited on than withdrawn from exchanges (investor skepticism?)

However, after Elon's interest turned out to be serious, that same net flow turned *negative* 21k BTC yesterday

Chart by @cryptoquant_com

were deposited on than withdrawn from exchanges (investor skepticism?)

were deposited on than withdrawn from exchanges (investor skepticism?)However, after Elon's interest turned out to be serious, that same net flow turned *negative* 21k BTC yesterday

Chart by @cryptoquant_com

15/18 One of the larger entities that has been accumulating #Bitcoin  over the last year regardless of price action is Grayscale, who sits on a 648k BTC position

over the last year regardless of price action is Grayscale, who sits on a 648k BTC position

Late last year, Grayscale shared that ~90% of the entities that invest via their service are institutional investors

over the last year regardless of price action is Grayscale, who sits on a 648k BTC position

over the last year regardless of price action is Grayscale, who sits on a 648k BTC position

Late last year, Grayscale shared that ~90% of the entities that invest via their service are institutional investors

16/18 The price of Grayscale's GBTC product is usually at a hefty premium compared to the spot #Bitcoin  prices, but that is currently sitting at historically low values, suggesting that @BarrySilbert's vacuum cleaner could soon be turned on again

prices, but that is currently sitting at historically low values, suggesting that @BarrySilbert's vacuum cleaner could soon be turned on again

Chart by @bybt_com

prices, but that is currently sitting at historically low values, suggesting that @BarrySilbert's vacuum cleaner could soon be turned on again

prices, but that is currently sitting at historically low values, suggesting that @BarrySilbert's vacuum cleaner could soon be turned on again

Chart by @bybt_com

17/18 With Elon's new interest in #Bitcoin  , Saylor's corporational on-boarding event this week & the #WSB crowd starting to take interest, there are multiple short-term triggers

, Saylor's corporational on-boarding event this week & the #WSB crowd starting to take interest, there are multiple short-term triggers

@woonomic estimates that each $1 currently invested in #Bitcoin lifts its market cap by $3.4

lifts its market cap by $3.4

, Saylor's corporational on-boarding event this week & the #WSB crowd starting to take interest, there are multiple short-term triggers

, Saylor's corporational on-boarding event this week & the #WSB crowd starting to take interest, there are multiple short-term triggers@woonomic estimates that each $1 currently invested in #Bitcoin

lifts its market cap by $3.4

lifts its market cap by $3.4

18/18 To summarize, my personal view is that:

- ..the current cycle has likely not completed if we assume it will be similar to previous ones,

- ..but it had its 1st serious correction,

- ..that may have bottomed,

- ..and is now waiting for something to trigger the next leg up

- ..the current cycle has likely not completed if we assume it will be similar to previous ones,

- ..but it had its 1st serious correction,

- ..that may have bottomed,

- ..and is now waiting for something to trigger the next leg up

Read on Twitter

Read on Twitter