Lot of good stuff from Nintendo earnings today. Here's a closer look at the company's digital business.

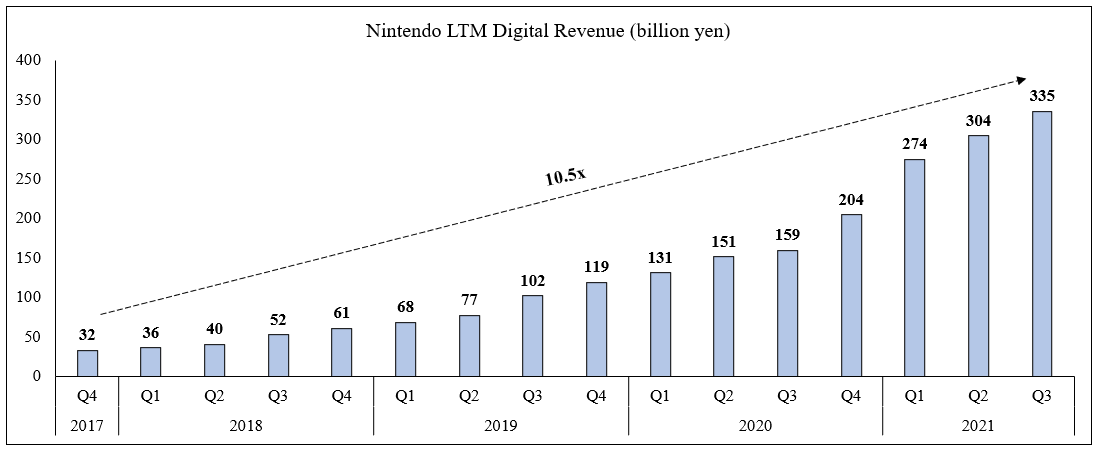

LTM digital revenue of 335 billion yen or ~$3.2 billion is up 10.5x since 2017.

$NTDOY

LTM digital revenue of 335 billion yen or ~$3.2 billion is up 10.5x since 2017.

$NTDOY

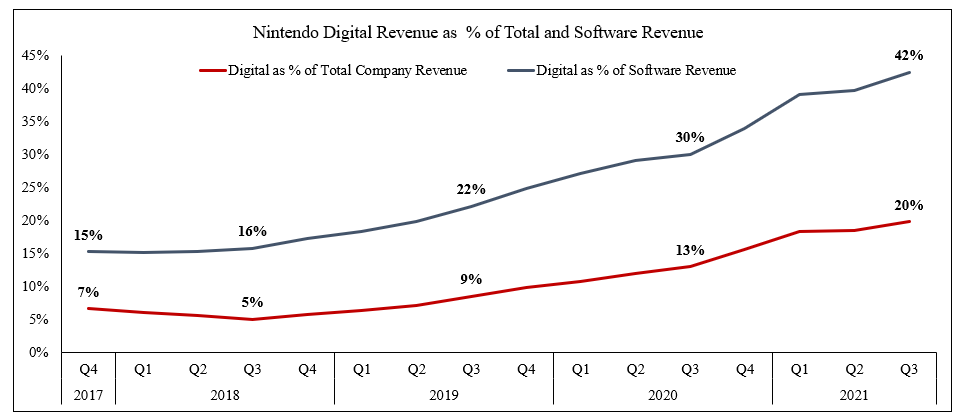

Digital now makes up 20% of total company revenue and 42% of software revenue

This is a part of the business that effectively didn't exist 5 years ago which shows the transformation underway

This is a part of the business that effectively didn't exist 5 years ago which shows the transformation underway

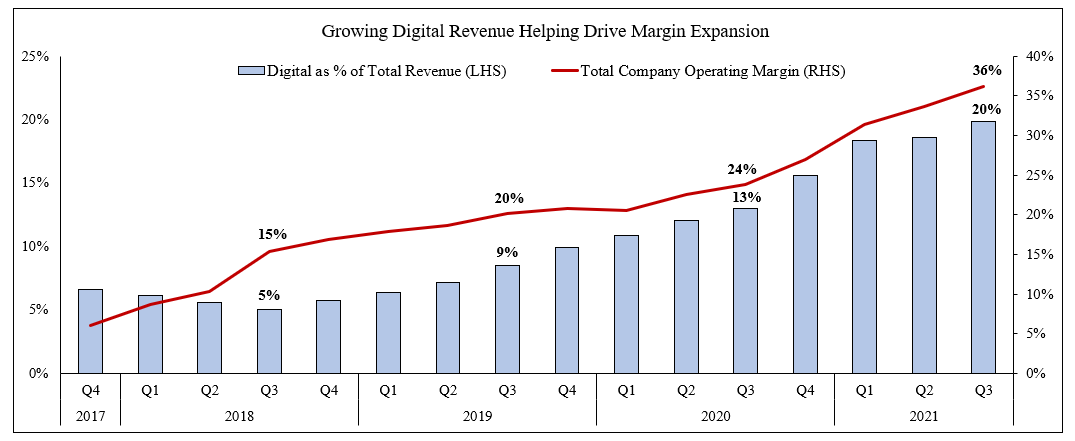

This growth of digital is no doubt helping drive total company operating margin expansion, now up to 36%

The "digital" segment includes revenue from:

1) downloaded first party games

2) Switch Online subscriptions

3) Downloadable game content (DLC)

4) 30% royalties on 3P games sold in the eShop

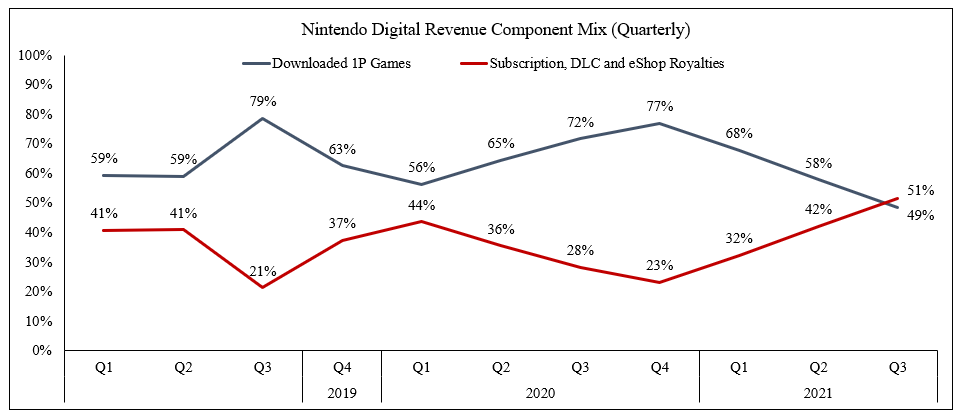

During this past holiday quarter, rev from 2 - 4 exceeded rev from 1 for the first time

1) downloaded first party games

2) Switch Online subscriptions

3) Downloadable game content (DLC)

4) 30% royalties on 3P games sold in the eShop

During this past holiday quarter, rev from 2 - 4 exceeded rev from 1 for the first time

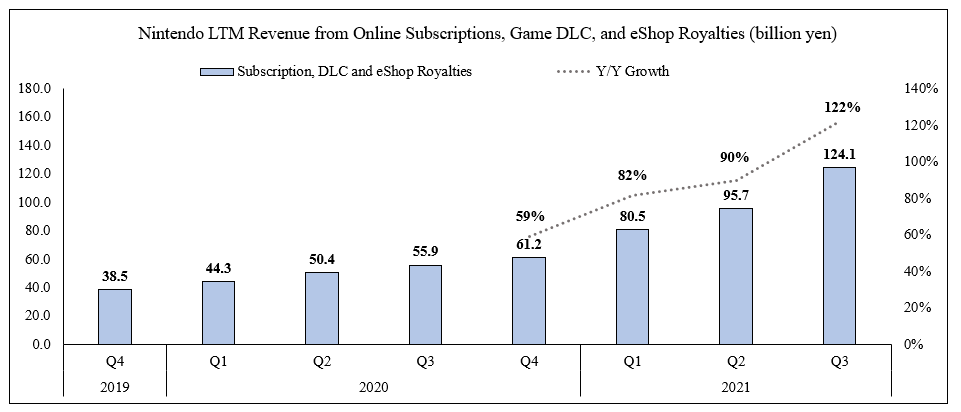

Revenue from these sources is particularly attractive b/c they're either recurring (subscription) and/or very high margin (DLC and royalties)

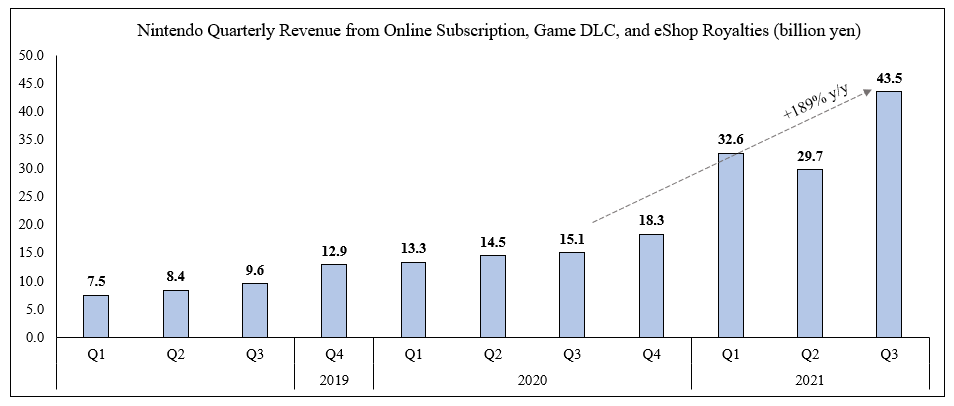

This subsegment is the fastest growing piece of Nintendo's business, up 189% y/y last quarter to 43.5 billion yen or ~$415 million

This subsegment is the fastest growing piece of Nintendo's business, up 189% y/y last quarter to 43.5 billion yen or ~$415 million

Read on Twitter

Read on Twitter