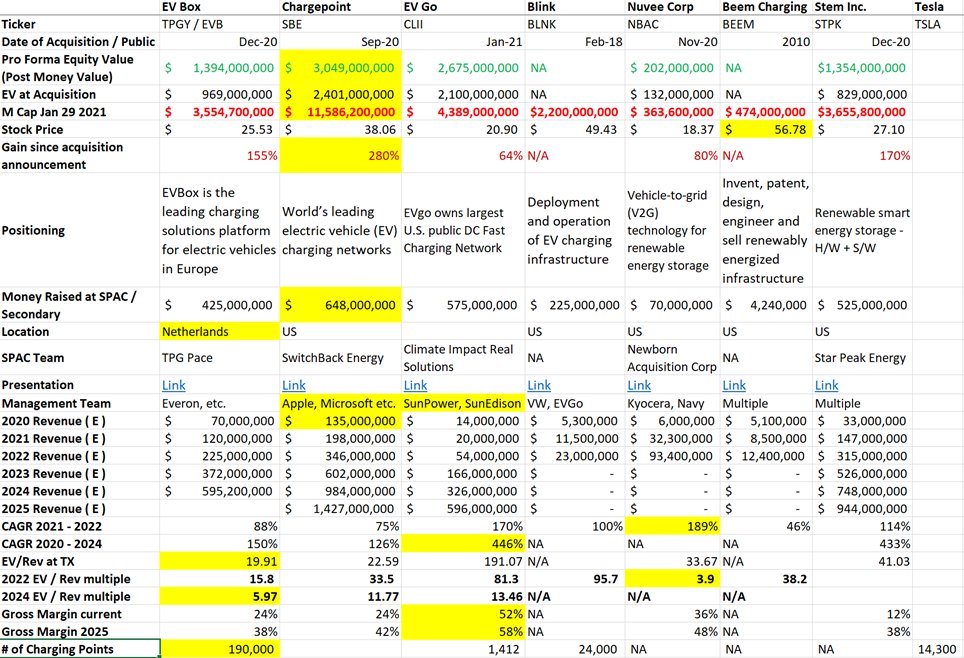

EV Charging - A thread on the segment of charging infrastructure & stocks including

$TPGY $SBE $CLII $BLNK $NBAC $BEEM $STPK $TSLA $IDEX

$TPGY $SBE $CLII $BLNK $NBAC $BEEM $STPK $TSLA $IDEX

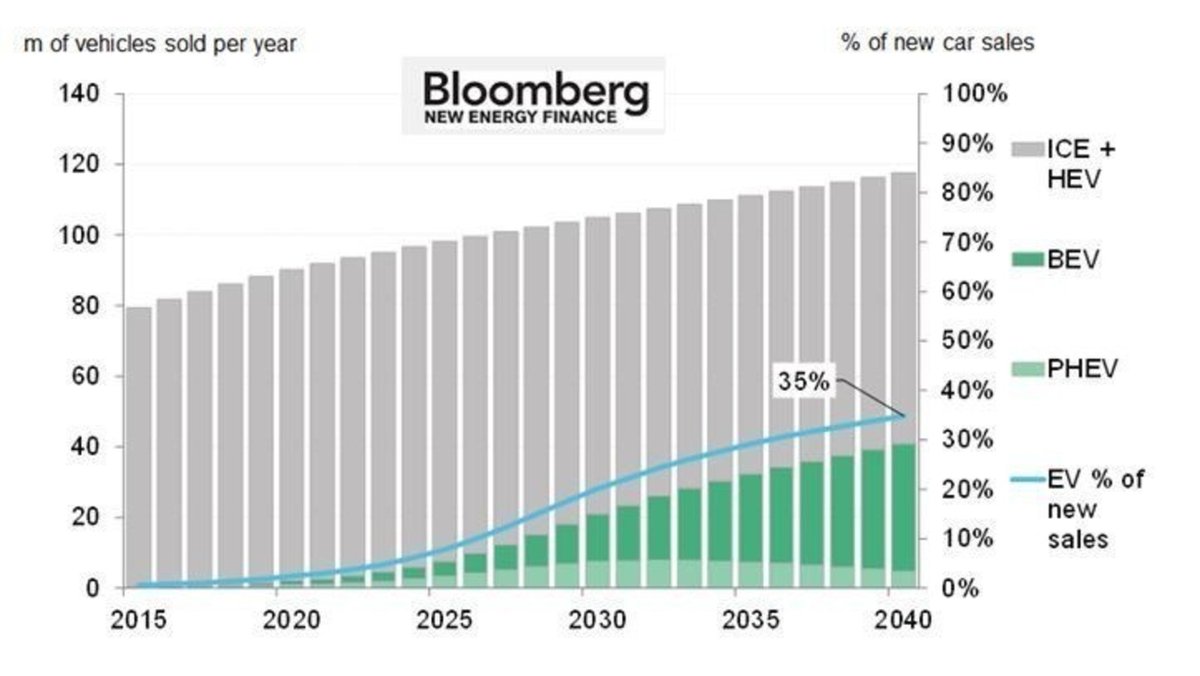

According to the International Energy Agency, which forecasts that there may be 300-400 million EVs (cars + commercial) on the road out of approximately 2 billion vehicles by 2040.

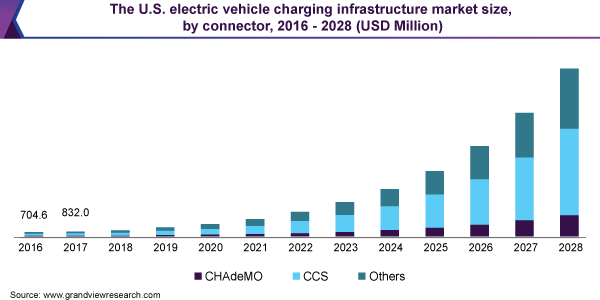

The global electric vehicle charging infrastructure market size was valued at USD 15.06 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 33.4% from 2021 to 2028.

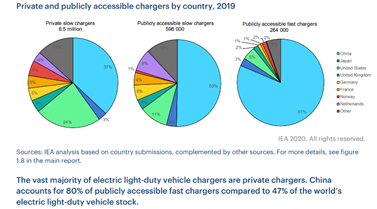

In 2019, there were about 7.3 million chargers worldwide, of which about 6.5 million were private. US alone needs about 2 million EV charging stations for the 40 or more electric car models that are likely to be on the roads in their multitudes by 2025. China leads the market.

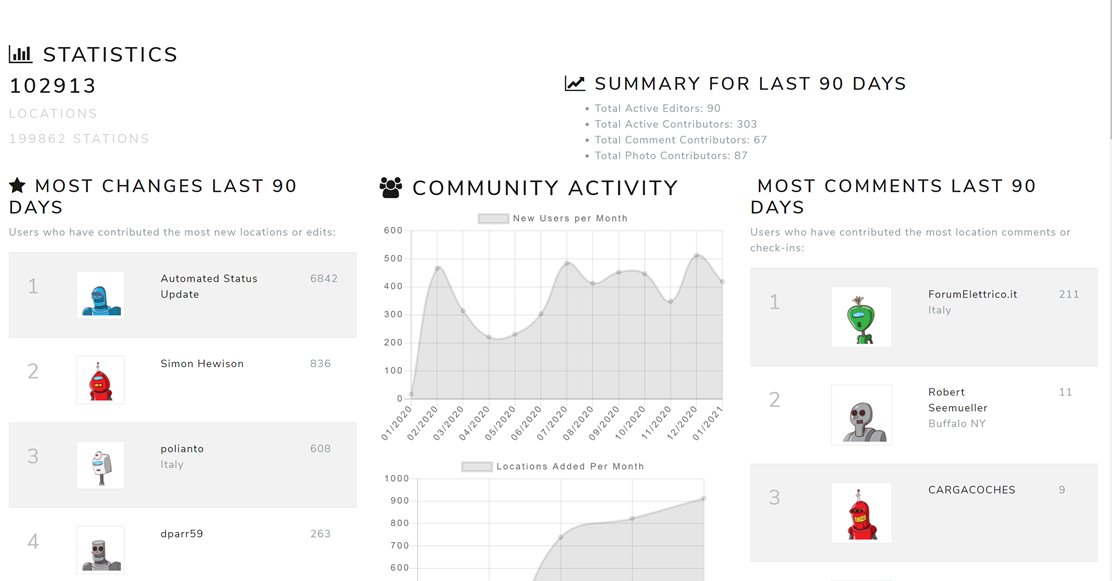

According to the Open Charge Map, there are almost 200K charging stations across about 100K locations around the world.

https://openchargemap.org/site/stats

https://openchargemap.org/site/stats

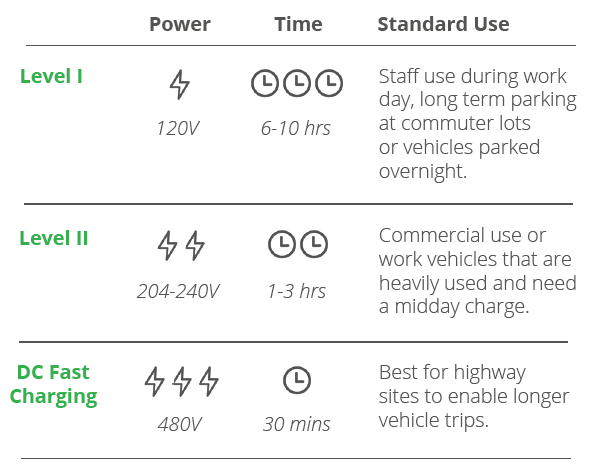

There are 3 types of chargers by speed - L1, L2 and Fast charging

Fast charging is the future. No one wants to wait for 30-60 minutes to get their vehicle charged. So fast charging network is growing

Fast charging is the future. No one wants to wait for 30-60 minutes to get their vehicle charged. So fast charging network is growing

There are over 50 companies in the space including traditional big oil companies. I put together a partial list below - this is not comprehensive.

The "public charging market" comprises of - charging points @ work, commercial establishments, etc.) or the traditional “gas stations”, but a global network of charging points

I am dividing the charging segment is divided into 3 sub sectors:

a) Infrastructure providers – H/W, S/W, Services e.g. $CLII, $NBAC

b) Charging as a Service providers e.g. $BLNK, $SBE, $TPGY

c) Energy management (Vehicle2Grid, etc.) e.g. Stem $STPK

a) Infrastructure providers – H/W, S/W, Services e.g. $CLII, $NBAC

b) Charging as a Service providers e.g. $BLNK, $SBE, $TPGY

c) Energy management (Vehicle2Grid, etc.) e.g. Stem $STPK

Publicly accessible chargers accounted for 12% of global light-duty vehicle chargers in 2019, most of which are slow chargers.

Globally, the number of publicly accessible chargers increased by 60% in 2019 compared with the previous year. Below is China Southern Power Grid

Globally, the number of publicly accessible chargers increased by 60% in 2019 compared with the previous year. Below is China Southern Power Grid

This segment is a "picks and shovels" play in the EV segment. You need charging for EV rollout to be successful.

China has learned that and is rapidly growing their based. Europe (Netherlands) is following them and US is still lagging. Except $TSLA is leading the charge here

China has learned that and is rapidly growing their based. Europe (Netherlands) is following them and US is still lagging. Except $TSLA is leading the charge here

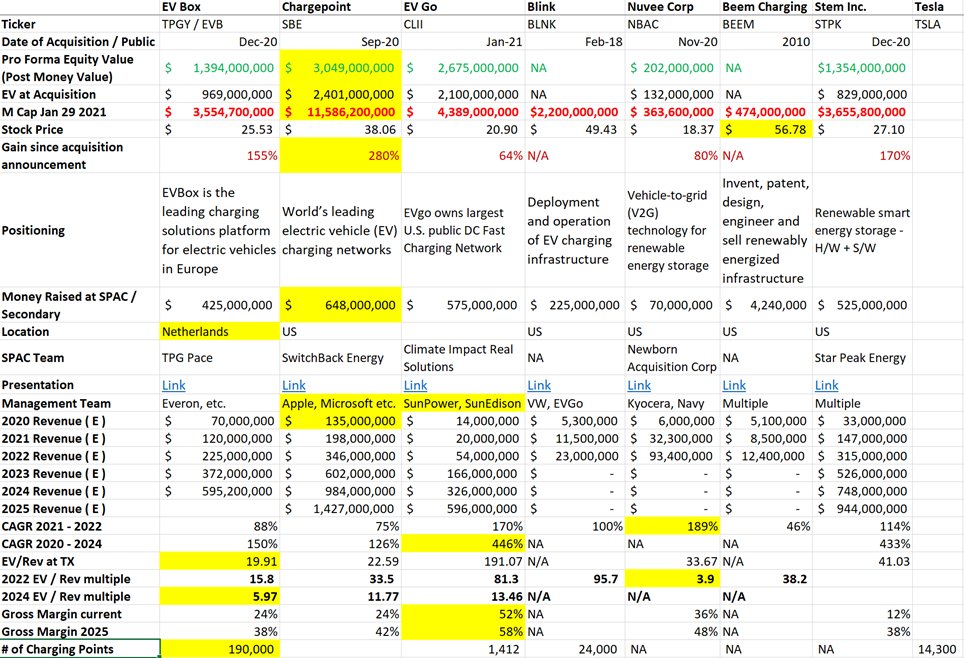

In my comparison I highlighted (yellow) the companies leading by each metric - by row.

Quite simply you wont go wrong picking $SBE and $TPGY - for the LONG HAUL. They are relatively expensive now is MY OPINION.

Another company I really like is $STPK

Quite simply you wont go wrong picking $SBE and $TPGY - for the LONG HAUL. They are relatively expensive now is MY OPINION.

Another company I really like is $STPK

I am going to skip each co pros and cons since this thread is getting long.

EvGo: $CLII presentation

https://www.evgo.com/wp-content/uploads/2021/01/evgo-investor-relations-presentation-final.pdf

EvGo: $CLII presentation

https://www.evgo.com/wp-content/uploads/2021/01/evgo-investor-relations-presentation-final.pdf

$STPK Stem presentation

…https://3zkqyz2t3xwi492ll518psvq-wpengine.netdna-ssl.com/wp-content/uploads/2020/12/Stem-Star-Peak-Investor-Presentation_Dec2020.pdf

…https://3zkqyz2t3xwi492ll518psvq-wpengine.netdna-ssl.com/wp-content/uploads/2020/12/Stem-Star-Peak-Investor-Presentation_Dec2020.pdf

EVBox $TPGY presentation

https://www.tpg.com/sites/default/files/2020-12/EVBox%20Group%20Investor%20Presentation_121720.pdf

https://www.tpg.com/sites/default/files/2020-12/EVBox%20Group%20Investor%20Presentation_121720.pdf

ChargePoint Swithback energy $SBE presentation

https://switchback-energy.com/wp-content/uploads/2020/09/ChargePoint-New-Investor-Deck-23-Sept-2020-8K.pdf

https://switchback-energy.com/wp-content/uploads/2020/09/ChargePoint-New-Investor-Deck-23-Sept-2020-8K.pdf

Blink $BLNK presentation

https://d1io3yog0oux5.cloudfront.net/_eecdb5730817b48b4150e17f11e46ebf/blinkcharging/db/60/1289/pdf/InvestorPresentation_Jan_2021_LR-NoOEM.pdf

https://d1io3yog0oux5.cloudfront.net/_eecdb5730817b48b4150e17f11e46ebf/blinkcharging/db/60/1289/pdf/InvestorPresentation_Jan_2021_LR-NoOEM.pdf

Nuvve $NBAC presentation

https://nuvve.com/wp-content/uploads/2020/11/nuvve-investor-presentation-november-2020-v9.pdf

https://nuvve.com/wp-content/uploads/2020/11/nuvve-investor-presentation-november-2020-v9.pdf

BeamforAll $BEEM presentation

https://beamforall.com/wp-content/uploads/2020/12/Beam-Global-Corporate-Presentation.pdf

https://beamforall.com/wp-content/uploads/2020/12/Beam-Global-Corporate-Presentation.pdf

Other companies in the "Charging as a Service" segment:

Tesla

Ideanomics

Electrify America

Ionity

Qingdao

Tritium

New Motion

Enel X

Tesla

Ideanomics

Electrify America

Ionity

Qingdao

Tritium

New Motion

Enel X

Read on Twitter

Read on Twitter