Robinhood's strategy is a cautionary tale for all builders in highly-regulated spaces.

I wanted to break down the growth strategy RH used and why it ultimately led to last week.

Drawing from my time as growth and fintech PM ( and

and  ):

):

I wanted to break down the growth strategy RH used and why it ultimately led to last week.

Drawing from my time as growth and fintech PM (

and

and  ):

):

If you want to know a company's strategy, start at their product.

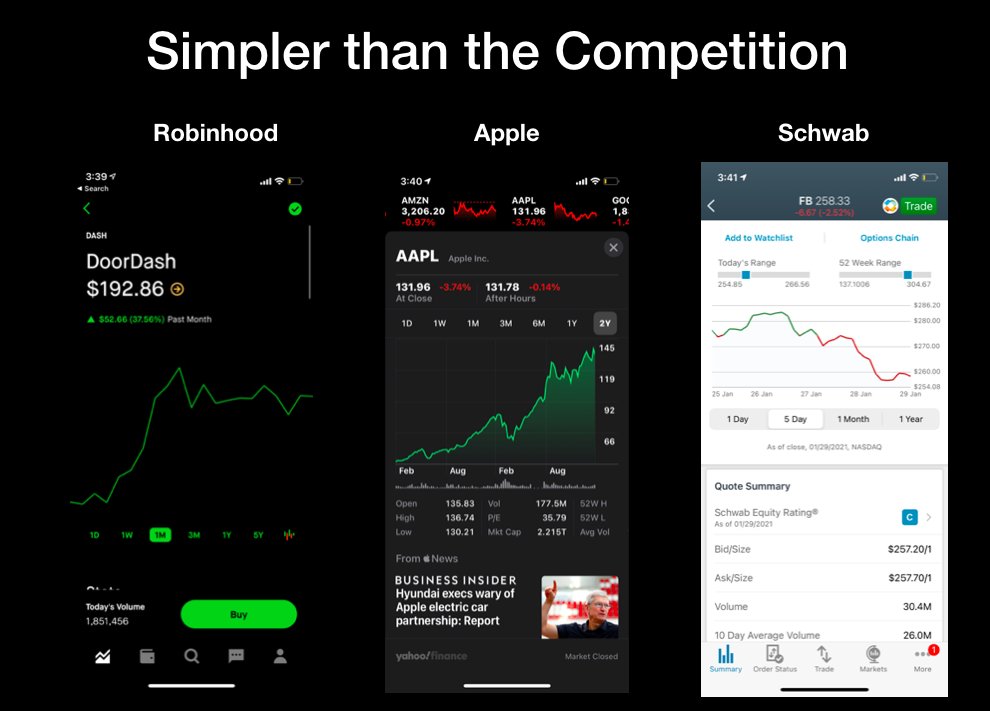

Robinhood app is the simplest of any of its peers by a long shot. Its accessible and looks closer to Spotify than Schwab.

Likewise, its strategy is more similar to social apps that banks.

Robinhood app is the simplest of any of its peers by a long shot. Its accessible and looks closer to Spotify than Schwab.

Likewise, its strategy is more similar to social apps that banks.

Robinhood's growth strategy uses the following tactics:

Activation-based growth

Activation-based growth

Cater to users with lower financial literacy

Cater to users with lower financial literacy

Encourage frictionless decision making

Encourage frictionless decision making

Activation-based growth

Activation-based growth  Cater to users with lower financial literacy

Cater to users with lower financial literacy Encourage frictionless decision making

Encourage frictionless decision making

1/ Activation-based growth

There are multiple steps in a growth funnel: awareness, engagement, retention etc.

RH focused on *activation*: getting users to own their first stock in minutes.

This locked users into the app with a real asset (that they come back to check).

There are multiple steps in a growth funnel: awareness, engagement, retention etc.

RH focused on *activation*: getting users to own their first stock in minutes.

This locked users into the app with a real asset (that they come back to check).

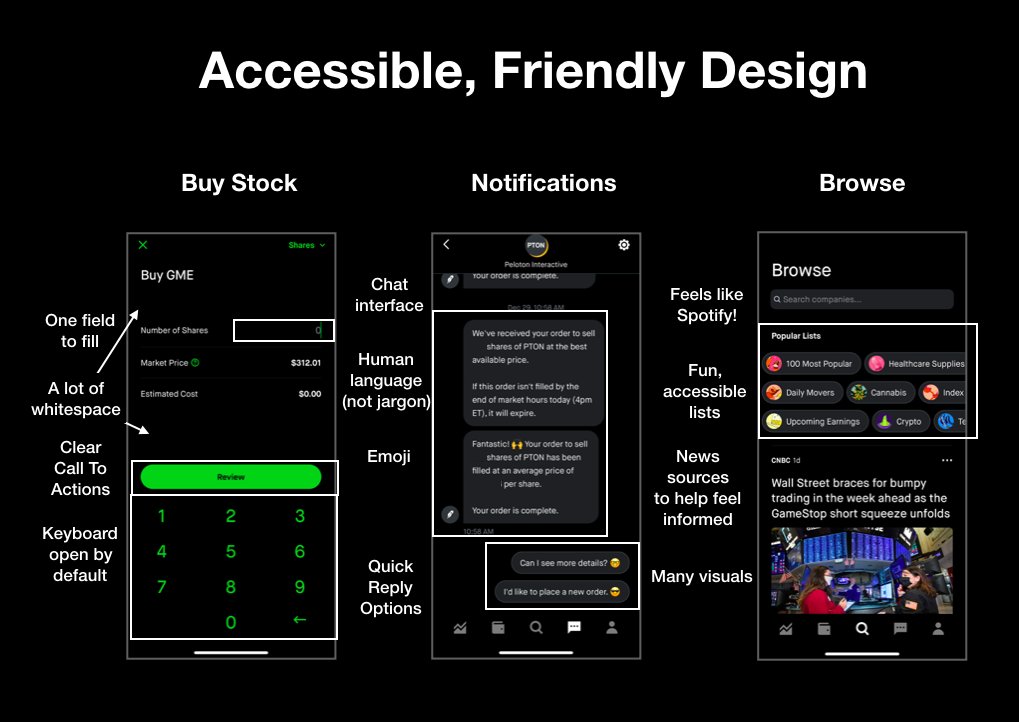

2/ Cater the platform to users with lower financial literacy

50% of users say they haven't invested before Robinhood.

The whole product is built with these users in mind. Here are some examples from the UI and content design:

50% of users say they haven't invested before Robinhood.

The whole product is built with these users in mind. Here are some examples from the UI and content design:

3/ Encourage frictionless decision making

RH wants users to go from consideration to purchase in the shortest period of time. They've removed almost all the friction from the industry standard.

Today, a purchase of $500,000 can be made in under a minute on RH.

RH wants users to go from consideration to purchase in the shortest period of time. They've removed almost all the friction from the industry standard.

Today, a purchase of $500,000 can be made in under a minute on RH.

These three product principles are not new. Each of them can be seen in other verticals (ex. Wish -> frictionless decision making in ecommerce)

But combining them + operating in the regulatory nightmare that is fintech was a timebomb.

But combining them + operating in the regulatory nightmare that is fintech was a timebomb.

Last week, Robinhood did exactly what its designed to do: allow newer investors to trade with low consideration.

But unlike other software-only domains, Robinhood’s product actions are limited by regulation and their ability to service them.

But unlike other software-only domains, Robinhood’s product actions are limited by regulation and their ability to service them.

In other words, the surge in actions is no longer limited to bits. It affects atoms that are scarce and highly scrutinized.

While there are many explanations for RH's decision to halt buying of WSB stocks, its clear that RH could no longer support the behaviours it created.

While there are many explanations for RH's decision to halt buying of WSB stocks, its clear that RH could no longer support the behaviours it created.

: You can't grow a fintech product like you would a software-only product because of regulation and real world consequences.

: You can't grow a fintech product like you would a software-only product because of regulation and real world consequences.This is not meant to dunk on RH. Instead its a warning the next generation of builders: don't port over all the lessons of past successes.

I go into more detail and discuss the following in this week's article:

1. The basis of all growth strategies

2. A "blitzscaling" mindset in fintech

3. A call to action for the next generation of builders https://willlawrence.substack.com/p/robinhood-why-fintech-cant-use-softwares

1. The basis of all growth strategies

2. A "blitzscaling" mindset in fintech

3. A call to action for the next generation of builders https://willlawrence.substack.com/p/robinhood-why-fintech-cant-use-softwares

Read on Twitter

Read on Twitter