CBO forecasts are out.

CBO forecasts are out.Some early reports have suggested the CBO forecast revisions are cause for optimism. Not so fast!

My key takeaway: Forecasts have been upgraded from a *catastrophically* slow recovery to an *extremely* slow recovery.

1/ https://twitter.com/USCBO/status/1356273023784022017

CBO forecasts unemployment will fall v slowly, to 4.1% by 2025/26. Early 2020 -- 3.5% unemployment with no inflationary pressure -- suggests *full* employment is substantially below 3.5%! Extrapolating CBO's forecast, we might not get to full employment before the late 2020s. 2/

It's hard to overstate the welfare costs: *years* in which millions of people who want jobs can't get them, hugely high unemployment for African-American & Hispanic workers in particular, depressed wage growth, permanent scars in the labor market futures of millions of workers 3/

I prefer looking at employment than potential GDP, given the huge difficulties in forecasting potential GDP. (& my general skepticism about its usefulness as a concept).

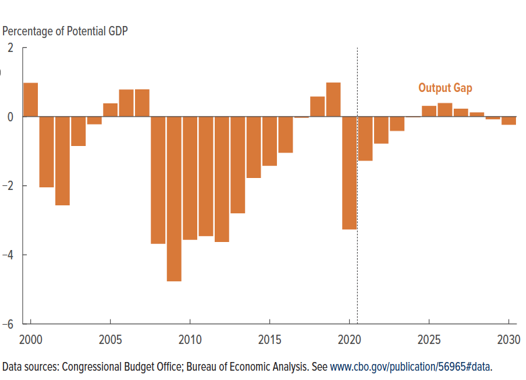

Still, it's worth emphasizing that CBO forecast estimates GDP will only reach potential by 2025.

4/

Still, it's worth emphasizing that CBO forecast estimates GDP will only reach potential by 2025.

4/

And note- this just means the economy is producing at (or a little over) its long run sustainable level BY 2025.

It doesn't mean any of the lost income from 2020-2024 has been caught up! To make up that lost income, GDP would need to run above potential for several years. 5/

It doesn't mean any of the lost income from 2020-2024 has been caught up! To make up that lost income, GDP would need to run above potential for several years. 5/

You can see from the CBO chart that the lost output from the 2020+ period *never* gets caught up, by their forecast. (the output gap bars above 0 add up to less than the output gap bars below 0).

So, the picture is not rosy by any means. 6/

So, the picture is not rosy by any means. 6/

Some important lessons from the past in US & elsewhere: estimates of potential GDP and full employment have been too small, estimates of needed stimulus have generally been too small, and action on stimulus has generally faded far too early - before the economy has recovered. 7/

All this, to me, underscores the message that we still need a big stimulus plan, acting fast is important to get the economy back to full employment as quickly as possible, and the costs of doing too little are far greater than the costs of doing too much. 8/

Final point: regardless of views on the macroeconomic stimulus side, I think the case for a large *relief and response* package is super strong. 1 in 10 households are reporting *not having enough to eat*. Health system, education system, state and local govt badly need funds. 9/

If one is worried about the price tag on the package (whether for debt sustainability or inflationary reasons), better to provide necessary relief and pandemic response, then reduce deficit and/or aggregate demand by raising taxes on those who can bear it best (e.g. wealthy) 10/

Read on Twitter

Read on Twitter