So here goes... I will start from the numbers and then move it slowly into other specific features...

all along ill keep it as simple as possible and will try to avoid all complicated terminologies! https://twitter.com/Kishoreciyer1/status/1356204268294823940

all along ill keep it as simple as possible and will try to avoid all complicated terminologies! https://twitter.com/Kishoreciyer1/status/1356204268294823940

To start off with, the size of our budget is ~34.83 lakh crores for FY22, which means the Govt is expected to make ~34.83lakh crores as receipts and is expected to expend that much or more for running day to day operations, subsidies, creating assets & launching schemes.

- Of the 34.83, ~44% is expected to come from taxes & ~43% is expected to be met by borrowings.

- Just so you understand, in FY20 ~51% was met through taxes and ~35% was met through borrowings.

- For FY21 RE, ~39% to be met by taxes & ~54% through borrowings

- Just so you understand, in FY20 ~51% was met through taxes and ~35% was met through borrowings.

- For FY21 RE, ~39% to be met by taxes & ~54% through borrowings

- If you observe, for FY21 BE, ~54% of the receipts was to be met by taxes and COVID ruined it and this number fell to ~39% in the RE

- The borrowings which was supposed to be only ~26% in FY21BE went up to ~54%. The COVID has had a very bad impact on Govt finances!

- The borrowings which was supposed to be only ~26% in FY21BE went up to ~54%. The COVID has had a very bad impact on Govt finances!

The Tax revenues have fallen and Govt is borrowing a lot, FY21BE borrowings were ~7.96 lakh crores but it shot up to ~18.48lakh crores, which is more than 2x. This is one of the main reasons why the interest rates are being kept low cos the Govt cannot afford high interest outgo

in FY22BE the borrowings are ~15.06Lakh crores which is still high.

One of the other reasons why the borrowings went up in FY21 was cos the Divestment was only ~32k crores & Dividends Profits came down from 1.55lakh crores to 96K crores in FY21RE.

One of the other reasons why the borrowings went up in FY21 was cos the Divestment was only ~32k crores & Dividends Profits came down from 1.55lakh crores to 96K crores in FY21RE.

For FY22BE, the Divestment target is ~1.75Lakh crores which I feel is slightly ambitious given that we are going to see a volatile market going forward. So I would not be surprised if the borrowings inch up to ~18Lakh crores in FY22RE, which will keep the interest rates low!

The reason why it is important to look at these numbers is because it gives you an idea about the variance these budget estimates undergo over a 12 month time frame!

So, drawing up a budget for a country isn't easy!

but finding fault is very easy!

So, drawing up a budget for a country isn't easy!

but finding fault is very easy!

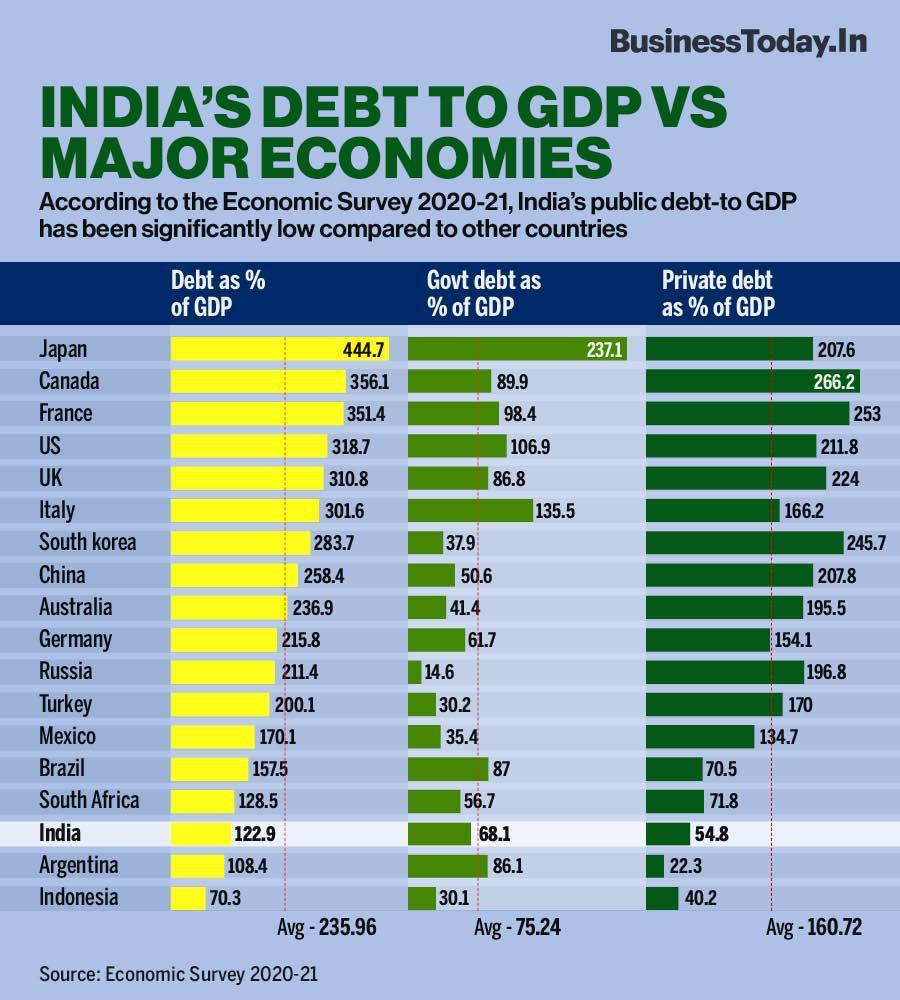

This also shows that taxes are a very big chunk of the Govt receipts and if this suffers govt has no other option than to borrow and very high debt level isn't great for any country BTW India's debt/GDP is 123% which is ~250lakh crores (wrap your head around that number)

I will take a pause over here and continue tomorrow cos too much information isn't good... I request everyone to go through these numbers if interested and we could discuss...

Thank you.... To be continued tomorrow!

Thank you.... To be continued tomorrow!

Read on Twitter

Read on Twitter