Building on @Ben_Mackovak's work on "when squeezes collapse," I pulled the data on the infamous "Hunt Brothers Corner" on silver (a corner is a causing of a squeeze).

A 6 Tweet thread

$GME, $SLV

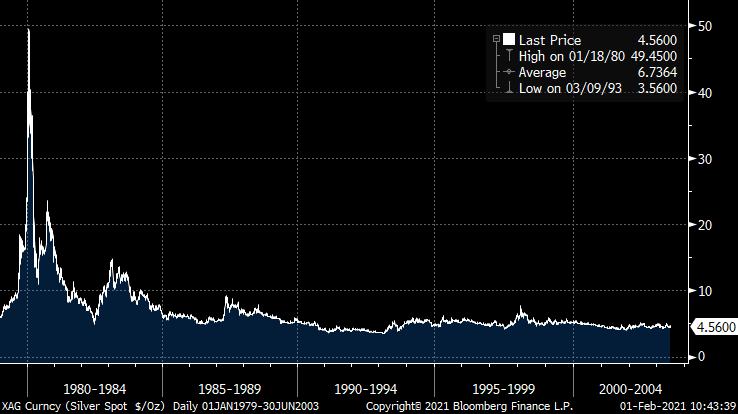

XAG (silver) graph:

Sept 30, 1979 - June 30, 1980

A 6 Tweet thread

$GME, $SLV

XAG (silver) graph:

Sept 30, 1979 - June 30, 1980

As you can see in the Bloomberg graph above:

- The full retracement (from start to finish) lasted 4 months

- The frenzy lasting 3 months

- The moonshot phase lasted 1 week

2:6

- The full retracement (from start to finish) lasted 4 months

- The frenzy lasting 3 months

- The moonshot phase lasted 1 week

2:6

The Upslope Phase:

11/27/79: the last day of a $16s price. I denote this as the Start Date.

12/31/79 (34 days) $32 (2x from Start Date)

1/2/80 (36 days) $40 (2.5x)

1/18/80 (52 days) was $50 (3x and *All-Time* peak, not to be seen again for >30 years)

3:6

11/27/79: the last day of a $16s price. I denote this as the Start Date.

12/31/79 (34 days) $32 (2x from Start Date)

1/2/80 (36 days) $40 (2.5x)

1/18/80 (52 days) was $50 (3x and *All-Time* peak, not to be seen again for >30 years)

3:6

The Downslope:

2/5/80 $40 (-20%, 18d from peak)

2/20/80 $30 (-40%, 33d from peak)

3/18/80 $17 (-65%, 60d from peak - full retracement, but it kept falling)

4:6

2/5/80 $40 (-20%, 18d from peak)

2/20/80 $30 (-40%, 33d from peak)

3/18/80 $17 (-65%, 60d from peak - full retracement, but it kept falling)

4:6

The Denouement:

3/27/80 The Hunt Bros failed a margin call

3/31/80 $13.50 - (-73% - more than a full retracement, 73d from peak)

5/22/80 $10.89 - local bottom (1/3 below *pre-corner* and -80% & 122d from peak)

3/9/93 $3.56 -No bueno

12/31/2003 $4.56 -Todavía no es bueno

5:6

3/27/80 The Hunt Bros failed a margin call

3/31/80 $13.50 - (-73% - more than a full retracement, 73d from peak)

5/22/80 $10.89 - local bottom (1/3 below *pre-corner* and -80% & 122d from peak)

3/9/93 $3.56 -No bueno

12/31/2003 $4.56 -Todavía no es bueno

5:6

Summary:

After the Hunt Brothers silver corner peak, it took 2 months to fully retrace.

Another 2m and it was 80% off the peak (well below the starting value).

25 years later, silver was still dead.

Perhaps lessons for $GME diamond hands.

Yet The Silver may rise again.

[End]

After the Hunt Brothers silver corner peak, it took 2 months to fully retrace.

Another 2m and it was 80% off the peak (well below the starting value).

25 years later, silver was still dead.

Perhaps lessons for $GME diamond hands.

Yet The Silver may rise again.

[End]

Stupid no "edit" button: "(a corner is a COUSIN of a squeeze)"

Read on Twitter

Read on Twitter