Is stock performance and valuation indicative of deeper health?

HAHA NO!

Here's a crystal clear explanation of where valuation comes from and why you (in the role of employee, investor, good human being) really should care...

HAHA NO!

Here's a crystal clear explanation of where valuation comes from and why you (in the role of employee, investor, good human being) really should care...

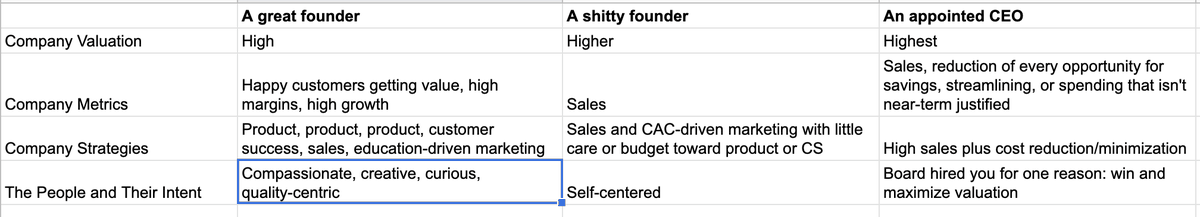

A valuation is established and justified by metrics. Those metrics emerge from company strategies and focus, and those strategies emerge from the humans running the company and teams; what their intent and personal strength and integrity is.

Let's start at the bottom layer.

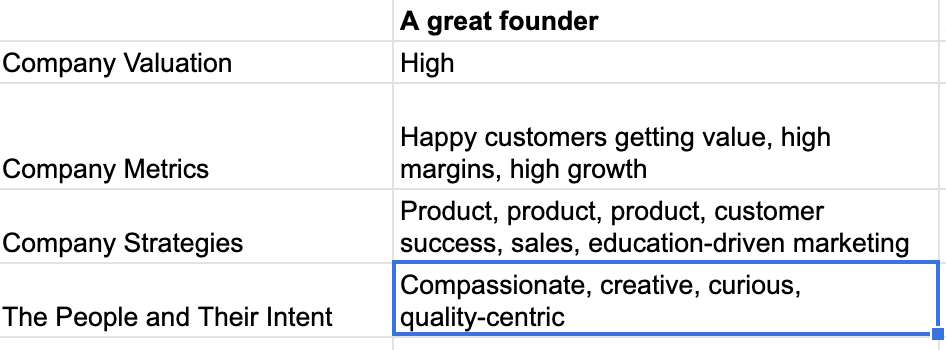

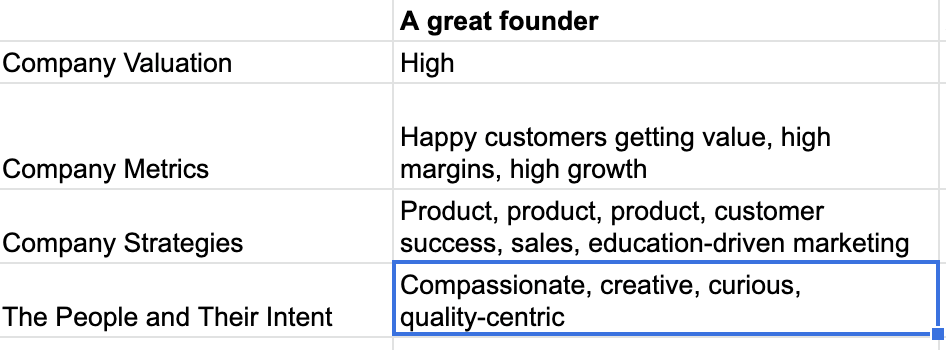

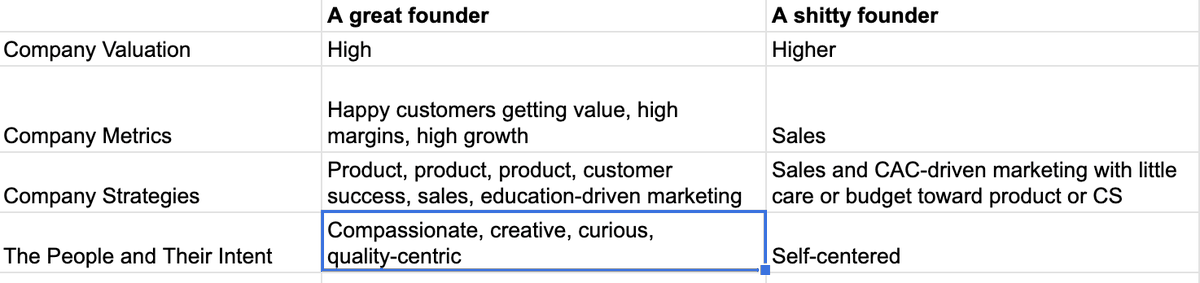

A great founder is great because they genuinely care. They have discovered a problem, inefficiency, or opportunity where their solution actually helps people. Yes, the solution is a means to an end...

A great founder is great because they genuinely care. They have discovered a problem, inefficiency, or opportunity where their solution actually helps people. Yes, the solution is a means to an end...

...but within that means is a quality of life improvement. We don't just help people make more money in their marketing....we do it by substantially reducing the pain, confusion, chaos, disarray of marketing, making the marketer's life better while delivering that upside.

It's the compassion, creativity, curiosity, and desire for genuine quality that motivates the great founder to deliver actual value, not just exploit the market. We all know someone whose "good enough" is nowhere near "good enough." These people are the opposite of that.

Because of these motivations, the founder sets strategies that are product and success centric. This is what @paulg was complimenting @sahil on the other day. That he was starting by making a small group of customers very happy before trying to continue the journey.

The metrics that these founders focus on is ensuring that customers are ACTUALLY GETTING VALUE, that they are happy with how it all works, and then they move on to growing and healthy economics once they are sure it's a legitimately great solution they can feel proud of pushing.

And the business derives a healthy valuation from that. Product first, customer success obsessed, growth engine.

Now let's look at a shitty founder and why we don't figure out that they are shitty until it's too late.

The shitty founder is a self-centered person. They want to get rich. And the fastest way to get rich isn't to focus on the product, it's to focus on sales.

Now it stands to reason that you can't sell if you have a shitty product....right?

Now it stands to reason that you can't sell if you have a shitty product....right?

And that's where a fundamentally-incorrect assumption triggers a reaction of faith in investors, customers, journalists, etc. That chain can go on for a long time as customers believe promises only to get a frustrating product that they struggle to use and almost never enjoy.

These founders know the market is willing to pay for a product or service that fixes their issue. They pay, find out that the product doesn't really work well or at all, and then the founder blames the customer and says other customers don't have these issues (BS).

Investors see sales (and possibly a churn problem the founder promises is being addressed), so they jump on board. Well-funded marketing teams make ever-more beautiful animations and presentations that continue to boost sales since everything "looks right" to the buyer...

....when making everything "look right" is exactly the objective of the founder and the teams. When product teams want to do the right thing and make the product better, they are challenged internally with proving how that will make the company grow sales.

The product teams try to appeal to the challenge of churn, returns, make-goods, etc., but they fail. Those aren't product issues...those are support issues.

Those customers stay on support lines for hours, talk to people who were hired last week and can't help them. The product teams think their job is revenue growth rather than quality.

And what happens with the valuation? It's EVEN HIGHER than for the great founder. And that's because self-centered motivation makes all energy go toward the metric of sales and revenue growth, with product and marketing making pretty screenshots, not real product.

Valuation moves on the metric of sales, not customer success. The "good faith" assumption that sales is somehow indicative of customer success us exploited, and under the surface is wholly incorrect.

Sometimes, this goes great. But here's how it looks even more often.

That hired CEO was hired by the board and shareholders, not hired by the market like the founder was.

And their instructions are simple: drive valuation.

That hired CEO was hired by the board and shareholders, not hired by the market like the founder was.

And their instructions are simple: drive valuation.

So regardless of the person's internal motivations, they have a job to do, or they'll be fired by the board so someone else can do the job.

And this is where things get tricky.

And this is where things get tricky.

The founder had the ability to spend whatever they wanted to make the company great. But this new CEO has to not only ramp sales but go around and cut out all of the excess spending, too. But it's not excess...

Boosting sales and shrinking expenses = highest valuation.

Boosting sales and shrinking expenses = highest valuation.

...making everyone think they are some sort of genius and the previous great founder was some sort of an idiot creating tons of waste. Meanwhile, health is being eroded.

That "waste reduction" will start to kill quality, kill product, kill customer success...slowly.

That "waste reduction" will start to kill quality, kill product, kill customer success...slowly.

So that maximization of valuation is only good for one group of people, and it's not worth the trade-off. A story comes to mind.

A co-founder wanted to grow the company by 30% in a year. Both founders owned 100% of the company, so no external pressure. One said that kind of growth at that particular moment would mean an incredible amount of stress on the team, and would go against our culture.

Their recommendation: let's grow that same 30%, but in 5 quarters instead of 4. By their estimation, that would be a 25% increase in time for a 80% reduction in burnout.

Seemed like easy math.

Seemed like easy math.

But the narcissistic partner who would feel none of the pain of the faster timeline insisted on pushing the team to the brink.

The result? Great people who never considered leaving before...they started leaving. This place wasn't what they thought it was.

The result? Great people who never considered leaving before...they started leaving. This place wasn't what they thought it was.

There's always a little more money to be made. What starts to happen when we chase that money is pain and quality issues. We cause our teams pain, and we cause our customers quality.

Eventually, quality issues turn into small doses of fraud: saying one thing and doing another.

Eventually, quality issues turn into small doses of fraud: saying one thing and doing another.

And we end up seeing clearly that the most profitable legitimate companies are essentially riding the brink of fraud. Any less quality and they'd be outright liars.

So for me, these "incredible" leaders who drive valuations while juicing the world are anything but heroes.

I just look for real value, and I know the math of making money will take care of itself.

I just look for real value, and I know the math of making money will take care of itself.

I don't need the maximum valuation that's only possible if I grind employees and customers to dust.

I'm fine to settle for a still-high valuation to do things beautifully right.

I'm fine to settle for a still-high valuation to do things beautifully right.

And I encourage you to see that there is zero material downside in taking the same view.

Read on Twitter

Read on Twitter