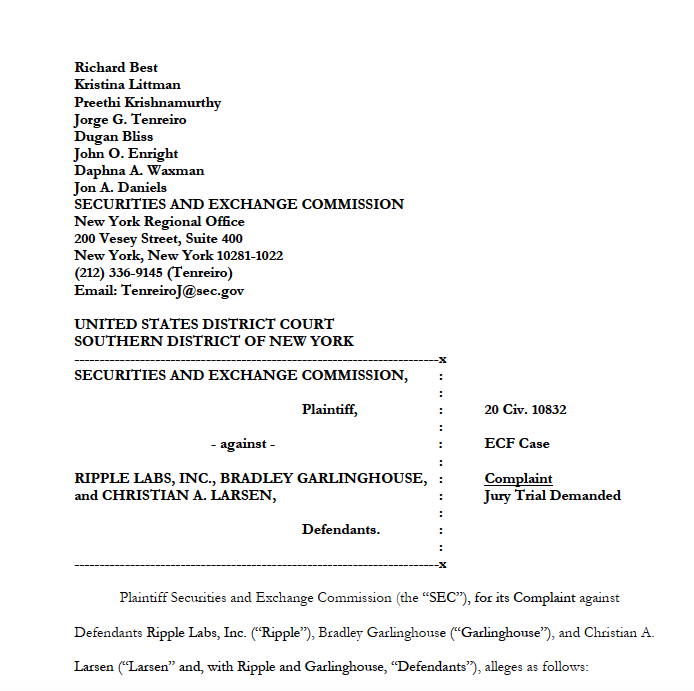

When a defendant is sued they have a couple of immediate options. They can move to dismiss, they can answer, they can ask for more time. It's very easy -- and typical -- for a defendant to ask for more time and slow things down. They filed a relatively quick answer.

I wouldn't have been surprised if they'd asked for another 30 days & then filed a nearly guaranteed to be denied motion to dismiss. But they didn't. They answered within about a month.

What does this mean?

Unlike most defendants they actually want a fast resolution.

What does this mean?

Unlike most defendants they actually want a fast resolution.

My initial response to the the Answer was a bit glib -- I said it was delusional. In fairness to their lawyers, they did about as well as can be expected given the facts (which they didn't create). I still don't think it's a winnable case but it's a very well put together answer.

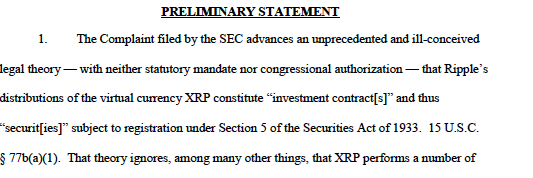

A second thing that jumps out at me is the way the Answer begins. They include their own "preliminary statement". This is atypical. An answer admits or denies allegations and includes affirmative defenses/avoidances, and sometimes includes a counterclaim.

As a procedural matter, you don't typically include your own affirmative explanation of your position in an answer. The purpose is clearly to make this a statement to the general public and highlight the arguments to the court (and law clerks). It's weird, but I get the reason.

If I were the SEC and pissed off about using an Answer as a press release I might file a motion to strike this as irrelevant or impertinent material, but maybe it's not worth the effort as maybe it doesn't really matter (as I discuss below).

So, what are the arguments?

First, "it's not a security." This is what we call "bald ipse dixit" but you don't really expect full briefing in an answer, so no harm no foul (and there was some of that in the Complaint as well, though more facts than conclusion in my view).

First, "it's not a security." This is what we call "bald ipse dixit" but you don't really expect full briefing in an answer, so no harm no foul (and there was some of that in the Complaint as well, though more facts than conclusion in my view).

I'm not really taken by the argument that FinCEN said X or it's not a security in other countries. First, other countries have different laws. Second, a thing can be both a security and a currency (or something else), as other courts have ruled.

There's a lot going on in this paragraph. Again, I seriously doubt that "BUT CHINA!" or "THE SEC HURT THE INVESTORS, WE DIDN'T" are winnable arguments. But points for creativity. It sounds nice, but if you don't know anything about law or judges, this might be more persuasive.

This reads more like an opening statement at trial or a press release than an answer. And the number of people you have employed in various offices isn't a defense to a securities enforcement action (or anything else for that matter).

again with the press release about bitcoin being bad and XRP being good. totally, absolutely, unequivocally irrelevant in this case. nothing to do with whether or not it's a security. at all.

probably taken from the wells response and will no doubt feature in a motion for summary judgment at some point.

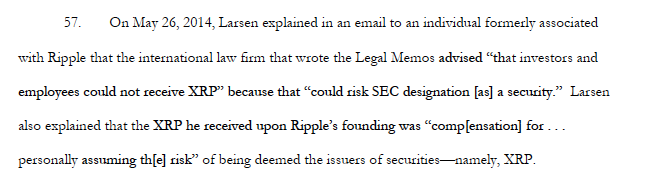

The SEC complaint is chock full of (in my simple country lawyer opinion) damaging quotes from documents. The way lawyers deal with this sometimes is by saying "the document speaks for itself." The snarky response is "it sure does". That's prolly what I'd say here if in trial.

This isn't a criticism of the lawyers, btw -- the Answer if full of responses like this. It's a common pleading convention when, yeah, the quote is from a document and maybe you don't love it.

No, I haven't been hacked. The lawyers did what they could with what they had, and notable that they didn't take an extension of file a guaranteed to be denied 12(b)(6) motion.

Ripple says that the SEC selectively quotes from the law firm opinion letter -- I suspect we'll eventually see that as an exhibit (though maybe filed under seal). Sadly, not here.

about 1/2 of the answer is the "the document speaks for itself"

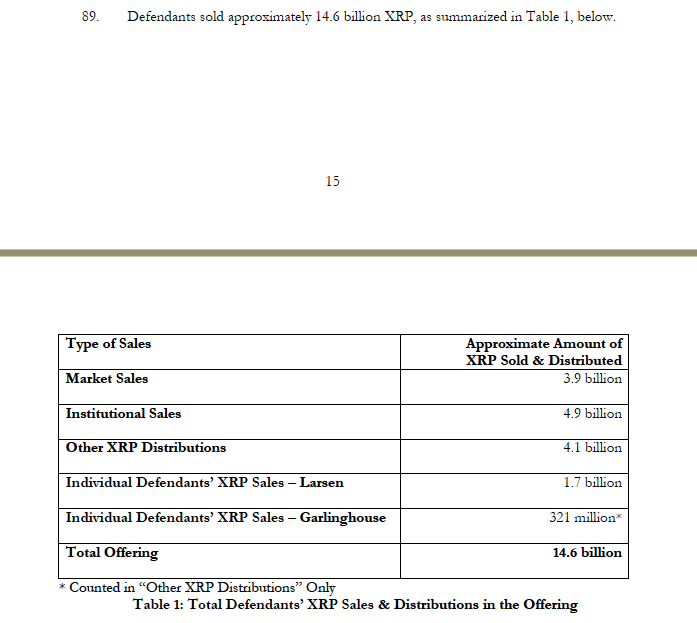

ultimately, Ripple is probably going to have to admit that this is true. the non-denial denial (which the complaint is full of) kicks the can down the road (not atypical by the way, but not winnable in the end -- SEC probably based this on evidence from the enforcement action)

tl;dr -- Ripple answered fast. They provide a press release-like opening for the public and policymakers. The facts in the end are probably not really going to be in dispute. Question is whether any of their defenses are winnable.

skeptical that how other countries treat XRP really matters

judge MAY be sympathetic to time argument, but in the end, not if within statute of limitations and tolling agreements.

still give Ripple, despite their fine legal team, less than 10 percent shot at winning.

judge MAY be sympathetic to time argument, but in the end, not if within statute of limitations and tolling agreements.

still give Ripple, despite their fine legal team, less than 10 percent shot at winning.

case should settle after motion practice, maybe with an ability to allow trading to commence again in US. SEC probably not entirely deaf to impact on US buyers, nor should it be (whatever one thinks of the company or its head honchos)

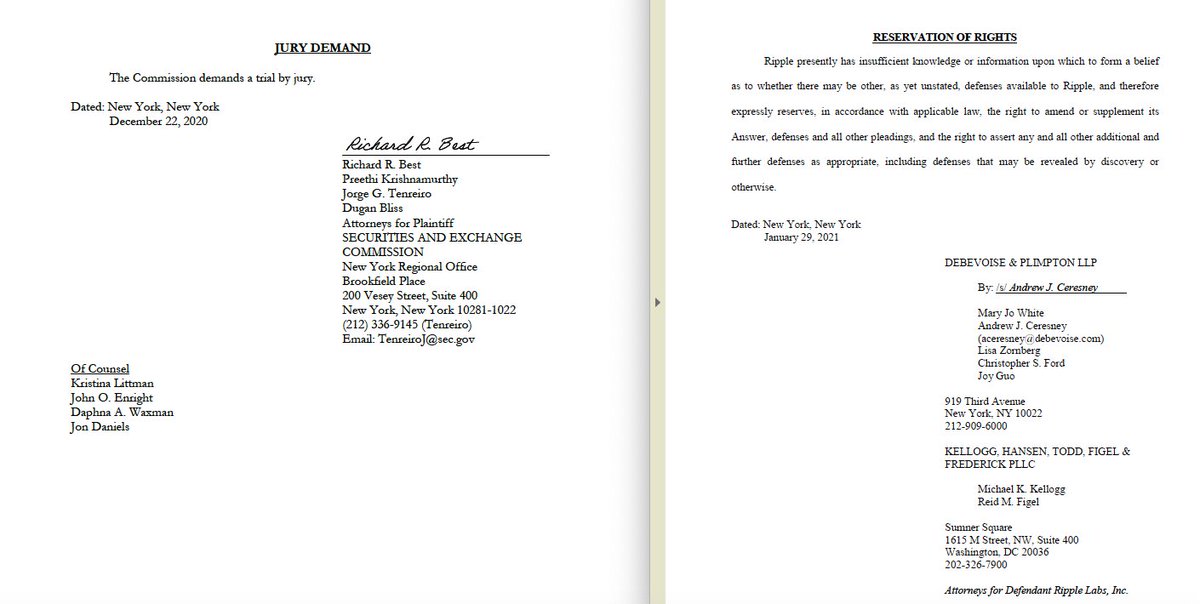

Larsen and Garlinghouse haven't answered yet -- assume will respond separately.

Read on Twitter

Read on Twitter