Bears. Bulls. Battlestar Galactica

Stock market investing can make you feel anxious or scared if you are a beginner investor

Here are some stock market history facts to calm you down

/THREAD/

Stock market investing can make you feel anxious or scared if you are a beginner investor

Here are some stock market history facts to calm you down

/THREAD/

1/ First some definitions.

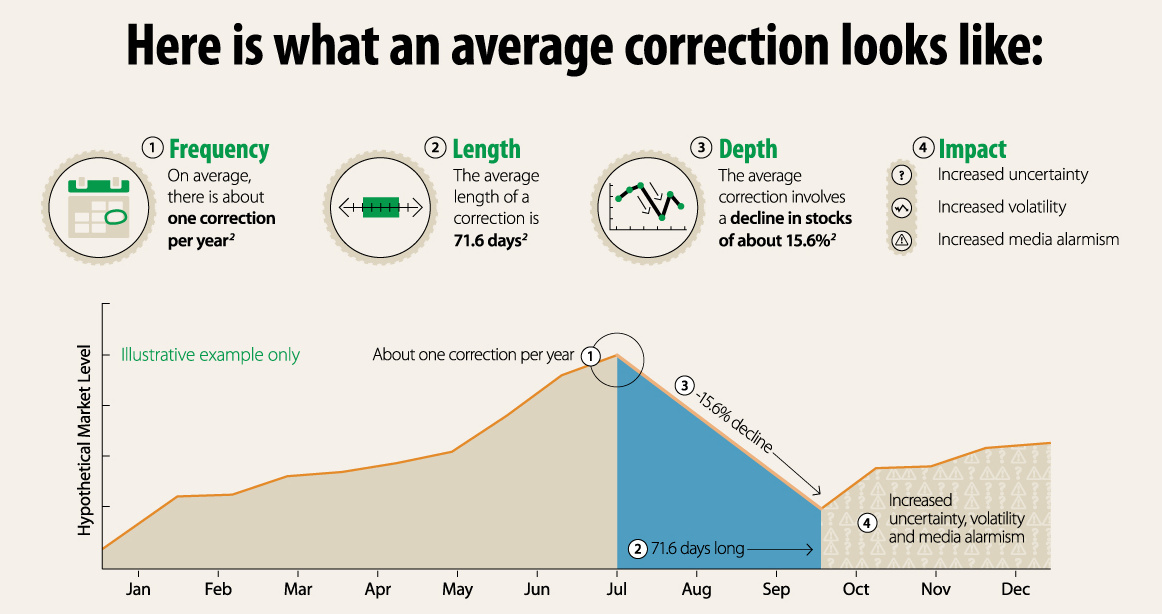

A 10% drop in the market is considered a correction.

A drop exceeding 20% is considered a bear market.

An increase by more than 20% is considered a bull market.

A 10% drop in the market is considered a correction.

A drop exceeding 20% is considered a bear market.

An increase by more than 20% is considered a bull market.

2/ FACT

Corrections occur once a year on average.

If you watch financial news, there will always be something to make you scared that the stock market will tank.

Oil prices, inflation, slow growth, trade wars, China, Russia, debt increase, the Middle East, an epidemic.

Corrections occur once a year on average.

If you watch financial news, there will always be something to make you scared that the stock market will tank.

Oil prices, inflation, slow growth, trade wars, China, Russia, debt increase, the Middle East, an epidemic.

3/ The story goes on. There will always be something to make the future seem bleak.

But market drops are a natural occurrence, almost once every year since 1900.

On average they last a little more than 2 months.

But market drops are a natural occurrence, almost once every year since 1900.

On average they last a little more than 2 months.

4/ FACT

Less than 1 in 5 corrections turn into bear markets.

If the market drops by 10% and you are scared that this will turn into a death spiral and make your investments tank, don't be.

There is a greater than 80% chance this won't happen.

Less than 1 in 5 corrections turn into bear markets.

If the market drops by 10% and you are scared that this will turn into a death spiral and make your investments tank, don't be.

There is a greater than 80% chance this won't happen.

5/ FACT

Nobody can predict successfully and consistently the stock market movements.

During the dot-com mania in the late 1990s, all the pundits and analysts were euphoric.

Nobody can predict successfully and consistently the stock market movements.

During the dot-com mania in the late 1990s, all the pundits and analysts were euphoric.

6/ They were predicting that stocks would keep rising.

Some made bold predictions that the Dow index would hit 40,000 or even 100,000 points.

Soon later, the tech market tanked by 80%.

Some made bold predictions that the Dow index would hit 40,000 or even 100,000 points.

Soon later, the tech market tanked by 80%.

7/ Jim Cramer, yes that @jimcramer, gave a list of ten stocks that would dominate the market in the next decades.

Had you invested in them, you would have lost most of your money a few years later.

Had you invested in them, you would have lost most of your money a few years later.

8/ On the other hand, there are the so-called merchants of doom.

No matter what happens in the market they always predict declines, crashes, bubbles bursting, and recessions.

No matter what happens in the market they always predict declines, crashes, bubbles bursting, and recessions.

9/ They make articles or videos with flashy headlines.

"Stock market CRASH coming soon"

"The bubble will BURST soon. What to do"

At some point, they will finally be true.

"Stock market CRASH coming soon"

"The bubble will BURST soon. What to do"

At some point, they will finally be true.

10/ "We've long felt that the only value of stock forecasters is to make fortune-tellers look good."

-Warren Buffett

-Warren Buffett

12/ A holding period of more than 20 years never produced a negative return.

So buy and hold for the long-term. https://twitter.com/itsKostasOnFIRE/status/1346488622493691904?s=20

So buy and hold for the long-term. https://twitter.com/itsKostasOnFIRE/status/1346488622493691904?s=20

13/ FACT

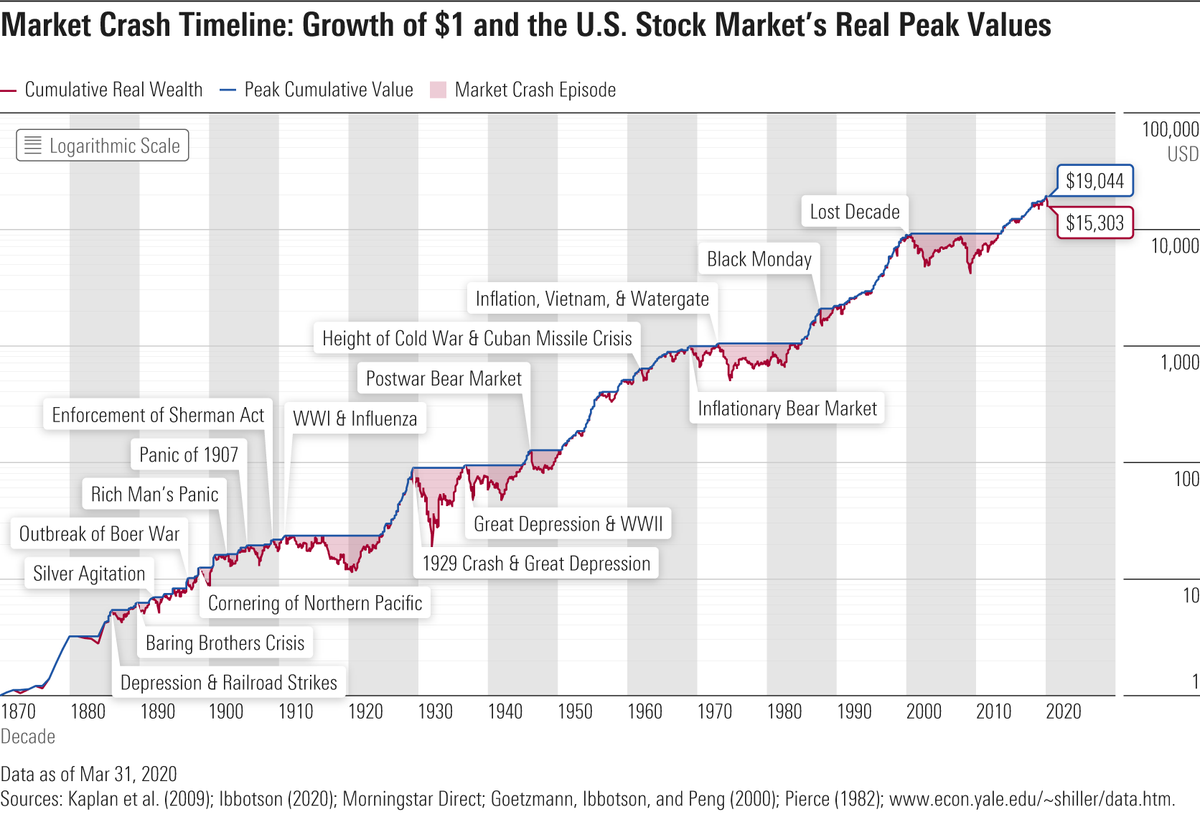

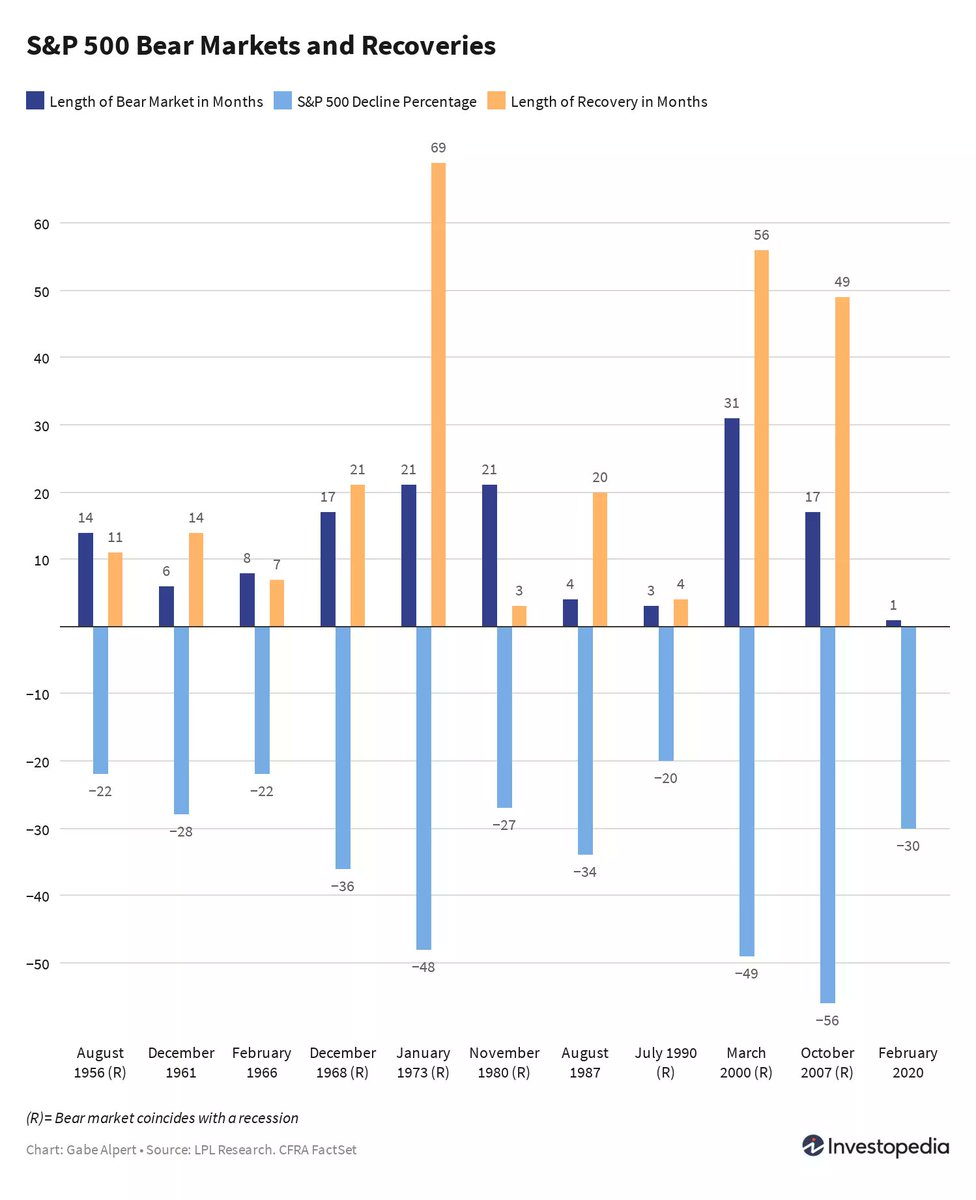

Bear markets occur once every 3-5 years.

There have been 37 bear markets since 1900, 17 of them after WWII.

That means that every 3 to 5 years there will be a bear market.

Bear markets occur once every 3-5 years.

There have been 37 bear markets since 1900, 17 of them after WWII.

That means that every 3 to 5 years there will be a bear market.

14/ History might not repeat itself but it definitely rhymes.

If you are in your twenties you will probably experience 15 bear markets.

Get used to it.

If you are in your twenties you will probably experience 15 bear markets.

Get used to it.

16/ FACT

Every bear market eventually turns into a bull market.

Apart from the Great Depression, which created a ten-year bear market, bear markets last on average around one year.

They are always followed by a bull market where the gains more than make up for the losses.

Every bear market eventually turns into a bull market.

Apart from the Great Depression, which created a ten-year bear market, bear markets last on average around one year.

They are always followed by a bull market where the gains more than make up for the losses.

17/ FACT

Time in the market always beat timing the market.

Trying to predict the stock market cycles and being influenced by the news is not a good guide for investing.

Time in the market always beat timing the market.

Trying to predict the stock market cycles and being influenced by the news is not a good guide for investing.

18/ Staying invested always beats going in and out of the market.

For more on this see the thread below. https://twitter.com/itsKostasOnFIRE/status/1346488602562322434?s=20

For more on this see the thread below. https://twitter.com/itsKostasOnFIRE/status/1346488602562322434?s=20

19/ So now that you know these facts you shouldn't let your emotions cloud your judgement and affect your investing decisions.

Every time you feel scared or anxious go over those facts again.

And stay the course.

/END/

Every time you feel scared or anxious go over those facts again.

And stay the course.

/END/

If you liked this thread click below and retweet the first tweet, and follow to stay updated. https://twitter.com/itsKostasOnFIRE/status/1356258067684458496?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

Read on Twitter

Read on Twitter