THREAD: With #silversqueeze trending on Twitter, it appears that this week's market spectacle may well be in the silver market.

A perfect moment for a thread on the Hunt Brothers and their alleged attempt to corner the silver market...

A perfect moment for a thread on the Hunt Brothers and their alleged attempt to corner the silver market...

1/ First, let's set the stage.

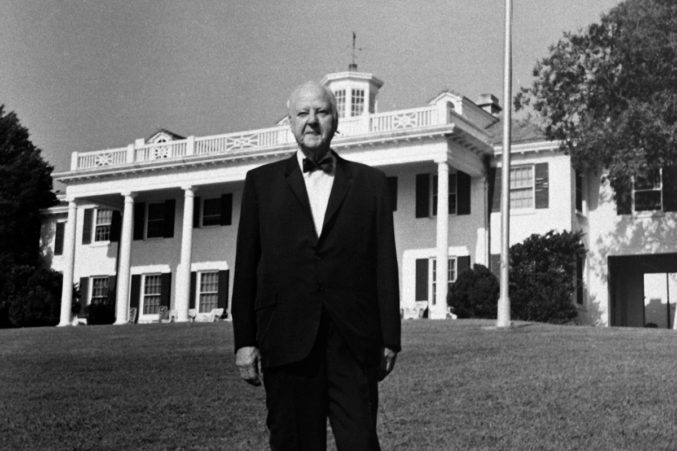

The Hunt Brothers - Nelson Bunker Hunt, William Herbert Hunt, and Lamar Hunt - were the sons of Texas tycoon H.L. Hunt.

H.L. Hunt had amassed a billion-dollar fortune in the oil industry.

He died in 1974 and left that fortune to his family.

The Hunt Brothers - Nelson Bunker Hunt, William Herbert Hunt, and Lamar Hunt - were the sons of Texas tycoon H.L. Hunt.

H.L. Hunt had amassed a billion-dollar fortune in the oil industry.

He died in 1974 and left that fortune to his family.

2/ After H.L.'s passing, the Hunt Brothers had taken over the family holdings and successfully managed to expand the Hunt empire.

By the late 1970s, the family's fortune was estimated to be ~$5 billion.

In the financial world, the Hunt name was as good as gold (or silver!).

By the late 1970s, the family's fortune was estimated to be ~$5 billion.

In the financial world, the Hunt name was as good as gold (or silver!).

3/ But the 1970s were a turbulent time in America.

Following the oil crisis of the early 1970s, the U.S. had entered a period of stagflation - a dire macroeconomic condition characterized by high inflation, low growth, and high unemployment. https://twitter.com/SahilBloom/status/1301209639741161473?s=20

Following the oil crisis of the early 1970s, the U.S. had entered a period of stagflation - a dire macroeconomic condition characterized by high inflation, low growth, and high unemployment. https://twitter.com/SahilBloom/status/1301209639741161473?s=20

4/ The Hunt Brothers - particularly Nelson Bunker and William Herbert - believed that the inflationary environment would persist and destroy the value of their family's holdings.

To hedge this risk, they turned to silver.

They began buying the metal at ~$3 per ounce in 1973.

To hedge this risk, they turned to silver.

They began buying the metal at ~$3 per ounce in 1973.

5/ Not a conservative bunch, in the mid-late 1970s, the Hunt Brothers began more aggressively buying physical silver.

But it didn't stop there.

They started buying all of the available silver futures contracts as well.

A primer on futures is below. https://twitter.com/SahilBloom/status/1291769272323039232?s=20

But it didn't stop there.

They started buying all of the available silver futures contracts as well.

A primer on futures is below. https://twitter.com/SahilBloom/status/1291769272323039232?s=20

6/ Typically, these futures contracts are settled in cash, meaning the buyer (the Hunts) just receives cash for whatever the contract is worth at expiry.

But the Hunts were not typical - they wanted the silver!

So planes were loaded and shuttled silver to vaults in Switzerland.

But the Hunts were not typical - they wanted the silver!

So planes were loaded and shuttled silver to vaults in Switzerland.

7/ In addition to using their personal cash fortunes to execute this buying, the Hunt Brothers began aggressively leveraging their position.

They used margin (primer below) to expand their buying power in the market.

Their silver position ballooned. https://twitter.com/SahilBloom/status/1284167630820016128?s=20

They used margin (primer below) to expand their buying power in the market.

Their silver position ballooned. https://twitter.com/SahilBloom/status/1284167630820016128?s=20

8/ With the flood of demand from the Hunt Whale, silver prices began to rise.

At this point, it was rumored that this was more than a simple bet on silver as a hedge against paper currency.

The Hunt Brothers were attempting - rather successfully - to corner the silver market.

At this point, it was rumored that this was more than a simple bet on silver as a hedge against paper currency.

The Hunt Brothers were attempting - rather successfully - to corner the silver market.

9/ Cornering a market means an individual or entity acquires enough shares or ownership to manipulate the market price.

The individual backs the market into a corner - the market has nowhere to run.

The cornering party has full control over it.

It seemed like the Hunt's plan.

The individual backs the market into a corner - the market has nowhere to run.

The cornering party has full control over it.

It seemed like the Hunt's plan.

10/ In addition to their prolific buying, the Hunts brought other investors, some of Saudi origin, into the trade.

As prices climbed, a short squeeze was on.

Silver shorts were forced to cover their positions, further accelerating the price rise. https://twitter.com/SahilBloom/status/1291030969953038336?s=20

As prices climbed, a short squeeze was on.

Silver shorts were forced to cover their positions, further accelerating the price rise. https://twitter.com/SahilBloom/status/1291030969953038336?s=20

11/ The price of silver skyrocketed from $6 per ounce in early 1979 to over $49 per ounce in early 1980 (a 700%+ spike!).

The Hunt position was now worth ~$5 billion.

They were believed to control 2/3 of the available market - intentionally or not, they had cornered the market.

The Hunt position was now worth ~$5 billion.

They were believed to control 2/3 of the available market - intentionally or not, they had cornered the market.

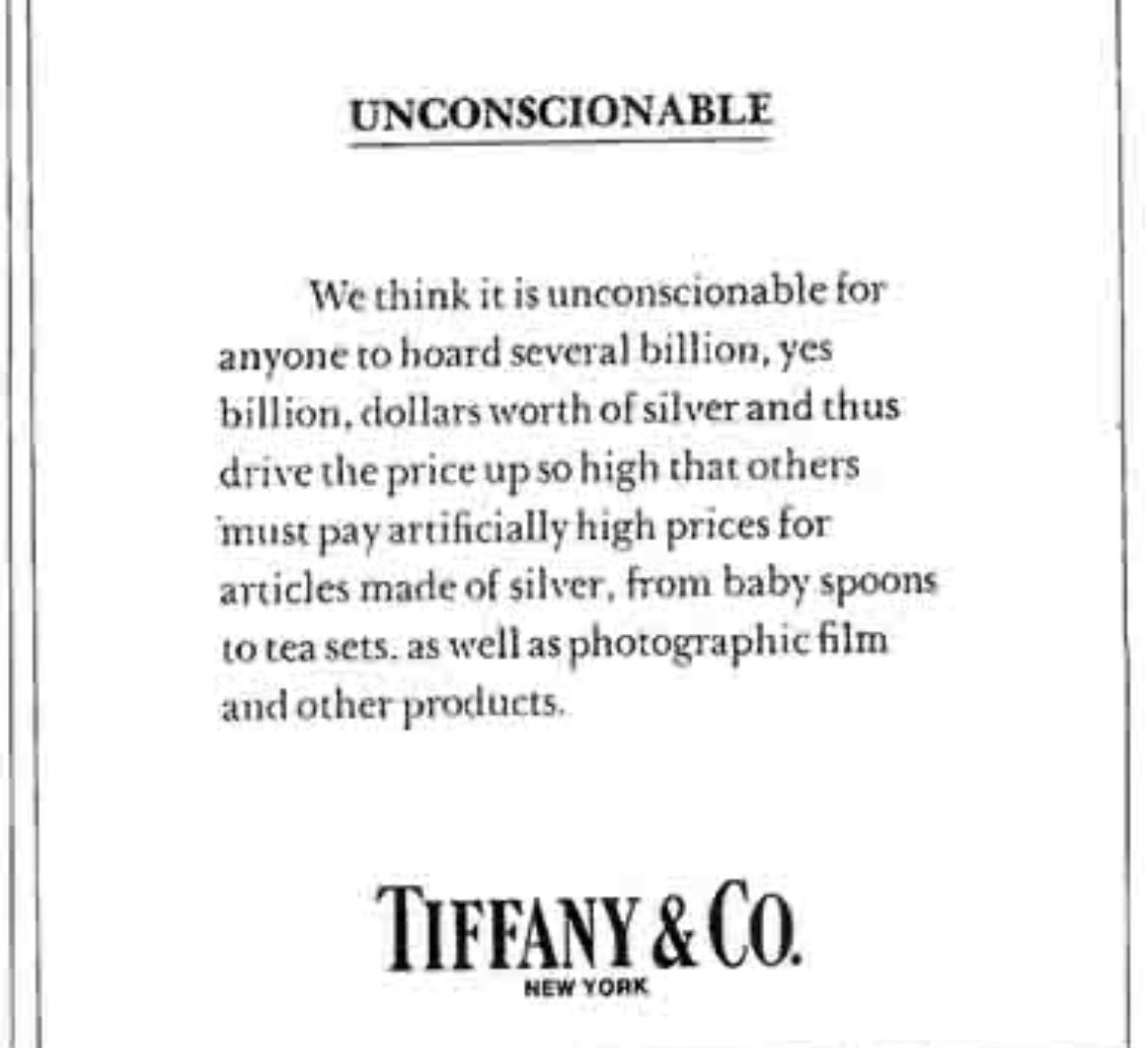

12/ With prices at all-time highs, the silver frenzy was in full effect.

The price rise was so dramatic that Tiffany's took out a full-page ad in the @nytimes deriding the Hunt Brothers for their actions and their impact on pushing mom-and-pop silver buyers out of the market.

The price rise was so dramatic that Tiffany's took out a full-page ad in the @nytimes deriding the Hunt Brothers for their actions and their impact on pushing mom-and-pop silver buyers out of the market.

13/ At this point, the government took notice.

And if there is one thing we learned in the last week, it's that the rules of the game can be changed at any time.

Unfortunately for the Hunt Brothers, the rules of the game were about to change and pull the rug from under them.

And if there is one thing we learned in the last week, it's that the rules of the game can be changed at any time.

Unfortunately for the Hunt Brothers, the rules of the game were about to change and pull the rug from under them.

14/ In January 1980, Federal regulators stepped in.

In "Silver Rule 7," regulators increased the margin requirements on silver futures, meaning purchasers would need to post additional collateral to support their loans.

The rules had changed - the Hunts were now the hunted.

In "Silver Rule 7," regulators increased the margin requirements on silver futures, meaning purchasers would need to post additional collateral to support their loans.

The rules had changed - the Hunts were now the hunted.

15/ What followed was a classic, leverage-induced downward spiral.

The price of silver began to fall.

The Hunt Brothers were issued margin calls on their loans.

To meet the margin calls, they had to sell silver.

The selling dropped the price, leading to more margin calls.

The price of silver began to fall.

The Hunt Brothers were issued margin calls on their loans.

To meet the margin calls, they had to sell silver.

The selling dropped the price, leading to more margin calls.

16/ On March 27, 1980, when news broke that the Hunt Brothers had been unable to meet a $100+ million margin call, the silver market collapsed 50% to under $11 per ounce.

The government even grew worried about the systemic risk to the system if the Hunt's brokers went under.

The government even grew worried about the systemic risk to the system if the Hunt's brokers went under.

17/ Given their other business interests, the Hunt Brothers were able to secure a rescue package of $1.1 billion from a variety of banks in order to meet their obligations.

While they did later declare bankruptcy to protect certain assets, the family fortune generally survived.

While they did later declare bankruptcy to protect certain assets, the family fortune generally survived.

18/ Throughout the government and legal proceedings that followed the incident, the Hunt Brothers denied any wrongdoing.

They maintained that their silver purchases were not an attempt to corner the market but a legitimate investment in a hedge against fiat destruction.

They maintained that their silver purchases were not an attempt to corner the market but a legitimate investment in a hedge against fiat destruction.

19/ So as the world once again turns its gaze to the silver market, I hope the story of the Hunt Brothers provides an interesting historical backdrop for this week's show.

As always, do your research and never take undue risks!

As always, do your research and never take undue risks!

20/ If you enjoyed this, follow me for more educational threads on business, money, finance, and economics. You can find all of my threads in the meta-thread below. https://twitter.com/SahilBloom/status/1284583099775324161?s=20

21/ And if you are less Twitter inclined, sign up for my newsletter here, where you can find all of my old threads and receive all of my new threads directly to your inbox. https://sahilbloom.substack.com/

Read on Twitter

Read on Twitter