1/A LOT of critically important charts in this week's #DirtyDozen.

I cover growing trend fragility, a monthly sell signal, discuss why this *isn't* a major top buy why we should expect a 1-2 month correction to begin w/in the next few weeks, plus more.

https://macro-ops.com/a-major-monthly-sell-signal-dirty-dozen/

I cover growing trend fragility, a monthly sell signal, discuss why this *isn't* a major top buy why we should expect a 1-2 month correction to begin w/in the next few weeks, plus more.

https://macro-ops.com/a-major-monthly-sell-signal-dirty-dozen/

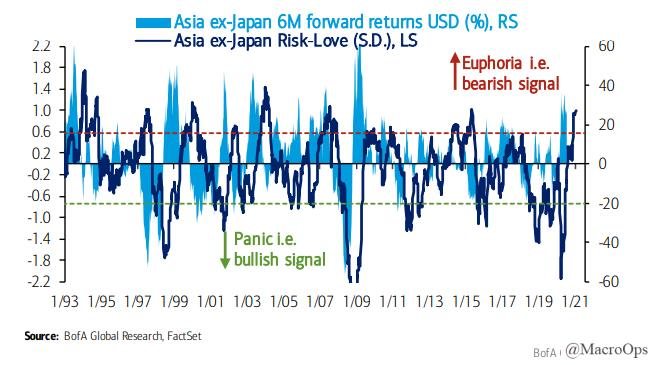

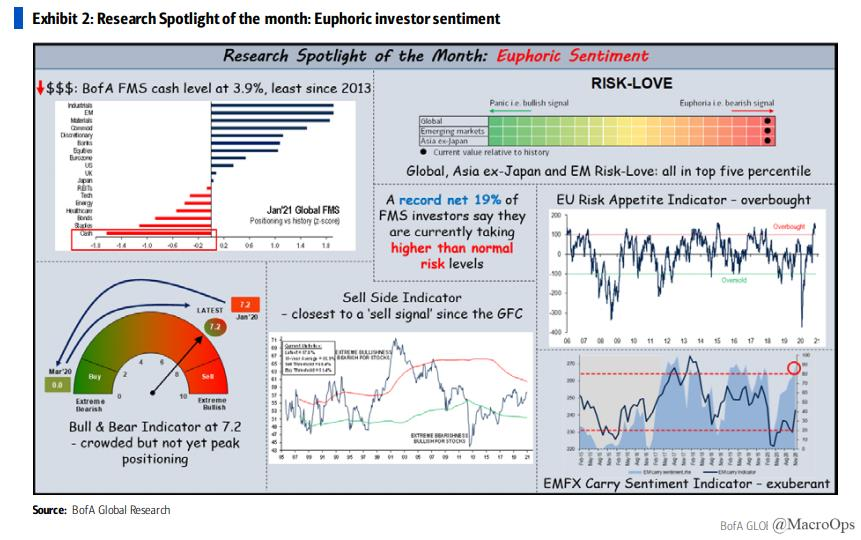

2/ High euphoria = high trend fragility

-Record net 19% FMS investors raking greater risk

-FMS cash level at 3.9% triggering a 'sell signal'

-Global Risk-Love in 97th %-tile going back to 1987

-Asia/EM Risk-Love signaling "euphoria" for 1st time since 2015

-Record net 19% FMS investors raking greater risk

-FMS cash level at 3.9% triggering a 'sell signal'

-Global Risk-Love in 97th %-tile going back to 1987

-Asia/EM Risk-Love signaling "euphoria" for 1st time since 2015

3/ “Two-month flows into DM and EM equity funds the highest since [Oct 2000]. November alone saw the highest monthly inflow into global equity funds on record. Also over a three-month horizon, we’ve now seen the highest inflows into equity funds on record” via BofA $EEM

4/ Asia ex-Japan Risk-Love indicator’s Euphoria / Bearish Signal implies weak 6-month forward returns in Asia/EM.

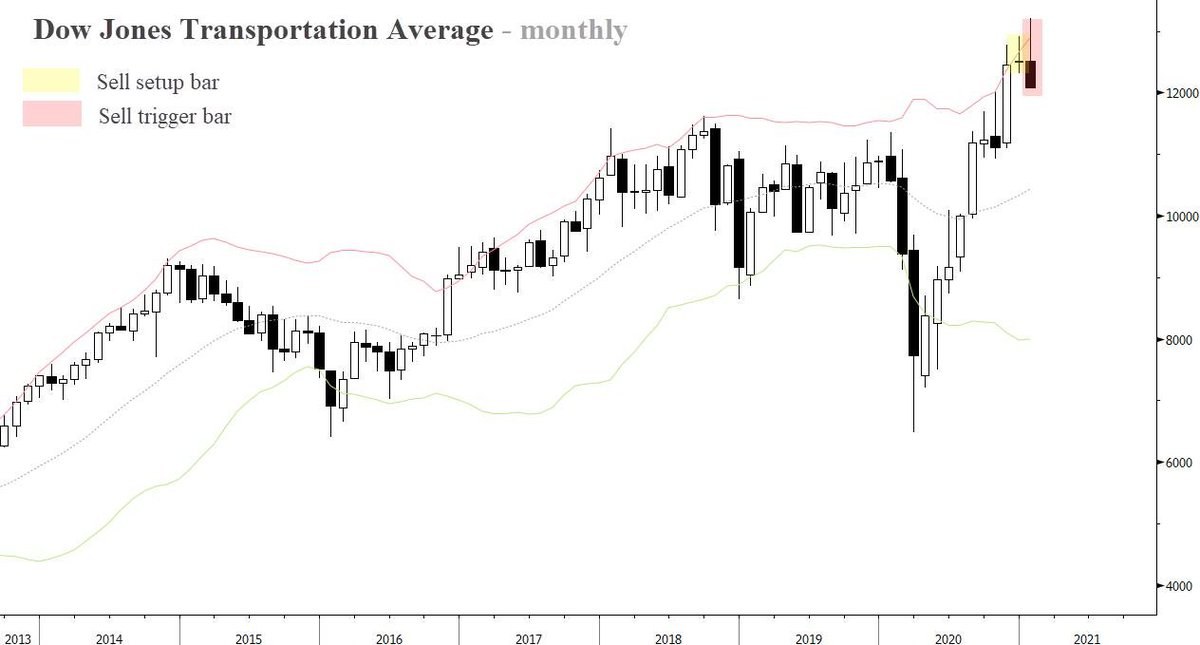

5/ $IYT triggered a sell signal in Jan.

Dec's Doji (yellow) gave us a sell setup. Jan's Outside Bear Bar closed on its lows & gave us a sell signal. But, the strong bullish thrust of the preceding 8 bars means this pullback will likely be bought after a 1-2m pullback.

Dec's Doji (yellow) gave us a sell setup. Jan's Outside Bear Bar closed on its lows & gave us a sell signal. But, the strong bullish thrust of the preceding 8 bars means this pullback will likely be bought after a 1-2m pullback.

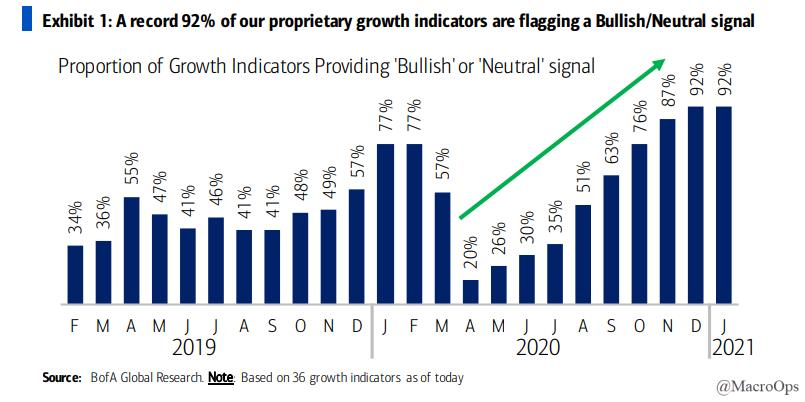

6/ But, investors who continue to try and call a top will once again be disappointed…

The economic backdrop is not one you want to fade. 92% BofA’s proprietary suite of growth indicators “are flagging a Bullish/Neutral signal, the highest level on record.”

The economic backdrop is not one you want to fade. 92% BofA’s proprietary suite of growth indicators “are flagging a Bullish/Neutral signal, the highest level on record.”

Read on Twitter

Read on Twitter

![3/ “Two-month flows into DM and EM equity funds the highest since [Oct 2000]. November alone saw the highest monthly inflow into global equity funds on record. Also over a three-month horizon, we’ve now seen the highest inflows into equity funds on record” via BofA $EEM 3/ “Two-month flows into DM and EM equity funds the highest since [Oct 2000]. November alone saw the highest monthly inflow into global equity funds on record. Also over a three-month horizon, we’ve now seen the highest inflows into equity funds on record” via BofA $EEM](https://pbs.twimg.com/media/EtJijm2XUAYmHvi.png)