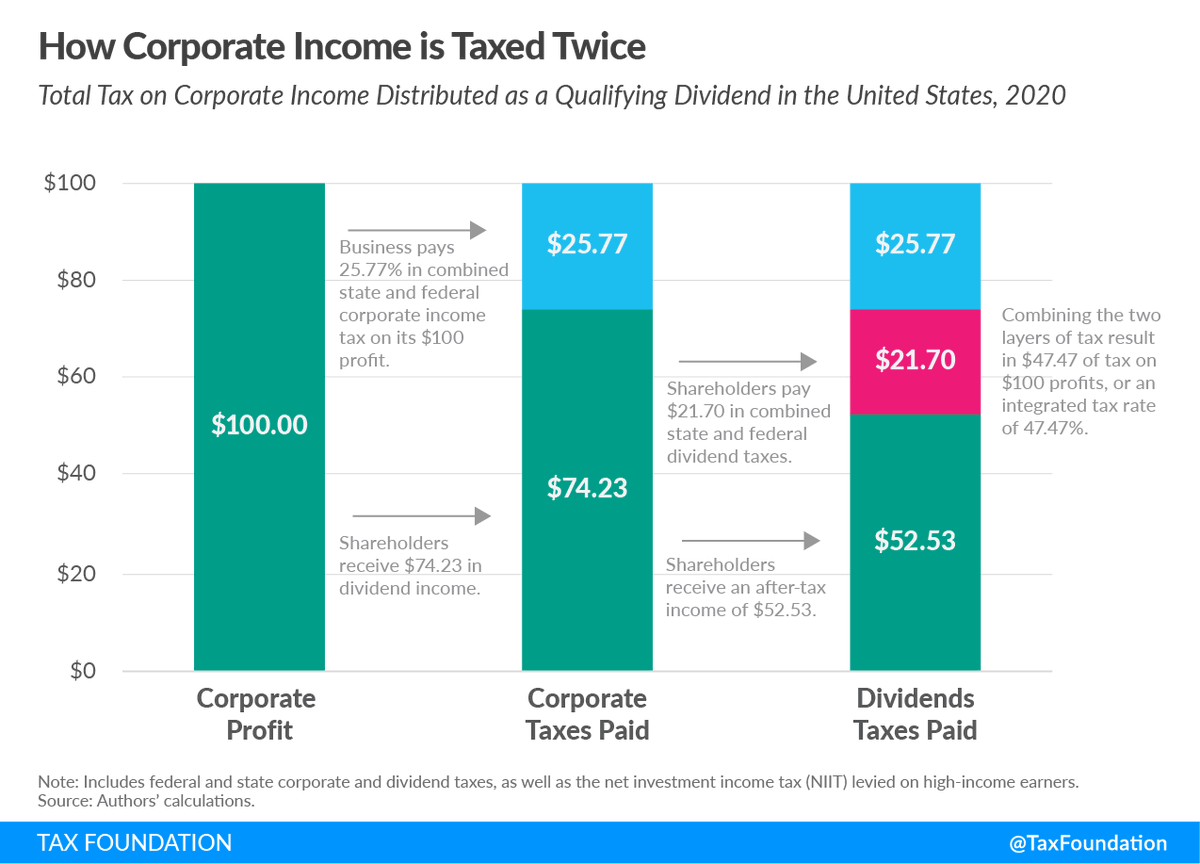

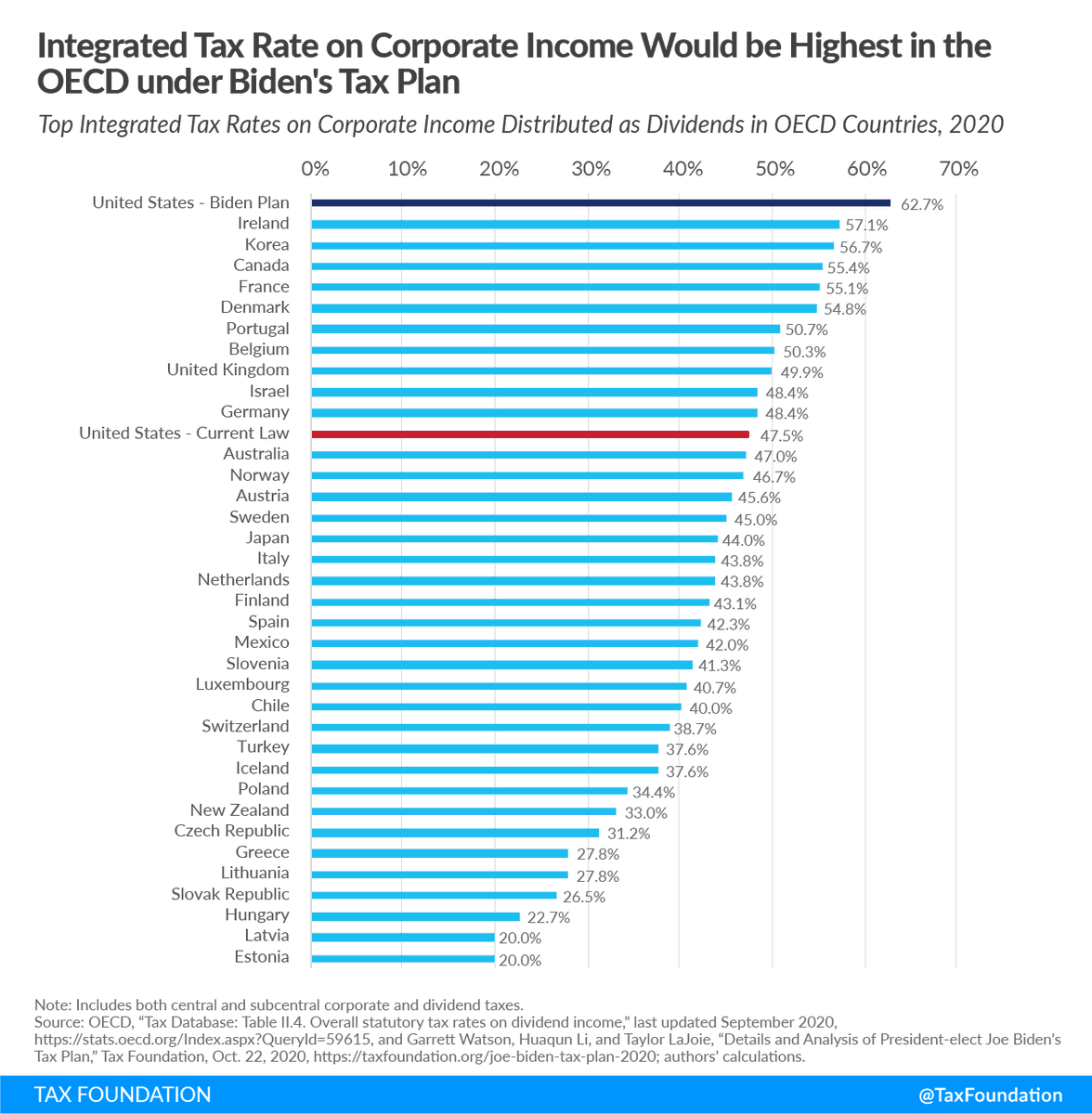

Double taxation of corporate income can lead to economic distortions such as reduced savings and investment, a bias towards certain business forms, and debt financing over equity financing.

REPORT: Double Taxation of Corporate Income in the U.S. and OECD: https://buff.ly/3qjjzDU

REPORT: Double Taxation of Corporate Income in the U.S. and OECD: https://buff.ly/3qjjzDU

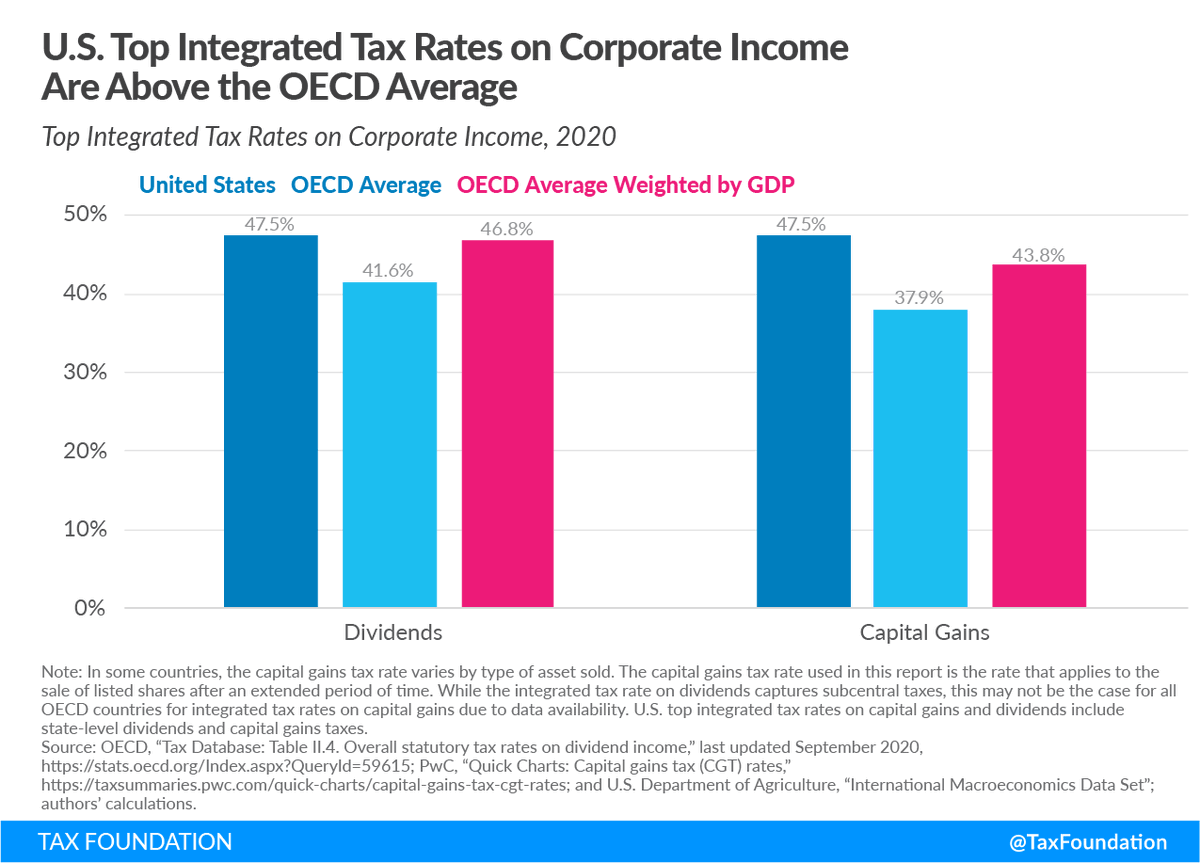

Several OECD countries have integrated corporate and individual tax codes to eliminate or reduce the negative effects of double taxation on corporate income.

Read on Twitter

Read on Twitter