#CAMS

(Business - Case Study)

Please Read Full Thread for Best Knowledge.

#CAMS:Computer Age Management Service Incorporated 1988 in Chennai

Company is Technology Driver Financial Infrastructure and Service Provider to Mutual Funds & Other Financial Institutions..

Company is Technology Driver Financial Infrastructure and Service Provider to Mutual Funds & Other Financial Institutions..

1/n

(Business - Case Study)

Please Read Full Thread for Best Knowledge.

#CAMS:Computer Age Management Service Incorporated 1988 in Chennai

Company is Technology Driver Financial Infrastructure and Service Provider to Mutual Funds & Other Financial Institutions..

Company is Technology Driver Financial Infrastructure and Service Provider to Mutual Funds & Other Financial Institutions..1/n

In Simple Terms,

#CAMS is Service Solution Partner to Mutual Funds Industry..

Also Serving Service to Financial Institutions With 2+ Decades Track Records..

CAMS is "MARKET-LEADING" Register & Transfer Agent to Mutual Funds Industry of India Serving 70% of Total AUM..

CAMS is "MARKET-LEADING" Register & Transfer Agent to Mutual Funds Industry of India Serving 70% of Total AUM..

2/n

#CAMS is Service Solution Partner to Mutual Funds Industry..

Also Serving Service to Financial Institutions With 2+ Decades Track Records..

CAMS is "MARKET-LEADING" Register & Transfer Agent to Mutual Funds Industry of India Serving 70% of Total AUM..

CAMS is "MARKET-LEADING" Register & Transfer Agent to Mutual Funds Industry of India Serving 70% of Total AUM..2/n

~ CAMS Bring Ability to Serving B2C (Direct to Customer) of Every Mutual Funds, Insurance & Other Financial Services..

Highest Technological Competitive Advantage..

Highest Technological Competitive Advantage..

Technology is Core of #CAMS Service..

~ Company has Own Data Center as Well as Build Very Well RPA*.

3/n

Highest Technological Competitive Advantage..

Highest Technological Competitive Advantage..

Technology is Core of #CAMS Service..

~ Company has Own Data Center as Well as Build Very Well RPA*.

3/n

RPA: Robotic Problem Automation

Provide Back Office Service to..

Provide Back Office Service to..

1. Mutual Funds

2. Insurance Company

3. Banks & NBFC's

Shareholding Pattern:

Shareholding Pattern:

Foreign Promoter: 31%

* Warburg Pincus A Leading Global Equity Firm

MF: 12%

Insurance Co. : 2.1%

FII's: 8.7%

Other's: 46.2%

4/n

Provide Back Office Service to..

Provide Back Office Service to..1. Mutual Funds

2. Insurance Company

3. Banks & NBFC's

Shareholding Pattern:

Shareholding Pattern:Foreign Promoter: 31%

* Warburg Pincus A Leading Global Equity Firm

MF: 12%

Insurance Co. : 2.1%

FII's: 8.7%

Other's: 46.2%

4/n

Core Service/Subsidiary Company:

Core Service/Subsidiary Company: . Mutual Funds Related Service Provided by CAMS Its-self.

. Mutual Funds Related Service Provided by CAMS Its-self.~ One of The India's Largest Mutual Funds Transfer Agency

~ Distributor Service

~ Data Confidentiality & Security

(Save Impo Customer Data)

~ Handled Customer Care Services too.

5/n

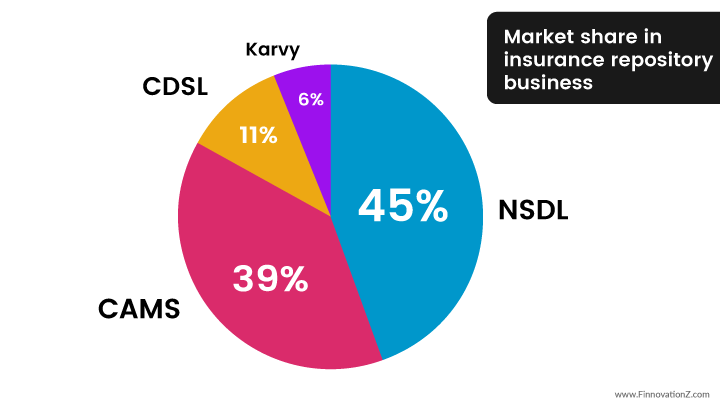

. #CAMS Rep:

. #CAMS Rep:(E-Insurance Related Service)

~ India's Leading Repository Service Over 40 Insurance Companies and 2+ Million E-Insurance Policy..

~ E-Insurance Business has HUGE Potential in Future.

~ Placed 2nd in E-Isurance Market Just After NSDL with 39% Market Share..

6/n

. #CAMS Finserve:

. #CAMS Finserve:~ RBI Permitted Account Aggregator Platform..

~ CAMS Finserve Collect All of Customer Financial Information From Various Institutions and Provide all as Aggregatly to Customer for Easy and Repid Use..

. #CAMS KRA: A Wholly Owned Subsidiary of CAMS..

. #CAMS KRA: A Wholly Owned Subsidiary of CAMS..7/n

~ CAMS KRA Provide Service Related to KYC Service.

Sterling Software:

Sterling Software:

~ Company Conducted Software Solution Business & Provide Mobility Solution to Customer Ease of Service to Customer.

Company has Higher Standard of Corporate Governance With Experience Management.

Company has Higher Standard of Corporate Governance With Experience Management.

8/n

Sterling Software:

Sterling Software:~ Company Conducted Software Solution Business & Provide Mobility Solution to Customer Ease of Service to Customer.

Company has Higher Standard of Corporate Governance With Experience Management.

Company has Higher Standard of Corporate Governance With Experience Management.

8/n

Financials:

Financials:~ Company's Revenue Rise at 12.8% CAGR..

(Same as AUM ₹ Growth)

~ EBITA Margin: 42.9%

~ EPS: ₹ 35+ of FY 2020

*[Estimation for FY 2021 is 38-40+]

~ PE at 50

~ ROCE = 52.5%

~ ROI = 35%

89% Revenue Come From Mutual Funds Sector..

89% Revenue Come From Mutual Funds Sector..(Not Much Diversify)

9/n

Service Oriented Asset Light Business Model, So Most Profit Only Converted into Cash.

Service Oriented Asset Light Business Model, So Most Profit Only Converted into Cash.

~ Due to Cash Rich, Small but Regular Dividend Pay Company.

Relation with Other MF Company:

Relation with Other MF Company:~ In Business From Which CAMS belongs, Relation between both Parties are V. Important

10/n

~ Company has 70% of Total Market Share with 19.2 Laks Crore AUM & 16 Big Clients..

~ MF Business Will Grow Upto 16% CAGR Till end of 2024

~ "0" Probability to Switching Business with High Entry Barriers.

~ Healthy Relation & 20+ Y Experience Give Competitive Advantage

11/n

~ MF Business Will Grow Upto 16% CAGR Till end of 2024

~ "0" Probability to Switching Business with High Entry Barriers.

~ Healthy Relation & 20+ Y Experience Give Competitive Advantage

11/n

Competitors:

Competitors:#CAMS have Greater Competitive Advantage over Other's with Some High Technological Structure..

Almost in All Front of View, #CAMS is Better than Others as Described in below Table..

Almost in All Front of View, #CAMS is Better than Others as Described in below Table..Karvey Own 26% M.Share & Frenklin Held 3-5% M.Share also..

12/n

4 Out of Top 5 and 6 Out of Top 10 Mutual Funds are Clients of #CAMS ..

HDFC AMC, ICICI Pru. , SBI MF, Aditya Birla MF are Some Big Nme Who Own Service from CAMS..

HDFC AMC, ICICI Pru. , SBI MF, Aditya Birla MF are Some Big Nme Who Own Service from CAMS..

Company has Brighter Future in Coming Years If They Focus on Increase Revenue From Other Source..

Company has Brighter Future in Coming Years If They Focus on Increase Revenue From Other Source..

13/n

HDFC AMC, ICICI Pru. , SBI MF, Aditya Birla MF are Some Big Nme Who Own Service from CAMS..

HDFC AMC, ICICI Pru. , SBI MF, Aditya Birla MF are Some Big Nme Who Own Service from CAMS.. Company has Brighter Future in Coming Years If They Focus on Increase Revenue From Other Source..

Company has Brighter Future in Coming Years If They Focus on Increase Revenue From Other Source..13/n

A Worth Study:)

If You Enjoy Thread,Help to Spread it for Max.

#Like

#RETWEEET

@Investor_Mohit @Stockstudy8

@nakulvibhor @CAPratik_INDIAN @Jitendra_stock @sanstocktrader @Rishikesh_ADX @RajarshitaS @drprashantmish6 @caniravkaria @Atulsingh_asan @unseenvalue

Thank You.

If You Enjoy Thread,Help to Spread it for Max.

#Like

#RETWEEET

@Investor_Mohit @Stockstudy8

@nakulvibhor @CAPratik_INDIAN @Jitendra_stock @sanstocktrader @Rishikesh_ADX @RajarshitaS @drprashantmish6 @caniravkaria @Atulsingh_asan @unseenvalue

Thank You.

Read on Twitter

Read on Twitter

![Financials:~ Company's Revenue Rise at 12.8% CAGR..(Same as AUM ₹ Growth)~ EBITA Margin: 42.9%~ EPS: ₹ 35+ of FY 2020*[Estimation for FY 2021 is 38-40+]~ PE at 50 ~ ROCE = 52.5%~ ROI = 35% 89% Revenue Come From Mutual Funds Sector..(Not Much Diversify)9/n Financials:~ Company's Revenue Rise at 12.8% CAGR..(Same as AUM ₹ Growth)~ EBITA Margin: 42.9%~ EPS: ₹ 35+ of FY 2020*[Estimation for FY 2021 is 38-40+]~ PE at 50 ~ ROCE = 52.5%~ ROI = 35% 89% Revenue Come From Mutual Funds Sector..(Not Much Diversify)9/n](https://pbs.twimg.com/media/EtI0IYCXAAA4hcH.jpg)

![Financials:~ Company's Revenue Rise at 12.8% CAGR..(Same as AUM ₹ Growth)~ EBITA Margin: 42.9%~ EPS: ₹ 35+ of FY 2020*[Estimation for FY 2021 is 38-40+]~ PE at 50 ~ ROCE = 52.5%~ ROI = 35% 89% Revenue Come From Mutual Funds Sector..(Not Much Diversify)9/n Financials:~ Company's Revenue Rise at 12.8% CAGR..(Same as AUM ₹ Growth)~ EBITA Margin: 42.9%~ EPS: ₹ 35+ of FY 2020*[Estimation for FY 2021 is 38-40+]~ PE at 50 ~ ROCE = 52.5%~ ROI = 35% 89% Revenue Come From Mutual Funds Sector..(Not Much Diversify)9/n](https://pbs.twimg.com/media/EtI0Ii6XIBM6I3P.jpg)