The implications of HTF continuation from here are something to behold (too early to say for sure, but I'm long)

In that case: I assume we will enter a fully extended fifth wave

1/ https://twitter.com/BTC_JackSparrow/status/1354118035670523904

In that case: I assume we will enter a fully extended fifth wave

1/ https://twitter.com/BTC_JackSparrow/status/1354118035670523904

The expected strength of that extended fifth movement largely depends on how shallow current correction is and equally or more important: the spot volume traded

2/ https://twitter.com/BTC_JackSparrow/status/1346774841958027265?s=20

2/ https://twitter.com/BTC_JackSparrow/status/1346774841958027265?s=20

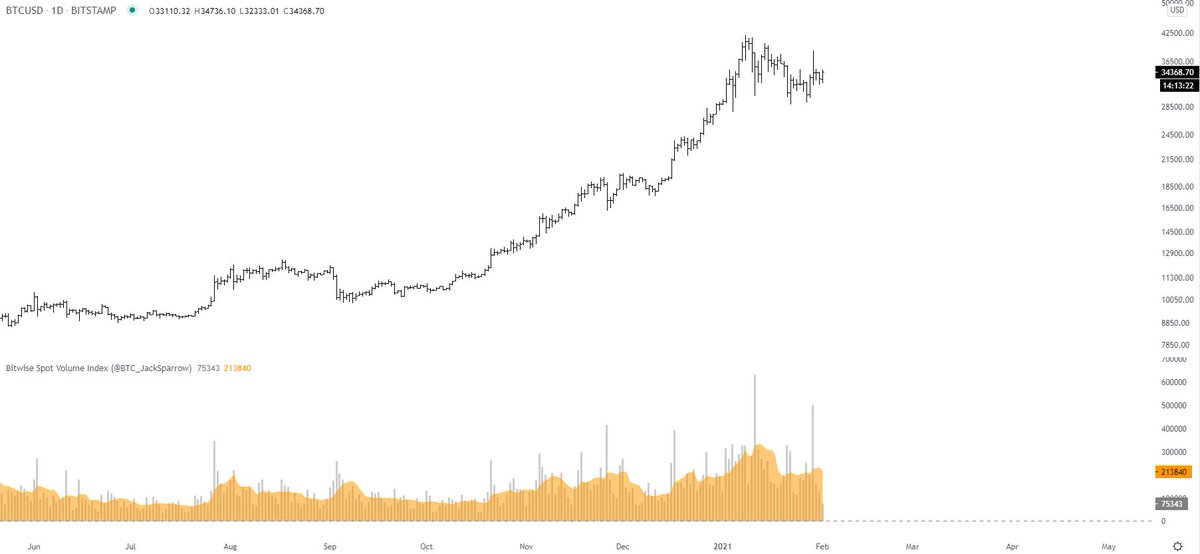

Here is a look at the spot volume: more volume traded results in higher explosivity if continuation happens

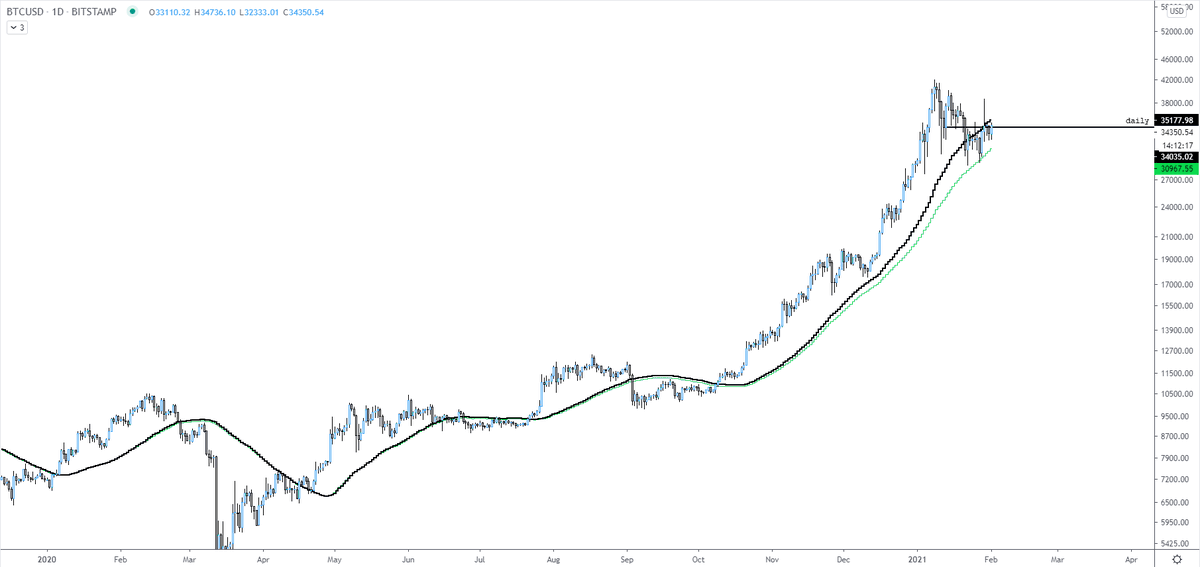

Also a look at on chain volume weighted moving average (black) and a purely price based MA (green)

Black moving faster than green means strong on chain volumes

3/

Also a look at on chain volume weighted moving average (black) and a purely price based MA (green)

Black moving faster than green means strong on chain volumes

3/

Spot volumes are expanding: sign of strength of the rally, must continuation occur

The chain is heavily transacting confirms this is not just trader ping pong on exchanges, investments are made

4/

The chain is heavily transacting confirms this is not just trader ping pong on exchanges, investments are made

4/

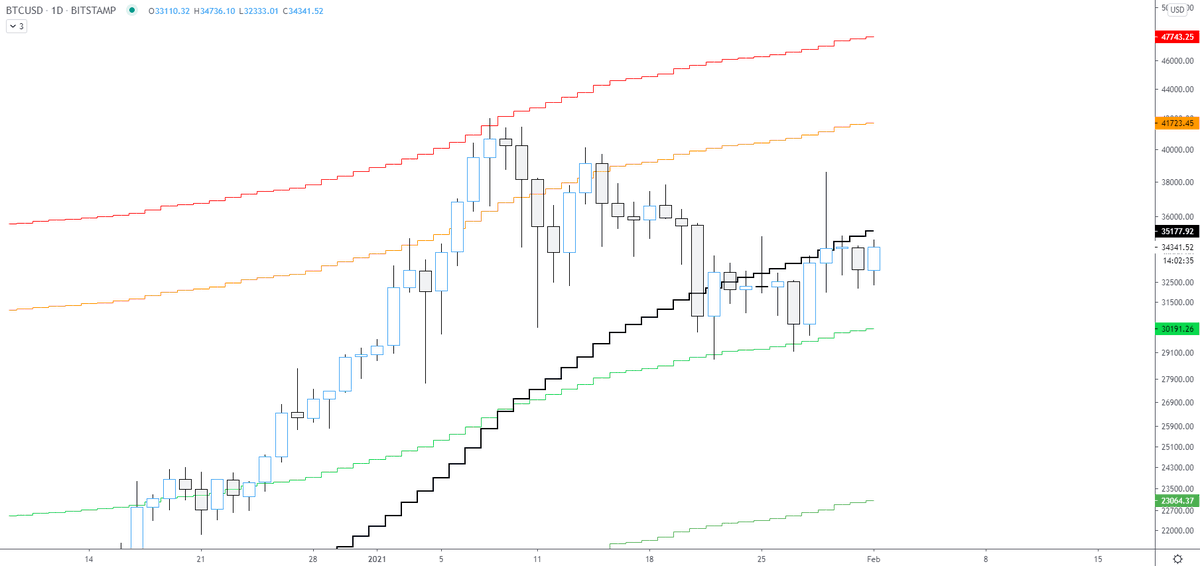

Here is another picture

Greens are our developing on chain price supports

Red marks our developing price cap and in the latter parts of parabolic growth, orange becomes a support too

Likelihood of continuation increases on a daily close above the black line (or >39K)

5/

Greens are our developing on chain price supports

Red marks our developing price cap and in the latter parts of parabolic growth, orange becomes a support too

Likelihood of continuation increases on a daily close above the black line (or >39K)

5/

If an extended fifth occurs in any way similar to how they generally extend for bitcoin, we are looking at 80-90K or 180-190K to cap the extension at (you'll get the chart with reasoning later)

If we do get continuation, it's unlikely to be minor

6/6

If we do get continuation, it's unlikely to be minor

6/6

Read on Twitter

Read on Twitter