Comments on CME Silver Futures:

1) The market does operate with a ~18% fractional reserve backing with 168k contract open interest backed by 30k contracts worth of registered silver.

1) The market does operate with a ~18% fractional reserve backing with 168k contract open interest backed by 30k contracts worth of registered silver.

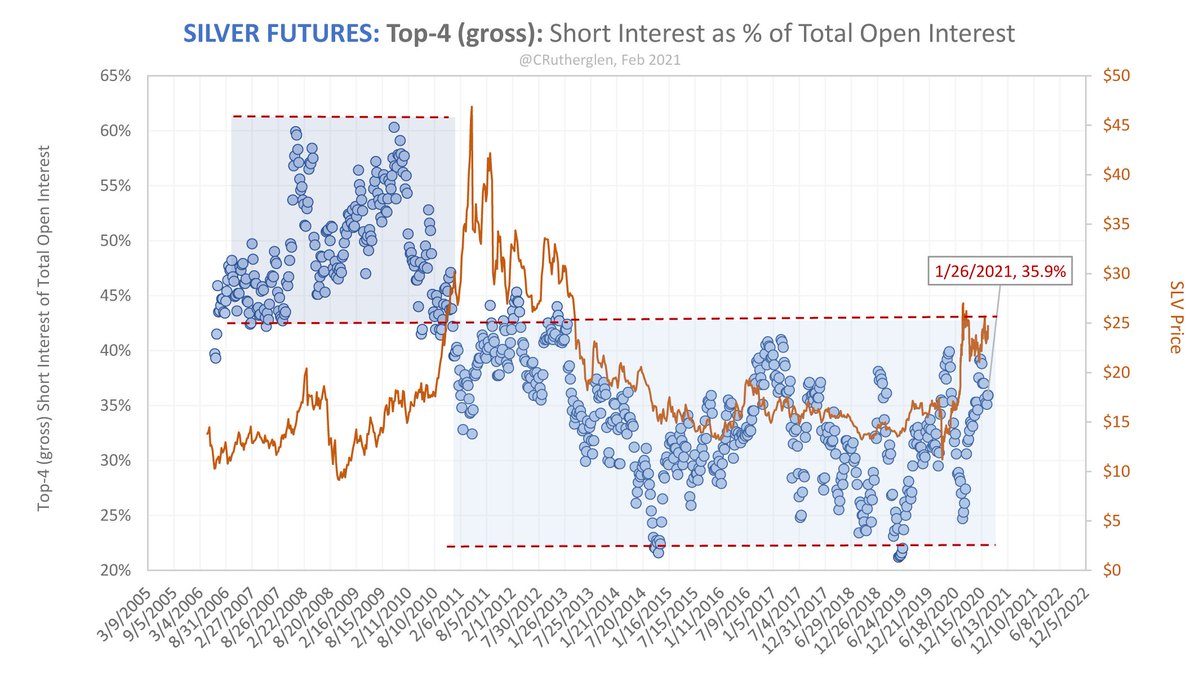

2) Prior to the 2010-'11 run up in the silver price, the top-4 traders accounted for ~43% to 61% of the total shorts. From 2011 to present, that range dropped to ~23% to 43%.

In other words, the top-4 traders (gross) reduced their concentrated short position by ~20% on average.

In other words, the top-4 traders (gross) reduced their concentrated short position by ~20% on average.

3) When considering the top-4 trader's net position (their long position less their short position), there has been a gradual trending reduction in their net-position since 2008.

4) The 'Swap-Dealers' & 'Producers' traders have a large short position, but having them cover that position is not by itself a bullish sign.

(See comments previously posted regarding this on gold)

https://twitter.com/CRutherglen/status/1334402517606617088

(See comments previously posted regarding this on gold)

https://twitter.com/CRutherglen/status/1334402517606617088

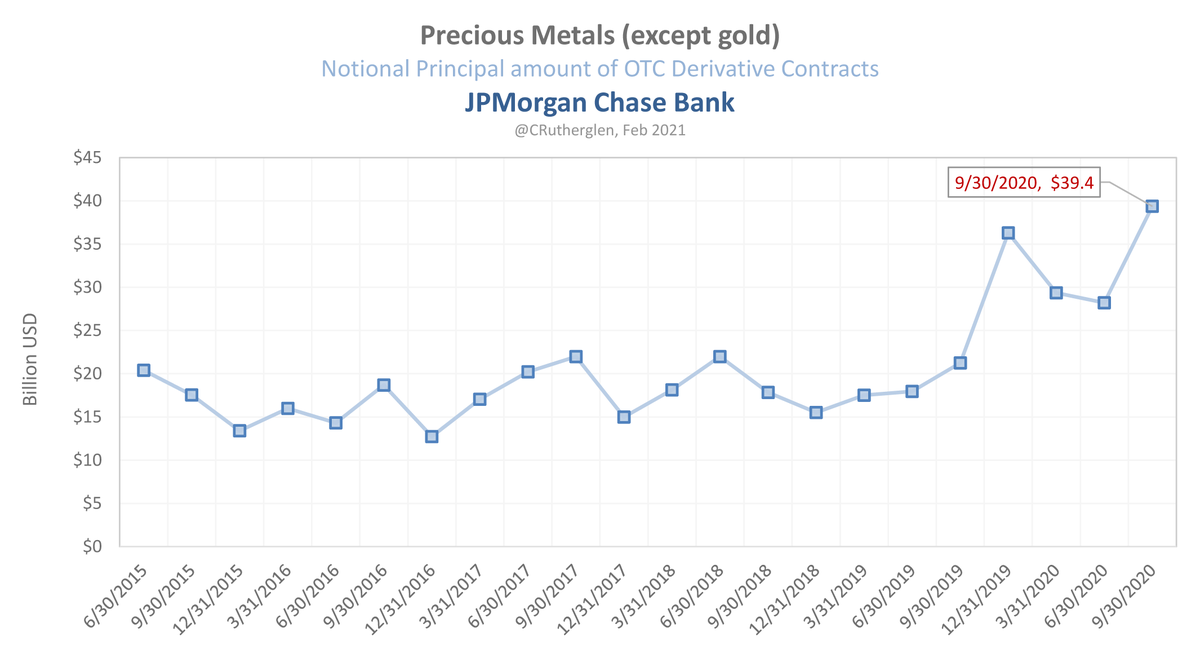

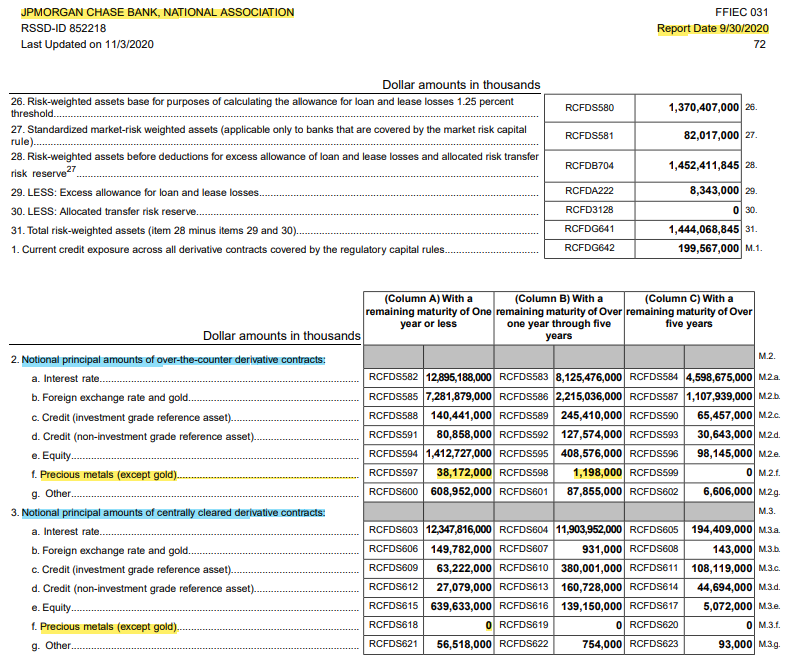

5) JP Morgan does have a large position in silver or more specifically, 'precious metals except gold'. However, I have no way to say what their net position looks like specifically.

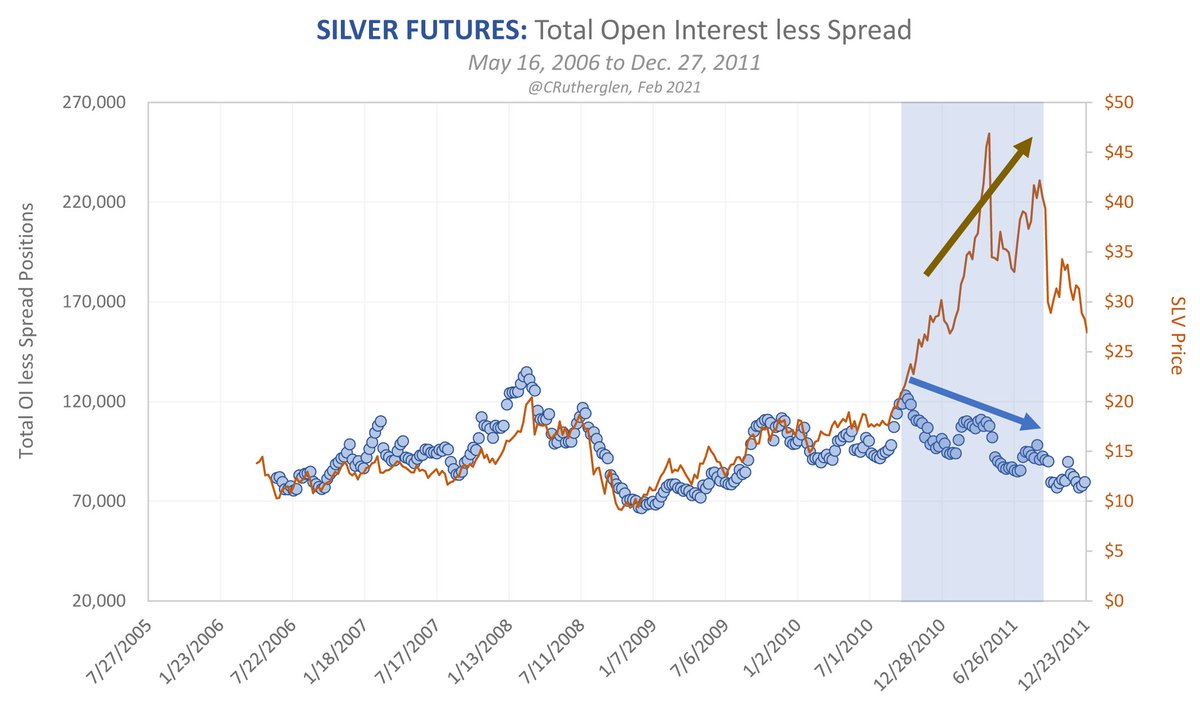

6) Some commonalities between the current market and that associated with the 2010-2011 run-up in the silver price: both periods started with silver disconnecting from its correlation with open-interest. In fact, silver and open interest became a bit more negatively correlated.

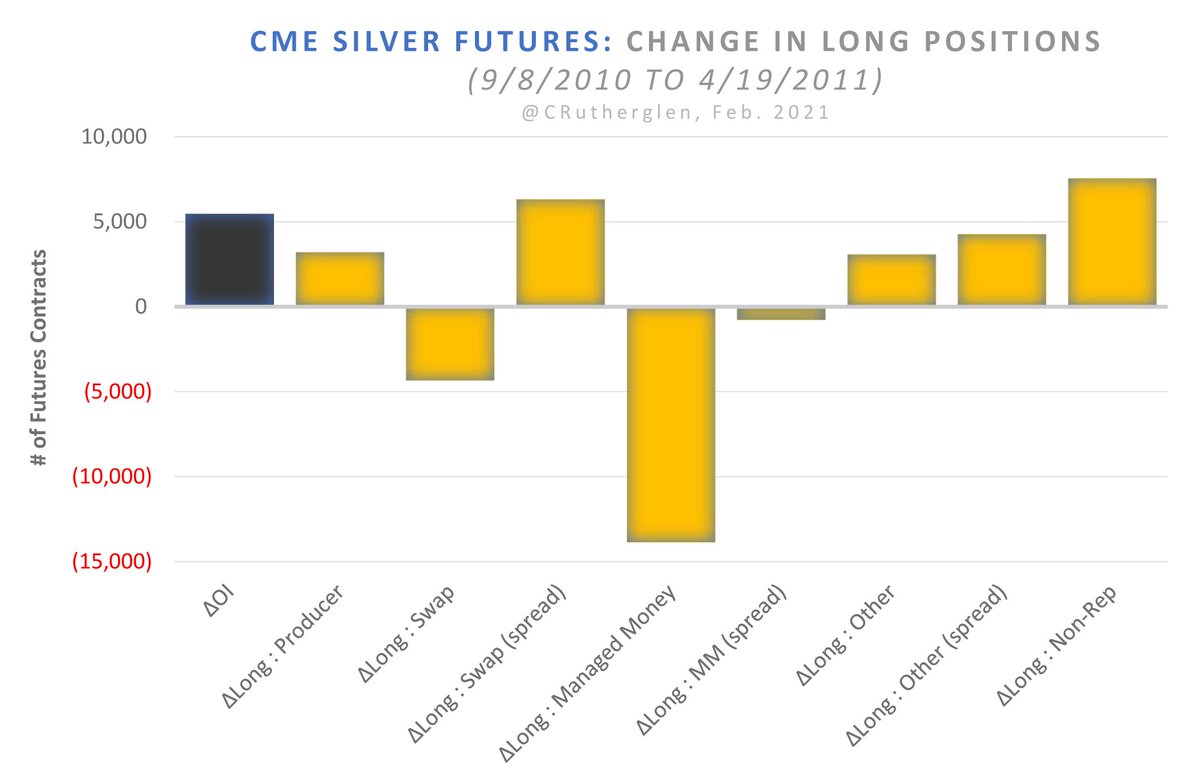

7) During the 2010-2011 period when the silver price rose from $20 to $50, here is how the COT trader categories changed:

Long Positions

- 'Non-reportable' were the major buyer while 'managed money' were reducing their long positions.

Long Positions

- 'Non-reportable' were the major buyer while 'managed money' were reducing their long positions.

8) (cont)

Short Positions

- 'Producers' were reducing their short positions.

'Swap Dealers' and 'Other' traders were most active on putting on spread positions which is both a long-position and a short-position but in different contract months.

Short Positions

- 'Producers' were reducing their short positions.

'Swap Dealers' and 'Other' traders were most active on putting on spread positions which is both a long-position and a short-position but in different contract months.

9) From the cycle perspective, we are in the window over the next month or so for the price to move up. With large demand coming in for silver, lets see where it takes us. Wholesale demand will be more important than retail product.

https://twitter.com/CRutherglen/status/1354117172423868416 https://twitter.com/CRutherglen/status/1345817999379292160

https://twitter.com/CRutherglen/status/1354117172423868416 https://twitter.com/CRutherglen/status/1345817999379292160

10) As for the ultimate price-target for silver, I think if gold hits the expected price of $7k-$8k over the next few year then assuming a 40:1 Au:Ag ratio would imply a silver price of $200. Between now and then, expect a roller-coaster ride. https://twitter.com/CRutherglen/status/1309967208710168577

Read on Twitter

Read on Twitter