1/ I'm moderately concerned the Reddit Army, should it decide to choose $SLV as its next short squeeze target, may wind up causing some near term disruption to the global PV market. To be sure, global PV manufacturers are what's known as 'commercials' and as such, they...

2/ ...routinely hedge their silver exposure, just as an industrial concern hedges their future expected need for all manner of inputs, from oil to industrial metals. That's why I'm only moderately concerned. However, the chatter on WSB is very much about wanting to disrupt...

3... the physical market, by pushing the futures market into extreme territory. My general guess is the Reddit Army will find it far more challenging to disrupt the silver market. Unless of course we see a repeat, as we did last week, when much larger players got involved.

4/ Last summer, @NatBullard did a very helpful post showing that the solar sector, in its rapidly improving learning curve, is getting more efficient in its reliance on the silver input to production. Ergo, higher PV output using less silver. https://twitter.com/NatBullard/status/1294737432668262400

5/ However, even when the learning rate of manufacturing needs fewer commodity inputs per unit of output, if a product like solar is undergoing a revolutionary growth phase (and it is) then the absolute number of inputs will still grow--alot.

6/ For example, according to the Silver Institute, the solar industry's call on silver has nearly doubled since 2014--that happens to almost perfectly correspond to the great global upwave in solar deployment. https://www.silverinstitute.org/silver-supply-demand/

7/ Now we come to the 2H of 2020, and the year ahead. China's solar output in Q4 of 2020 was so enormous it wiped out even the best forecasts of our best analysts. Again, there is no indication that silver was, or is, unduly pressured by this surge. In fact, it was *glass*...

8/ ...that was put under pressure last year in China. And that is its own sub-story: China policy makers spotted overcapacity in glass manufacturing and curbed its growth 24 months ago. This caused a real problem for input costs last year. https://www.reuters.com/article/china-solar-glass/chinas-solar-glass-shortage-to-drag-on-panel-output-into-2021-idINL1N2IJ0GU

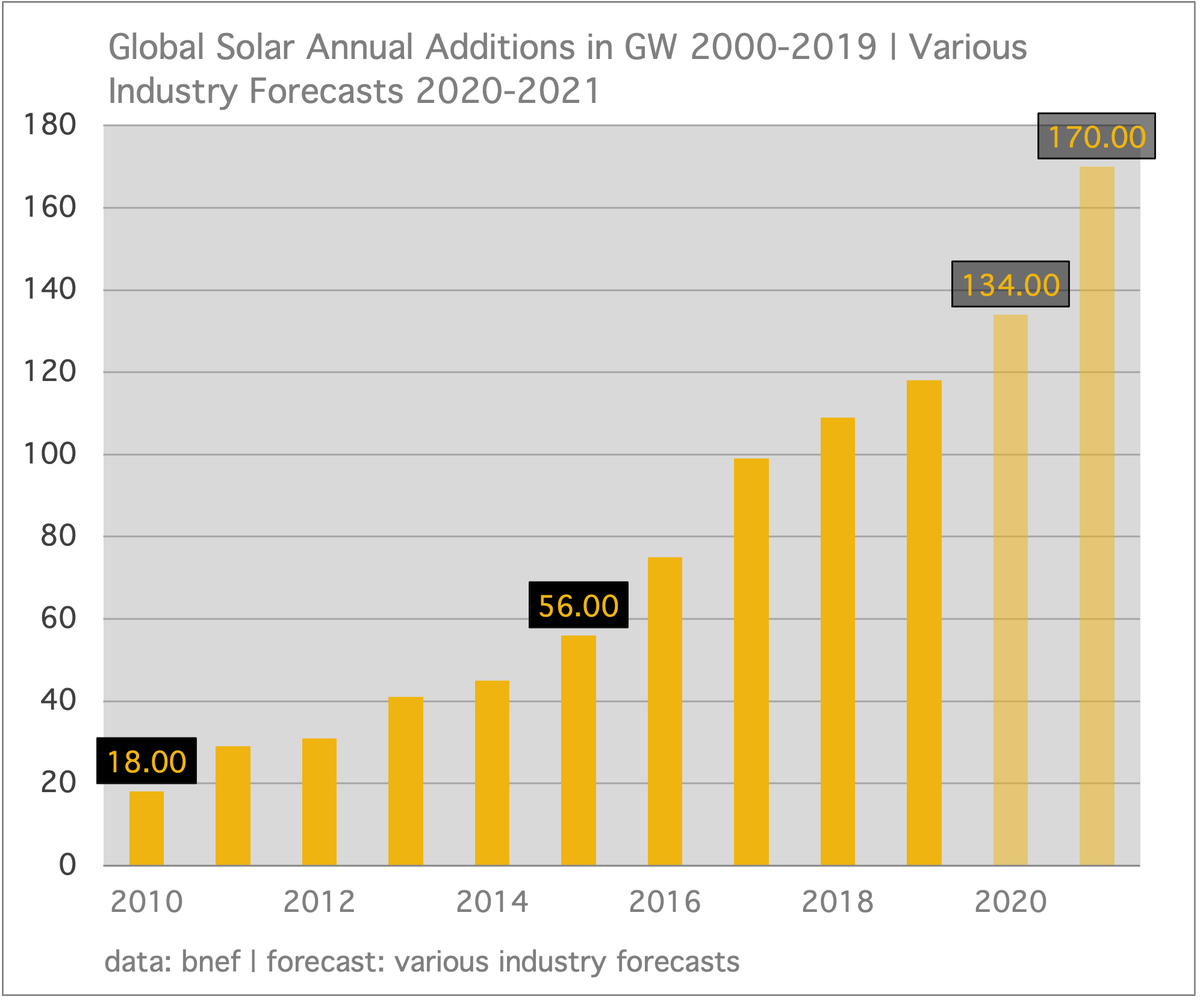

9/ Zooming out to the big picture, I assume most understand global solar is taking off right now, and is expected to stomp like a giant across our world this decade. Here are best estimates of last year's jump, and this year's potential.

10/ I believe someone on Twitter asked recently: how can we expect the material inputs to global energy transition to keep going higher, while also expecting a continued learning rate in wind and solar. That's easy: absolute demand for inputs grows, while inputs per unit falls.

11/ So we can indeed expect upward price pressure on copper, lithium, rare earth metals, and yes, silver as absolute demand rises. But as someone also pointed out: those upward price pressure are the motivator to continued improvements in the learning rate. All good.

12/ But that doesn't entirely allay my concerns about, say, what a very spectacular disruption in the silver market could do. It could force commercial users to panic hedge, and hit profitability. I don't want to see that. As one of the responders to this thread suggested:

13/ Perhaps we could get the Seven Nation Reddit Army to align with the global energy transition rollout. Nice idea. Are you listening, r/wallstreetbets? /fin

Further reading and remarks:

1. Sarah Cone: https://twitter.com/sarah_cone/status/1356021158496317443

2. Jenny Chase with details on how the glass shortage developed last year in China: https://twitter.com/solar_chase/status/1356023791130976256

1. Sarah Cone: https://twitter.com/sarah_cone/status/1356021158496317443

2. Jenny Chase with details on how the glass shortage developed last year in China: https://twitter.com/solar_chase/status/1356023791130976256

Read on Twitter

Read on Twitter