"If you could basically take Bitcoin, and if it ran 10 times faster, and it had $5T on it, and people with more money than the Bitcoiners were using that thing, then I would probably throw in the towel, sell Bitcoin, and buy that thing."

Let's chat in 2 years @michael_saylor :)

Let's chat in 2 years @michael_saylor :)

Defi on Ethereum is at ~$27B total value locked and growing ~10x per year—see https://defipulse.com

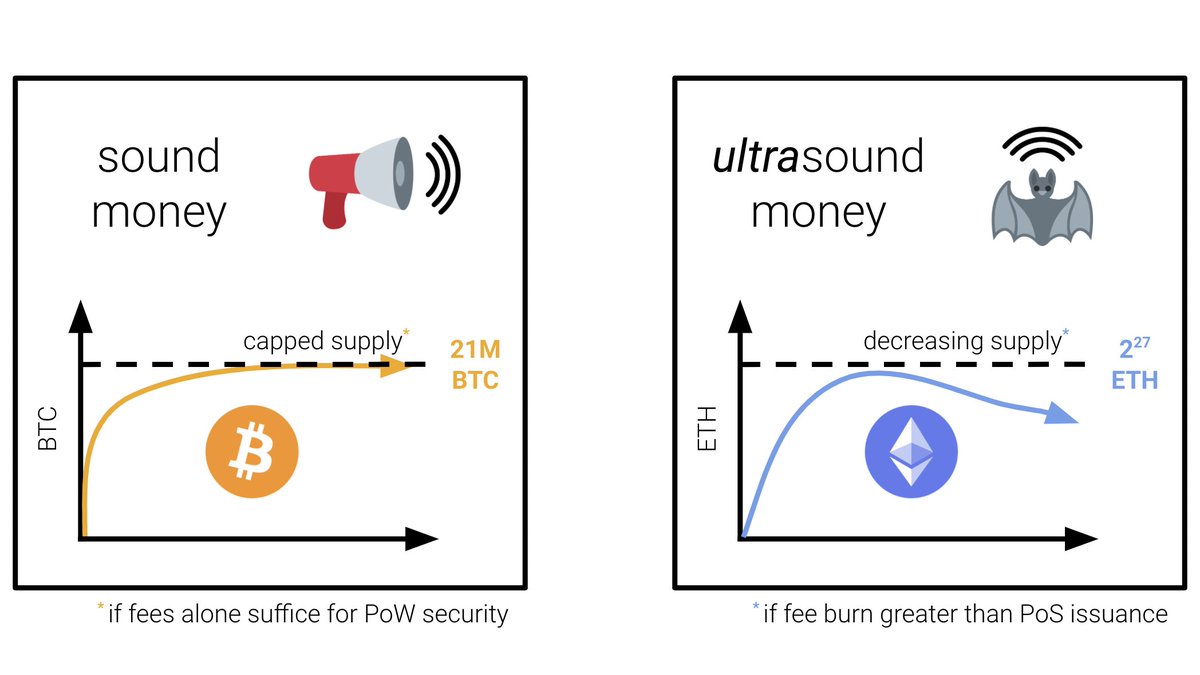

Also ETH will likely be ultrasound money in two years. We have ~5K ETH/day in transaction fees, most of these fees will be burnt, and this will more than compensate for PoS issuance.

Thermodynamically, ETH will long-term be the superior asset.

Focusing on the engineering, BTC issuance going to zero jeopardises the security foundations. Not to mention quantum attacks such as a Shor attack on EcDSA and Schnorr signatures, as well as Grover attacks on PoW.

Focusing on the engineering, BTC issuance going to zero jeopardises the security foundations. Not to mention quantum attacks such as a Shor attack on EcDSA and Schnorr signatures, as well as Grover attacks on PoW.

As the top-of-your-year MIT engineer I know you appreciate long-term fundamentals @michael_saylor, and that short term dynamics are noise.

I spent ~30 minutes talking about long-term BTC fundamentals here More than happy to chat about this further :)

I spent ~30 minutes talking about long-term BTC fundamentals here More than happy to chat about this further :)

Read on Twitter

Read on Twitter