Thread  on Union Budget Glossary

on Union Budget Glossary

(Explanation of common terms used in #UnionBudget Speech)

Re-Tweet if you like to maximize the reach.

on Union Budget Glossary

on Union Budget Glossary(Explanation of common terms used in #UnionBudget Speech)

Re-Tweet if you like to maximize the reach.

1/n

FM @nsitharaman will present #UnionBudget for 2021-22 in #LokSabha on 1 Feb 2021 at 11 AM.

There are many terms used during budget presentation which many people are not aware about. So I shall explain some important terms for convenience of general #public and #students.

FM @nsitharaman will present #UnionBudget for 2021-22 in #LokSabha on 1 Feb 2021 at 11 AM.

There are many terms used during budget presentation which many people are not aware about. So I shall explain some important terms for convenience of general #public and #students.

2/n

Definition of Union Budget

Definition of Union Budget

According to Article 112 of the #IndianConstitution, #UnionBudget of a year, also referred to as annual financial statement, is a statement of estimated receipts and expenditure of the government for that particular year.

#Budget #Budget2021

Definition of Union Budget

Definition of Union Budget

According to Article 112 of the #IndianConstitution, #UnionBudget of a year, also referred to as annual financial statement, is a statement of estimated receipts and expenditure of the government for that particular year.

#Budget #Budget2021

3/n

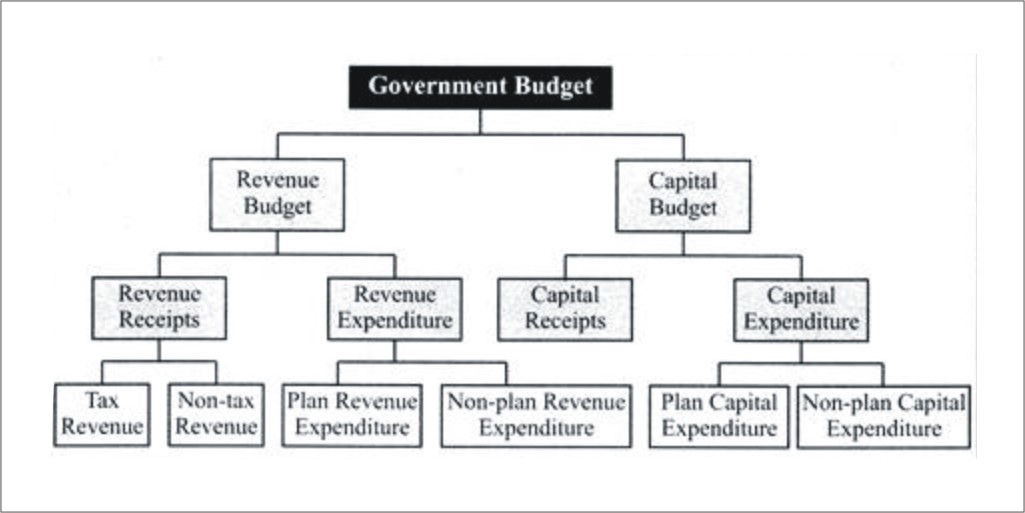

Union Budget is classified into #RevenueBudget and #CapitalBudget.

Revenue budget includes the government's revenue receipts and expenditure.

Revenue budget includes the government's revenue receipts and expenditure.

Capital Budget includes capital receipts and payments of the government.

Capital Budget includes capital receipts and payments of the government.

#Budget #Budget2021

Union Budget is classified into #RevenueBudget and #CapitalBudget.

Revenue budget includes the government's revenue receipts and expenditure.

Revenue budget includes the government's revenue receipts and expenditure. Capital Budget includes capital receipts and payments of the government.

Capital Budget includes capital receipts and payments of the government. #Budget #Budget2021

4/n

#Budget Glossary

#DirectTaxes - They are taxes directly levied on income of individuals & corporates — for example, income tax, corporate tax, etc.

#IndirectTaxes - They are taxes which are levied on goods & services supplied. Final consumer pays it at time of sale.

#Budget Glossary

#DirectTaxes - They are taxes directly levied on income of individuals & corporates — for example, income tax, corporate tax, etc.

#IndirectTaxes - They are taxes which are levied on goods & services supplied. Final consumer pays it at time of sale.

5/n

#IncomeTax - It is a direct tax levied on individuals based on their #income.

#CorporateTax - It is a direct tax levied on a company based on their profits.

#IncomeTax - It is a direct tax levied on individuals based on their #income.

#CorporateTax - It is a direct tax levied on a company based on their profits.

6/n

#GST & #ExciseDuty - Excise Duty is levied on goods manufactured in India & meant for home consumption. Goods and Services Tax (GST) is levied on supply of goods and services in India.

#CustomsDuty - Customs Duty is imposed on export & import of goods from or into country.

#GST & #ExciseDuty - Excise Duty is levied on goods manufactured in India & meant for home consumption. Goods and Services Tax (GST) is levied on supply of goods and services in India.

#CustomsDuty - Customs Duty is imposed on export & import of goods from or into country.

7/n

#FiscalDeficit - It occurs when government's total expenditures exceed its revenue, excluding the money from borrowings.

Revenue Deficit - It arises when government's revenue expenditure exceeds its revenue receipts.

#FiscalDeficit - It occurs when government's total expenditures exceed its revenue, excluding the money from borrowings.

Revenue Deficit - It arises when government's revenue expenditure exceeds its revenue receipts.

8/n

#FiscalPolicy - It is decision taken by government for adjusting its expenditure level & revenue collection (via taxation) to monitor & accomplish nation's economic goals.

#MonetaryPolicy - It is action plan by #RBI, to monitor & manage demand - supply of money in economy.

#FiscalPolicy - It is decision taken by government for adjusting its expenditure level & revenue collection (via taxation) to monitor & accomplish nation's economic goals.

#MonetaryPolicy - It is action plan by #RBI, to monitor & manage demand - supply of money in economy.

9/n

#CapitalBudget - Capital Budget is estimated amount of capital receipts and payments. It includes investments in shares, loans and advances granted by Central Government to State Governments, Government companies, corporations and other parties.

#Budget #Budget2021

#CapitalBudget - Capital Budget is estimated amount of capital receipts and payments. It includes investments in shares, loans and advances granted by Central Government to State Governments, Government companies, corporations and other parties.

#Budget #Budget2021

10/n

#RevenueBudget - In the context of #UnionBudget, Revenue Budget is the estimated amount required for the growth, development and infrastructure of the country.

#Budget #Budget2021

#RevenueBudget - In the context of #UnionBudget, Revenue Budget is the estimated amount required for the growth, development and infrastructure of the country.

#Budget #Budget2021

11/n

#BudgetEstimates - Approximation of expenses Government will incur to run country & their rough income made through taxes in a financial year.

#RevisedEstimates - It is mid-year review of potential expenditures for remainder of financial year (based on first half trends)

#BudgetEstimates - Approximation of expenses Government will incur to run country & their rough income made through taxes in a financial year.

#RevisedEstimates - It is mid-year review of potential expenditures for remainder of financial year (based on first half trends)

12/n

Plan Expenditure - They are calculated after discussing with concerned ministries and Planning Commission.

Non-plan Expenditure - It is any expense incurred by government other than plan expenditure.

#Budget #Budget2021

Plan Expenditure - They are calculated after discussing with concerned ministries and Planning Commission.

Non-plan Expenditure - It is any expense incurred by government other than plan expenditure.

#Budget #Budget2021

13/n

#Disinvestment - When government sells or liquidates any of its asset or subsidiary, we call it Disinvestment.

Example - Selling its stake in various PSUs.

#Disinvestment - When government sells or liquidates any of its asset or subsidiary, we call it Disinvestment.

Example - Selling its stake in various PSUs.

14/n

Gross Domestic Product - Gross Domestic Product or #GDP is final value of goods and services that are produced within geographic boundaries of a country in a given time period, typically a year.

It is an important indicator of a country's economic performance.

#Budget

Gross Domestic Product - Gross Domestic Product or #GDP is final value of goods and services that are produced within geographic boundaries of a country in a given time period, typically a year.

It is an important indicator of a country's economic performance.

#Budget

15/n

Central Plan Outlay - Central Plan Outlay is the division of the monetary resources among various sectors of the economy and ministries of the government.

Central Plan Outlay - Central Plan Outlay is the division of the monetary resources among various sectors of the economy and ministries of the government.

There are many many more terms, but I have tried to explain only the important ones.

#Budget #Budget2021

#Budget #Budget2021

Read on Twitter

Read on Twitter