Very interesting deal announced today, for many reasons. As @Landmannery posted earlier, Surge Energy has agreed to acquire Grenadier Energy Partners II for $420 mm. The backstory behind Grenadier is interesting by itself. Gren II was formed in 2012 by EnCap and Kayne, /1

following the sale of Gren I, a portco started in 2007 with investments in the Barnett and Marcellus, which sold as part of a 3 co. pkg to Statoil for $590 mm. Mgt. of Grenadier was formerly at Stroud Energy, another portco that was sold to $RRC for $490 mm in 2006. /2

Grenadier was originally scheduled to be part of a SPAC business combo with Pure Acq. (Jack Hightower) for $615 mm in cash and stock; that deal fell through and Grenadier pocketed a $76.5 mm termination fee from Pure (now $HPK). The $420 mm current price therefore translates /3

into total cash to Grenadier of almost $500 mm, vs. the $615 mm deal originally envisioned. Not knowing exactly how much the PE cos. contributed to each of the 3 deals (Stroud, Gren I, Gren II), the cash returns to them seem to have been very substantial. /4

The interesting part of the current deal does not end there, though. The buyer, Surge Energy, is the US subsidiary of Chinese based Shandong Xinchao Energy Corporation Limited, a publicly traded company on the Shanghai Stock Exchange. Not exactly the kind of co. one expects /5

to see in Howard County, TX. For $420 mm, Surge is acquiring 18,000 net acres, which currently have wells producing 9,000 boepd (75% oil) and 120 "high quality, economic future locations." The Grenadier deal could be described as a "bolt-on" deal for Surge, which acquired /6

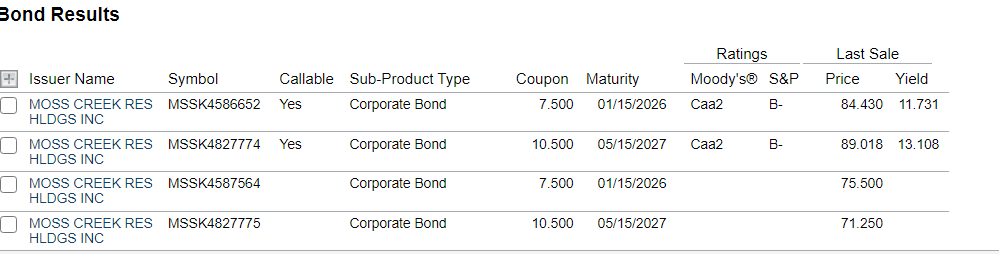

Moss Creek from 2 PE cos in 2015. Originally producing 6,500 boepd from 30 wells, it now produces 56 mboepd after the drilling of 370 HZ wells that cost > $1 B/ yr. A good part of that capex has come from its Chinese parent, but Moss Creek also has 2 public debt issues /7

that total $1.2 B. After trading as low as $30 in Mar. 2020, those notes have rebounded to the $85-$90 range, with maturities in 2026-27. They have both Rule 144A notes and "regular" issues, which trade at roughly a $10 discount. /8

The last thing of interest is what this might mean for other Permian, and specifically Howard Cty. deals. How does this translate into a valuation for $HPK, for example, and/or cos like $SM? And what might EnCap do with its Sabalo portco, which suffered the same fate as /9

Grenadier in that a negotiated merger with $ESTE fell through at the same time? Consolidation continues, but who will exit and who will enter/expand in 2021? TBD.

Read on Twitter

Read on Twitter