The financial world has been gripped by Bitcoin’s price swings over the past year, with it trading between $5,000 and $40,000.

But there’s an aspect of Bitcoin that gets far less attention: the energy consumption needed to mine and maintain it https://bloom.bg/3t6mgei

But there’s an aspect of Bitcoin that gets far less attention: the energy consumption needed to mine and maintain it https://bloom.bg/3t6mgei

Crypto is regularly lumped in with energy-transition trades such as Tesla, regardless of the fact that Bitcoin clearly makes an investment portfolio less green.

The Bitcoin algorithm demands increasing amounts of power to validate transactions http://bloom.bg/3t6mgei

The Bitcoin algorithm demands increasing amounts of power to validate transactions http://bloom.bg/3t6mgei

If the Bitcoin network were a country, its annual estimated carbon footprint would be comparable to  New Zealand at about 37 million tons of CO2.

New Zealand at about 37 million tons of CO2.

One Bitcoin transaction would generate the CO2 equivalent to 706,765 swipes of a Visa credit card http://bloom.bg/3t6mgei

New Zealand at about 37 million tons of CO2.

New Zealand at about 37 million tons of CO2.One Bitcoin transaction would generate the CO2 equivalent to 706,765 swipes of a Visa credit card http://bloom.bg/3t6mgei

Energy estimates aren’t an exact science, but the direction of travel for power consumption has been clear. Bitcoin’s annual consumption has gone up rapidly:

2017: 9.6 terawatt-hours

2017: 9.6 terawatt-hours

2021: 77.8 TWh by one estimate http://bloom.bg/3t6mgei

2021: 77.8 TWh by one estimate http://bloom.bg/3t6mgei

2017: 9.6 terawatt-hours

2017: 9.6 terawatt-hours 2021: 77.8 TWh by one estimate http://bloom.bg/3t6mgei

2021: 77.8 TWh by one estimate http://bloom.bg/3t6mgei

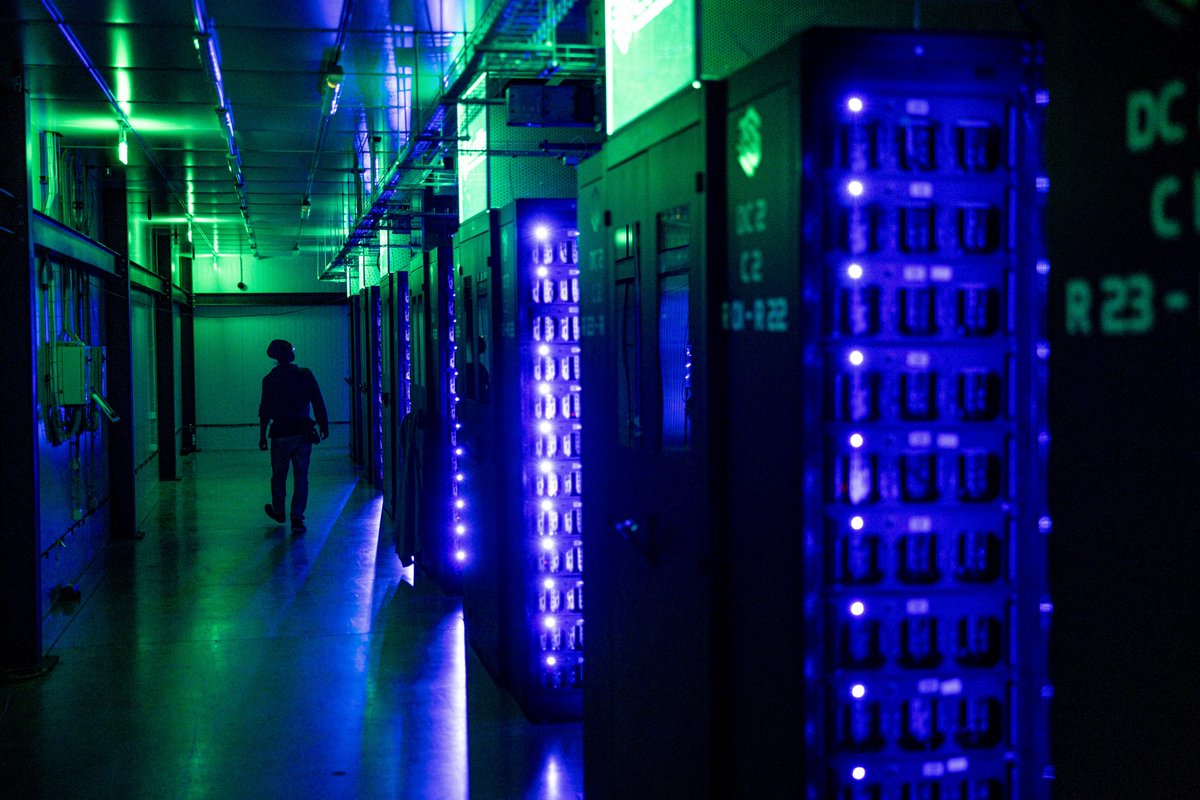

The economics of mining outpaced the average laptop long ago.

Firms like Marathon Patent now buy tens of thousands of specialized chips at once to power their crypto farms http://bloom.bg/3t6mgei

Firms like Marathon Patent now buy tens of thousands of specialized chips at once to power their crypto farms http://bloom.bg/3t6mgei

It would be one thing if this were taking place somewhere like Sweden, which has a carbon tax of more than €100 per metric ton of CO2 (with exemptions).

But one paper suggests almost half of the world’s Bitcoin mining capacity is in southwest China http://bloom.bg/3t6mgei

But one paper suggests almost half of the world’s Bitcoin mining capacity is in southwest China http://bloom.bg/3t6mgei

In southwest China, power is:

Cheap

Cheap

Less taxed

Less taxed

Supplied by coal-fired plants and hydroelectricity http://bloom.bg/3t6mgei

Supplied by coal-fired plants and hydroelectricity http://bloom.bg/3t6mgei

Cheap

Cheap Less taxed

Less taxed Supplied by coal-fired plants and hydroelectricity http://bloom.bg/3t6mgei

Supplied by coal-fired plants and hydroelectricity http://bloom.bg/3t6mgei

. @CambridgeAltFin estimates coal accounts for 38% of Bitcoin miner power.

The defense from Bitcoiners is that this is still “good” overall: This is energy that would otherwise be wasted, and the share of renewables will grow http://bloom.bg/3t6mgei

The defense from Bitcoiners is that this is still “good” overall: This is energy that would otherwise be wasted, and the share of renewables will grow http://bloom.bg/3t6mgei

The Siberian city of Norilsk, for example, now hosts the Arctic’s first crypto farm:

Made from scrap metal

Made from scrap metal

Kept cool by sub-zero temperatures

Kept cool by sub-zero temperatures

Powered by cheap gas and hydropower http://bloom.bg/3t6mgei

Powered by cheap gas and hydropower http://bloom.bg/3t6mgei

Made from scrap metal

Made from scrap metal Kept cool by sub-zero temperatures

Kept cool by sub-zero temperatures Powered by cheap gas and hydropower http://bloom.bg/3t6mgei

Powered by cheap gas and hydropower http://bloom.bg/3t6mgei

But Bitcoiners’ arguments ring hollow. Cheap power usually comes with other costs:

Recent power blackouts in Iran were blamed on Bitcoin

Recent power blackouts in Iran were blamed on Bitcoin

Cryptocurrency trading appears to have influence on the pricing in large electricity and utilities markets http://bloom.bg/3t6mgei

Cryptocurrency trading appears to have influence on the pricing in large electricity and utilities markets http://bloom.bg/3t6mgei

Recent power blackouts in Iran were blamed on Bitcoin

Recent power blackouts in Iran were blamed on Bitcoin Cryptocurrency trading appears to have influence on the pricing in large electricity and utilities markets http://bloom.bg/3t6mgei

Cryptocurrency trading appears to have influence on the pricing in large electricity and utilities markets http://bloom.bg/3t6mgei

Not all cryptocurrencies need energy-hungry, proof-of-work algorithms, but Bitcoin wouldn’t go back on its founding rules without a fight.

For example, Fidelity Digital Assets’ defense of Bitcoin’s energy inefficiency is that it gets you Bitcoin in return http://bloom.bg/3t6mgei

For example, Fidelity Digital Assets’ defense of Bitcoin’s energy inefficiency is that it gets you Bitcoin in return http://bloom.bg/3t6mgei

It raises a question:

What would Bitcoin really be worth if, in order to care for the world it set out to revolutionize, it changed its algorithm, or miners unhooked themselves from cheap power? http://bloom.bg/3t6mgei

What would Bitcoin really be worth if, in order to care for the world it set out to revolutionize, it changed its algorithm, or miners unhooked themselves from cheap power? http://bloom.bg/3t6mgei

Read on Twitter

Read on Twitter