I received a few DMs asking for some help with LP strategies.

LPing was a subject of in-depth theoretical studies performed by Gountlet: https://github.com/thorchain/Resources/blob/master/Audits/THORChain-Gauntlet-EconomicSecurityReview-May2020.pdf

Today we can supplement the theoretical models with empirical data and draw some helpful conclusions

/thread

LPing was a subject of in-depth theoretical studies performed by Gountlet: https://github.com/thorchain/Resources/blob/master/Audits/THORChain-Gauntlet-EconomicSecurityReview-May2020.pdf

Today we can supplement the theoretical models with empirical data and draw some helpful conclusions

/thread

Before we get to strategies, here are two observations since $RUNE inception:

- All assets generally grow in value (bull market)

- $RUNE grows in value faster than connected assets

- All assets generally grow in value (bull market)

- $RUNE grows in value faster than connected assets

As long as this is true, as LP you should not bet against $RUNE. By that, I mean:

- Enter asymmetrically with the other asset only (say BTCB in $BTCB-$RUNE pool)

- Ideally when $RUNE dips

- If you only have $RUNE and have no other assets to LP with, do not enter

- Enter asymmetrically with the other asset only (say BTCB in $BTCB-$RUNE pool)

- Ideally when $RUNE dips

- If you only have $RUNE and have no other assets to LP with, do not enter

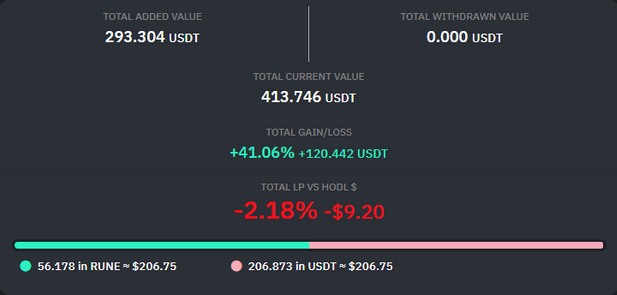

Let's have a look at what happens if you do not follow this understanding. Here @bagofincome experiences an “impermanent loss” - a change in his portfolio value relative to simply hodling $RUNE.

https://leofinance.io/@bagofincome/usdt-rune-pool-on-chaosnet-day-15-losing-some-precious-rune

https://leofinance.io/@bagofincome/usdt-rune-pool-on-chaosnet-day-15-losing-some-precious-rune

Here @bagofincome “hedged” his $RUNE in $USDT, thus reducing the risk of being exposed to $RUNE. As an LP, you are in the business of volatility harvesting, and you want to be on the right side of the trade. This comes down to general understanding of the market conditions.

His strategy may work in on sideways market, but we are not in a sideway market, as per observations above. While @bagofincome is still making money (+41% measured in USDT), he would be better off just hodling his $RUNE (+100% from $1.88 to $3.76)

Timing the market is impossible, but you know when $RUNE dips and although this entry was not perfect, it is an example of what happens when you enter a pool asymmetrically with the counter asset – in this case BTCB in a similar market conditions

While making 41% APY is not a bad result from a financial perspective and I am sure @bagofincome is happy, “do not bet against $RUNE” is not a meme. The genius behind the design creates a positive feedback loop that creates a demand for $RUNE.

It also comes with ingenious, on chain mechanisms and integrations for you to create your own winning strategy in a variable market conditions. Make sure you understand and learn how to play @thorchain to your advantage, experiment and share!

/fin

/fin

Read on Twitter

Read on Twitter