$BTC daily Round-up (+Long-term swing opportunity at end of thread)

Current ranges with standard deviations shown below

If you are bullish on this current consolidation you should open some longs at $32,400 if bitcoin manages to dip down there today

Current ranges with standard deviations shown below

If you are bullish on this current consolidation you should open some longs at $32,400 if bitcoin manages to dip down there today

MOVING AVERAGES

Bitcoin is currently testing the 21 EMA as support, yesterday it managed to bounce off it and hopefully today it can close above the 21 once again.

Bitcoin is currently testing the 21 EMA as support, yesterday it managed to bounce off it and hopefully today it can close above the 21 once again.

MOMENTUM

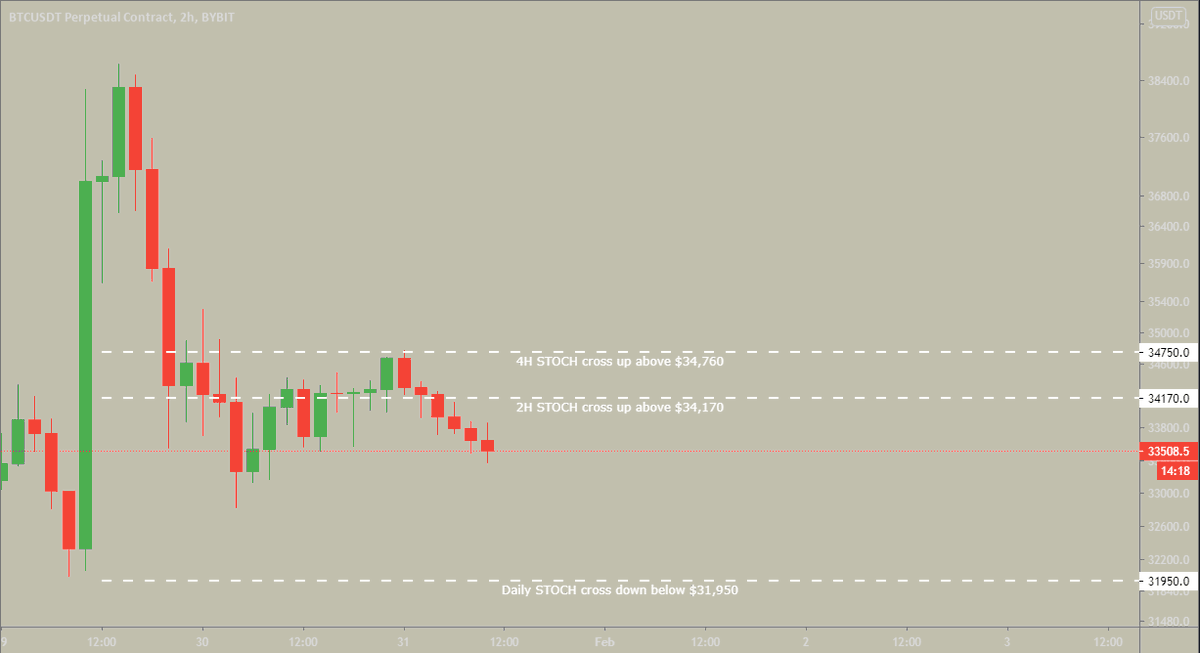

On the daily momentum favours the bulls but on the lower TF it differs. Like I said a dip down to $32,000 would give a great opportunity with good RR

A 4H close above $34,750 and Momentum would shift to the bulls on all TF and a move back up to $38K-$40K is likely

On the daily momentum favours the bulls but on the lower TF it differs. Like I said a dip down to $32,000 would give a great opportunity with good RR

A 4H close above $34,750 and Momentum would shift to the bulls on all TF and a move back up to $38K-$40K is likely

STRUCTURE

We are currently range bound

until CMEs open again on Monday we will likely be bouncing between these fibs

We are currently range bound

until CMEs open again on Monday we will likely be bouncing between these fibs

Long-term swing opportunity

Bitcoin has been range bound for 21 days and with the consolidation becoming so mature a major swing opportunity is here

If Bitcoin closes a 4H above $34,850 all momentum will shift upwards which will imply a test of range highs at $38K

Bitcoin has been range bound for 21 days and with the consolidation becoming so mature a major swing opportunity is here

If Bitcoin closes a 4H above $34,850 all momentum will shift upwards which will imply a test of range highs at $38K

Bitcoin is likely to not stop there as this consolidation is so mature, I believe that the break of this range will happen soon and both these trades are targeting $60k

Invalidation would be a daily close below $31,950

The risk:reward is great

Invalidation would be a daily close below $31,950

The risk:reward is great

Read on Twitter

Read on Twitter