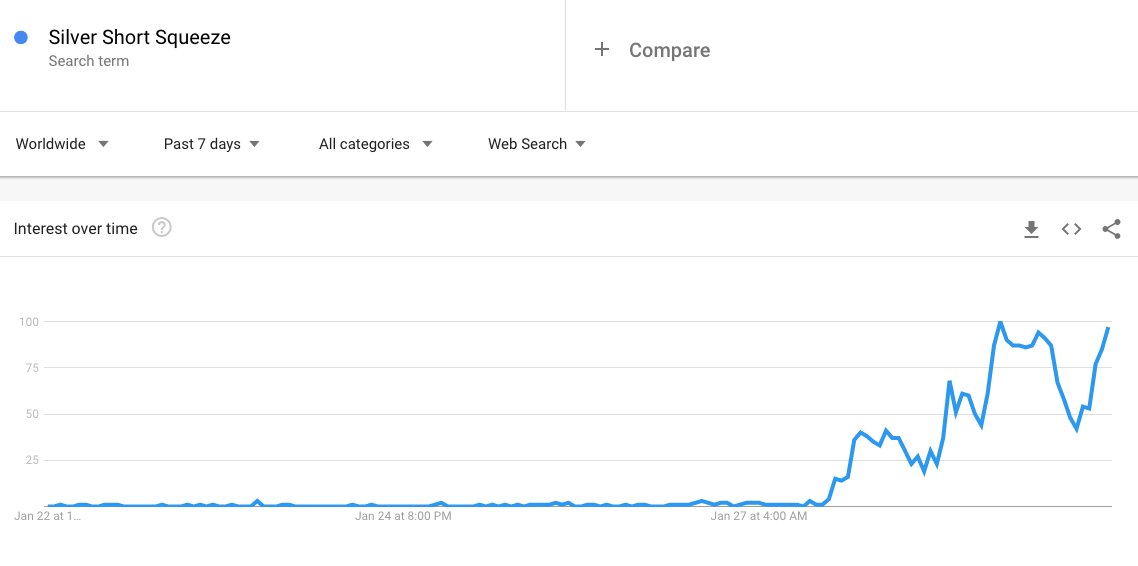

Why #SilverSqueeze is Trending Topic on US Twitter?

A quick thread & charts summary

Open your eyes. This opportunities don't come often.

Hope this helps you!

For more detailed info, seek a FA or DM me.

#DecodeMode $SLV

A quick thread & charts summary

Open your eyes. This opportunities don't come often.

Hope this helps you!

For more detailed info, seek a FA or DM me.

#DecodeMode $SLV

First and above all.....

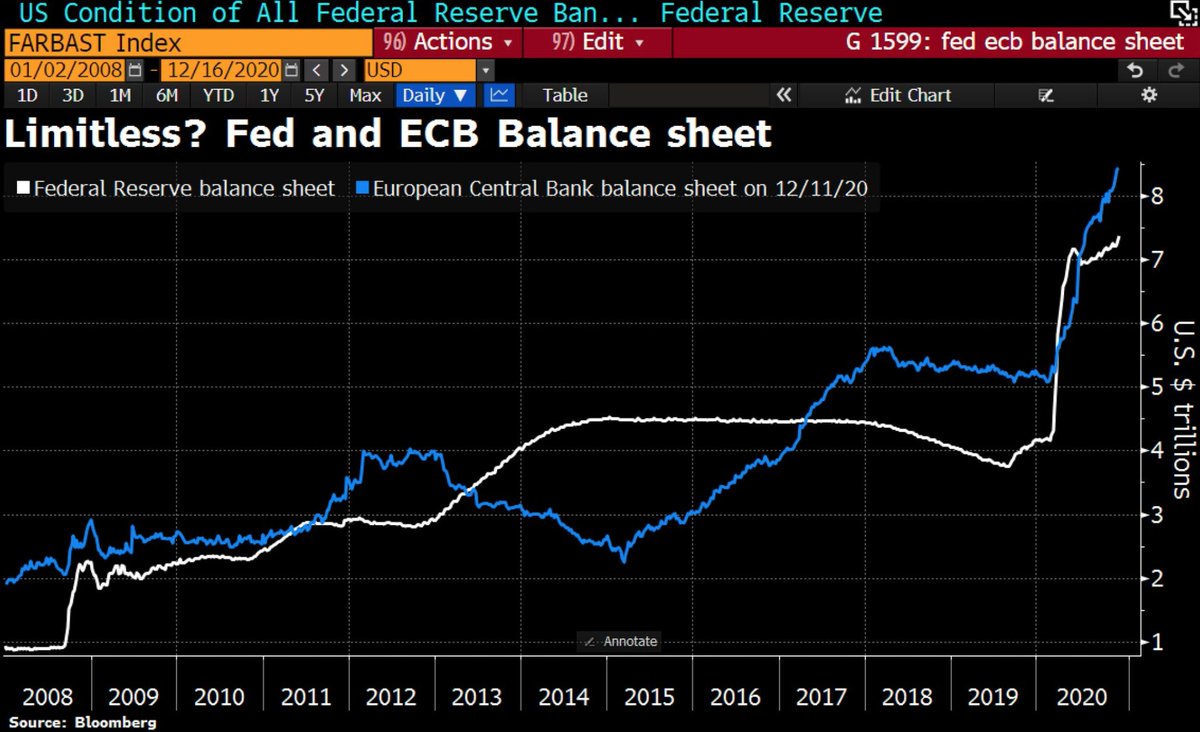

Central Banks all collectively stepped in with QE on steroids. Attached ECB and FED balance sheets added.

We all need a hedge against paper money.

Gold, Silver, Commodities, Bitcoin... you name it

Central Banks all collectively stepped in with QE on steroids. Attached ECB and FED balance sheets added.

We all need a hedge against paper money.

Gold, Silver, Commodities, Bitcoin... you name it

Then, the WSB Silver Crusade as 8 Big Banks are SHORT 404 million ounces

Every $2.50 move higher, they lose $1 billion

Imagine bringing Silver to $100

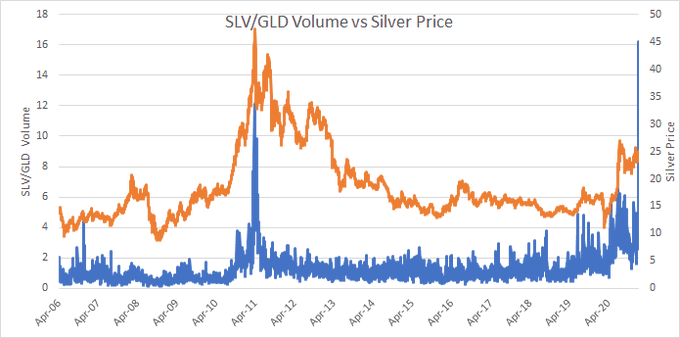

As a result $SLV volume on Jan28 was 8x 3 month average. Options volume 30x avg

Physical 30% premium https://www.reddit.com/r/wallstreetbets/comments/l68ill/the_biggest_short_squeeze_in_the_world_slv_silver/

Every $2.50 move higher, they lose $1 billion

Imagine bringing Silver to $100

As a result $SLV volume on Jan28 was 8x 3 month average. Options volume 30x avg

Physical 30% premium https://www.reddit.com/r/wallstreetbets/comments/l68ill/the_biggest_short_squeeze_in_the_world_slv_silver/

Some fundamentals already pointed out on my Aug 2018 article for SeekingAlpha.

"Will Forgotten Silver Ever Shine Again? The Answer In A Few Charts" $SLV https://seekingalpha.com/article/4194360-will-forgotten-silver-ever-shine-again-answer-in-charts

"Will Forgotten Silver Ever Shine Again? The Answer In A Few Charts" $SLV https://seekingalpha.com/article/4194360-will-forgotten-silver-ever-shine-again-answer-in-charts

Next on #SilverSqueeze

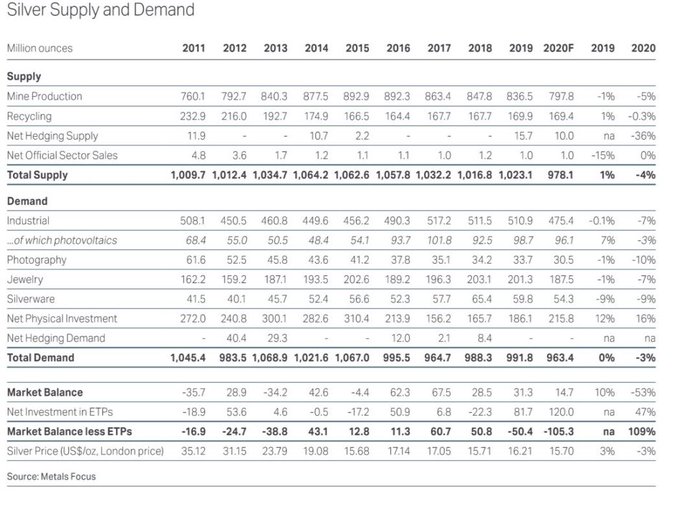

2020 Physical Supply is the lowest in a decade.

Actual production will be even lower due to COVID-19

The link:

https://www.silverinstitute.org/silver-supply-demand/

The survey estimated 105 million ounce ETF demand in 2020. $SLV did 39 million in one day.

Bet on 2021 deficit...

2020 Physical Supply is the lowest in a decade.

Actual production will be even lower due to COVID-19

The link:

https://www.silverinstitute.org/silver-supply-demand/

The survey estimated 105 million ounce ETF demand in 2020. $SLV did 39 million in one day.

Bet on 2021 deficit...

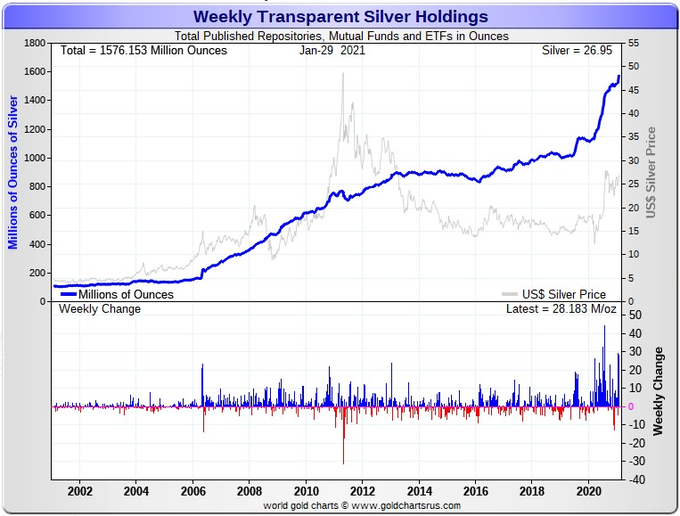

Investment demand to pop #SilverSqueeze

So far January 2021 Silver Investment Demand reached 65 million ounces, A RECORD. Again... in a "normal year" that number is in the 100m ounces... $SLV

So far January 2021 Silver Investment Demand reached 65 million ounces, A RECORD. Again... in a "normal year" that number is in the 100m ounces... $SLV

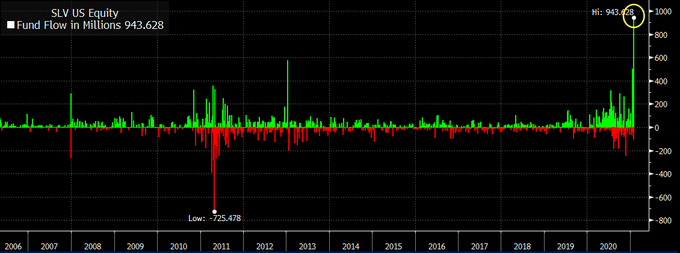

Inflows are leading to #SilverSqueeze

Silver ETF $SLV saw inflows of almost $1Bn on Friday, almost DOUBLE the previous record inflow for this 15 year-old ETF

Silver ETF $SLV saw inflows of almost $1Bn on Friday, almost DOUBLE the previous record inflow for this 15 year-old ETF

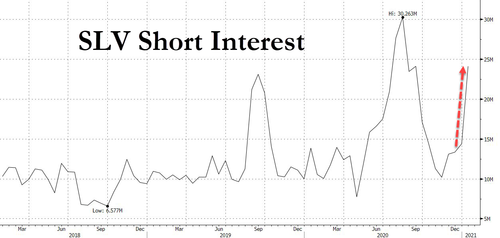

Increased Short Interest at max's lead to WSB interest on #SilverSqueeze

Silver $SLV ETF short interest has been increasing

Silver $SLV ETF short interest has been increasing

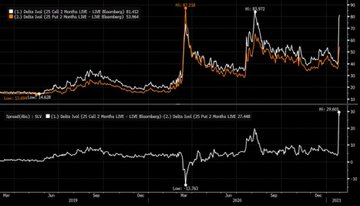

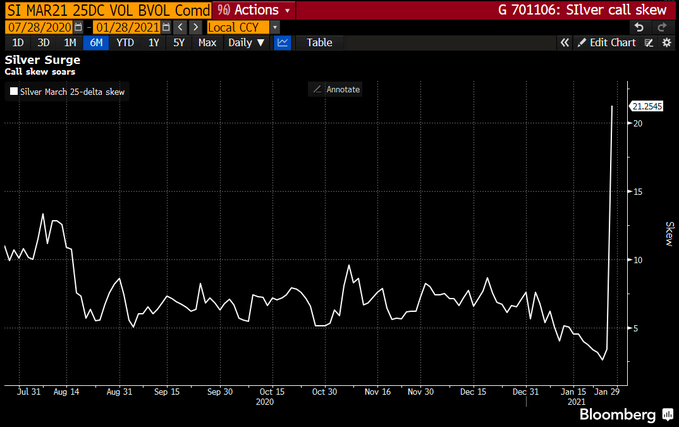

Implied Volatility (IV) spiked, as it has done on other hot WSB names pointing to #SilverSqueeze

IV spike, but still at 80%

$GME IV reached north of 1000%

Above $30 $SLV to go parabolic as is still 50% under 1979 nominal high

IV spike, but still at 80%

$GME IV reached north of 1000%

Above $30 $SLV to go parabolic as is still 50% under 1979 nominal high

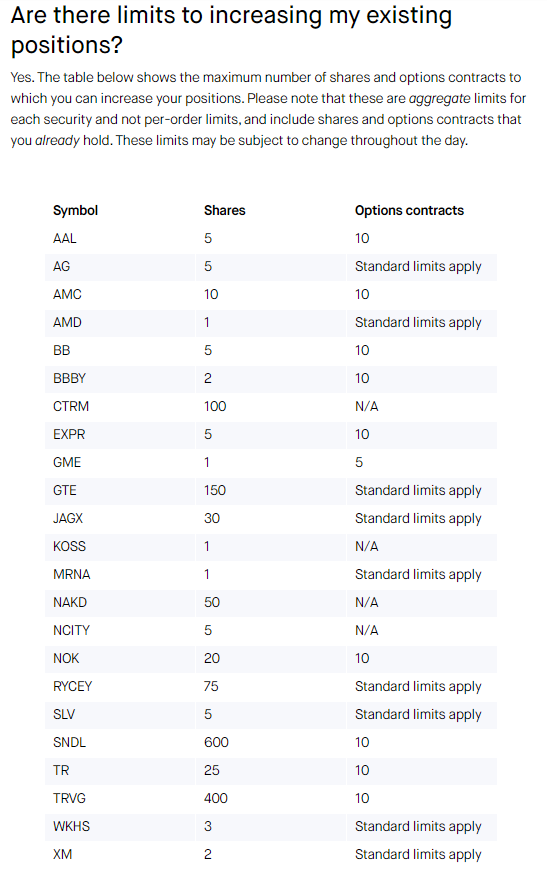

Guidelines on WSB for next week $SLV squeeze are black & white written

Silver $SLV is about to be the next one judging by today's 7x daily average volume and 30x option average trades.

Above $30 will go parabolic

Above $30 will go parabolic

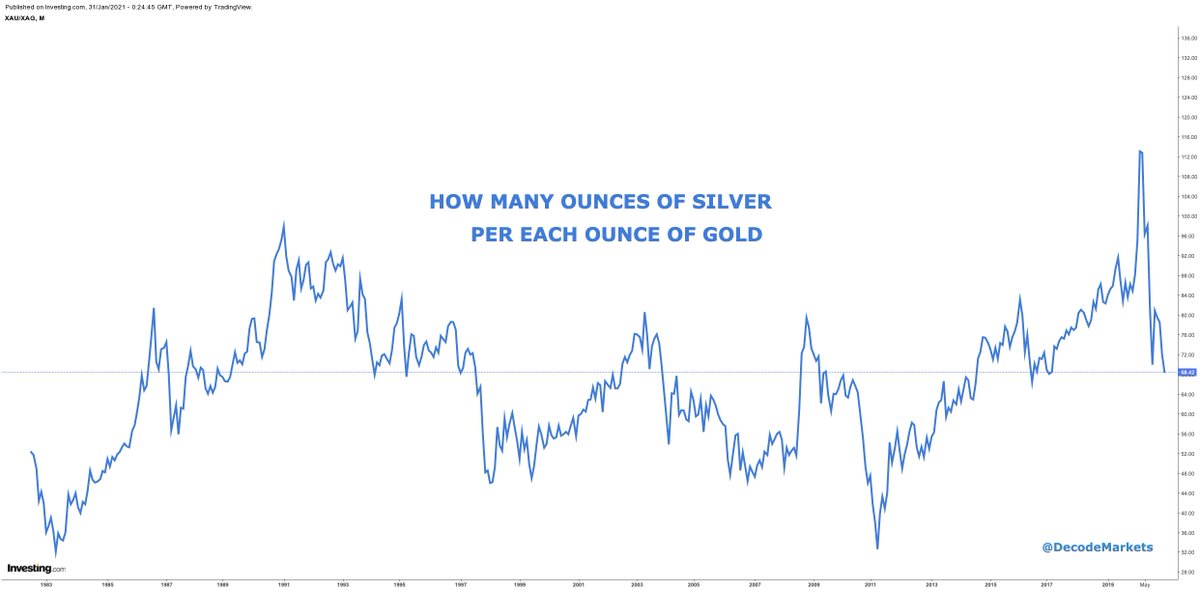

1 Ounce of Gold $GLD equals 68.5 ounces of Silver $SLV

Lots of room still here as in the late 1979s or 2011, when Silver got in fashion, the ratio was low 30s!

Lots of room still here as in the late 1979s or 2011, when Silver got in fashion, the ratio was low 30s!

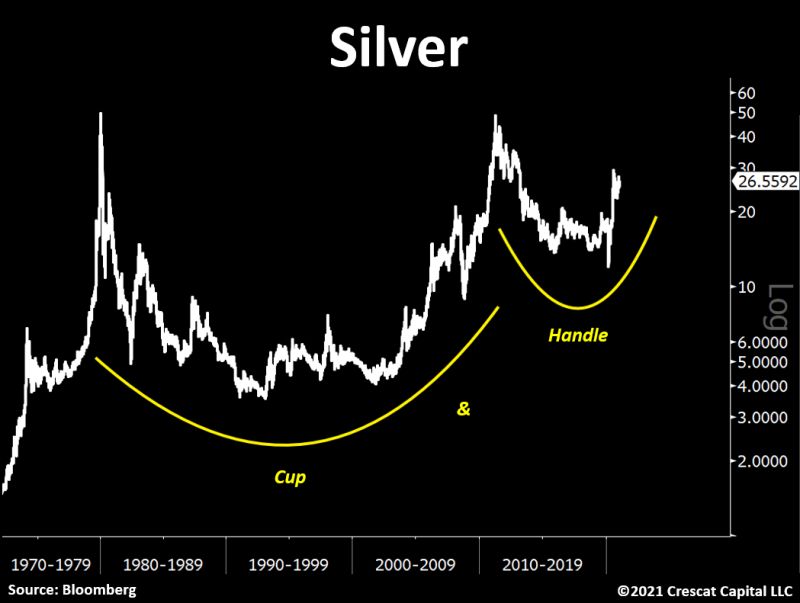

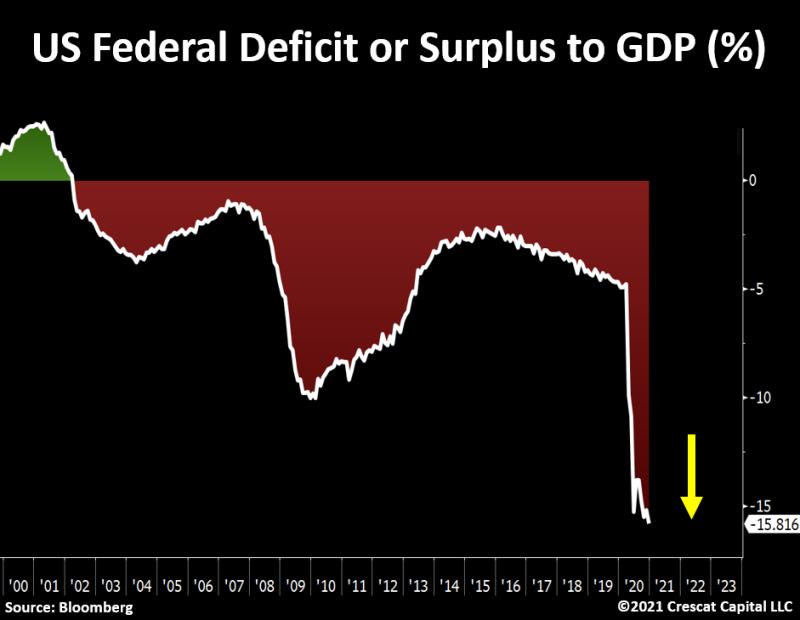

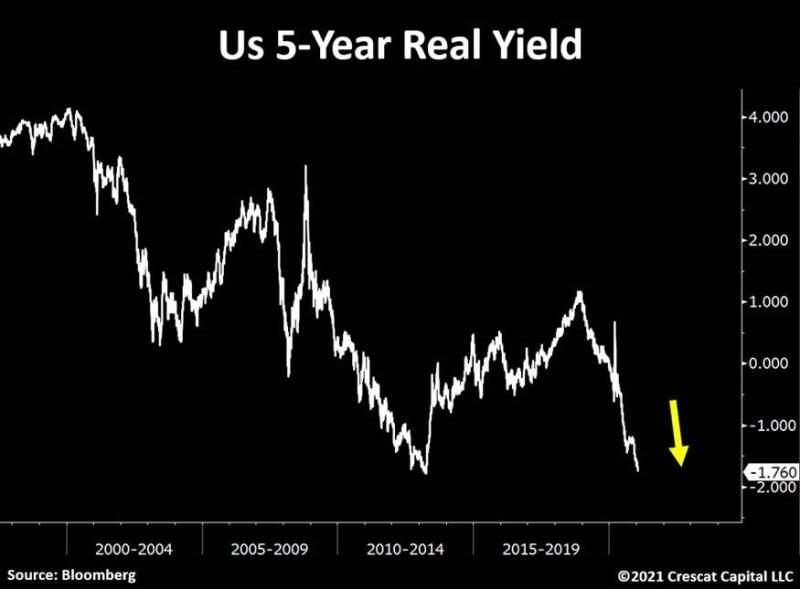

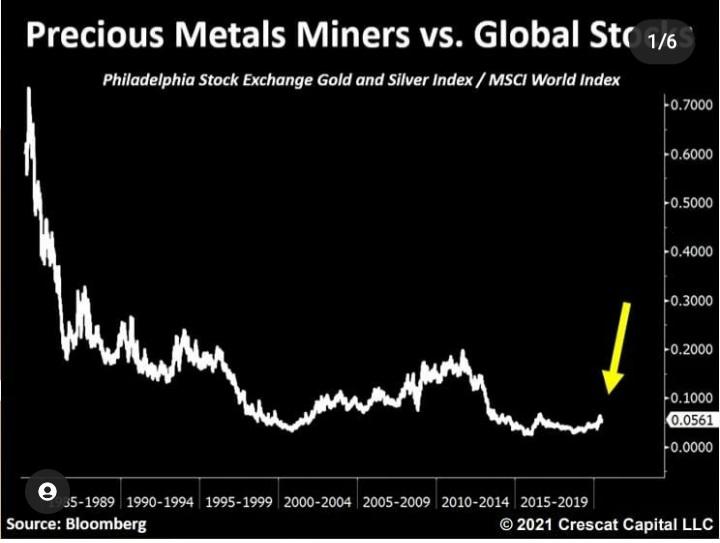

Chartwise, there's a lot out there. Let me bring 4 charts that like the most for $SLV was brought by @TaviCosta days ago.

This book is a MUST READ if you want to get into this game

"The Big Silver Short: How The Wall Street Banks Have Left The Silver Market In Place For The Short-Squeeze Of A Lifetime"

Buy this book on $SLV

https://www.amazon.com/Big-Silver-Short-Short-Squeeze-Lifetime/dp/B08BDZ5H6K

"The Big Silver Short: How The Wall Street Banks Have Left The Silver Market In Place For The Short-Squeeze Of A Lifetime"

Buy this book on $SLV

https://www.amazon.com/Big-Silver-Short-Short-Squeeze-Lifetime/dp/B08BDZ5H6K

Feb 2020 call still on

Silver on an inverted H&S floor? $SLV https://twitter.com/DecodeMarkets/status/1229799515412193280?s=20

Silver on an inverted H&S floor? $SLV https://twitter.com/DecodeMarkets/status/1229799515412193280?s=20

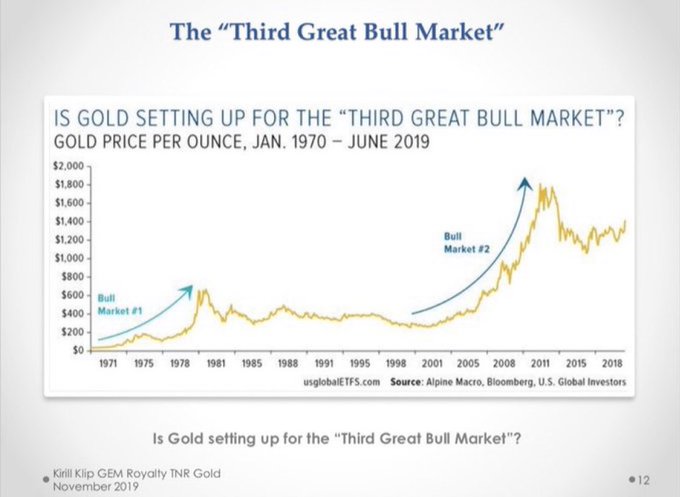

Is worth to look at GOLD BULL WAVES.

1971-1979

Started with Gold Standard ended Aug15, 1971

2000-2011

Started with the Fed help

Is it a 3rd coming?

Watch the FED... And get ready

“Printing machine” works 24x7

Silver $SLV is Gold $GLD on steroids

1971-1979

Started with Gold Standard ended Aug15, 1971

2000-2011

Started with the Fed help

Is it a 3rd coming?

Watch the FED... And get ready

“Printing machine” works 24x7

Silver $SLV is Gold $GLD on steroids

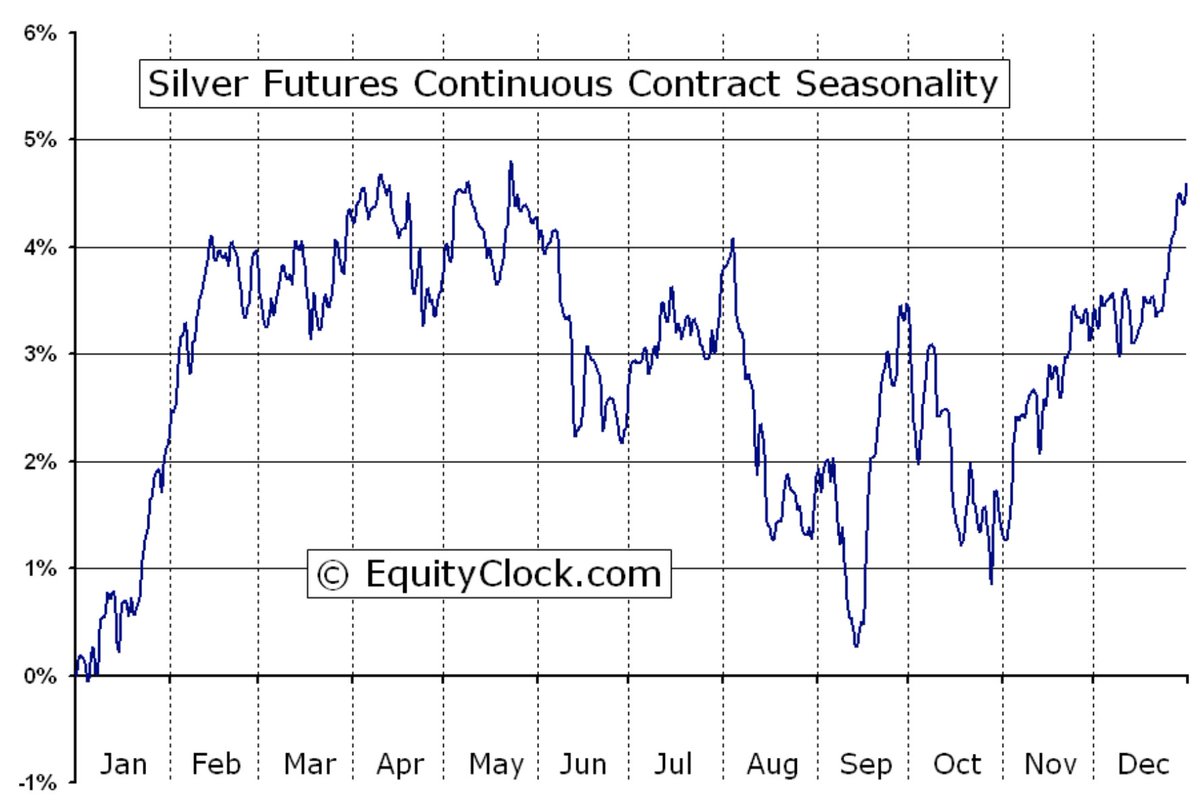

Silver Seasonality is also helping a run on January and February. $SLV

Read on Twitter

Read on Twitter