So #silversqueeze is trending & not just in AUS its trending all around the globe right now. For a leveraged play on silver, buying individual stocks is a great opportunity.

So lets go through some charts that are exposed to silver and could benefit from a move #ASX

lets go through some charts that are exposed to silver and could benefit from a move #ASX

1/9

So

lets go through some charts that are exposed to silver and could benefit from a move #ASX

lets go through some charts that are exposed to silver and could benefit from a move #ASX1/9

$SVL - Near 52 week here a break of .260 would be deadly 2/9

$TMZ - Sym triangle and was on my watchlist before silver started getting mentioned, the real resistance is at .135, it hit a bit of supply on Friday, tiny amount of SOI could really benefit TMZ

3/9

3/9

$ARD - .066 resistance, this pattern will be a similar trend on a lot of silver exposed charts due to the individual stocks mimicking silvers spot price to an extent.

4/9

4/9

$IVR -I have tweeted about the break of this stock last year as you can see in the large pattern previously shown. No current pattern or trend can be seen currently

5/9

5/9

$MTH - Broken out of base after downward trend, high amount of shares on issue compared to market cap which is always something I dont like, chart still has potential though so worth a mention

6/9

6/9

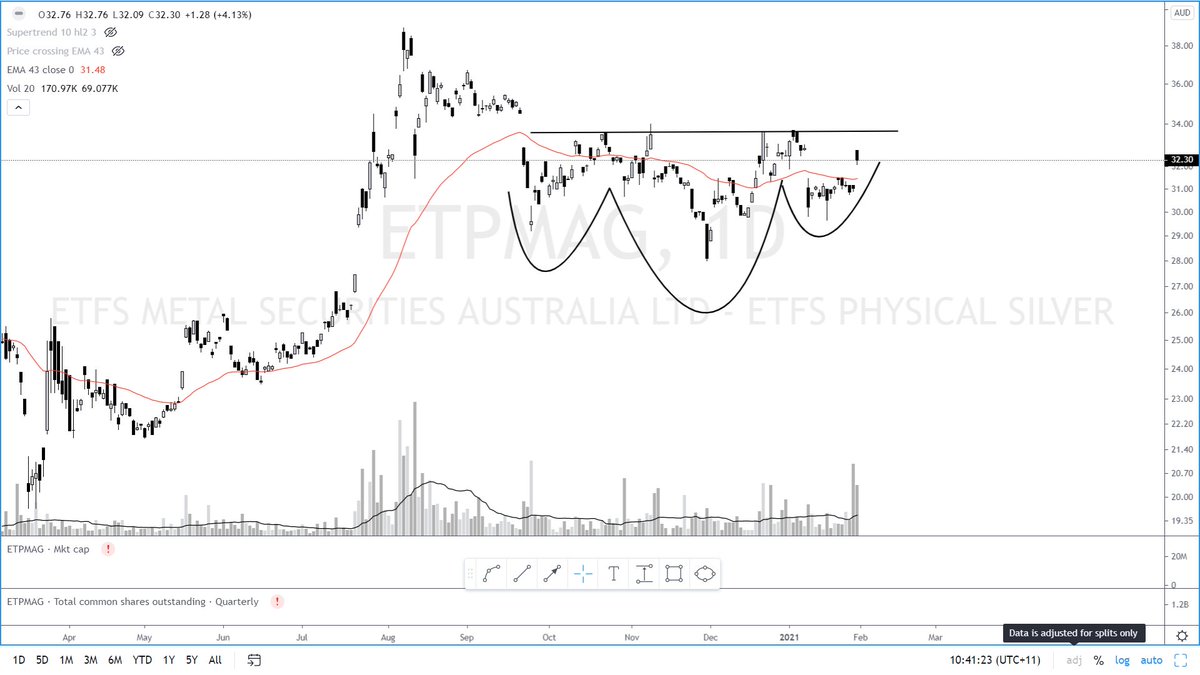

$ETPMAG - If you are into ETFs then this the one for you, a dead ringer for the XAGAUD chart with an inverted H&S that can be seen clearly

7/9

7/9

I thought I would end it with a $SILVER and $XAGAUD chart for reference. Whilst there are more names (and I recommend you check this tweet out https://twitter.com/258Capital/status/1354933062656643078 from @258Capital) these are probably the strongest names currently. Enjoy all, is it Monday yet?

9/9

9/9

Read on Twitter

Read on Twitter