1/ things seem pretty "late stage" to me in equities, very similar feeling to late 2017 in crypto.

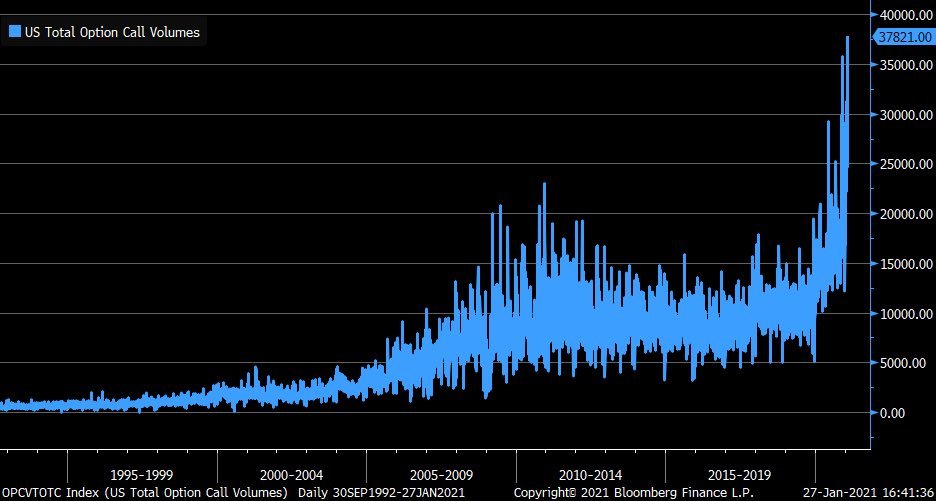

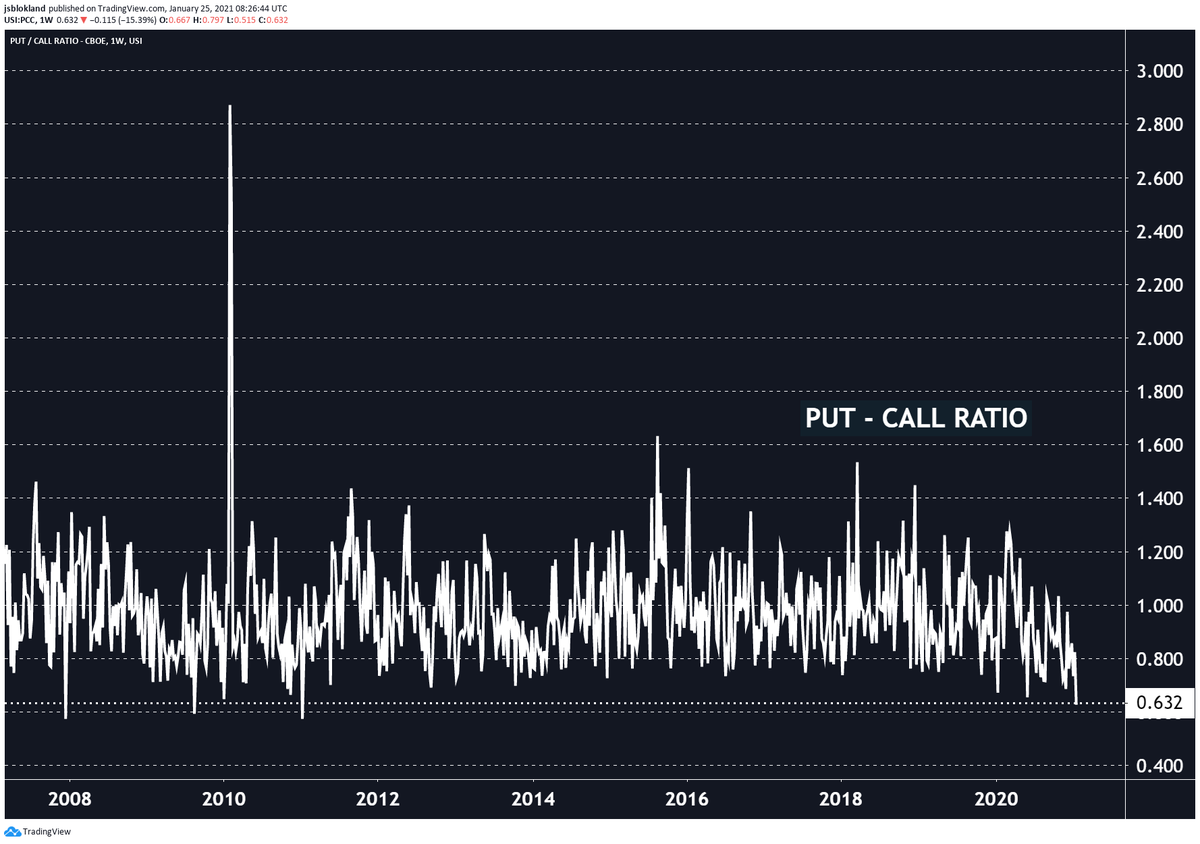

2/ in the last year we've had rotation from fang => cloud => solar => clean energy/EVs => bitcoin => short-interest/doge. arguably the quality of the sector has decreased with each subsequent pump. this is consistent with the behavior in previous bubbles that were about to burst.

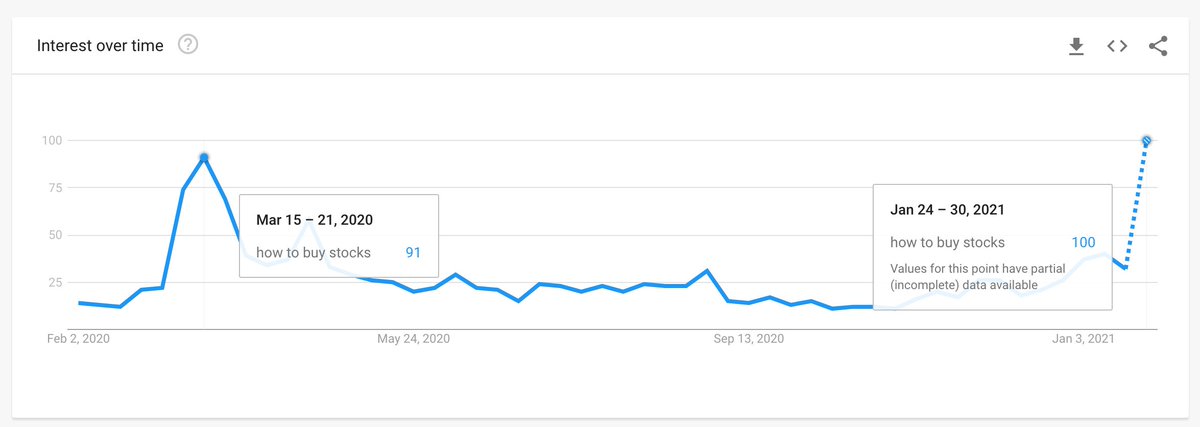

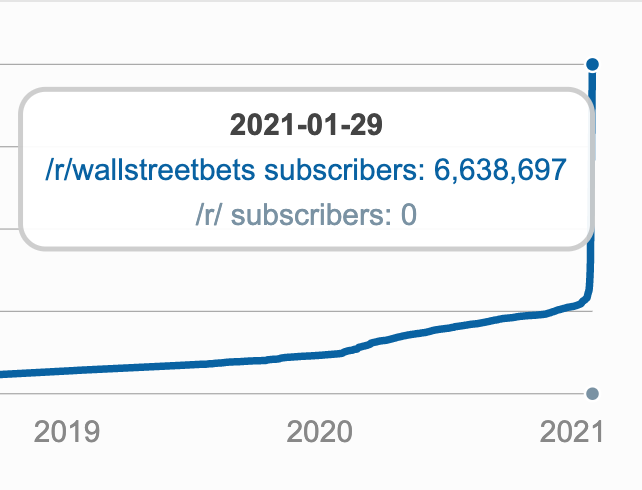

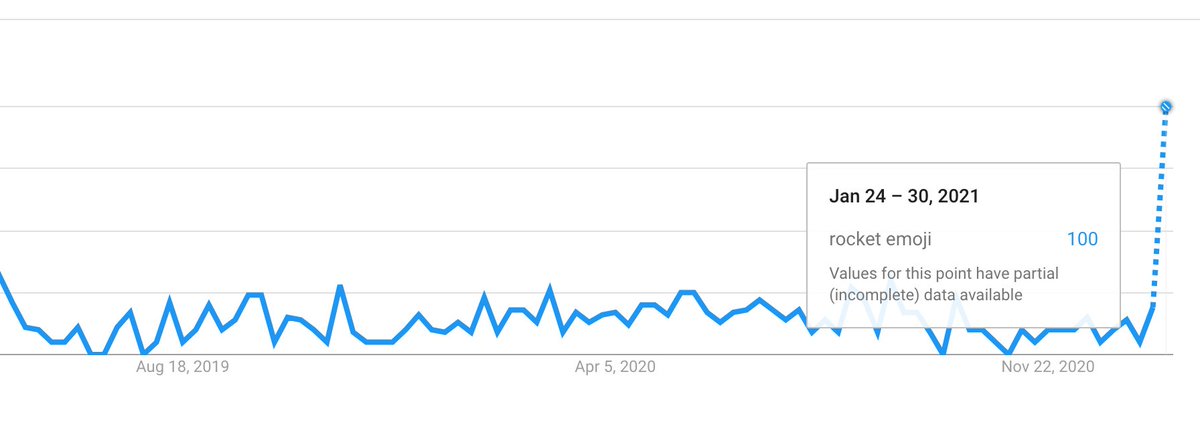

3/ wsb and the concept of the "retail trader" is hitting maximum media coverage and attention. "How to buy stocks" is at ATH google trends (prev high march 2020). WSB has TRIPLED from roughly 2 million users to over 6 million in a week.

5/ Analyst predictions for 2021 were universally positive with essentially no bank willing to even venture a forcecast below 6% upside in the S&P and most around the 14-17% range.

6/ even as this latest "dash to trash" is occurring, media attention on the stock market i and retail indices are starting to roll over and break technicals with the broader market turning red as people keep the meme names alive.

7/ this channel has been the only thing to matter for ES for the last three months, with no daily closes above or below despite dozens of touches, until last week, the worst for ES since the election and third-worst since the coronavirus crash

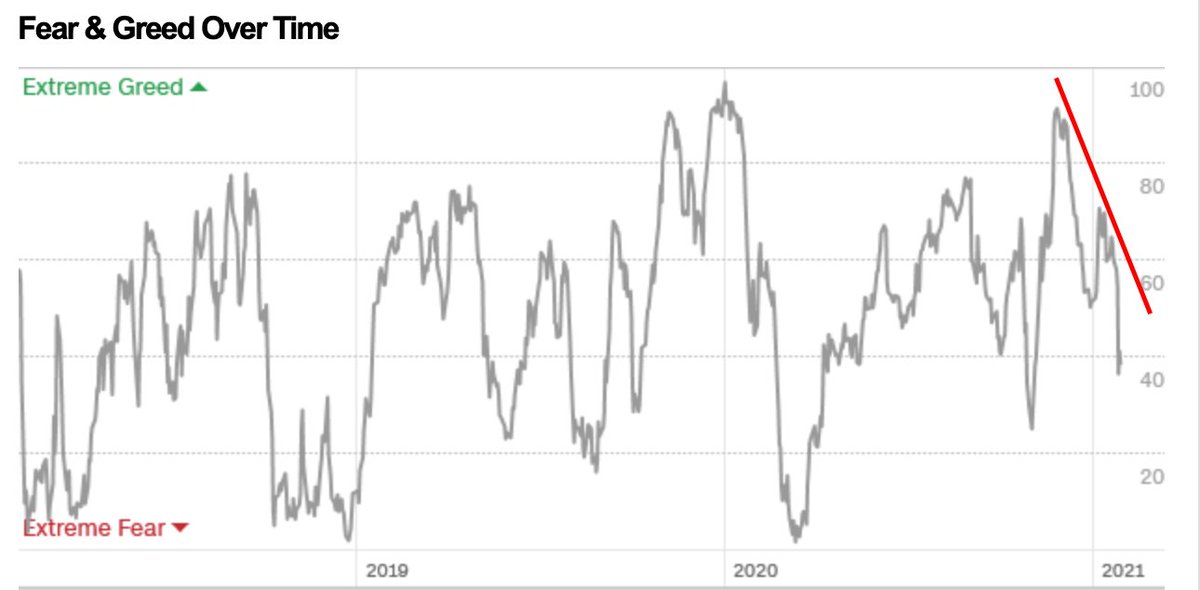

8/ one argument i've heard against a correction is that the "market usually does not like to crash when people are fearful" pointing to AAII bull/bear and fear/greed index without the euphoria that occurs right before a major correction.. but what if.. bearish divergence?

9/ these are all reasons I think that point to a intermediate top and for a "actual" correction of around -10% to occur on the SPX

That being said what will actually probably happen is SPX 3900 and GME 1000 next week. Thank you.

@nope_its_lily @jam_croissant @Ksidiii @StrizziJ

That being said what will actually probably happen is SPX 3900 and GME 1000 next week. Thank you.

@nope_its_lily @jam_croissant @Ksidiii @StrizziJ

@SoccerMomTrades my "maybe this will actually fucking correct for once" bear thesis

Read on Twitter

Read on Twitter