1/ To any that don't realize the $DAIQ potential here-

Let me break down why I keep shilling this and why all it needs is a tiny push to make massive early $ESD $DSD size gains.

So why is it primed to move?

Let me break down why I keep shilling this and why all it needs is a tiny push to make massive early $ESD $DSD size gains.

So why is it primed to move?

2/ First of all

MARKET CAP SIZE AND CIRCULATING SUPPLY MATTERS MUCH MORE THAN PRICE FOR ALGO STABLES.

Lets compare

$ESD $126,302,977

$DSD $44,641,162

$DAIQ $6,000,000

So the market cap is much lower. Now let's compare circulating supplies.

MARKET CAP SIZE AND CIRCULATING SUPPLY MATTERS MUCH MORE THAN PRICE FOR ALGO STABLES.

Lets compare

$ESD $126,302,977

$DSD $44,641,162

$DAIQ $6,000,000

So the market cap is much lower. Now let's compare circulating supplies.

3/ Circulating Supplies:

$ESD 442,483,152

$DSD 141,849,191

$DAIQ 11,686,440

So why is this relevant? Because algo stables rebase, like $AMPL, they are targeting a certain price. All of these algo stables target approx $1.

$ESD 442,483,152

$DSD 141,849,191

$DAIQ 11,686,440

So why is this relevant? Because algo stables rebase, like $AMPL, they are targeting a certain price. All of these algo stables target approx $1.

4/ What are the implications of this?

Lower circulating supply = lower dumping pressure. $DAIQ not only has an improved coupon system to mitigate debt cycles, it also has dynamic epochs.

But it needs to break free of its first debt cycle. This has a snowball effect.

Lower circulating supply = lower dumping pressure. $DAIQ not only has an improved coupon system to mitigate debt cycles, it also has dynamic epochs.

But it needs to break free of its first debt cycle. This has a snowball effect.

5/ What happens when we break the debt cycle?

Rebase incentives for DAO holders and LPs kick in. This causes liquidity to shoot up, and massive buying pressure because it is so lucrative to be a DAO holder or LP during expansion.

This is where others have made insane profit

Rebase incentives for DAO holders and LPs kick in. This causes liquidity to shoot up, and massive buying pressure because it is so lucrative to be a DAO holder or LP during expansion.

This is where others have made insane profit

6/ The reason this happens is because increasing the supply pushes the price closer back to the peg organically through selling pressure.

But what has happened in the past once $ESD and $DSD have reached expansion cycles, is that they stay there for long periods of time, as..

But what has happened in the past once $ESD and $DSD have reached expansion cycles, is that they stay there for long periods of time, as..

7/ .. buying pressure outweighs selling pressure. All this time, people bonding their algo stable to the Dao or LP reap all the rebases, providing an insane APY.

Eventually with a large enough supply, the algo stable stabilizes. But initially there is much more space...

Eventually with a large enough supply, the algo stable stabilizes. But initially there is much more space...

8/ .. for participants to profit, because of the two things I mentioned earlier:

LOW MARKET CAP and LOW CIRCULATING SUPPLY

Of which $DAIQ has both!

Not only this, but it has an upgraded coupon system used by NO OTHER ALGO STABLE that will help mitigate debt cycles.

LOW MARKET CAP and LOW CIRCULATING SUPPLY

Of which $DAIQ has both!

Not only this, but it has an upgraded coupon system used by NO OTHER ALGO STABLE that will help mitigate debt cycles.

9/ The only problem is- we have yet to escape our first one, which is the hardest. Once we do- there is an insane amount of room for upside.

Right now the people who keep selling are tiny wallets who do not understand the economics of this and are fine taking .1 eth profits..

Right now the people who keep selling are tiny wallets who do not understand the economics of this and are fine taking .1 eth profits..

10/ .. instead of making 500x or greater like people who were early in $ESD and $DSD.

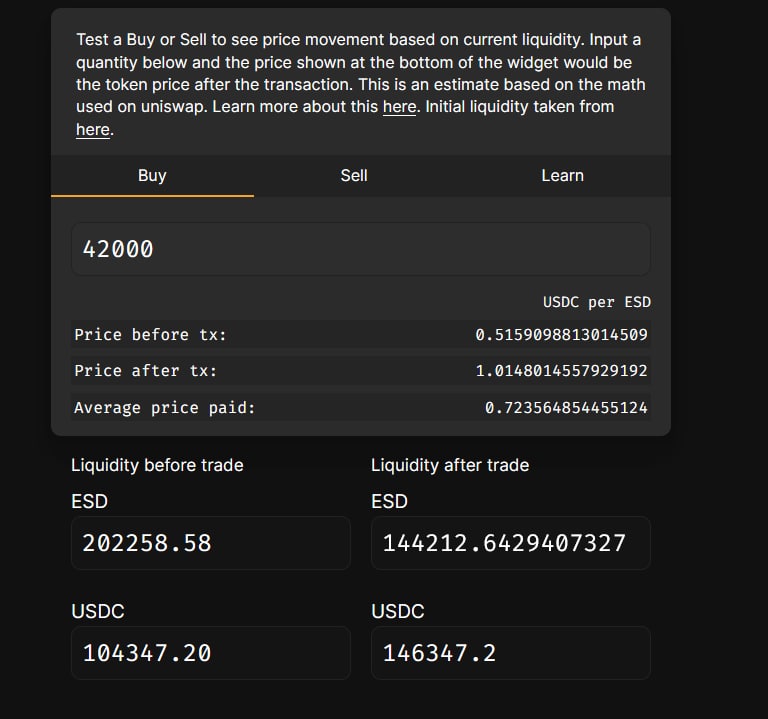

This tool below is for $ESD but if you use the same formula for $DAIQ you will see that we only need $42,000 of buy pressure with no sells to hit expansion.

Yes, that is literally it.

This tool below is for $ESD but if you use the same formula for $DAIQ you will see that we only need $42,000 of buy pressure with no sells to hit expansion.

Yes, that is literally it.

11/ Once we lock into expansion, liquidity will be vast. When $DAIQ first launched in its bootstrapping phase, it was over $4,000,000

Anybody who is selling now is shooting themselves and everybody around them in the foot.

You could be selling into massive liquidity instead

Anybody who is selling now is shooting themselves and everybody around them in the foot.

You could be selling into massive liquidity instead

Read on Twitter

Read on Twitter