1/ Hello fellow intelligent investors. Today I’ll outline why in investing, the person turning over the most rocks wins, discuss the power of “snap judgments,” and share my snap judgments framework. As always, I hope you learn something new today. Let's get started!

2/ I’m a big fan of Peter Lynch. One of my favorite quotes from him is the following one:

"The person that turns over the most rocks wins the game."

And he's right. Investing requires a certain amount of dedication to obtain good results.

"The person that turns over the most rocks wins the game."

And he's right. Investing requires a certain amount of dedication to obtain good results.

3/ At the end of the day, those turning over the most rocks, reading the most 10-Ks and shareholder letters, and looking up the most 13-Fs of superstar investors, will learn the most, will analyze the most companies, and will generally do the best when it comes to investing.

4/ If you look at ten companies, you might find one company that's worth taking a closer look at. You can probably immediately reject the other nine firms as they are not worth your time.

5/ Now if you look at 20 companies, you might find two companies that are interesting. If you look at 100, you will find ten. Basically, you want to look at 100 companies and then be able to quickly identify those that are worth looking at closer.

6/ Warren Buffett has said the same thing. When he started, he went through the Moody’s manual page by page – 20.000 pages in total.

7/ During Buffett's time, Moody's published enormous manuals that were the ultimate stock market resource and listed every single publicly-traded company in the U.S.

8/ "It was absolutely a question of turning pages. (...) I took those manuals and went through each one of them page by page. All 10,000 pages. Some of the best investments were found near the end of those manuals. All the good stuff is in the back."

(Warren Buffett)

(Warren Buffett)

9/ You may be thinking that this is a lot of work that you can’t do yourself. Well, it is a lot of work, but having the ability to reject ideas quickly makes it an easier process. I truly believe that it is your job to reject ideas quickly. You want to focus on the no-brainers.

10/ This is a lesson Mohnish Pabrai taught me. In fact, I believe that around 95% of stocks aren’t worth your time. But how do you spot the 5% worth examining further?

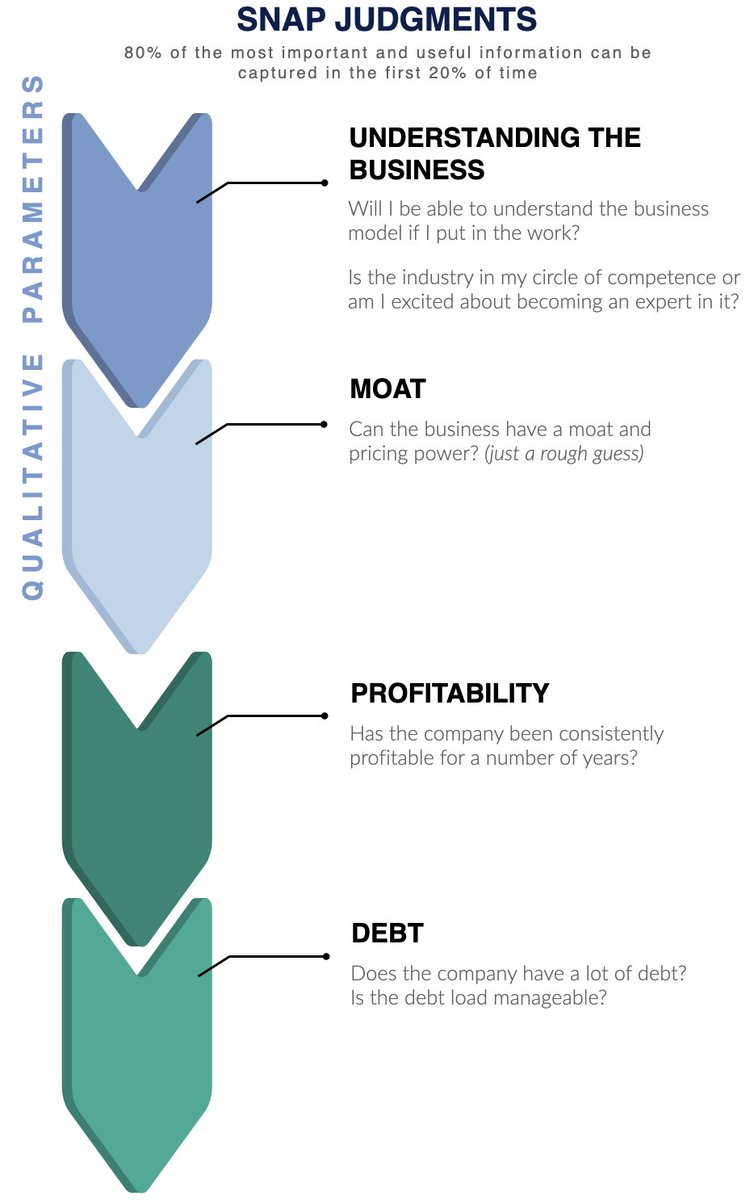

11/ Well, I believe that 80% of the most important and useful information can be captured in the first 20% of the time spent analyzing a business. You can think of it like an "80/20 rule."

12/ Martin J. Whitman is quoted saying, "Rarely do more than three or four variables really count. Everything else is noise."

So let me share some of the most important criteria I use when making "snap judgments." I distinguish between qualitative and quantitative criteria:

So let me share some of the most important criteria I use when making "snap judgments." I distinguish between qualitative and quantitative criteria:

13/ 𝐐𝐮𝐚𝐥𝐢𝐭𝐚𝐭𝐢𝐯𝐞 𝐜𝐫𝐢𝐭𝐞𝐫𝐢𝐚

Will I be able to understand the business model if I put in the work? Is the industry in my circle of competence or am I excited about becoming an expert in it?

Will I be able to understand the business model if I put in the work? Is the industry in my circle of competence or am I excited about becoming an expert in it?

Will I be able to understand the business model if I put in the work? Is the industry in my circle of competence or am I excited about becoming an expert in it?

Will I be able to understand the business model if I put in the work? Is the industry in my circle of competence or am I excited about becoming an expert in it?

14/ For instance, I will never be able to understand biotech companies, so I just get rid of these companies quickly. Some ideas should simply be put in your too hard box!

15/ "Too hard" means two things: a) you don't understand the business model and/or b) you don't know how to value the stock as you cannot figure out where the business is going to be in 10 years.

16/ Buffett and Munger said that knowing what to leave out is just as important as knowing what to focus on.

“If something is too hard, we move on to something else. What could be simpler than that?”(Charlie Munger)

“If something is too hard, we move on to something else. What could be simpler than that?”(Charlie Munger)

17/  I quickly try to assess whether the business might have a moat and pricing power (e.g. I can immediately reject commodity businesses).

I quickly try to assess whether the business might have a moat and pricing power (e.g. I can immediately reject commodity businesses).

I quickly try to assess whether the business might have a moat and pricing power (e.g. I can immediately reject commodity businesses).

I quickly try to assess whether the business might have a moat and pricing power (e.g. I can immediately reject commodity businesses).

18/  Are there (strong) secular growth drivers?

Are there (strong) secular growth drivers?

Are there (strong) secular growth drivers?

Are there (strong) secular growth drivers?

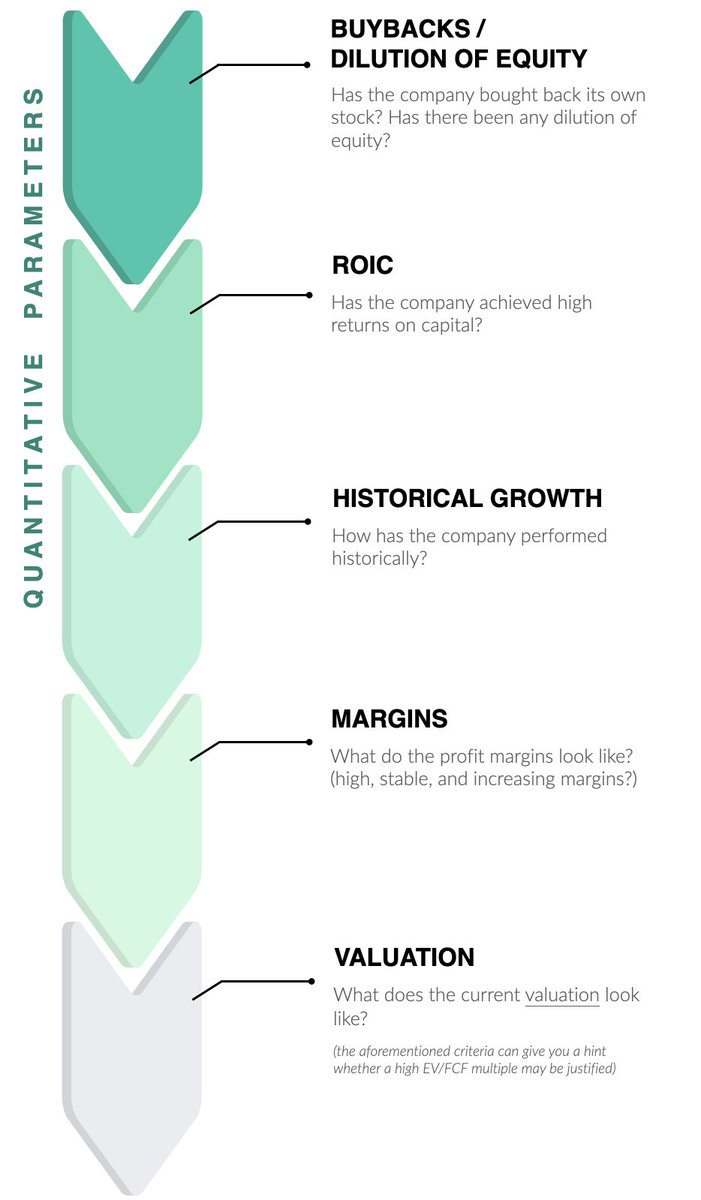

19/ 𝐐𝐮𝐚𝐧𝐭𝐢𝐭𝐚𝐭𝐢𝐯𝐞 𝐜𝐫𝐢𝐭𝐞𝐫𝐢𝐚:

Has the company been consistently profitable for a number of years?

Has the company been consistently profitable for a number of years?

Does the company have a lot of debt? Is the debt load manageable?

Does the company have a lot of debt? Is the debt load manageable?

Has the company bought back its own stock? Has there been any dilution of equity?

Has the company bought back its own stock? Has there been any dilution of equity?

Has the company been consistently profitable for a number of years?

Has the company been consistently profitable for a number of years? Does the company have a lot of debt? Is the debt load manageable?

Does the company have a lot of debt? Is the debt load manageable? Has the company bought back its own stock? Has there been any dilution of equity?

Has the company bought back its own stock? Has there been any dilution of equity?

20/  Has the company achieved high returns on capital?

Has the company achieved high returns on capital?

Has the company achieved high returns on capital?

Has the company achieved high returns on capital?

21/  How has the company performed historically? Was the company able to grow revenue/FCF/EBIT/EPS? Has the stock beaten the S&P since IPO / in the last 5 years? (Winners keep on winning, losers keep on losing)

How has the company performed historically? Was the company able to grow revenue/FCF/EBIT/EPS? Has the stock beaten the S&P since IPO / in the last 5 years? (Winners keep on winning, losers keep on losing)

How has the company performed historically? Was the company able to grow revenue/FCF/EBIT/EPS? Has the stock beaten the S&P since IPO / in the last 5 years? (Winners keep on winning, losers keep on losing)

How has the company performed historically? Was the company able to grow revenue/FCF/EBIT/EPS? Has the stock beaten the S&P since IPO / in the last 5 years? (Winners keep on winning, losers keep on losing)

22/  What do the profit margins look like? (high, stable and increasing margins?)

What do the profit margins look like? (high, stable and increasing margins?)

What does the current valuation look like? (the aforementioned criteria can give you a hint whether a high EV/FCF multiple may be justified)

What does the current valuation look like? (the aforementioned criteria can give you a hint whether a high EV/FCF multiple may be justified)

What do the profit margins look like? (high, stable and increasing margins?)

What do the profit margins look like? (high, stable and increasing margins?) What does the current valuation look like? (the aforementioned criteria can give you a hint whether a high EV/FCF multiple may be justified)

What does the current valuation look like? (the aforementioned criteria can give you a hint whether a high EV/FCF multiple may be justified)

23/ “You got to get the basic fundamentals crystal clear. Someone said that any damn fool can make it complicated, it takes a genius to make it simple.” (Ray Dalio)

24/ There simply isn't enough time to investigate every company trading on a public stock market in detail. Thus, you need to use the aforementioned criteria as "filters." Those are just the most important things that should jump out at you.

25/ Most businesses will not pass this initial test.

So if you see a red flag – e.g. negative growth, too much debt, or if you have any doubts about understanding the business –, just stop! You don't need to understand every detail of every business.

So if you see a red flag – e.g. negative growth, too much debt, or if you have any doubts about understanding the business –, just stop! You don't need to understand every detail of every business.

26/ Your time is very valuable. You can use that time to look at another company.

27/ For instance, if you have a business that achieves only 5% ROIC and another firm that provides 15%, the 15% business is the one you want to take a closer look at because every dollar they reinvest into the business creates a superior return.

28/ "I don’t try to jump over seven-foot bars; I just look around for one-foot bars that I can step over."

(Warren Buffett)

(Warren Buffett)

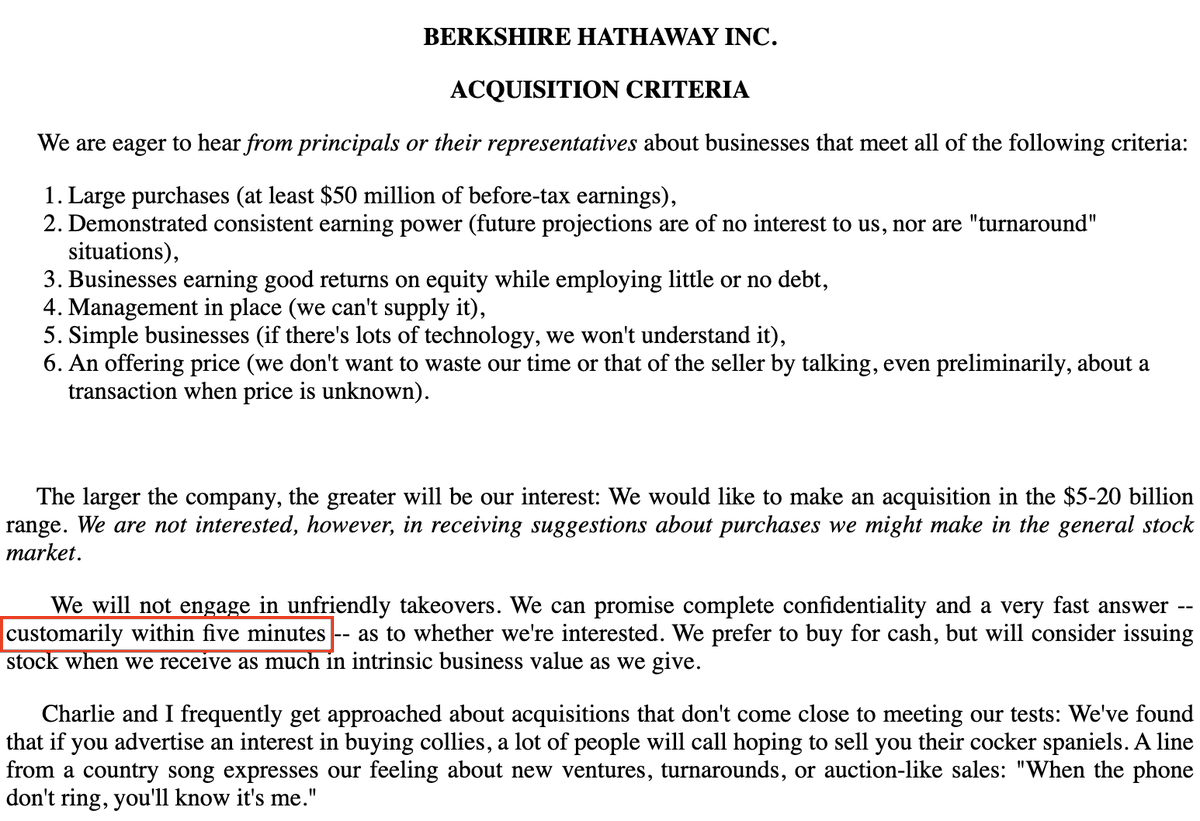

29/ All of this shouldn't take you longer than 5 minutes. Let me show you Berkshire's acquisition criteria.

Charlie Munger said people would be shocked if they saw how quickly Buffet makes investment decisions.

Charlie Munger said people would be shocked if they saw how quickly Buffet makes investment decisions.

30/ And Warren himself is quoted saying, “we can really say no in 10 seconds or so to 90%+ of all the things that come along simply because we have these filters.”

31/ Mohnish Pabrai is another proponent of this philosophy. He recommends rushing through a lot of stuff and only spending time on stocks that look like absolute no-brainers. He argues that investors should "be unreasonable."

32/ "My take has always been that you're likely to make the most money with the ideas that are the simplest.”

(Mohnish Pabrai)

(Mohnish Pabrai)

33/ Actually, the best type of business to own is the one where you need the least amount of information – both in terms of a) the amount of information needed as well as b) the frequency of information (i.e. revisiting an investment once a year will often do the job).

34/ “If you have to spend a large amount of time and it’s not obvious, it’s probably not a good investment. In some of our most successful investments, the amount of work that was done was in the hours as opposed to even in the days or weeks or months.”

(Bill Ackman)

(Bill Ackman)

35/ Although simply looking at a few numbers and metrics is certainly not enough to reach a full understanding of an individual company and to determine if the stock is a great investment, it is a good starting point.

36/ In most cases, looking at a few numbers is certainly enough to know whether an individual company deserves any further research.

All I need for this is quickFS (and maybe the business description provided by SeekingAlpha).

All I need for this is quickFS (and maybe the business description provided by SeekingAlpha).

37/ At first, making snap judgments – separating a truly compelling opportunity from a run-of-the-mill investment – will be a challenging task, but it helps to have looked at many companies and you will get better the more frequently you do it.

38/ After this preliminary analysis, you can start wading through other sources (proxy statements, write-ups, podcasts, CEO interviews etc.) to truly understand the business, management incentives, etc.

39/ 𝐁𝐞 𝐩𝐚𝐭𝐢𝐞𝐧𝐭 𝐚𝐧𝐝 𝐝𝐨𝐧’𝐭 𝐞𝐱𝐩𝐞𝐜𝐭 𝐢𝐦𝐦𝐞𝐝𝐢𝐚𝐭𝐞 𝐫𝐞𝐬𝐮𝐥𝐭𝐬! While you will be looking at a lot of companies, you will likely not find many high-quality companies that are trading at a fair price.

40/ Most of the interesting companies will not be purchased right away. Instead, they will end up on your wish list and stay there for months or years (after initially investigating them) – if the stock price ever drops significantly, you might purchase them.

41/ Garfield Drew: "Simplicity or singleness of approach is a greatly underestimated factor of market success.

42/ As soon as the attempt is made to watch a multiplicity of factors even though each one has some element to justify it, one is only too likely to become lost in a maze of contradictory implications.

43/ The various factors involved may be so conflicting that the conclusion finally drawn is no better than a snap judgment would have been."

44/ A retweet would be much appreciated!

Read on Twitter

Read on Twitter