<1> 4+ years ago (June 25th 2017) I was taking the bus back home from work. A developer friend was telling me "Get in on this bitcoin thing" - lets use AWS resources to mine crypto. I put $1000 in with him, because I trusted him, but did not know about crypto.

My friend then started to mine. I had no clue what that was. Like always I spent 3 months reading every book I could about crypto assets, bitcoin, ETC, etc. We bought 1 BTC each for $2589.41 By Dec 2017 the price went to $15,864.10

We both sold

We both sold

I kept reading more and I understood the power of crypto somewhat. I had read 30+ books, papers, etc. I listened to 20 different podcasts. I learned about mining in China, power consumption requirements etc.

Anand (my friend) and I were working full time so we could not spend time doing more of this. There were 150+ ICO (Initial coin offerings) so there was a bubble / frenzy.

I decided to put a small <5% of my assets in crypto. Speculative.

I decided to put a small <5% of my assets in crypto. Speculative.

I learned that there was not going to be one winner. There were going to be multiple. So late Dec 2017, early Jan 2018 I researched enough to buy a basket of crypto currencies. It was the "peak" of the BTC price. We bought at nearly $20K

Over the next few months we both watched in horror (but were busy with work to do anything about it) as the prices dropped to $4K.

3 years later - the basket gained 100%, after dropping to 30% of its value (70% draw down)

Moral: Long term investing in a basket of assets.

3 years later - the basket gained 100%, after dropping to 30% of its value (70% draw down)

Moral: Long term investing in a basket of assets.

Moral 2: I see similar potential in Electrification of Transport.

Please dont ignore this.

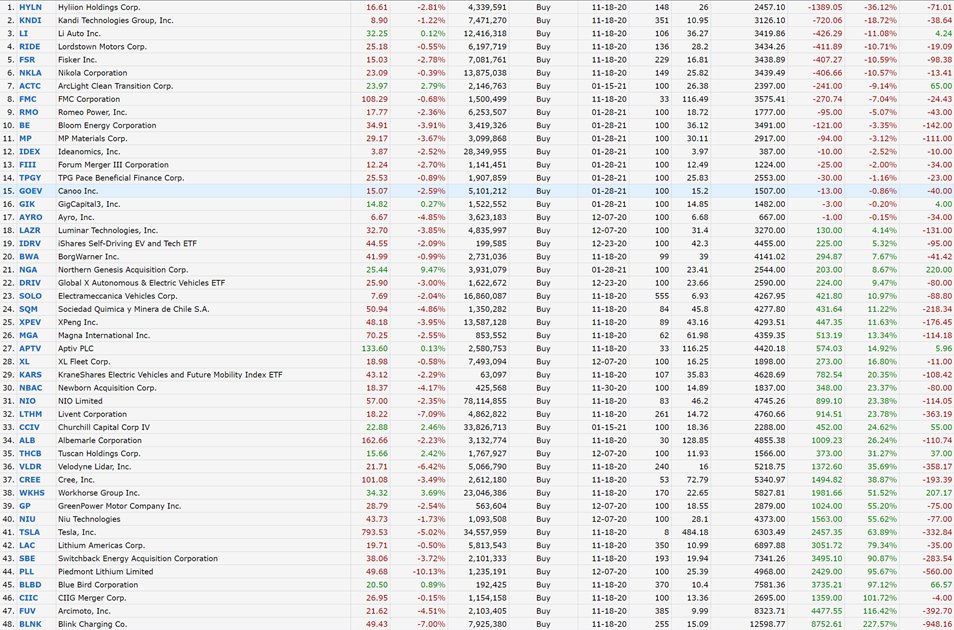

You can have a PoV on which stock you like <now> based on your "conviction". You will probably be wrong. I am not mean or rude. It is hard to pick winners now.

Please dont ignore this.

You can have a PoV on which stock you like <now> based on your "conviction". You will probably be wrong. I am not mean or rude. It is hard to pick winners now.

Let me give you an analogy. Say you have a 2 year old. One day your two year old throws a ball from one end of the room to another. You think - "Whoa! Hall of fame baseball outfielder in 20 years".

My suggestion is to pick 5-10 companies or an ETF and KEEP it for 3+ years

My suggestion is to pick 5-10 companies or an ETF and KEEP it for 3+ years

You wont go wrong if you buy that basket of 5-10 stocks.

This is a secular trend with strong tail winds.

Buy it for your kids and give it to them in 5+ years.

Enjoy and be kind to one another.

This is a secular trend with strong tail winds.

Buy it for your kids and give it to them in 5+ years.

Enjoy and be kind to one another.

Read on Twitter

Read on Twitter