Ok, now that that week’s over let’s do a recap on this whole Gamestop thing.

So, basically hedge funds borrowed too many shares, which they needed to buy back eventually. People realized this, and bought as many shares at they could, to drive the price up and mess with the hedge funds

Detailed breakdown of this can be read here: https://twitter.com/MrBrownEyes2020/status/1354517067240771584

Detailed breakdown of this can be read here: https://twitter.com/MrBrownEyes2020/status/1354517067240771584

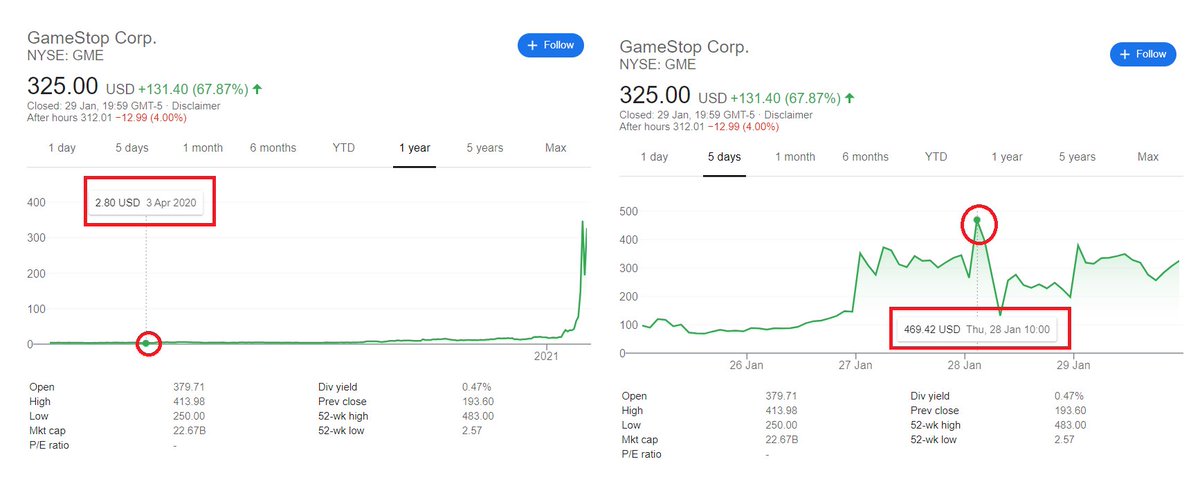

As a result, the share price went up from $2.80, to a whopping $469.42 at one point.

Hedge funds and the media freaked out, and started screaming about it on every show, trying to paint the Redditors as bad guys, and hedge funds as innocent victims.

Hedge funds and the media freaked out, and started screaming about it on every show, trying to paint the Redditors as bad guys, and hedge funds as innocent victims.

They even tried to claim these Redditors were part of the alt-right who attacked the capital on January 6th, and that this was an attack by foreign powers.

(Though they eventually backtracked on these claims).

(Though they eventually backtracked on these claims).

This backfired like crazy, as people started to realize what was going on, and a huge level of support for these Wallstreetbets guys developed. More people started buying the shares, driving the price up further.

On Monday, short sellers had borrowed 140% of every available share, but as this news story broke, public opinion sided with these small internet trades, more people bought shares, so Wallstreet panicked.

They desperately tried to crash the stock, and buy back as much as they could. By Market close Wednesday, they bought back 30% of all shares.

Melvin Capital hedge fund still went broke, and was basically bought out by a bigger hedge fund called Citadel.

Melvin Capital hedge fund still went broke, and was basically bought out by a bigger hedge fund called Citadel.

However, people still weren’t selling, to the rage and disgust of Wallstreet. In fact, they still were buying.

And then Thursday happened.....

And then Thursday happened.....

Brokers such as Robinhood, Ameritrade, E-toro and Interactive Brokers, stopped allowing regular people to buy GME. They still let people sell GME, and institutional investors and hedge funds could buy, but not regular people.

I have never in my life seen this happen before.

I have never in my life seen this happen before.

This crashed the stock. People started panic selling. In an hour price went from $420 to $125.

Ordinary people lost HUGE amounts of money, due to something that was likely illegal.

Ordinary people lost HUGE amounts of money, due to something that was likely illegal.

Now these brokers are trying to say it was to protect the little guy. But quite frankly, that’s bullshit. If that was their goal, they would have stopped both buying and selling, until things calmed down.

Now here's where it gets interesting.

After this market crash, where mostly only hedge funds and institutional buyers could buy, the short interest went from 100% to 75%. Meaning these hedge funds bought back a quarter of ALL SHARES while the market was deliberately crashed

After this market crash, where mostly only hedge funds and institutional buyers could buy, the short interest went from 100% to 75%. Meaning these hedge funds bought back a quarter of ALL SHARES while the market was deliberately crashed

And you might be wondering, why would brokers do this?

Hold on to your hats, because this is messed up.

Hold on to your hats, because this is messed up.

Robinhood and most of the brokers who suspended buying for ordinary people but still allowed selling, have links to Citadel LLC.

Citadel handles the trades for these brokers. https://www.ft.com/content/4a439398-88ab-442a-9927-e743a3ff609b

Citadel handles the trades for these brokers. https://www.ft.com/content/4a439398-88ab-442a-9927-e743a3ff609b

And as we established earlier, Citadel is the hedge fund that bailed out Melvin Capital, who went bankrupt from shorting GME.

This reads like one of those ridiculous conspiracy theories.

But the CEO of Robinhood couldn’t give a good reason why they did what they did.

He denied it was to protect themselves from liquidity issues.

But the CEO of Robinhood couldn’t give a good reason why they did what they did.

He denied it was to protect themselves from liquidity issues.

He started referring to “regulations” and other vague claims. But the SEC and the NYSE didn’t tell them to do anything (apparently). This was a decision taken by individual brokers, many of whom are connected to Citadel.

So how many shares are still owed by these short sellers?

We won’t have updated numbers till market opens on Monday, but you can bet your ass they are trying to get out ASAP. http://isthesqueezesquoze.com/

We won’t have updated numbers till market opens on Monday, but you can bet your ass they are trying to get out ASAP. http://isthesqueezesquoze.com/

This whole fiasco shows how badly the game is rigged, and that the “free market” is only allowed to operate if it benefits Wallstreet.

The media and many politicians are trying to go after these Reddit traders, completely ignoring what was likely blatant illegal market manipulation by brokers (and possibly hedge funds).

However, some, such as @RepAOC and @SenTedCruz want to investigate what these brokers did.

However, some, such as @RepAOC and @SenTedCruz want to investigate what these brokers did.

Anyway, that's about it.

There's a lot of other stuff going on in the background, like gamma squeezes, and social media bots, but this about covers the main points (that I can think of).

I'll try to respond to as many questions as possible, but it's hard to respond to everyone.

There's a lot of other stuff going on in the background, like gamma squeezes, and social media bots, but this about covers the main points (that I can think of).

I'll try to respond to as many questions as possible, but it's hard to respond to everyone.

Read on Twitter

Read on Twitter