1/ $TSLA truth vs Reality

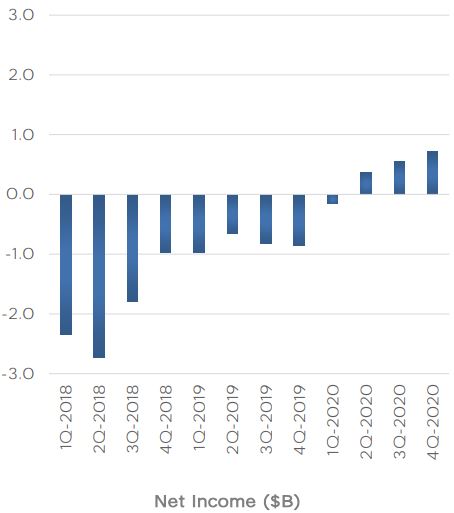

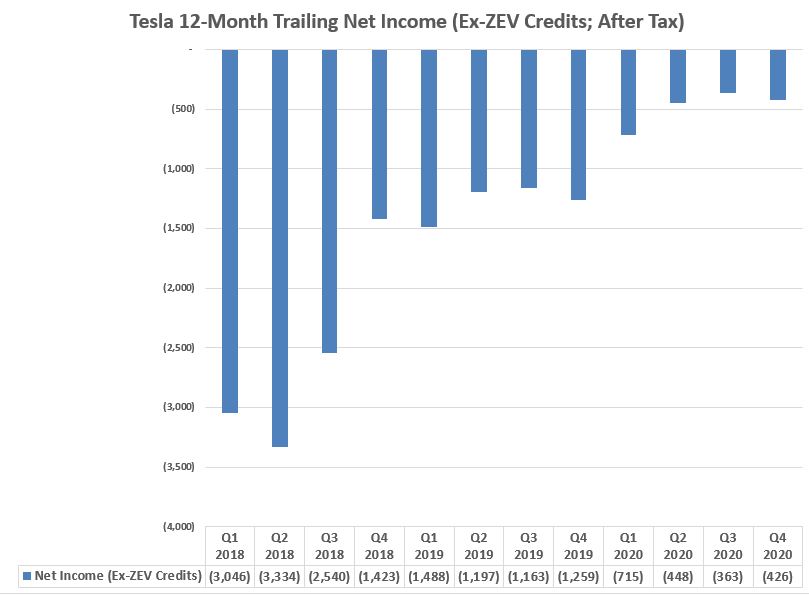

$TSLA: operating margin of 5.4% in Q4

Reality: Ex-ZEV credit OP margin of 1.4%--industry low

SBC shouldn't be excluded. You paid it. Shareholders lost.

$TSLAQ

$TSLA: operating margin of 5.4% in Q4

Reality: Ex-ZEV credit OP margin of 1.4%--industry low

SBC shouldn't be excluded. You paid it. Shareholders lost.

$TSLAQ

2/ $TSLA truth vs Reality

You dropped the price of the MIC Model 3 for the 4th time in Oct'20 in 12 months.

MIC Model Y is too expensive to achieve the same volumes as the MIC Model 3.

$TSLAQ

You dropped the price of the MIC Model 3 for the 4th time in Oct'20 in 12 months.

MIC Model Y is too expensive to achieve the same volumes as the MIC Model 3.

$TSLAQ

3/ $TSLA truth vs Reality

Tesla Energy had a record-high gross loss of $35m. First gross loss since Q3 2016.

$TSLAQ

Tesla Energy had a record-high gross loss of $35m. First gross loss since Q3 2016.

$TSLAQ

4/ $TSLA truth vs Reality

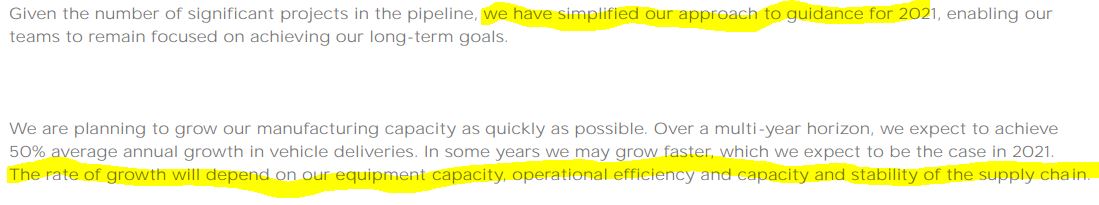

Tesla complicated their approach to 2021 guidance.

Musk said 2021 deliveries of 840K-1M was "within the vicinity" on the Q3'20 conference call.

Now you're guiding for "minimum 755K" with tons of caveats to cover your ass.

$TSLAQ

Tesla complicated their approach to 2021 guidance.

Musk said 2021 deliveries of 840K-1M was "within the vicinity" on the Q3'20 conference call.

Now you're guiding for "minimum 755K" with tons of caveats to cover your ass.

$TSLAQ

$TSLA truth vs Reality

Both Berlin & Texas are behind schedule. We know that from the vendors you're using.

$TSLAQ

Both Berlin & Texas are behind schedule. We know that from the vendors you're using.

$TSLAQ

Read on Twitter

Read on Twitter