The insights of the Austrian School of Economics will prove invaluable to investors navigating the distorted global economy of 2021.

This 18-tweet thread walks you through the definitive guide "Austrian School for Investors" by @scholarium_at, @RonStoeferle and @MarkValek.

This 18-tweet thread walks you through the definitive guide "Austrian School for Investors" by @scholarium_at, @RonStoeferle and @MarkValek.

1/ The roots of the Austrian School can be traced back to its founder Carl Menger, whose 1871 book Principles of Economics provided a new foundation for economic theory and solved the age-old "Paradox of Value".

From Menger's work we can derive 4 pillars of Austrian Investing.

From Menger's work we can derive 4 pillars of Austrian Investing.

2/ 1: The Subjective Theory of Value recognises that value is not determined by any inherent property of a good, nor by the amount of labor necessary to produce it, but by the importance an acting individual places on it for the achievement of their desired ends.

3/ 2: The Law of Diminishing Marginal Utility recognises that as more units of a homogenous good are acquired, the utility derived from each additional unit declines.

This wide-ranging insight helps explain important economic phenomena such as the historical emergence of money.

This wide-ranging insight helps explain important economic phenomena such as the historical emergence of money.

4/ 3: Methodological Individualism is the principle that economic phenomena result from the actions of individuals.

Collective magnitudes like “the people” cannot act, & therefore cannot be treated as ultimate causes.

Austrians are cautious in their use of economic aggregates.

Collective magnitudes like “the people” cannot act, & therefore cannot be treated as ultimate causes.

Austrians are cautious in their use of economic aggregates.

5/ 4: Causal Realism entails basing economic explanations on the notion of cause and effect grounded in human action.

Austrians reject posited functional relationships between abstract statistical constructions such as CPI, GDP or unemployment.

@saifedean explains

Austrians reject posited functional relationships between abstract statistical constructions such as CPI, GDP or unemployment.

@saifedean explains

6/ These four pillars provide us with a framework for thinking about economics.

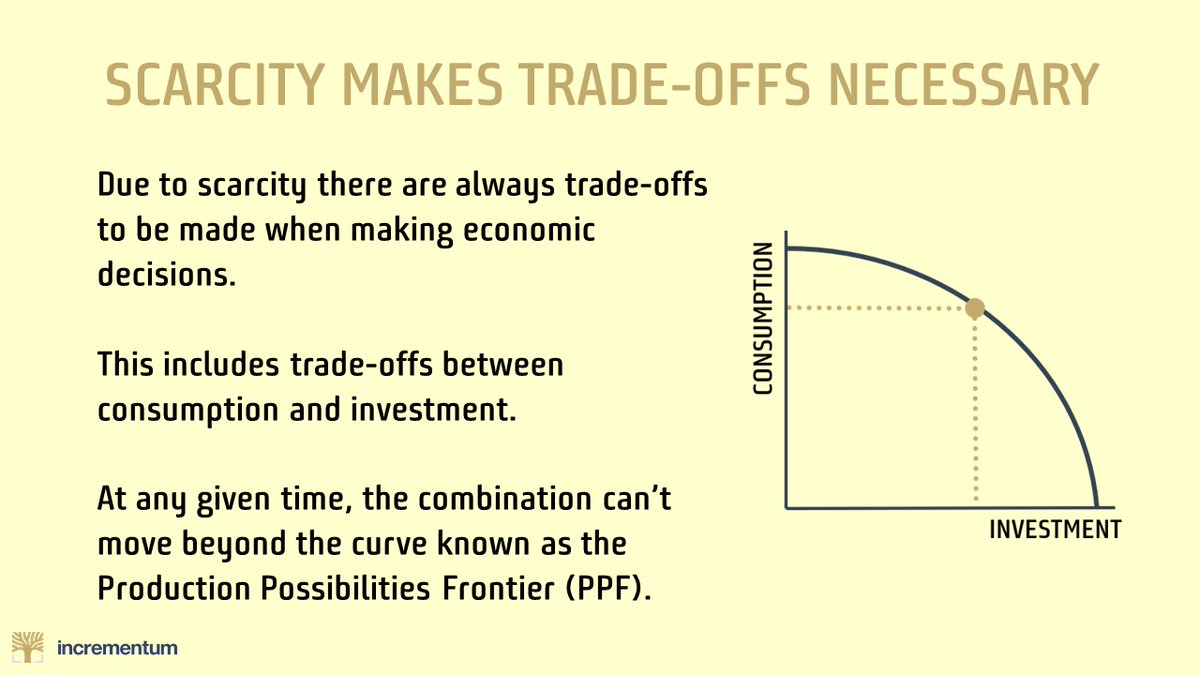

Underpinning each is an acknowledgement of a fundamental fact about economic life: that humans act under conditions of scarcity.

When we employ resources there is always the need to make trade-offs.

Underpinning each is an acknowledgement of a fundamental fact about economic life: that humans act under conditions of scarcity.

When we employ resources there is always the need to make trade-offs.

7/ Scarcity is key to understanding the relationship between consumption, investment and economic growth.

Given that resources are finite at any given time, if we want to increase investment and thereby increase the rate of growth, we need first to reduce present consumption.

Given that resources are finite at any given time, if we want to increase investment and thereby increase the rate of growth, we need first to reduce present consumption.

8/ "Capital" is another concept important for understanding economic growth.

Unlike Keynesians, Austrians recognise that a nation's capital is a structure made up of distinct goods tailored to specific production stages.

Capital isn't amorphous, nor is it the same as "money".

Unlike Keynesians, Austrians recognise that a nation's capital is a structure made up of distinct goods tailored to specific production stages.

Capital isn't amorphous, nor is it the same as "money".

9/ In a free market, interest rates play an important role in coordinating economic activity.

They help society find the right balance between consumption and investment.

But investors today live in a world where rates are heavily distorted by central bank intervention.

They help society find the right balance between consumption and investment.

But investors today live in a world where rates are heavily distorted by central bank intervention.

10/ This intervention leads to the periodic booms and busts that are definitive of modern economies.

For investors looking to make sense of this phenomenon, Austrian Business Cycle Theory (ABCT) provides an explanation.

@BobMurphyEcon explains

For investors looking to make sense of this phenomenon, Austrian Business Cycle Theory (ABCT) provides an explanation.

@BobMurphyEcon explains

11/ In a free market, greater saving leads to a natural fall in interest rates, since more resources have been set aside for production.

For entrepreneurs, low interest rates are a signal that sufficient resources have been made available to undertake projects profitably.

For entrepreneurs, low interest rates are a signal that sufficient resources have been made available to undertake projects profitably.

12/ But when central banks manipulate interest rates the crucial coordinating function they play is broken.

Authorities typically intervene to lower interest rates below their natural level by lending new money into existence.

This sends conflicting signals to the market.

Authorities typically intervene to lower interest rates below their natural level by lending new money into existence.

This sends conflicting signals to the market.

13/ It leads to:

>overinvestment in unprofitable projects as entrepreneurs are misled about the state of the economy. (We call these projects "malinvestments")

>overconsumption of consumer goods (and stimulation of late-stage production) due to decreased incentives to save.

>overinvestment in unprofitable projects as entrepreneurs are misled about the state of the economy. (We call these projects "malinvestments")

>overconsumption of consumer goods (and stimulation of late-stage production) due to decreased incentives to save.

14/ Since early and late-stage production cannot be stimulated simultaneously, economic dislocation results.

It reveals itself in a recession: a “cluster of errors" where investors discover the resources needed to complete projects are insufficient.

@CaitlinLong_ explains

It reveals itself in a recession: a “cluster of errors" where investors discover the resources needed to complete projects are insufficient.

@CaitlinLong_ explains

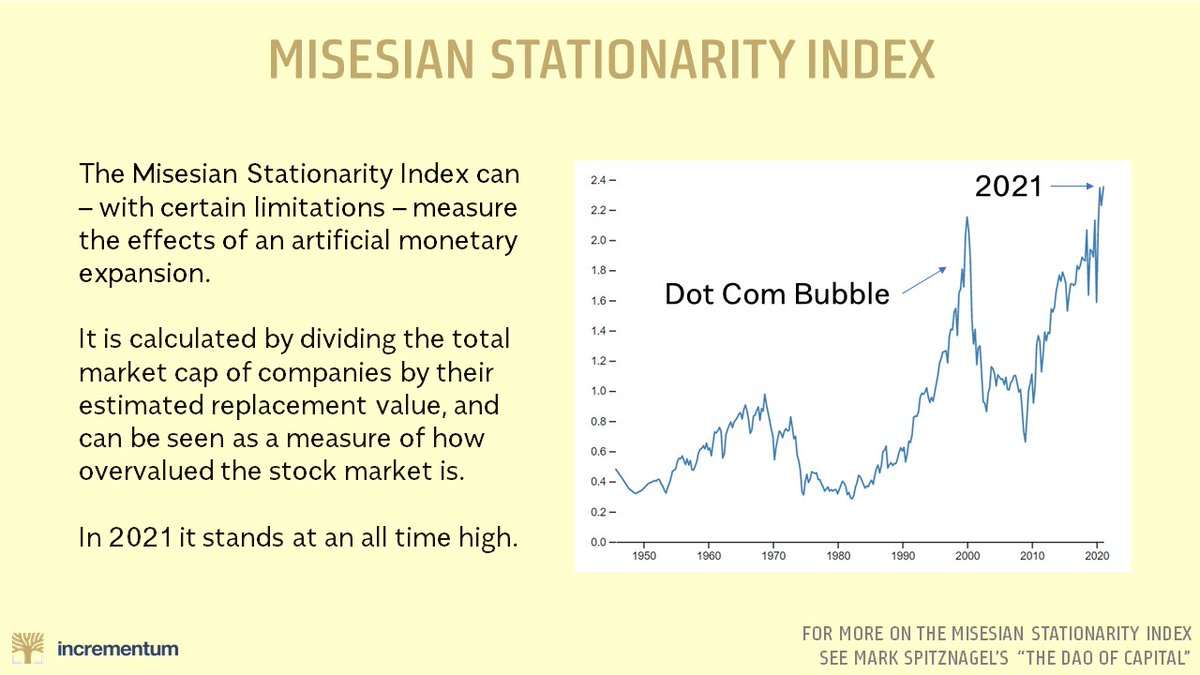

15/ Whilst timings are notoriously hard to predict, understanding the character of cycles is key to protecting investments.

Metrics such as the Misesian Stationarity Index (Tobin's Q) and Rothbard-Salerno True Money Supply can help us gauge where we are in the cycle.

Metrics such as the Misesian Stationarity Index (Tobin's Q) and Rothbard-Salerno True Money Supply can help us gauge where we are in the cycle.

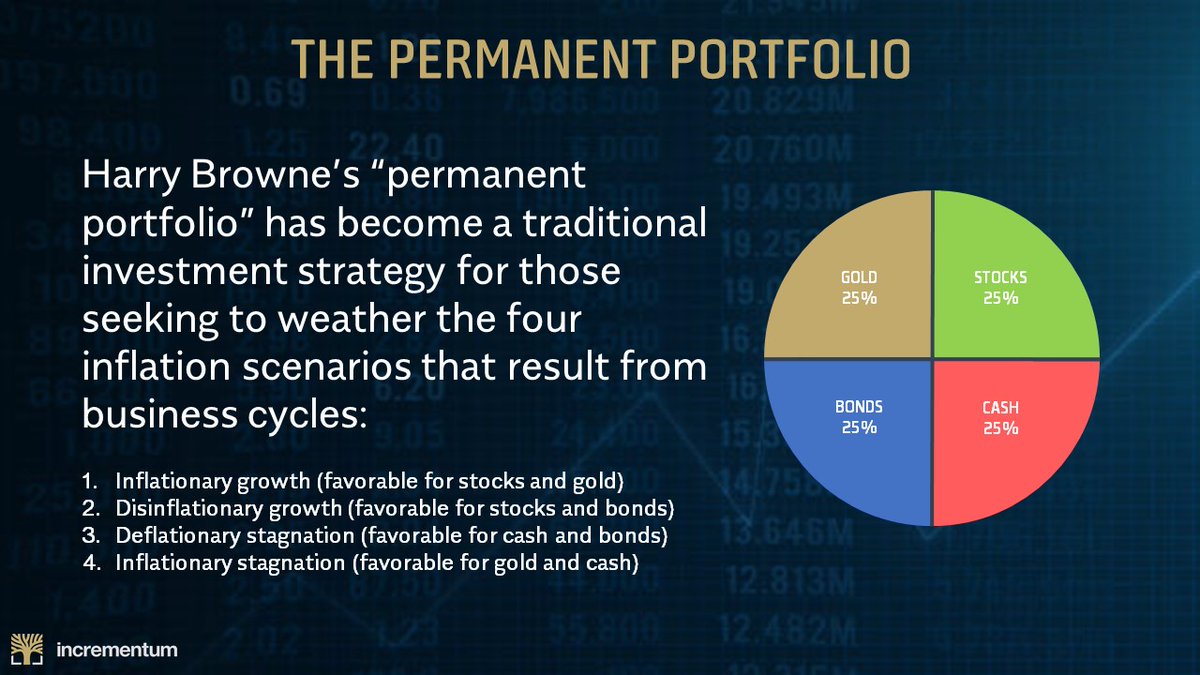

16/ Several prominent investment strategies have been influenced by ABCT.

They include Harry Brown’s “Permanent Portfolio” which balances gold, cash, stocks and bonds to manage risks of the four scenarios for inflation and growth that are brought about by business cycles.

They include Harry Brown’s “Permanent Portfolio” which balances gold, cash, stocks and bonds to manage risks of the four scenarios for inflation and growth that are brought about by business cycles.

17/ The recent rise of digital currencies like bitcoin has garnered intense interest from Austrians.

There are risks around its development, but Austrian theory suggests that bitcoin's attributes make it well suited to grow in use as a store of value.

@MarkValek explains

There are risks around its development, but Austrian theory suggests that bitcoin's attributes make it well suited to grow in use as a store of value.

@MarkValek explains

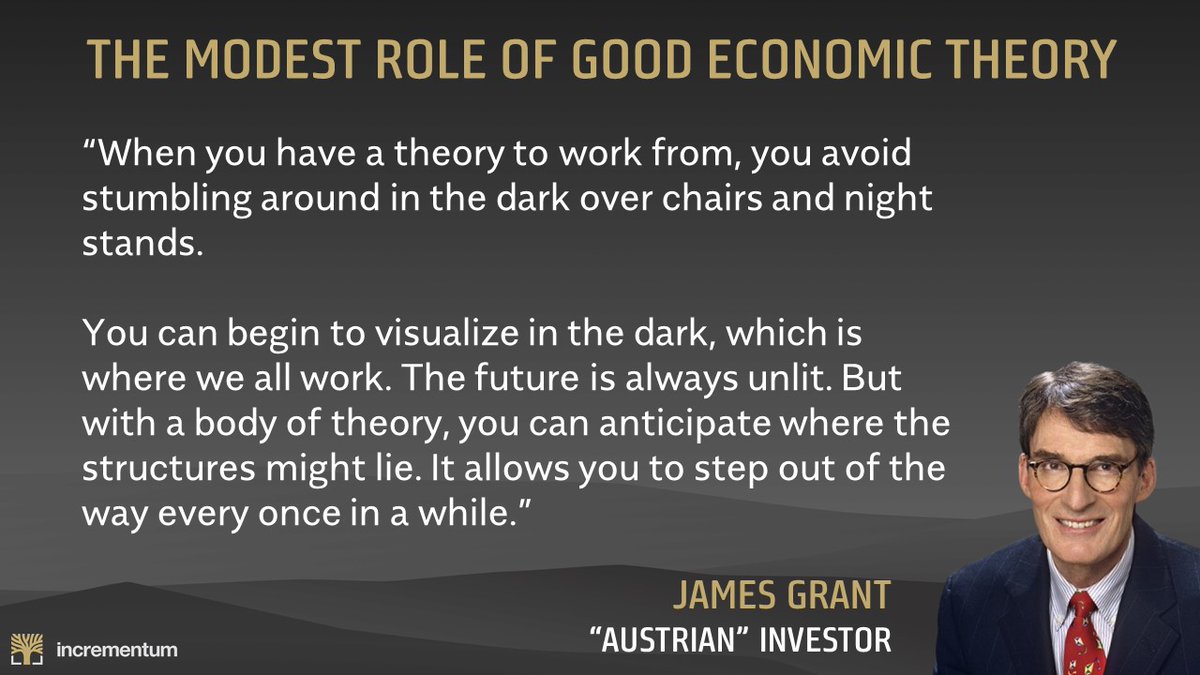

18/ The Austrian School provides a sound theoretical foundation for our engagement with economic reality.

It equips us with the tools we need for navigating the uncertainty of a distorted world.

Its insights help us recognize patterns so we can invest wisely and act ethically.

It equips us with the tools we need for navigating the uncertainty of a distorted world.

Its insights help us recognize patterns so we can invest wisely and act ethically.

Thank you for reading.

This thread was produced by @TheAustrian3 as a partnership with "Austrian" investment firm Incrementum.

If you enjoyed, please retweet to help its message reach a wider audience.

You can find out more about Incrementum here: https://www.incrementum.li/en/

This thread was produced by @TheAustrian3 as a partnership with "Austrian" investment firm Incrementum.

If you enjoyed, please retweet to help its message reach a wider audience.

You can find out more about Incrementum here: https://www.incrementum.li/en/

RESOURCES/1

Austrian School of Investors by @scholarium_at, @RonStoeferle and @MarkValek, on which this thread was based, is available on Amazon here: https://amzn.to/3ovYwNk

Resources by tweet number:

5: Principles of Economics by @saifedean: https://saifedean.com/

Austrian School of Investors by @scholarium_at, @RonStoeferle and @MarkValek, on which this thread was based, is available on Amazon here: https://amzn.to/3ovYwNk

Resources by tweet number:

5: Principles of Economics by @saifedean: https://saifedean.com/

RESOURCES/2

7-14: Roger Garrison ABCT presentations: https://bit.ly/2YptwUs

11: Bob Murphy explains ABCT:

15: @RaoulGMI & @CaitlinLong_ interview:

18: @RealVision: @AshBennington & @MarkValek:

7-14: Roger Garrison ABCT presentations: https://bit.ly/2YptwUs

11: Bob Murphy explains ABCT:

15: @RaoulGMI & @CaitlinLong_ interview:

18: @RealVision: @AshBennington & @MarkValek:

Another excellent explanation of Austrian Business Cycle Theory is given in this 8 minute talk by @ThomasEWoods:

For those looking for a deeper dive, this explanation of ABCT by Roger Garrison is recommended:

His slides, which were the inspiration for my business cycle graphics above, can be viewed here: https://bit.ly/2YptwUs

His slides, which were the inspiration for my business cycle graphics above, can be viewed here: https://bit.ly/2YptwUs

Read on Twitter

Read on Twitter