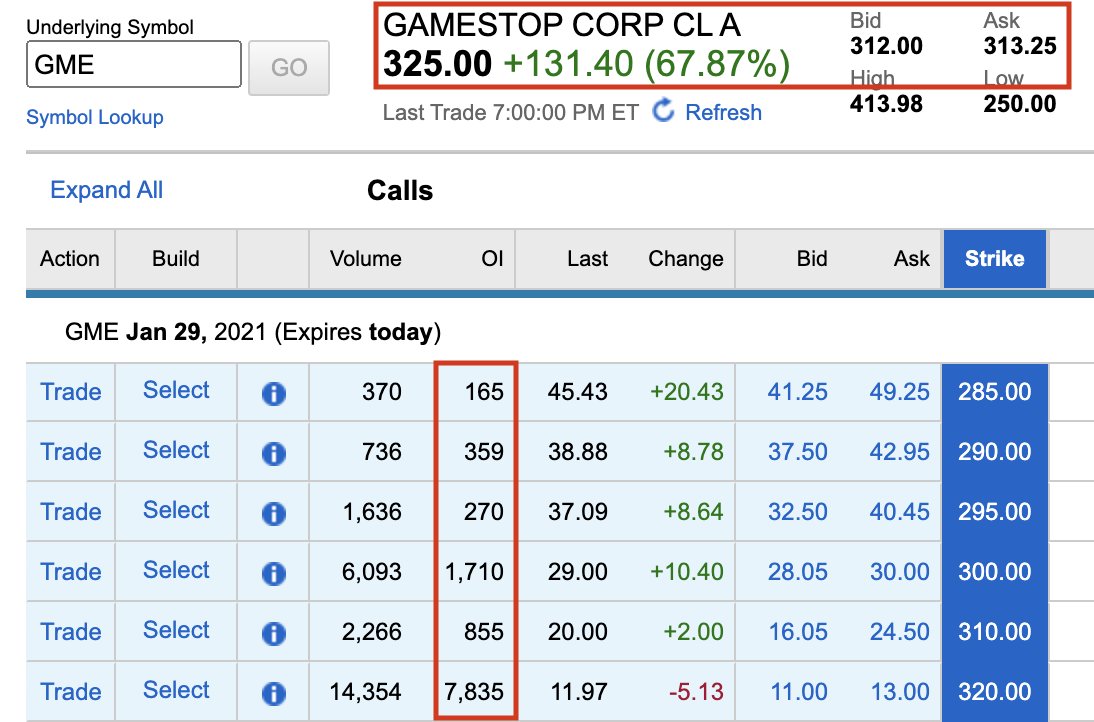

$GME closed at $325 and held at $320 at 5:30pm ET. Why is this important?

At $320+, an unusually large number of call options were profitable to exercise for shares by the cutoff, 5:30pm. Three things can happen with a call option that's in the money:

At $320+, an unusually large number of call options were profitable to exercise for shares by the cutoff, 5:30pm. Three things can happen with a call option that's in the money:

When an option is exercised, the person who made the option (the option writer) owes 100 shares per contract to the person who bought the option at the option's strike price.

1. If the option writer buys back their own options, things just cancel out.

1. If the option writer buys back their own options, things just cancel out.

Otherwise, the option writer needs to procure 100 shares they owe.

2. If the option writer already owns 100 shares, they just sell those shares to the option holder. (The options are "covered".)

2. If the option writer already owns 100 shares, they just sell those shares to the option holder. (The options are "covered".)

But sometimes people write options without already owning the shares they may owe. This can be extremely risky and is the third scenario.

3. If the option writer doesn't own 100 shares, they need to buy 100 shares to sell to the option holder. (The options are "naked".)

3. If the option writer doesn't own 100 shares, they need to buy 100 shares to sell to the option holder. (The options are "naked".)

Back to $GME. 84,712 call option contracts expired in the money today. We don't know how many of those were bought back by the writers, how many were covered, and how many were naked. But for each naked contract, the writers will need to buy 100 shares of GME.

$GME rose so quickly that I suspect many option writers at the higher strike prices ($300, $310, $320) did not fully expect to have to cover their options. They need to buy shares, specifically shares that held by people who refuse to sell at $310~$320.

Keep in mind that $GME is still extremely shorted at 75% to 113% of the float, depending on the source (real-time data on short interest is not transparent). Every bit of buying pressure puts short sellers a bit deeper in the hole. Too deep and they get margin called.

A margin call is when your broker says, "You need to close your positions now. If your losses grow even more, you won't have enough cash to pay your dues."

The way you close a short position is to buy shares, adding even more pressure on the rest of the short sellers still left.

The way you close a short position is to buy shares, adding even more pressure on the rest of the short sellers still left.

This way, one short seller's margin call can lead to the next, and so on, especially if most of the shareholders refuse to sell (

), sharply raising the stock price as the short sellers capitulate. This is a short squeeze.

), sharply raising the stock price as the short sellers capitulate. This is a short squeeze.

), sharply raising the stock price as the short sellers capitulate. This is a short squeeze.

), sharply raising the stock price as the short sellers capitulate. This is a short squeeze.

Read on Twitter

Read on Twitter