8/x And where is she getting her info? Where are all the citations from in her statement?

From the Wall St. Journal and NYT. This is one level above citing crying Wall St people from CNBC.

From the Wall St. Journal and NYT. This is one level above citing crying Wall St people from CNBC.

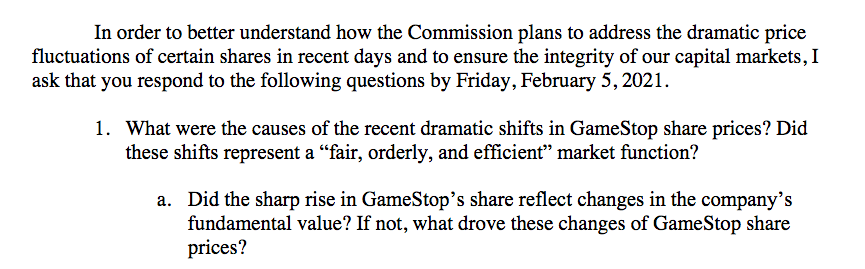

9/x Again Warren blames internet schemes and small traders. She's not only wrong, she's bizarrely focused on the wrong issue.

The manipulation that took place was not people buying GME, it was rigging the entire market to crash select stocks bc some hedge funds were losing big.

The manipulation that took place was not people buying GME, it was rigging the entire market to crash select stocks bc some hedge funds were losing big.

10/x Throughout she keeps equating small investors, people on reddit, w hedge funds & institutions. That they were both doing wrong or are somehow comparable.

This both sides bs, intentional or not, downplays the obscene behavior of the real crooks. She misses the real problems.

This both sides bs, intentional or not, downplays the obscene behavior of the real crooks. She misses the real problems.

11/x Again blaming hedge funds shorting 140% of a stock AND retail investors who "seek to inflict financial damage" on the hedge funds.

As if they are both bad or to blame. Fuck hedge funds. I didn't vote for Warren for Senator so she can protect them from people on reddit.

As if they are both bad or to blame. Fuck hedge funds. I didn't vote for Warren for Senator so she can protect them from people on reddit.

12/x Another theme is an imagery good stock market exists, that w some regulation it would be good again and benefit workers, companies, consumers, and efficiently allocate capitol for useful purposes.

This has never existed and will never exist. Tulip bubble anyone?

This has never existed and will never exist. Tulip bubble anyone?

13/x It's all a scam.

It has never been about raising capitol for efficient use, for productive investment in the company, or do do anything to benefit workers, consumers, or the economy. https://twitter.com/NathanJRobinson/status/1354998875719872513?s=20

It has never been about raising capitol for efficient use, for productive investment in the company, or do do anything to benefit workers, consumers, or the economy. https://twitter.com/NathanJRobinson/status/1354998875719872513?s=20

14/x Jamie Dimon just said corporations have so much cash they couldn't possibly use it all. https://twitter.com/TakeOnWallSt/status/1355235298716889088?s=20

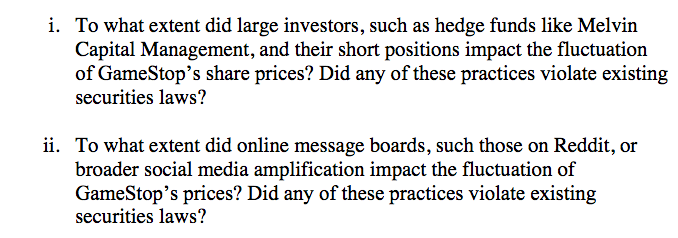

15/x Warren has declared in the past she is a capitalist to her bones, that she believes in markets. What is needed is some regulations to curb excesses, but fundamentally markets are good.

How would the SEC make sure stock prices reflect fundamentals?

How would the SEC make sure stock prices reflect fundamentals?

16/x Warren keeps talking about manipulation. But she is isn't focusing on blocking trades Thursday. She thinks people buying Gamestop early in the week was manipulation.

16/x Even Jim Cramer from CNBC and Charles Payne from Fox Business have said this is bs. It's free speech. You can't tell people on reddit they can't tell each other to buy Gamestop.

17/x We know the company's fundamentals didn't change. Hedge funds made huge short bets & buyers executed a squeeze. That was the entire point.

It was rationale & shrewd. The only reason this is an issue is bc billionaires suffered huge losses & this is apparently unacceptable.

It was rationale & shrewd. The only reason this is an issue is bc billionaires suffered huge losses & this is apparently unacceptable.

18/x Again she keeps talking about these imaginary fair, orderly, and efficient markets.

Outside of an Econ 101 textbook this doesn't exist.

Outside of an Econ 101 textbook this doesn't exist.

19/x Again, hedge funds and people on reddit are two sides of the same coin to Warren.

It's so tiring to keep seeing this framed as a both sides issue, and tiring to see people defending her claiming she didn't.

She's asking the SEC to investigate people on reddit.

It's so tiring to keep seeing this framed as a both sides issue, and tiring to see people defending her claiming she didn't.

She's asking the SEC to investigate people on reddit.

20/x This is not a serious proposal or request.

The stock market is a scam. It's fake.

The funny thing is people on Wallstreetbets understand that better than Warren does.

And they invest anyways because they understand the game as it exists, not as she imagines it.

The stock market is a scam. It's fake.

The funny thing is people on Wallstreetbets understand that better than Warren does.

And they invest anyways because they understand the game as it exists, not as she imagines it.

And how is Warren blaming Gamestop on a "flash mob" with money much different than the billionaire guy on CNBC complaining about people "sitting at home getting their checks from the government, trading their stocks." https://twitter.com/jangelooff/status/1354846320494784515?s=20

Read on Twitter

Read on Twitter