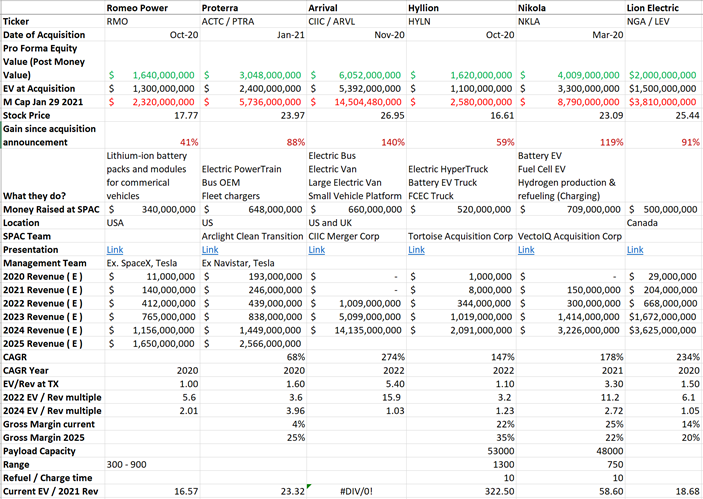

Short Commercial EV thread: $RMO, $ACTC, $CIIC, $HYLN, $NKLA, $NGA

I spent a week understanding the market first and then looked at all presentations

I spent a week understanding the market first and then looked at all presentations

Market: Global Commercial market for Class 5-8 Buses and Trucks was $1.32 Trillion

This includes: Medium Urban Trucks, Long range trucks, Utility Trucks, School Buses, Transit Buses, Cold Chain trucks - everything.

This includes: Medium Urban Trucks, Long range trucks, Utility Trucks, School Buses, Transit Buses, Cold Chain trucks - everything.

These commercial vehicles are used for multiple purposes by different "fleet" owners and independent truck / transport operators.

US alone is a $250B to $400B market for commercial vehicles

US alone is a $250B to $400B market for commercial vehicles

The big push to Electric is coming from a) Climate change concerns - emissions control, reduction in green house gases.

So the big push between 2020 and 2025 to 2030 is vehicle electification

This is also a BIG theme for ARK ideas

So the big push between 2020 and 2025 to 2030 is vehicle electification

This is also a BIG theme for ARK ideas

The current landscape has over 150 truck and bus manufacturers.

Truck alone has to 10 - e.g. Freightliners, Volvo, Mercedes, etc.

School buses themselves have top 5 e.g. Blue Bird.

So this is NOT a winner take all market.

If anyone says $NGA or $CIIC or $LEV wins - WRONG

Truck alone has to 10 - e.g. Freightliners, Volvo, Mercedes, etc.

School buses themselves have top 5 e.g. Blue Bird.

So this is NOT a winner take all market.

If anyone says $NGA or $CIIC or $LEV wins - WRONG

They could all win in different segments is my analysis. Or the "also ran" companies might get acquired by the current top manufacturers all of who have made investments and placed orders with the new EV commercial manufacturers

There are 3 (+1) types of EV

1. Battery EV

2. Hybrid EV (HEV) - Gas or CNG

3. Plug-in EV

and

4. Hydrogen powered EV https://www.evgo.com/why-evs/types-of-electric-vehicles/

1. Battery EV

2. Hybrid EV (HEV) - Gas or CNG

3. Plug-in EV

and

4. Hydrogen powered EV https://www.evgo.com/why-evs/types-of-electric-vehicles/

A basic commercial EV comprises of multiple "parts"

Truck Cabin

Body

Chassis

Battery ***

Powertrain / Skateboard***

Brake

Suspension

Steering

Some EV cos chose to make the whole thing (e.g. $CIIC, $NGA, $ACTC)

Others chose to play a part - e.g. battery $RMO

*** == Valuable

Truck Cabin

Body

Chassis

Battery ***

Powertrain / Skateboard***

Brake

Suspension

Steering

Some EV cos chose to make the whole thing (e.g. $CIIC, $NGA, $ACTC)

Others chose to play a part - e.g. battery $RMO

*** == Valuable

While existing manuf seem to understand most of these parts, the "battery" tech + Powertrain aka Skateboard is the *most* important - that's the area of differentiation

Along with software + charging infrastructure to manage fleets.

Along with software + charging infrastructure to manage fleets.

Just because one company has a ready bus now does not mean another (e.g. $NKLA will die)

On average EACH company has $300M - $800M CASH raised and in the bank thanks to the SPAC

So it is unlikely that they will declare bankruptcy anytime soon unless they "blow up" the money

On average EACH company has $300M - $800M CASH raised and in the bank thanks to the SPAC

So it is unlikely that they will declare bankruptcy anytime soon unless they "blow up" the money

So point #1 - If anyone says company X is undervalued, Y is dead, Z is going to win - I find that hard to get convinced given the people I spoke with or the data available.

This can be like $GOOG, $FB, $SNAP, $TWTR, $PINS - they can all win in different ways in AdTech

This can be like $GOOG, $FB, $SNAP, $TWTR, $PINS - they can all win in different ways in AdTech

1. $RMO Pluses: Focus on Lithium-ion battery packs and modules for commercial vehicles + charging infra. Ex SpaceX + $TSLA team. Terrific battery expertise 300 - 900 M range, Payload support for 35GmT

Cons: Only battery - think of them as a "supplier"

https://romeopower.com/RMO-Merger_Investor-Presentation_8-K_2020-10.pdf

Cons: Only battery - think of them as a "supplier"

https://romeopower.com/RMO-Merger_Investor-Presentation_8-K_2020-10.pdf

1b. $RMO current valuation $2.32B, 41% up since merger announcement, middle of the pack in terms of EV/Rev multiple both 2021 and 2024

$340M cash in bank.

$340M cash in bank.

2. $ACTC: Pros: they like to do it all "Electric PowerTrain, Bus OEM Fleet chargers" - Proterra

2021 revenue is the highest for the group - meaning they already are delivering, unlike $NKLA and $CIIC - Arrival

$648M Cash in the bank - strong distributed manuf support

2021 revenue is the highest for the group - meaning they already are delivering, unlike $NKLA and $CIIC - Arrival

$648M Cash in the bank - strong distributed manuf support

2b.$ACTC - slowest rev growth projected of the lot. This may be "under promise and over deliver - so YMMV"

Current value $5.7B, 88% gain since announcement. and low 2020 Ev/Rev multiple - opportunity to grow higher.

High execution risk in my opinion.

Current value $5.7B, 88% gain since announcement. and low 2020 Ev/Rev multiple - opportunity to grow higher.

High execution risk in my opinion.

3. $CIIC - $ARVL Arrival: Full stack - "Electric Bus, Electric Van, Large Electric Van, Small Vehicle Platform"

Pros: Lots of cash in bank $660M

Compelling vision for EU expansion

Expertise in cabins, body and powertain

…https://arrival-site-cms.s3.eu-west-2.amazonaws.com/39573881-229c-4bae-927b-969002d4a01b_Arrival_Investor_Presentation.pdf

Pros: Lots of cash in bank $660M

Compelling vision for EU expansion

Expertise in cabins, body and powertain

…https://arrival-site-cms.s3.eu-west-2.amazonaws.com/39573881-229c-4bae-927b-969002d4a01b_Arrival_Investor_Presentation.pdf

3b. $CIIC - cons: No revenue until 2022. Hard to tell if they are making progress until then.

They can still win, but they are richly valued at $14B, 15.9X 2022 Rev/EV multiple

They can still win, but they are richly valued at $14B, 15.9X 2022 Rev/EV multiple

4. $HYLN: Pros: "Electric HyperTruck, Battery EV Truck, FCEC Truck" - they only company talking about long range, 1200+Mi with multi-battery platform. Everyone else is going after the easy money.

Raised $520M in cash, distributed manuf capability

http://hyliion.com/wp-content/uploads/2020/06/Hyliion-Tortoise-Overview-Presentation.pdf

Raised $520M in cash, distributed manuf capability

http://hyliion.com/wp-content/uploads/2020/06/Hyliion-Tortoise-Overview-Presentation.pdf

4b. $HYLN Current MCAp $2.5B, up 59% since announcement, CAGR seems unrealistic but they seem to back that at 147% from 2022 - 2025

5. $NKLA Pros: "Battery EV, Fuel Cell EV, Hydrogen production & refueling (Charging)" - Only company talking about Hybrid. Most others are BEV only.

They have the MOST cash raised at $709M - unless they blow it up in parties and make lots of bad mistakes - they are not dying

They have the MOST cash raised at $709M - unless they blow it up in parties and make lots of bad mistakes - they are not dying

5b. $NKLA Cons: most of you already know - seems like vaporware. Current MCap $8.8B - up 119% since merger (even after the mess).

6. $NGA - Lion Electric: Pros: Actual shipping vehicles + manufacturing 2500 already and being used. "Customer Experience Centers" in the US. 234% CAGR supported by multiple "sustaining orders". Compelling team.

https://pages.thelionelectric.com/wp-content/uploads/2020/11/Investor-Presentation_20203011.pdf

https://pages.thelionelectric.com/wp-content/uploads/2020/11/Investor-Presentation_20203011.pdf

6. $NGA - Currently valued at $3.8B, up 91% since merger. Moderately valued for 2021 rev E and 2025 revenue as well.

Raised over $500M in cash to expand manufacturing in US

Large near term TAM for school buses

Raised over $500M in cash to expand manufacturing in US

Large near term TAM for school buses

Ok bottom line time.

Instead of ONE Winner, I think there will be multiple - like the academy awards.

PLEASE keep in mind this is based on data and interviews I have currently done.

I dont have a crystal ball obviously. This is based on data + my VERY biased opinions

Instead of ONE Winner, I think there will be multiple - like the academy awards.

PLEASE keep in mind this is based on data and interviews I have currently done.

I dont have a crystal ball obviously. This is based on data + my VERY biased opinions

Awards:

1. Most to 10X my investment - $NGA or Lion Electric

2. Most to grow reliably (steady player) - $ACTC

3. Most to get acquired (before 2025) - $RMO

4. Most to shock / surprise - $NKLA

5. Most to be around for a while $CIIC

6. Most to return on investment $HYLN

1. Most to 10X my investment - $NGA or Lion Electric

2. Most to grow reliably (steady player) - $ACTC

3. Most to get acquired (before 2025) - $RMO

4. Most to shock / surprise - $NKLA

5. Most to be around for a while $CIIC

6. Most to return on investment $HYLN

If I could only buy two stocks <after technical stock analysis for right entry points> $RMO and $ACTC

If 2 more $NGA and $HYLN

Finally $CIIC (Arrival) and $NKLA

If 2 more $NGA and $HYLN

Finally $CIIC (Arrival) and $NKLA

Links:

Proterra presentation:

https://www.proterra.com/wp-content/uploads/2021/01/ACTC-Proterra-Investor-Presentation.pdf

Proterra presentation:

https://www.proterra.com/wp-content/uploads/2021/01/ACTC-Proterra-Investor-Presentation.pdf

Arrival presentation $ACTC

…https://arrival-site-cms.s3.eu-west-2.amazonaws.com/39573881-229c-4bae-927b-969002d4a01b_Arrival_Investor_Presentation.pdf

…https://arrival-site-cms.s3.eu-west-2.amazonaws.com/39573881-229c-4bae-927b-969002d4a01b_Arrival_Investor_Presentation.pdf

Hyliion presentation $HYLN

http://hyliion.com/wp-content/uploads/2020/06/Hyliion-Tortoise-Overview-Presentation.pdf

http://hyliion.com/wp-content/uploads/2020/06/Hyliion-Tortoise-Overview-Presentation.pdf

$RMO Romeo Power presentation

https://romeopower.com/RMO-Merger_Investor-Presentation_8-K_2020-10.pdf

https://romeopower.com/RMO-Merger_Investor-Presentation_8-K_2020-10.pdf

$LEV Lion Electric $NGA presentation

https://pages.thelionelectric.com/wp-content/uploads/2020/11/Investor-Presentation_20203011.pdf

https://pages.thelionelectric.com/wp-content/uploads/2020/11/Investor-Presentation_20203011.pdf

Be happy. Be safe. Be nice to one another.

Read on Twitter

Read on Twitter