WSB is plotting the Great Silver Train Robbery (always pulling for the underdog) so good to run through $SI_F.

WSB is plotting the Great Silver Train Robbery (always pulling for the underdog) so good to run through $SI_F.The robbery will take place in the ETF's and seeing some astute folks accumulating physical; that is the road to short squeeze Valhalla if you are capitalized for it.

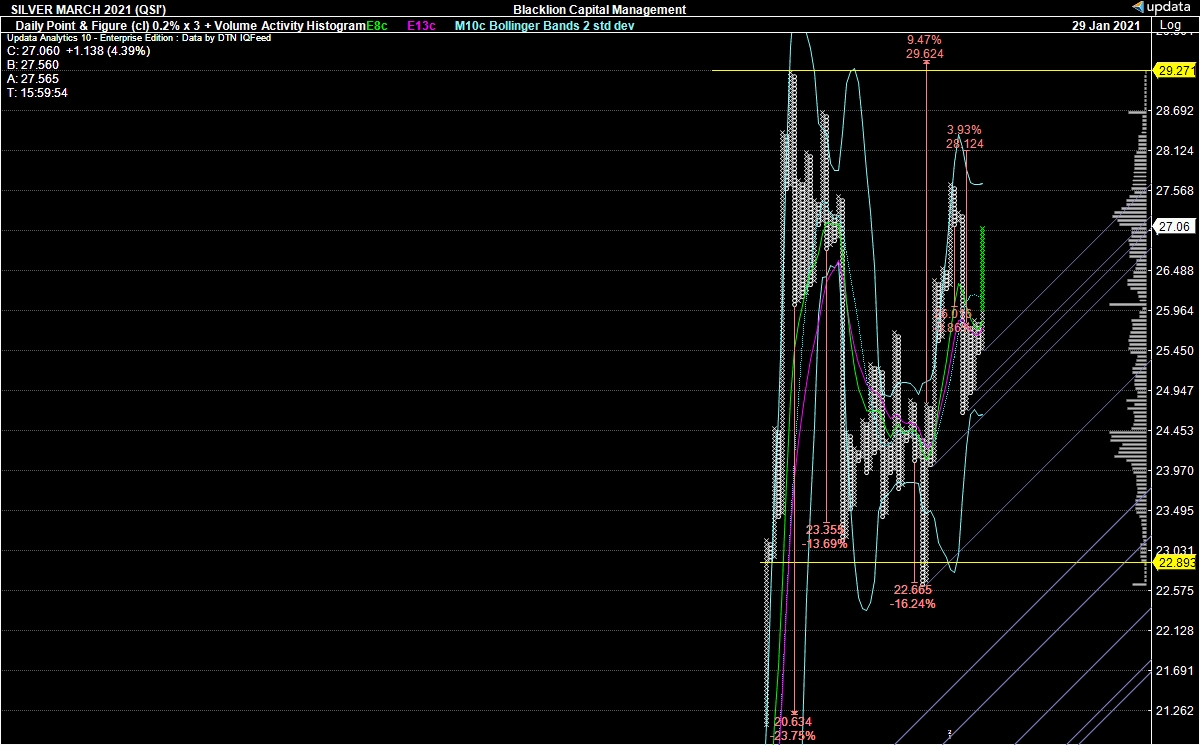

2/Daily Technical: Ichimoku (L) positive all above positive clouds with sharply rising OBV. The P&F at this box size is sloppy since August, but positive trend on a buy signal with two positive targets: $28.12 and $29.624. Bullish, not crazy.

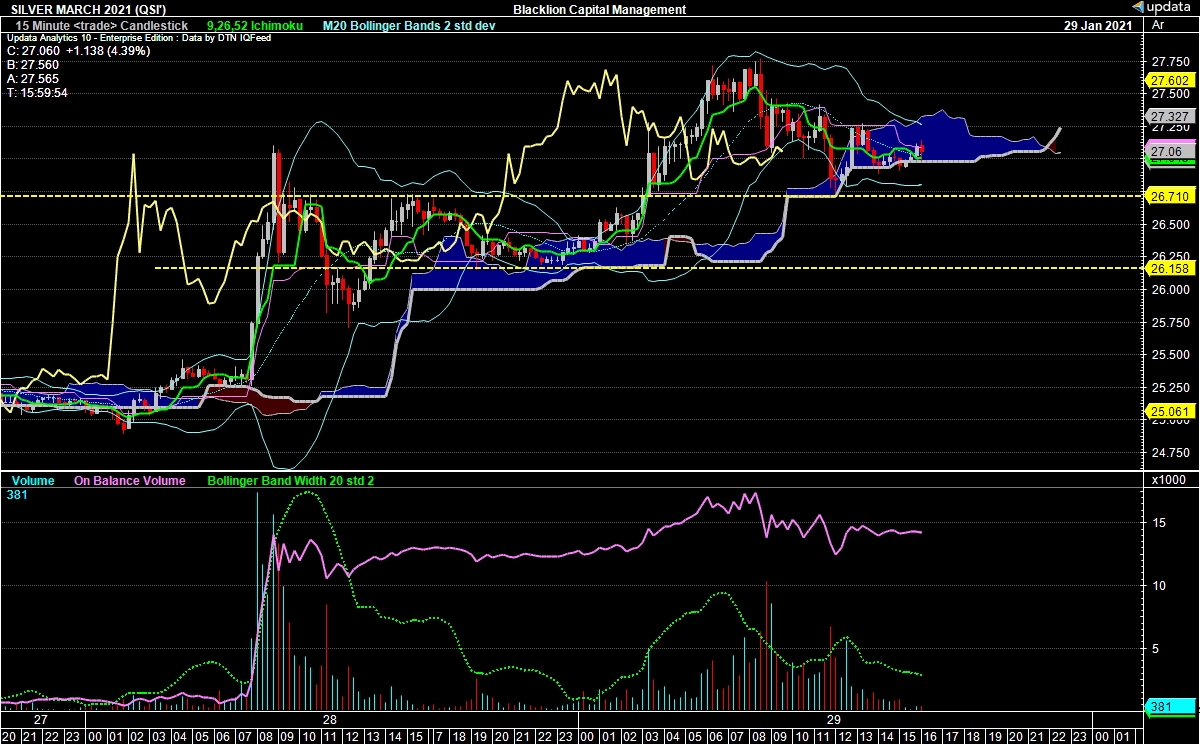

3/ $SI_F Intraday technicals unremarkable and the 15-minute Ichimoku showing signs of weakness with cloud spans reversing negative and today's OBV trailing off. This is at least a pause in the positive daily trend. No sign of a squeeze/ramp.

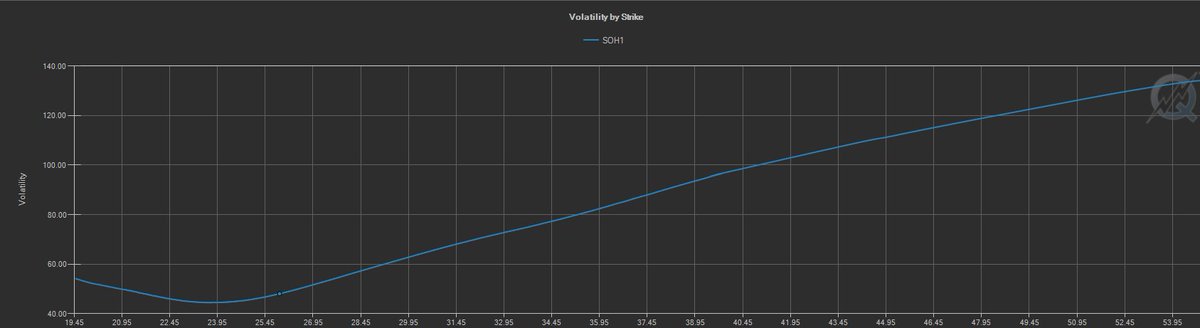

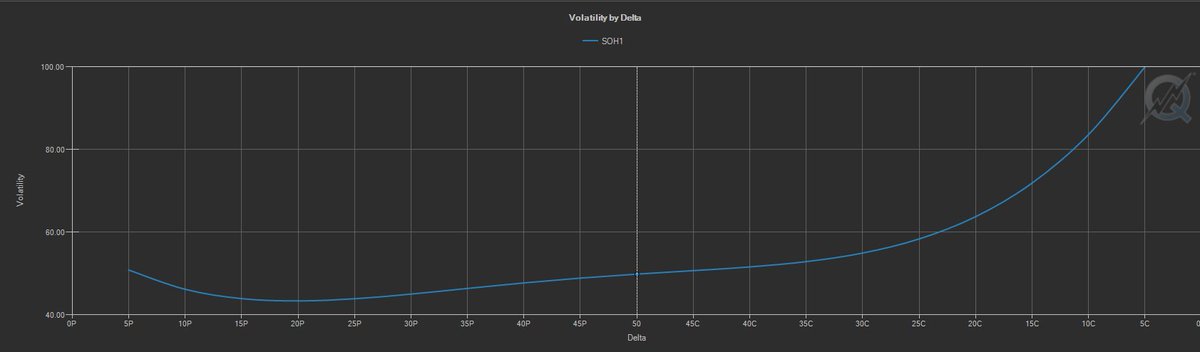

5/The Volatility by Strike (L) for March options as noted the past 2 days is spectacular; 44.85 at its nadir. Volatility by Delta (R) tells the story a little different with 99.96IV for 5Delta calls.

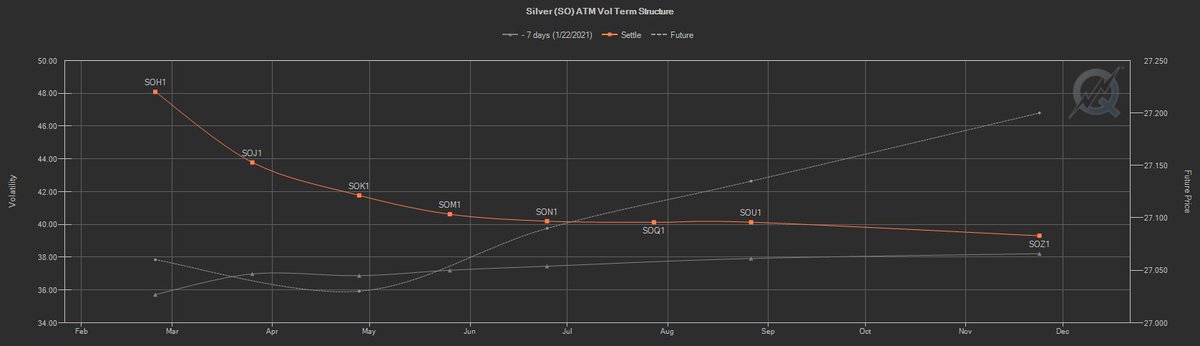

6/Term Structure of ATM Volatility not surprising shows the IV centered around the March, but even the thinly traded May K's are 43.78.

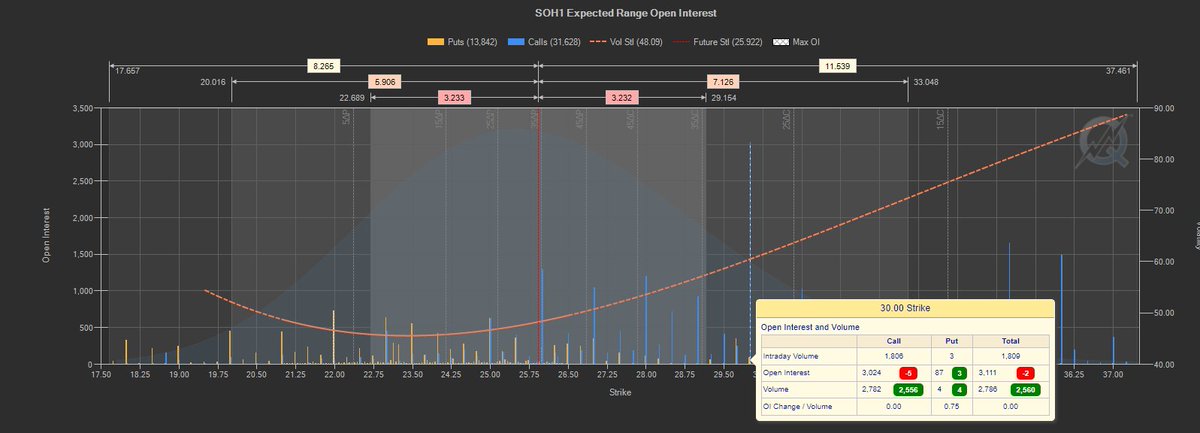

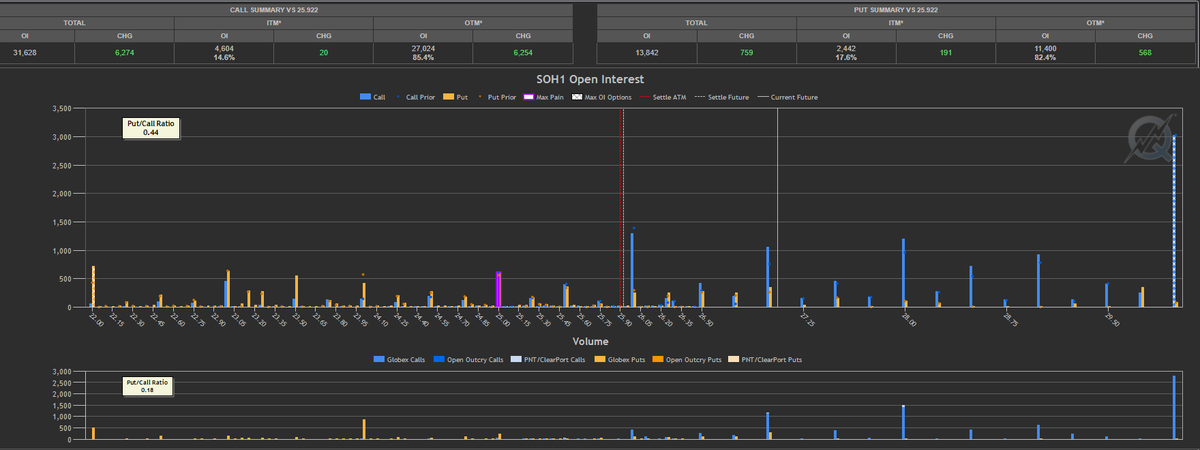

7/The biggest call open interest is at the 30 strike with 3,024 calls (and 87 puts). Interesting the biggest OI is > resistance on the daily chart.

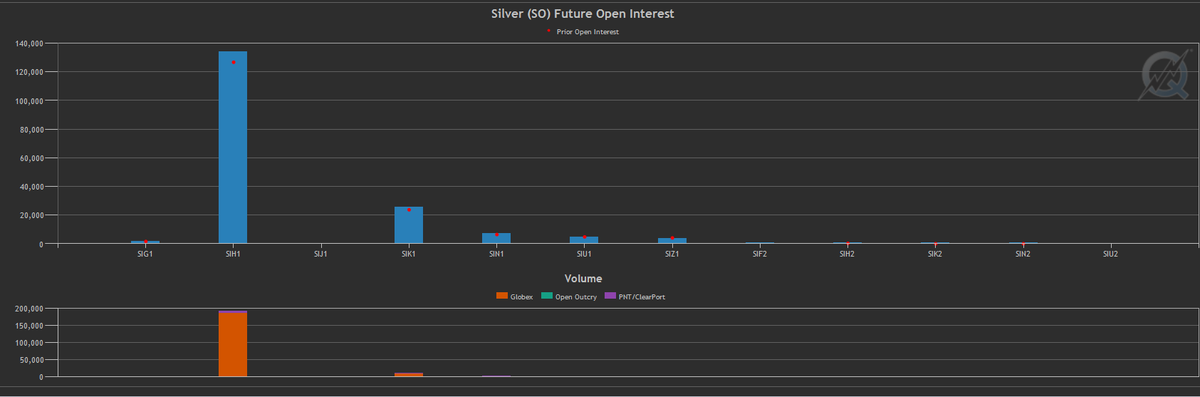

8/The volume in the calls is notable, not surprising, and not yet reflected in Commitment of Traders.

9/The $SI_F Commitment of Trader's data released today (Fri Jan 29th) is from Tuesday Jan 26th. I don't think the Great Train Robbery rumors were on the street then so this is stale and volume the past 2 days says next week's report will be VERY different.

10/I use the historical combined (futures and options). A lot of ranting about 'short speculators' so start here. $SI_F top, Spec Long green, Spec Short red, Net (B). There are 30.5k short positions offset by 85k LONGs for 54.5k NET LONG.

11/Why does this matter? The unhedged speculators on net are going to benefit from the Great Train Robbery and I do not know how many of the short positions are defined risk puts that will not force offset. If there is a $SI_F squeeze it isn't going to be the speculators.

12/ $SI_F Commercials is where the raid is focused if I understand correctly and this goes to the issue of how effectively the Commercials are hedged with physical. @LawrenceLepard & @TFMetals know this issue much better.

13/ $SI_F top, Commercial Longs green, Commercial Shorts red, Net (B). Long 47.7k, short 122k (sweet spot of the bull raid), net short 74.4k. If these positions are hedged w/physical exposure and some of the shorts are producers/miners, no big, but...

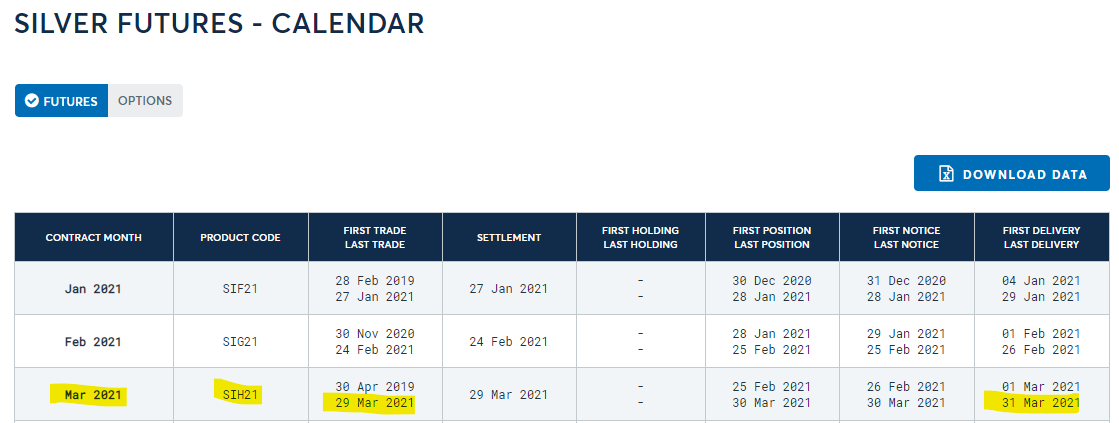

14/ If (and this a big IF) there are substantial open Commercial short positions that can be driven to offset before the end of March or shorts cannot deliver by the end of March this can get exciting and maybe into legal issues with CFTC, CME Group-COMEX, etc.

15/There are position limits on futures, but no limit to OI regardless of actual physical so no defined float like an individual equity name. I think this can limit the upside squeeze until it gets near March expiry. I am not sure how an attempted squeeze on ETF's hit futures.

16/ Great $SI_F Silver Train Robbery summary:

-Options market already positioning for upside, some of this is hedging those short positions and not yet reflected in COT.

-Speculators are long and here for it, not many shorts to scare

-We may find out if the Commercials are legit

-Options market already positioning for upside, some of this is hedging those short positions and not yet reflected in COT.

-Speculators are long and here for it, not many shorts to scare

-We may find out if the Commercials are legit

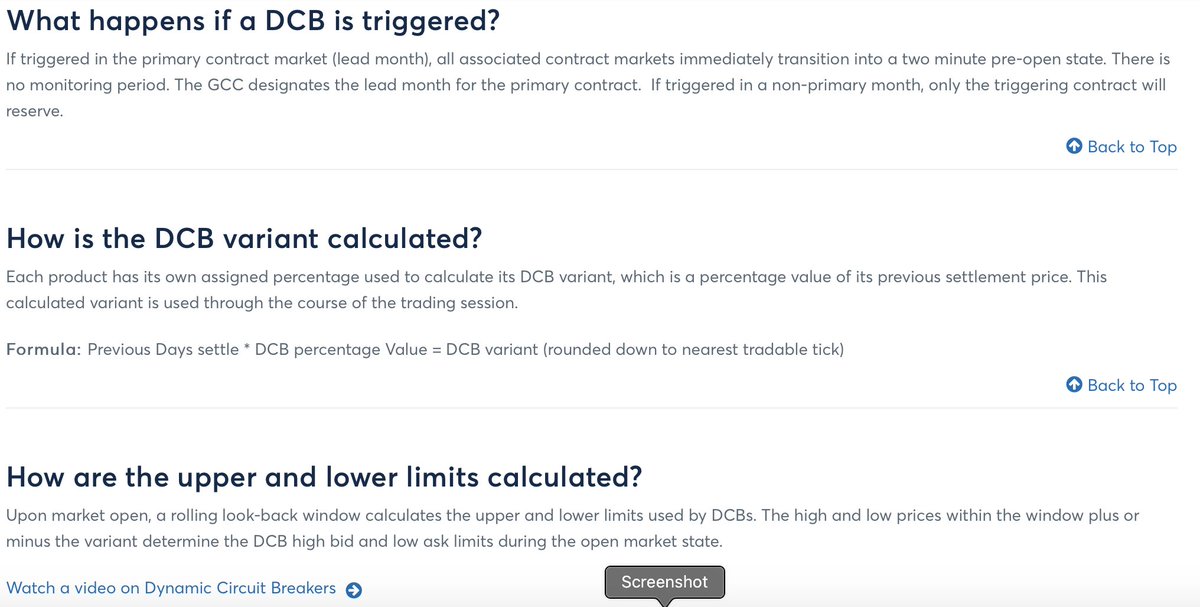

I tried looking up the limit moves for $SI_F, but they've transitioned to CME Group's Dynamic Circuit Breaker (DCB) methodology and I am just a simple former fighter pilot, MBA, etc. so don't know. These are circuit breakers and only good for 2-minute halts.

Read on Twitter

Read on Twitter