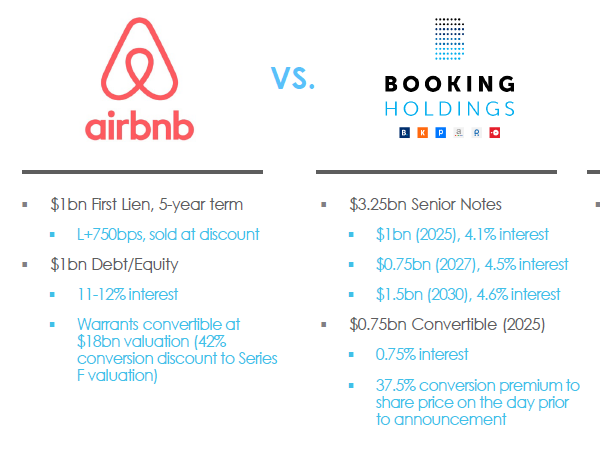

1/5 Thread about being public vs. private: During Covid, $ABNB & $BKNG raised money on following terms:

2/5 Yesterday, during a similar 100 year flood for their business RH raised money:

https://twitter.com/pitdesi/status/1355034886587830274?s=20

Yet they are restricting trading in a number of names:

https://www.cnbc.com/2021/01/29/robinhood-is-still-severely-limiting-trading-gamestop-holders-can-only-buy-one-additional-share.html

https://twitter.com/pitdesi/status/1355034886587830274?s=20

Yet they are restricting trading in a number of names:

https://www.cnbc.com/2021/01/29/robinhood-is-still-severely-limiting-trading-gamestop-holders-can-only-buy-one-additional-share.html

3/5 $IPOE (SoFI) said please send your trades our way and gave the following reason why they can trade those stocks when others are struggling: https://twitter.com/anthonynoto/status/1355250715770331138?s=20

4/5 If you are a private company that has reached a certain scale for your customers/ecosystem, do you actually have the right scale on the capital side to deal with your 100 yr flood? Are you taking disproportionate risk staying private? Especially true in areas like fintech.

5/5 Growth VC/PE typically do not have the balance sheets and may not be structured to provide the right financing when/how you actually need the money. Knowing you can get money when you need it may be the best reason to actually become a public company.

Read on Twitter

Read on Twitter