Your friendly vampire that works for you, only @thorchain_org

The term Vampire Attack was coined by @martinkrung in his Cryptonative article here: https://www.cryptonative.ch/vampire-attack-an-attack-on-liquidity-dependent-protocols/

/thread

The term Vampire Attack was coined by @martinkrung in his Cryptonative article here: https://www.cryptonative.ch/vampire-attack-an-attack-on-liquidity-dependent-protocols/

/thread

Martin did not see a vampire attack as friendly (hard to imagine either a vampire or an attack as friendly) and I am here to argue, that if you are on a right side of a trade, a vampire attack or migration mining can be not only desirable but highly beneficial to $RUNE LPs.

Now, for all of you afraid of being associated with an attacking vampire, the pejorative term seems to related to a clone of an original protocol (think SushiSwap – UniSwap saga). Because @thorchain is not a clone, think of it as your friendly vampire.

A vampire attack is simply locking in on a specific liquidity pool(s) and creating much better rewards and incentive structure to attract the migration of liquidity to your own, matching pool(s). How does it work in practice? Let's have a look at $RUNE-$ETH pool @SushiSwap.

Currently sitting at $7.2M liquidity, the fees generated in 24 hrs are $16,279, in other words to every dollar pulled in $0.0022 was added in the last 24hr. Keep in mind this pools has already been incentivized by @thorchain_org. Without it the returns would be less than a half.

Now imagine a scenario, where the same pair on @thorchain native gets twice as much of the reward for the same time. Would this be a good incentive to move to a different platform with the same assets? Definitely it would, but how is that possible?

@thorchain uses slip sensitive fee structure which has no opinion on its size, creates price inertia and makes arbitrage agents compete to drive up fees. Combine that with block rewards, and the reward structure is much more attractive than flat fee #XYK model on SushiSwap.

But that is not everything. There are also three other components that will add to this pool:

1. New incentive pendulum

2. Direct pool incentives

3. Upward price pressure for $RUNE from the $RUNE connected pools

Let me break those down for you:

1. New incentive pendulum

2. Direct pool incentives

3. Upward price pressure for $RUNE from the $RUNE connected pools

Let me break those down for you:

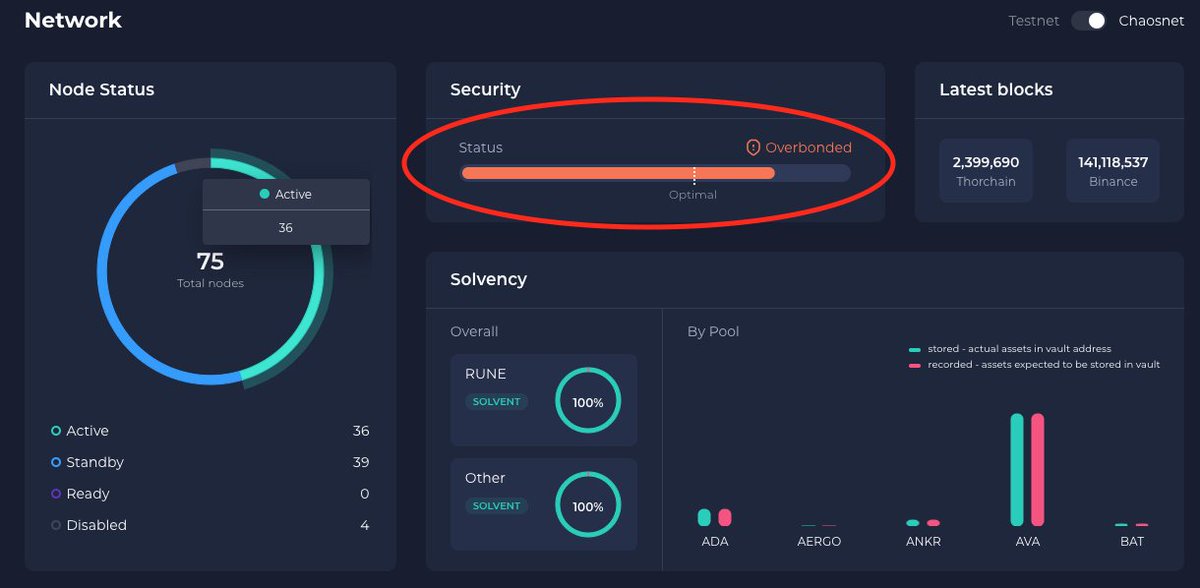

The new incentive pendulum, introduced in the upcoming network upgrade, will swing rewards more towards LPs if the network is over-bonded. In the original design the amount of rewards given to the node operators was 67% and 33% went to liquidity providers.

The new algorithm will give as much as 50% rewards to the LPs is the network is over-bonded, thus increasing the LPs' rewards by 50% in the extreme case. Keep in mind, that @thorchain_org LPs are already doing well

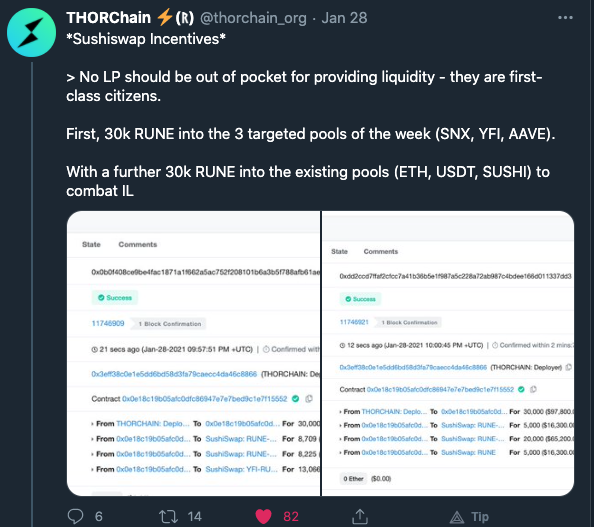

Direct pools incentives are chunks of $RUNE the team adds to the targeted pools in order to invite the liquidity. Right now those incentives are solely introduced by @thorchain_org. In the future I see the new pools heavily incentivizing their own communities to pull liquidity

3. Upward price pressure – this phenomena is reserved only to @thorchain_org protocol. In simple terms – all the pools have one thing in common and this is $RUNE – the king of all assets.

When a new pool is added to the network, it will by default put an upward price pressure on $RUNE, as $RUNE is required not only to balance the newly added liquidity, but also to bond it. It just sucks $RUNE from all available markets.

All of the above mechanisms are designed, or are a consequence of the design, to give you, a $RUNE hodler a license to multiply your holdings of an appreciating asset.

The @thorchain_org is the most friendly protocol in existence for those involved. As of today 50% of my small bag of $RUNE come from variety of incentives and CLP translates to me as CSPG – a Continuous Sustainable Protocol Generosity, only in the arms of a friendly vampire.

Read on Twitter

Read on Twitter