[THREAD]: The Untold Story Of Reddit's Golden Investor: The God of $GME

This is the narrative that deserves more attention...

Enjoy.

This is the narrative that deserves more attention...

Enjoy.

1/ In July, 2020, a retail investor, YouTuber, and Redditor u/DeepFuckingValue made a controversial video.

His argument was that Gamestop $GME was undervalued. The fundamentals of the company were strong, and it had a promising post-pandemic future.

His argument was that Gamestop $GME was undervalued. The fundamentals of the company were strong, and it had a promising post-pandemic future.

2/ But this wasn't the beginning.

More than a year prior, u/DeepFuckingValue had spotted the $GME opportunity—right alongside legendary investor Michael Burry.

Burry was the short seller who called the housing crisis in '08.

Movie: The Big Short https://www.reddit.com/r/wallstreetbets/comments/d1g7x0/hey_burry_thanks_a_lot_for_jacking_up_my_cost/

More than a year prior, u/DeepFuckingValue had spotted the $GME opportunity—right alongside legendary investor Michael Burry.

Burry was the short seller who called the housing crisis in '08.

Movie: The Big Short https://www.reddit.com/r/wallstreetbets/comments/d1g7x0/hey_burry_thanks_a_lot_for_jacking_up_my_cost/

3/ The opportunity wasn't just that $GME was undervalued.

It was that short interest was > 100%

What u/DeepFuckingValue and Michael Burry were betting on wasn't just that $GME was going to go back up, but that it was going to "squeeze" short sellers. https://www.capitalmind.in/2021/01/the-gme-gamestop-short-squeeze-and-the-reddit-wallstreetbets/

It was that short interest was > 100%

What u/DeepFuckingValue and Michael Burry were betting on wasn't just that $GME was going to go back up, but that it was going to "squeeze" short sellers. https://www.capitalmind.in/2021/01/the-gme-gamestop-short-squeeze-and-the-reddit-wallstreetbets/

4/ This was a very early bet, and one that would take 1yr+ to play out.

Every month, u/DeepFuckingValue would post his "YOLO Updates" on subreddit /wallstreetbets.

After $GME "nightmare" 2019 Q3 earnings report:

"Did I sell? Y'all for real? I added" https://www.reddit.com/r/wallstreetbets/comments/e9gmtk/gme_yolo_update_following_nightmare_q3_earnings/

Every month, u/DeepFuckingValue would post his "YOLO Updates" on subreddit /wallstreetbets.

After $GME "nightmare" 2019 Q3 earnings report:

"Did I sell? Y'all for real? I added" https://www.reddit.com/r/wallstreetbets/comments/e9gmtk/gme_yolo_update_following_nightmare_q3_earnings/

5/ And up until April, 2020, the narrative around $GME stayed largely around fundamentals.

Then, The Big Short Squeeze started.

$GME going up was the opposite of what hedge funds had bet on.

u/DeepFuckingValue was up nearly $300k.

Holding

https://www.reddit.com/r/wallstreetbets/comments/g1e5at/gme_yolo_update_following_the_start_of_the_big/

https://www.reddit.com/r/wallstreetbets/comments/g1e5at/gme_yolo_update_following_the_start_of_the_big/

Then, The Big Short Squeeze started.

$GME going up was the opposite of what hedge funds had bet on.

u/DeepFuckingValue was up nearly $300k.

Holding

https://www.reddit.com/r/wallstreetbets/comments/g1e5at/gme_yolo_update_following_the_start_of_the_big/

https://www.reddit.com/r/wallstreetbets/comments/g1e5at/gme_yolo_update_following_the_start_of_the_big/

6/ Here's where the hype cycle begins.

Between Apr & July, 2020, u/DeepFuckingValue's portfolio went down.

$300k back to $100k.

But he keeps holding.

Meanwhile, attention on Reddit begins to build.

"Maybe there's an opportunity here for the REST of us."

Between Apr & July, 2020, u/DeepFuckingValue's portfolio went down.

$300k back to $100k.

But he keeps holding.

Meanwhile, attention on Reddit begins to build.

"Maybe there's an opportunity here for the REST of us."

7/ Then, in August, 2020

u/DeepFuckingValue was up $600,000.

With his original $50k investment (which had fallen as low as $6k at one point), he had continued doubling down on $GME, leveraging The Big Short Squeeze.

Legendary. https://www.reddit.com/r/wallstreetbets/comments/ik5mvp/gme_yolo_monthend_update_aug_2020/

u/DeepFuckingValue was up $600,000.

With his original $50k investment (which had fallen as low as $6k at one point), he had continued doubling down on $GME, leveraging The Big Short Squeeze.

Legendary. https://www.reddit.com/r/wallstreetbets/comments/ik5mvp/gme_yolo_monthend_update_aug_2020/

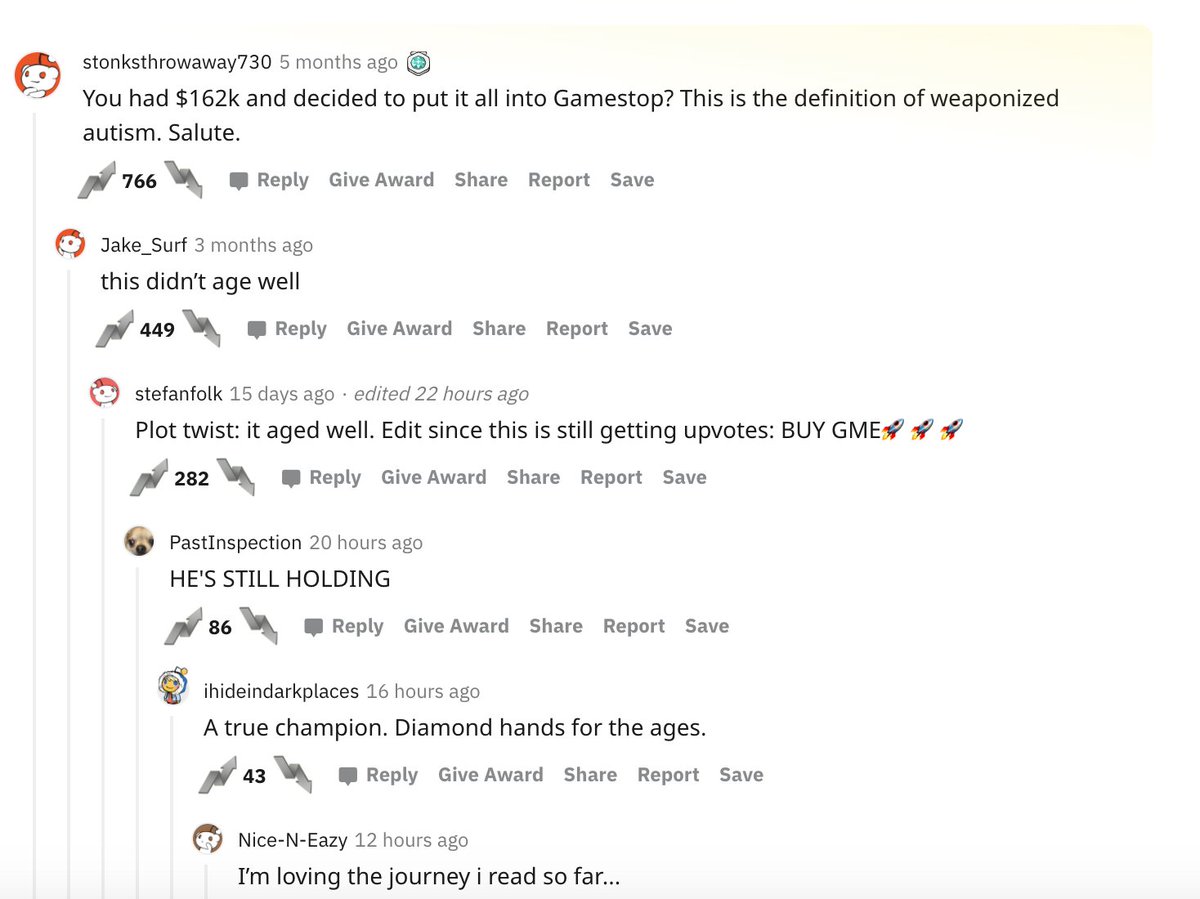

8/ Subreddit /wallstreetbets can't believe it.

u/stonksthrowaway730: "You had $162k and decided to put it all into Gamestop? This is the definition of weaponized autism. Salute."

u/stonksthrowaway730: "You had $162k and decided to put it all into Gamestop? This is the definition of weaponized autism. Salute."

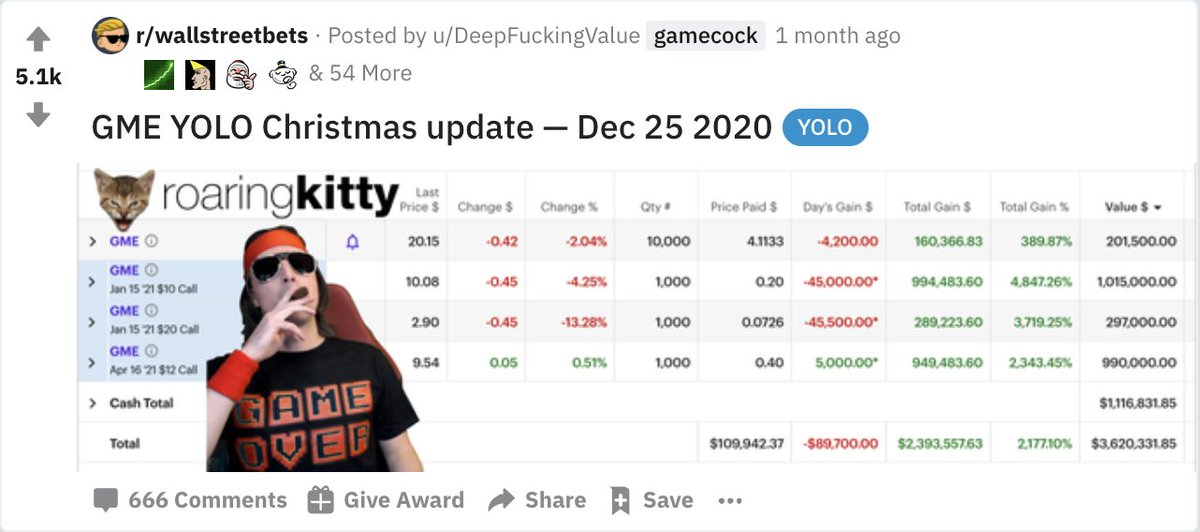

9/ Sept, 2020 is when things start going

By now, Reddit "likes the stock" and, following in u/DeepFuckingValue's footsteps, wants a piece of the action.

Aug: $612,191.84

Sep 1: $823,391.84

Sep 16: $973,838.04

Sep 22: $1,501,116.79

Oct 8: $2,274,323.00

Nov: $3,006,238.38

By now, Reddit "likes the stock" and, following in u/DeepFuckingValue's footsteps, wants a piece of the action.

Aug: $612,191.84

Sep 1: $823,391.84

Sep 16: $973,838.04

Sep 22: $1,501,116.79

Oct 8: $2,274,323.00

Nov: $3,006,238.38

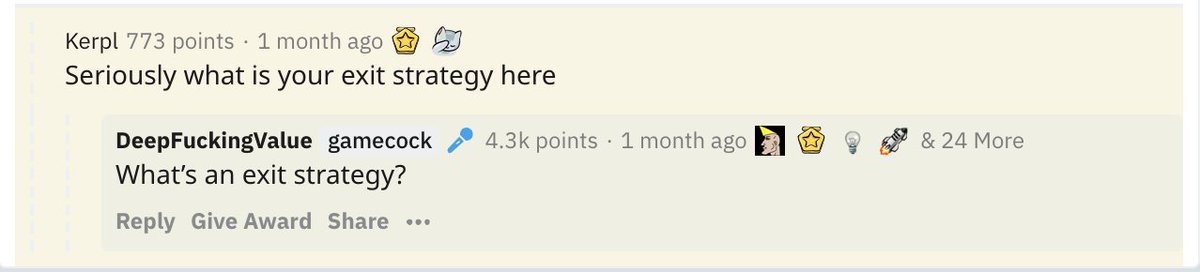

10/ But /wallstreetbets has a BIG question.

"What's your exit strategy here?"

Our legendary investor has turned $50k into $3 million.

Is it game over? Time to pull out and sell?

Not even close

"What's your exit strategy here?"

Our legendary investor has turned $50k into $3 million.

Is it game over? Time to pull out and sell?

Not even close

11/ Here is where the tide begins to turn.

Months prior, Burry exited his position. His bet came true ("a 1,400% gain on GameStop in under four months") & was out.

For /wallstreetbets, the fun was just beginning.

It was time to go to the moon

https://markets.businessinsider.com/news/stocks/big-short-michael-burry-gamestop-stock-price-rally-insane-dangerous-2021-1-1030006593

https://markets.businessinsider.com/news/stocks/big-short-michael-burry-gamestop-stock-price-rally-insane-dangerous-2021-1-1030006593

Months prior, Burry exited his position. His bet came true ("a 1,400% gain on GameStop in under four months") & was out.

For /wallstreetbets, the fun was just beginning.

It was time to go to the moon

https://markets.businessinsider.com/news/stocks/big-short-michael-burry-gamestop-stock-price-rally-insane-dangerous-2021-1-1030006593

https://markets.businessinsider.com/news/stocks/big-short-michael-burry-gamestop-stock-price-rally-insane-dangerous-2021-1-1030006593

12/ More than $$$, what /wallstreetbets realized was the real effect of The Big Short Squeeze.

Suddenly, the narrative became less about $GME fundamentals, and more about who these short sellers were.

"Eat the rich," the subreddit chanted. https://www.reddit.com/r/wallstreetbets/comments/l6omry/an_open_letter_to_melvin_capital_cnbc_boomers_and/

Suddenly, the narrative became less about $GME fundamentals, and more about who these short sellers were.

"Eat the rich," the subreddit chanted. https://www.reddit.com/r/wallstreetbets/comments/l6omry/an_open_letter_to_melvin_capital_cnbc_boomers_and/

13/ January, 2021, on the heels of a tumultuous year filled with civil unrest, political upheaval, blatant racism, a pandemic, and an L-shaped recovery "rebranded" as a K-recovery, /wallstreetbets saw a way to fight back.

Bleed the hedge funds. https://isthesqueezesquoze.com/

Bleed the hedge funds. https://isthesqueezesquoze.com/

14/ This is the most important moment in the story.

It's also the moment the main character of our story is no longer u/DeepFuckingValue, but the entire community of retail investors & everyday people who have never benefitted from the financial system as it stands.

War.

It's also the moment the main character of our story is no longer u/DeepFuckingValue, but the entire community of retail investors & everyday people who have never benefitted from the financial system as it stands.

War.

15/ As u/DeepFuckingValue's portfolio continues to skyrocket, momentum builds on /wallstreetbets that the hedge funds who shorted $GME are hurting.

Buying the stock is no longer about making money.

It's about payback for the '08 financial crisis. https://www.cnbc.com/2021/01/27/hedge-fund-targeted-by-reddit-board-melvin-capital-closed-out-of-gamestop-short-position-tuesday.html

Buying the stock is no longer about making money.

It's about payback for the '08 financial crisis. https://www.cnbc.com/2021/01/27/hedge-fund-targeted-by-reddit-board-melvin-capital-closed-out-of-gamestop-short-position-tuesday.html

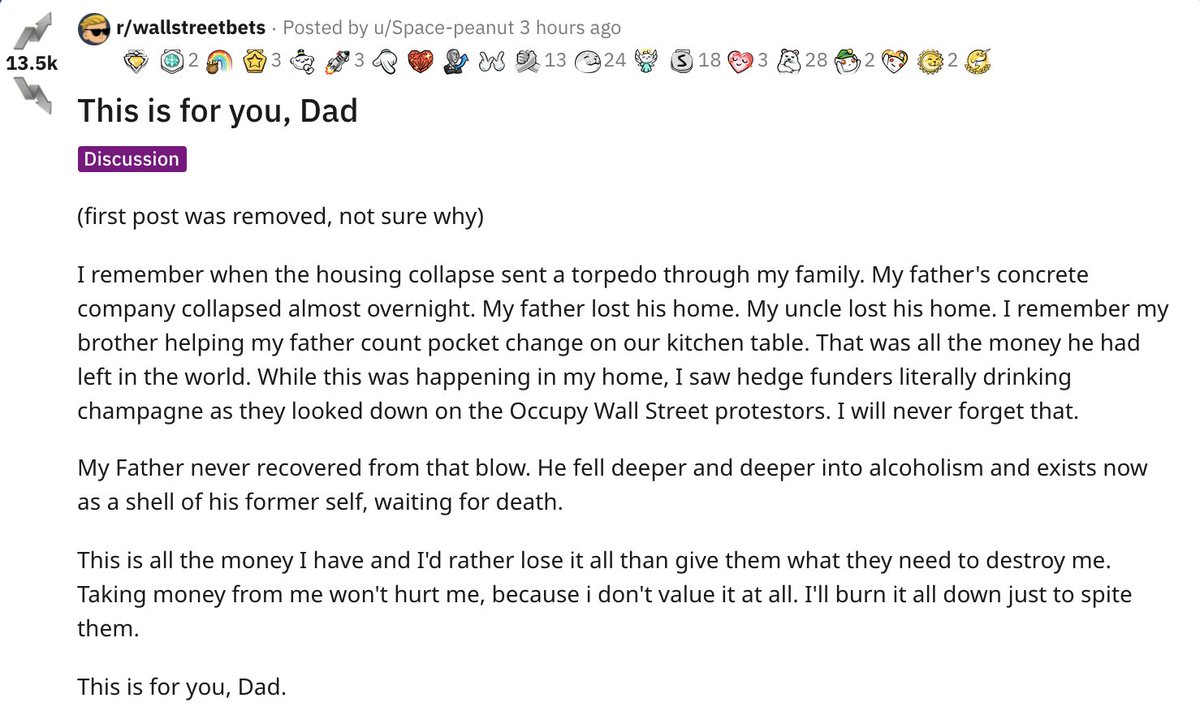

16/ Stories flood /wallstreetbets from everyday people who suffered the market meltdown in 2008.

It's heartbreaking.

Meanwhile, talking heads on CNBC are trying to rationalize the situation based on company fundamentals.

That ship sailed months ago.

"This is for you, Dad."

It's heartbreaking.

Meanwhile, talking heads on CNBC are trying to rationalize the situation based on company fundamentals.

That ship sailed months ago.

"This is for you, Dad."

17/ Jan 27, u/DeepFuckingValue is standing on the front lines (whether he intended to or not).

His portfolio has ballooned to:

$47,973,298.84

Wall Street insists: "You're going to get hurt."

Reddit responds: "WE LIKE THE STOCK." https://www.reddit.com/r/wallstreetbets/comments/l6ekdz/gme_yolo_update_jan_27_2021_guess_i_need_102/

His portfolio has ballooned to:

$47,973,298.84

Wall Street insists: "You're going to get hurt."

Reddit responds: "WE LIKE THE STOCK." https://www.reddit.com/r/wallstreetbets/comments/l6ekdz/gme_yolo_update_jan_27_2021_guess_i_need_102/

18/ What nobody on CNBC seems to realize, however, is that "WE LIKE THE STOCK" is an ironic diss.

It's a phrase repeated endlessly by "professionals" who (everyone knows) invest based on personal/insider information.

/wallstreetbets, as a forum, is that same unfair advantage.

It's a phrase repeated endlessly by "professionals" who (everyone knows) invest based on personal/insider information.

/wallstreetbets, as a forum, is that same unfair advantage.

19/ If this wasn't enough, Jan 28 is when hell breaks loose.

$GME is up to $400/share, the hedge funds who had been shorting it (driving the company into the ground) are bleeding billions, and /wallstreetbets has gone from 2.5 million subs to 5M+ in 48 hours.

Get ready

$GME is up to $400/share, the hedge funds who had been shorting it (driving the company into the ground) are bleeding billions, and /wallstreetbets has gone from 2.5 million subs to 5M+ in 48 hours.

Get ready

20/ Some shady behavior starts going down:

Robinhood, TD Ameritrade, and more, all start restricting people's ability to buy $GME (as well as other "meme-stonks" like $AMC, $BB, $NOK, and more).

This pours gasoline on what is already a raging viral fire

Robinhood, TD Ameritrade, and more, all start restricting people's ability to buy $GME (as well as other "meme-stonks" like $AMC, $BB, $NOK, and more).

This pours gasoline on what is already a raging viral fire

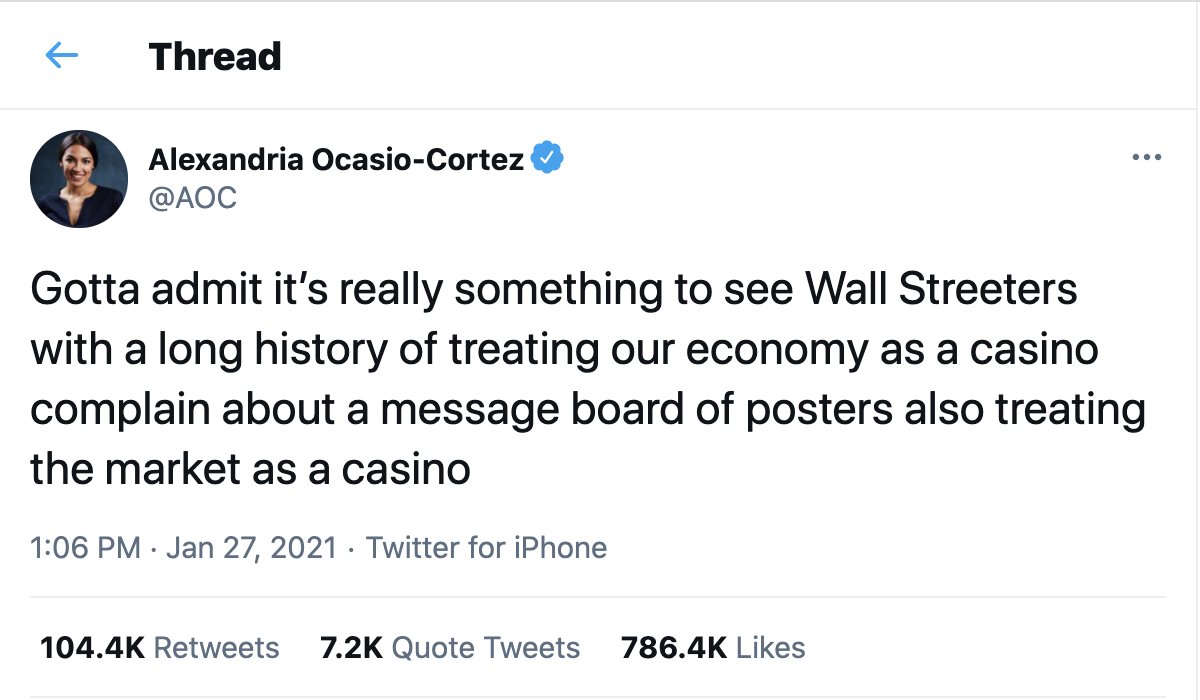

21/ Suddenly, this narrative is no longer confined to the walls of Wall Street—hedge funds vs retail investors.

It's yet another example of inequality in America (and the entire world).

And Buying or Selling $GME is a signal as to which side of the fence you're on.

It's yet another example of inequality in America (and the entire world).

And Buying or Selling $GME is a signal as to which side of the fence you're on.

22/ Hedge funds, brokerages, etc., all start saying, "We care about you. We want to educate you. You don't know what you're doing."

Reddit + retail is saying: "That's what you said last time. And you lied. So guess what? We're not selling.

We're buying more."

Reddit + retail is saying: "That's what you said last time. And you lied. So guess what? We're not selling.

We're buying more."

23/ The longer Redditors and retail investors hold, the harder and harder it is for the hedge funds (who were originally driving $GME into the ground) to exit their short positions.

The result?

They bleed...

and bleed...

and bleed. https://www.reddit.com/r/wallstreetbets/comments/l7p8pk/hold_the_line/

The result?

They bleed...

and bleed...

and bleed. https://www.reddit.com/r/wallstreetbets/comments/l7p8pk/hold_the_line/

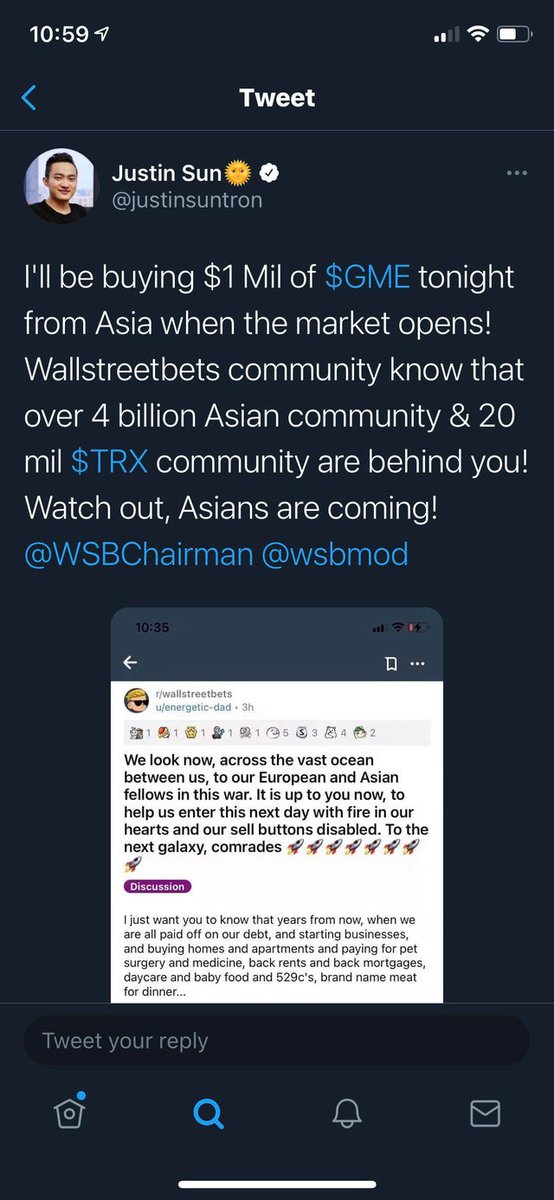

24/ This begins a rallying cry that spreads like wildfire across the internet.

This isn't about $GME at all.

This is about a society where the people with all the money dictate the rules. And for once, it's the disenfranchised who have "all the money."

The Big Short Squeeze

This isn't about $GME at all.

This is about a society where the people with all the money dictate the rules. And for once, it's the disenfranchised who have "all the money."

The Big Short Squeeze

Read on Twitter

Read on Twitter![[THREAD]: The Untold Story Of Reddit's Golden Investor: The God of $GME This is the narrative that deserves more attention...Enjoy. [THREAD]: The Untold Story Of Reddit's Golden Investor: The God of $GME This is the narrative that deserves more attention...Enjoy.](https://pbs.twimg.com/media/Es7F-zkVgAsdrUv.png)