If you've spent time on "Money Twitter" recently, you must have seen what's going on with GameStop stock recently.

It's called a short-squeeze!

What is that?

Read on

//thread//

It's called a short-squeeze!

What is that?

Read on

//thread//

Imagine you believe a stock is too highly valued.

Also imagine you want to capitalize on your view.

What can you do?

Correct, you can sell it - without even holding it.

This is called "shorting" a stock.

Some hedge funds love to do this...

Also imagine you want to capitalize on your view.

What can you do?

Correct, you can sell it - without even holding it.

This is called "shorting" a stock.

Some hedge funds love to do this...

Now, the second step would usually be to tell everyone that you've shorted a particular stock.

Tell everyone.

The more people short, the better for you.

Tell everyone.

The more people short, the better for you.

By theory, now, as the price goes down again, you can buy your shorted shares back much cheaper again - and book a profit.

...by theory.

Now, that's not what has happened recently, isn't it?

So what has happened?

...by theory.

Now, that's not what has happened recently, isn't it?

So what has happened?

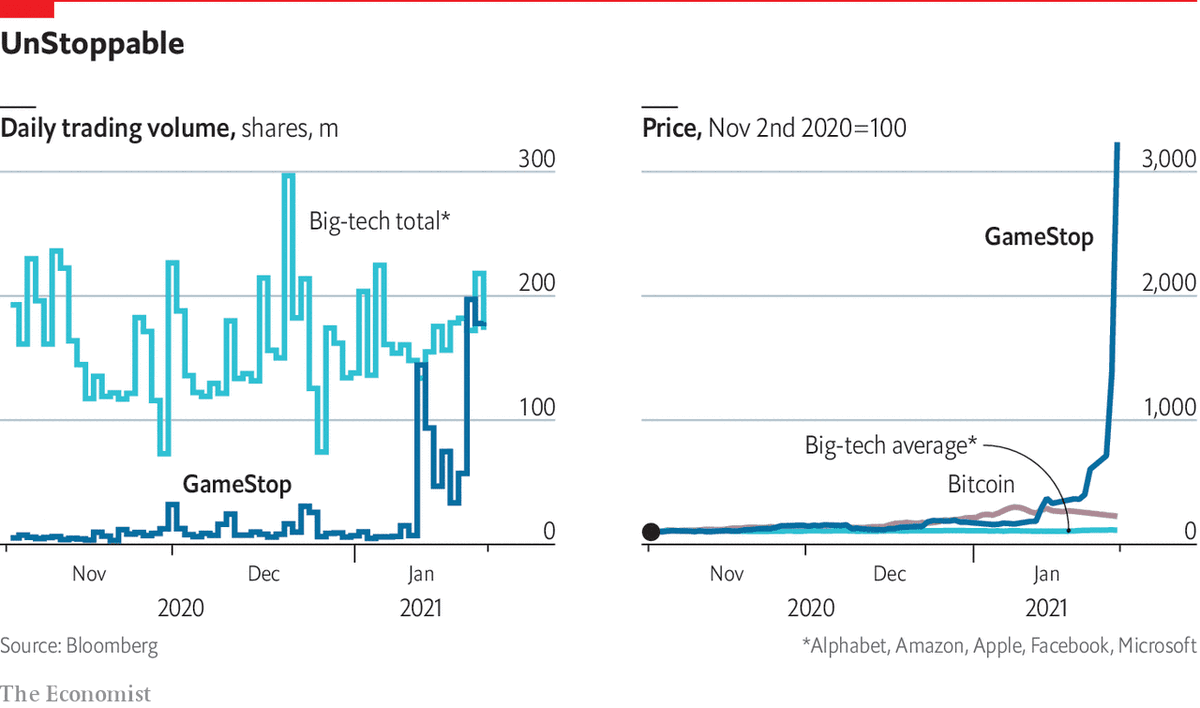

Well, as some hedge funds announced their shorty, some people connected online and decided to hold against them.

Why?

Because GameStop's daily trading volume is not that large and telling everyone you've got a large short is bait!

Why?

Because GameStop's daily trading volume is not that large and telling everyone you've got a large short is bait!

As an organized crew of small investors started to drive the GameStop price higher, the hedge funds started to get under tremendous pressure.

Let's say a share is at $5, if you short it your maximum gain is $5 if it drops down to $0.

If the share goes up to $10, you lose $5...

Let's say a share is at $5, if you short it your maximum gain is $5 if it drops down to $0.

If the share goes up to $10, you lose $5...

But what if the share price goes up further?

If it goes up to $20, well, you lose $15 - per share.

If it goes up to $100, you lose $95...

How long will your broker keep that position "open" for you? It will depend on your margin and deposits.

If it goes up to $20, well, you lose $15 - per share.

If it goes up to $100, you lose $95...

How long will your broker keep that position "open" for you? It will depend on your margin and deposits.

What's next?

When you reach the end of your margin, you get margin-called! Your positions get "covered". What does that mean? Some guys got to buy a lot of shares - no matter the price.

And then?

The price keeps climbing even more!

This is called a short-squeeze.

When you reach the end of your margin, you get margin-called! Your positions get "covered". What does that mean? Some guys got to buy a lot of shares - no matter the price.

And then?

The price keeps climbing even more!

This is called a short-squeeze.

The price will go up as much as required for all the shorts to get covered...

Once they're all covered, the price action shall normalize again.

Once they're all covered, the price action shall normalize again.

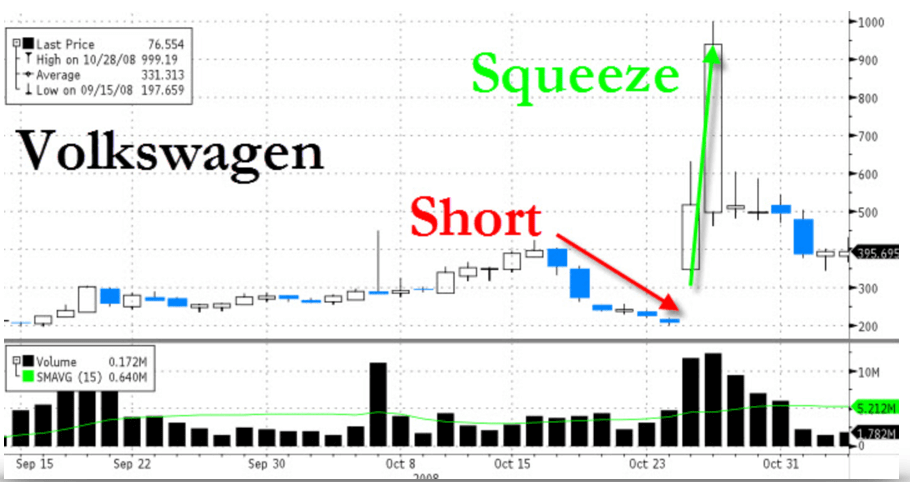

This is not the first time a short squeeze has happened.

They happen every once in a while.

Google Volkswagen or Tesla short squeeze for instance.

What they all have in common?

- they end faster than they started

- some people get filthy rich

- others lose everything

They happen every once in a while.

Google Volkswagen or Tesla short squeeze for instance.

What they all have in common?

- they end faster than they started

- some people get filthy rich

- others lose everything

Over the long run they will appear like a chart anomaly, like a mistake in the historic data archives, something completely out-of-the-ordinary...

Here the Volkswagen short squeeze:

Here the Volkswagen short squeeze:

Lessons learned?

Markets are ruled by human emotions!

Fear of missing out is one -

Fear and greed the other two.

If something like this happens, a lot of people do stuff they don't understand themselves.

No need to keep up with the Joneses!

Learn! https://www.financial-imagineer.com/fear-and-greed/

Markets are ruled by human emotions!

Fear of missing out is one -

Fear and greed the other two.

If something like this happens, a lot of people do stuff they don't understand themselves.

No need to keep up with the Joneses!

Learn! https://www.financial-imagineer.com/fear-and-greed/

Read on Twitter

Read on Twitter