Yesterday I gave a speech @LSE_SRC about the sovereign-bank-corporate nexus generated by the broad-based governmental support during the pandemic, in particular in the form of loan guarantees. 1/10 https://twitter.com/ecb/status/1354841149698174978

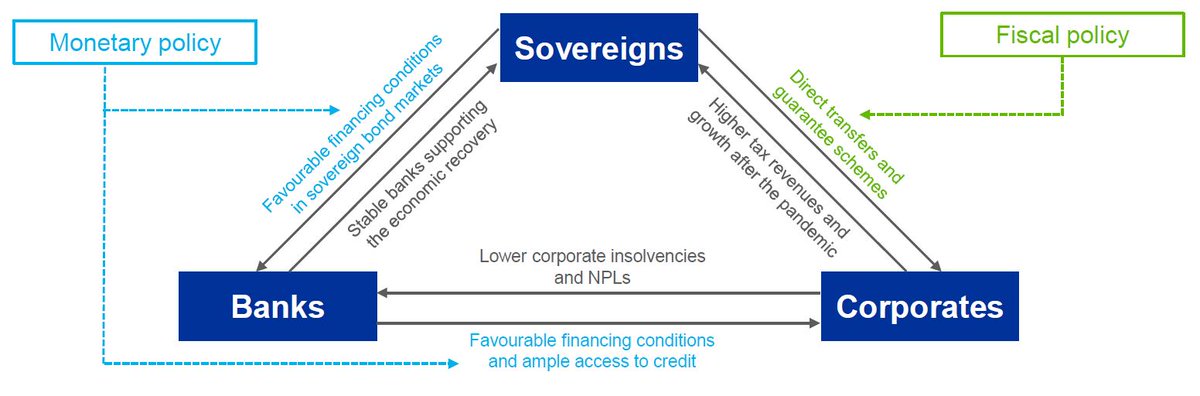

Together with monetary policy, these measures helped prevent an abrupt contraction of credit to firms and a wave of corporate defaults, and protected banks’ profitability and balance sheets. Thereby, they created a virtuous circle between sovereigns, banks and corporates. 2/10

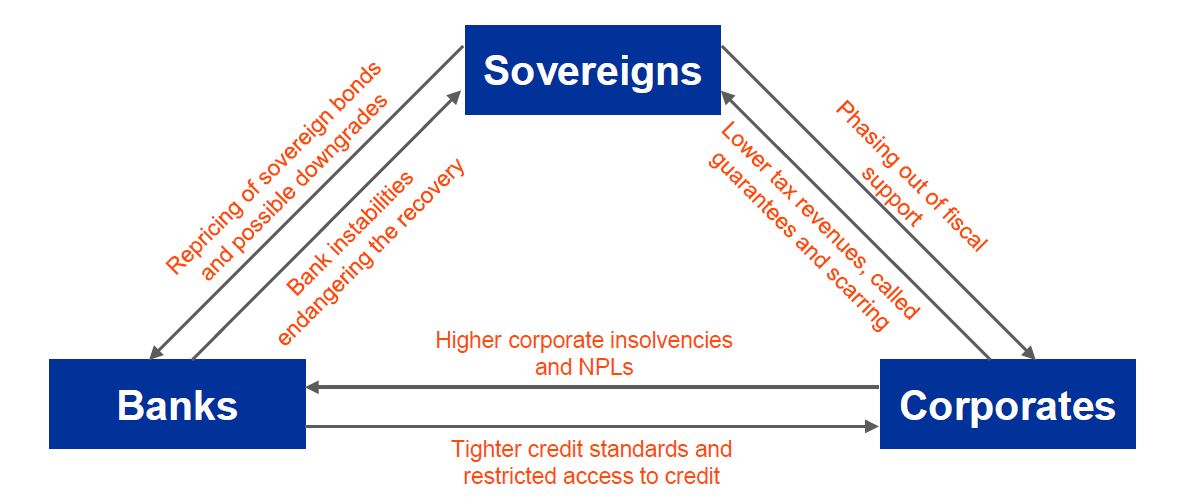

But if governments withdrew their support prematurely, the virtuous circle could turn vicious. It could trigger corporate defaults, a rise in non-performing loans and problems in the banking sector. This could deepen the recession and put pressure on the sovereigns. 3/10

Whether this could happen depends (1) on the effectiveness of policy support. The responsible and timely use of funds provided under Next Generation EU can reinforce the cyclical recovery and bring the economy back to a higher sustainable growth path. 4/10

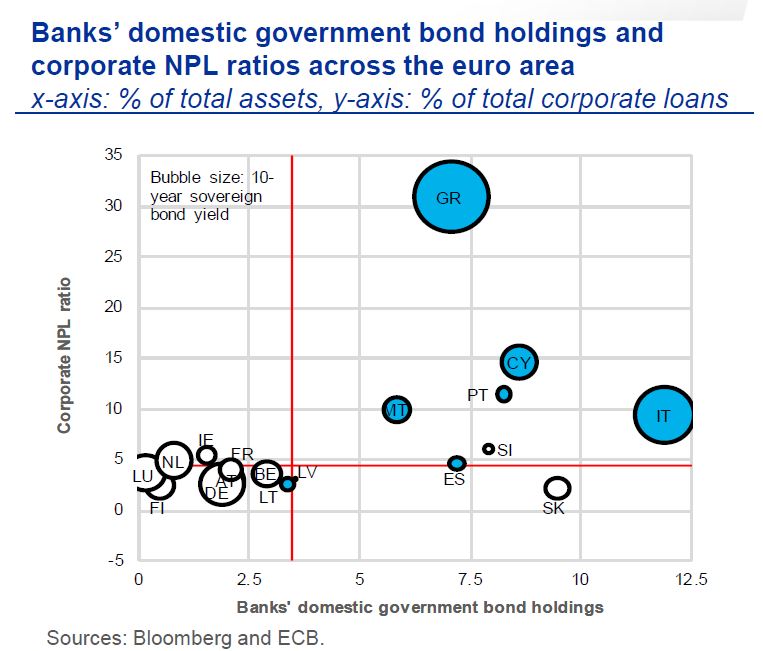

It depends (2) on the degree of divergence among euro area countries. Banks in more highly indebted countries, hit hardest by the crisis, also tend to exhibit higher domestic sovereign exposures and higher corporate NPL ratios, largely reflecting unresolved legacy issues. 5/10

This is also a reminder of the urgent need to make further progress on reforming the euro area’s institutional architecture, by completing the Banking Union, advancing the Capital Markets Union and reviewing the European fiscal framework. 6/10

The emergence of an adverse macro-financial feedback loop would matter for monetary policy because it could slow down the return of inflation to our medium-term aim and because it could impair the smooth transmission of monetary policy through financial instabilities. 7/10

Therefore, the @ecb continues to call on governments to extend targeted government support for as long as needed, and to use public funds with a clear focus on raising productivity and long-term growth potential. 8/10

The ECB will preserve favourable financing conditions for as long as necessary through the extension and expansion of our targeted longer-term refinancing operations (TLTRO III) and our asset purchases under the PEPP. 9/10

The long duration of PEPP stabilises financial markets by mitigating the risk of a sudden repricing. This helps to increase the efficiency of purchases. Our commitment to preserve favourable financing conditions implies that we maintain a strong presence in EA bond markets. 10/10

Read on Twitter

Read on Twitter