So $XRT to saw a $506 million outflow earlier this week. Equivalent to ~70% of the entire fund. Basically because it had a ton of $GME shares. And they were HIGH demand. Basically, $XRT acted like a dealer in the market... +1 for ETFs.

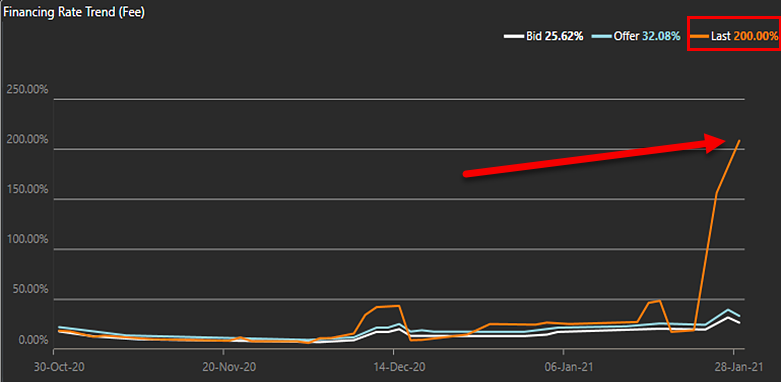

How high was the demand? According to @ihors3 & @S3Partners the borrow rates were 200% and even higher in some cases. Indicating the imbalance between share lending/hedging demand and the number available for loan.

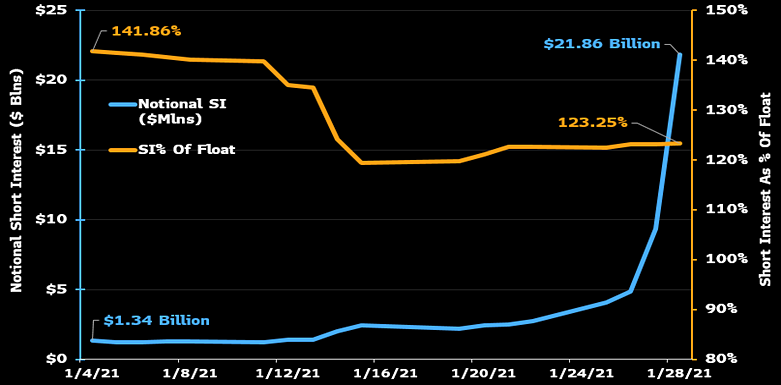

And obviously, as has been thoroughly flushed out. Short Interest was still quite high (falling some but not much) and notional short levels were skyrocketing. So people likely went to $XRT to get a quick delivery of ~192,000 $GME shares.

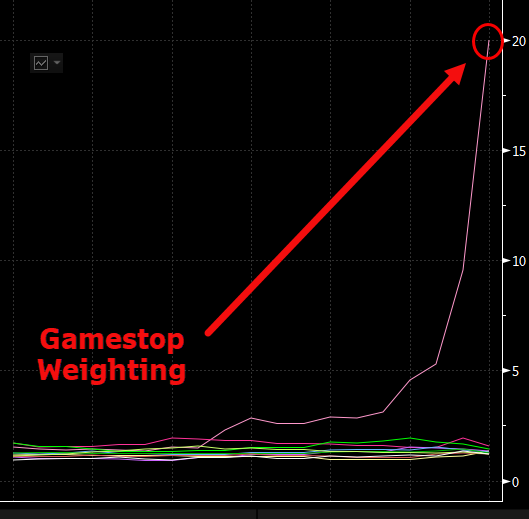

It was a perfect storm that lead to stripping the fund for parts. Or in this case one part -- Gamestop. It skyrocketed from 1% weight to 20% in a matter of days. $XRT is meant to be equal weighted with each stock a bit over 1% and rebalances quarterly. Next rebalance is March.

This and some additional detail/color on the terminal at:

https://blinks.bloomberg.com/news/stories/QNP7A7T1UM13

https://blinks.bloomberg.com/news/stories/QNP7A7T1UM13

Read on Twitter

Read on Twitter