1. One thing we can leader from the GameStop situation is the nature of @RobinhoodApp and what kind of business it is in.

It is free to use and free to make trades.

So how does it make money?

It sells trades generated by its users to hedge funds and others

It is free to use and free to make trades.

So how does it make money?

It sells trades generated by its users to hedge funds and others

2. @RobinhoodApp is selling what is known as "order flow."

Robinhood's biggest buyer of order flow is Citadel, which is also one of the hedge funds that bailed out Melvin Capital, which shorted a lot of GameStop stock

Robinhood's biggest buyer of order flow is Citadel, which is also one of the hedge funds that bailed out Melvin Capital, which shorted a lot of GameStop stock

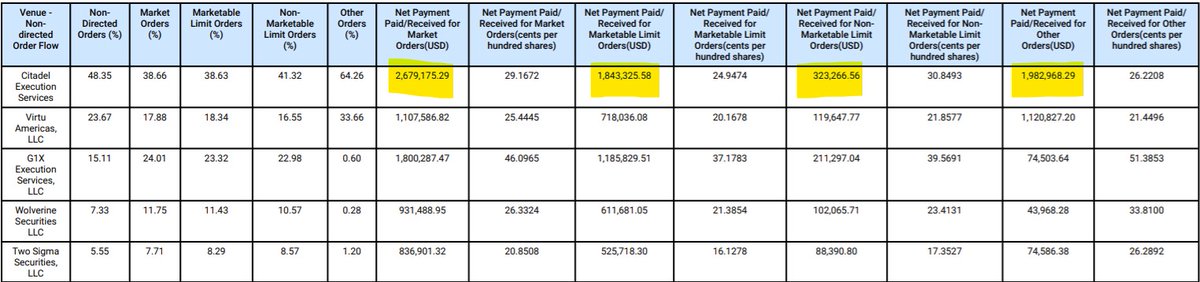

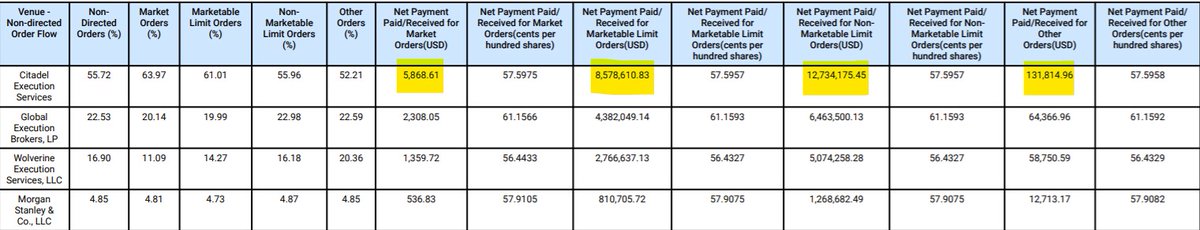

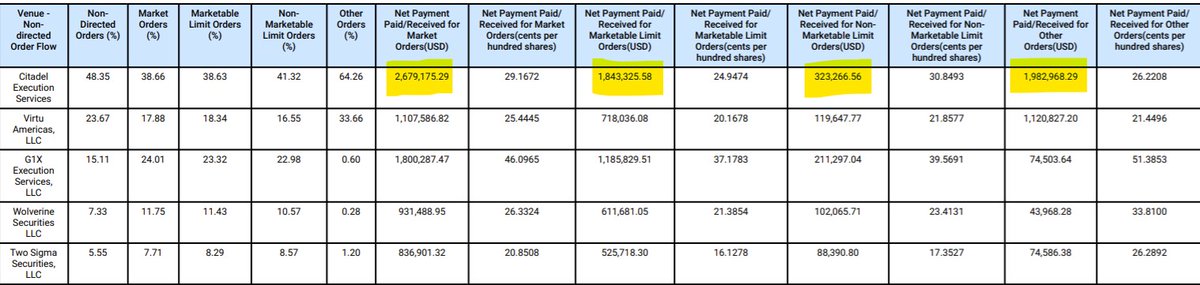

3. How much does Citadel pay @RobinhoodApp for order flow. Luckily, this information is publicly available through a required SEC disclosure.

In September 2020 alone (last month available) Citadel paid Robinhood more than $30 million for order flow

https://cdn.robinhood.com/assets/robinhood/legal/RHS%20SEC%20Rule%20606a%20and%20607%20Disclosure%20Report%20Q3%202020.pdf

In September 2020 alone (last month available) Citadel paid Robinhood more than $30 million for order flow

https://cdn.robinhood.com/assets/robinhood/legal/RHS%20SEC%20Rule%20606a%20and%20607%20Disclosure%20Report%20Q3%202020.pdf

4. I'm not an expert in the plumbing of the financial markets. Perhaps it was necessarily for @RobinhoodApp to halt trading on GameStop and other stocks yesterday.

But, in doing so, it appeared to benefit the large firms that are its actual customers at the expense of its users

But, in doing so, it appeared to benefit the large firms that are its actual customers at the expense of its users

5. If you want the background on how this whole situation started, I wrote about it yesterday. https://popular.info/p/the-merry-adventures-of-robinhood

6. We need to learn more about exactly what Robinhood and other retail platforms did and why they did it.

The companies are starting to say more, but there are a lot unanswered Qs

For updates and accountability journalism, sign up for the newsletter http://popular.info/subscribe

The companies are starting to say more, but there are a lot unanswered Qs

For updates and accountability journalism, sign up for the newsletter http://popular.info/subscribe

Read on Twitter

Read on Twitter