1/6 @Artem_Lazarevv of @whale_map grouped the realized price (price at last on-chain movement) of unspent transactions of certain sizes & found that the #Bitcoin  price finds support & resistance there

price finds support & resistance there

Short with a summary & some thoughts

with a summary & some thoughts

Source: https://lazarevv.medium.com/introducing-cohort-based-on-chain-analysis-part-1-realised-price-c06183874059

price finds support & resistance there

price finds support & resistance there

Short

with a summary & some thoughts

with a summary & some thoughts

Source: https://lazarevv.medium.com/introducing-cohort-based-on-chain-analysis-part-1-realised-price-c06183874059

2/6 The Realized Cap was originally introduced by @nic__carter & @khannib and is calculated by multiplying the #Bitcoin  supply with the price of all unspent #Bitcoin

supply with the price of all unspent #Bitcoin  transactions when last moved on-chain

transactions when last moved on-chain

It represents the estimated average value that was paid for each #Bitcoin

supply with the price of all unspent #Bitcoin

supply with the price of all unspent #Bitcoin  transactions when last moved on-chain

transactions when last moved on-chainIt represents the estimated average value that was paid for each #Bitcoin

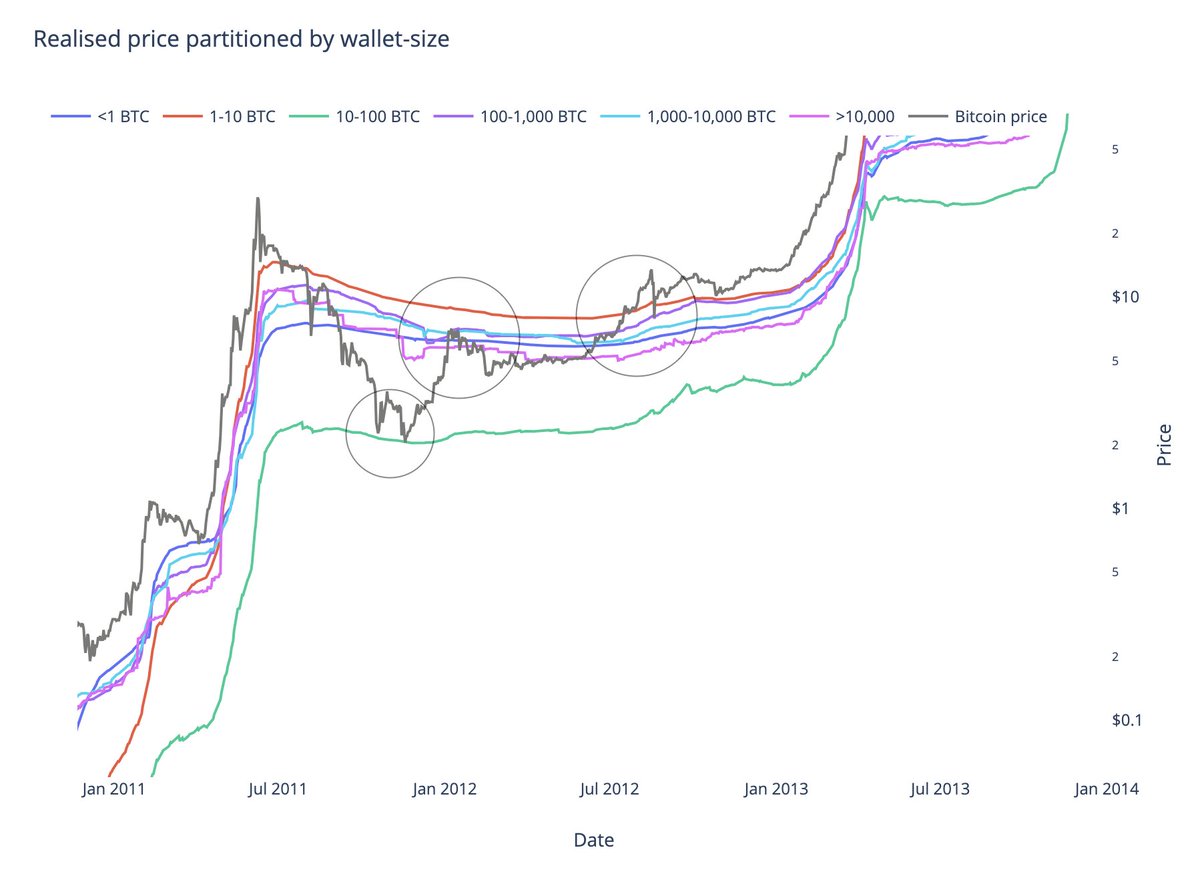

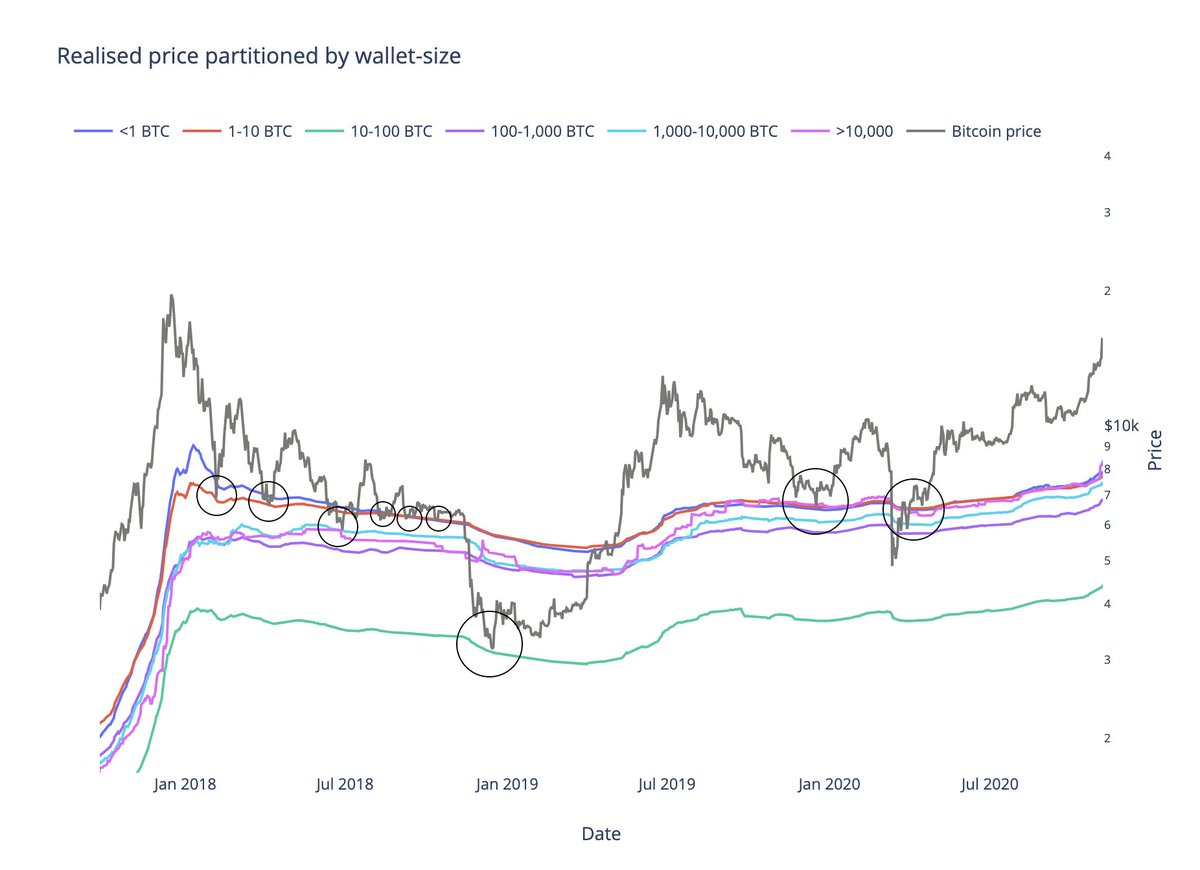

3/6 What the guys at @whale_map did, was calculate the realized price of each unspent transaction and group them by size (<1, 1-10, 10-100, 100-1000, 1000-10000 & >10000 BTC)

This approximates the #Bitcoin price paid by different holder bases, like whales or retail investors

price paid by different holder bases, like whales or retail investors

This approximates the #Bitcoin

price paid by different holder bases, like whales or retail investors

price paid by different holder bases, like whales or retail investors

4/6 During  market conditions where the #Bitcoin

market conditions where the #Bitcoin  price is searching for a bottom, these levels turn out to provide support and/or resistance

price is searching for a bottom, these levels turn out to provide support and/or resistance

Simply put; market participants appear to buy when price returns to 'their' price level, or sell when it reaches the break-even point

market conditions where the #Bitcoin

market conditions where the #Bitcoin  price is searching for a bottom, these levels turn out to provide support and/or resistance

price is searching for a bottom, these levels turn out to provide support and/or resistance

Simply put; market participants appear to buy when price returns to 'their' price level, or sell when it reaches the break-even point

5/6 Some observations:

- The 10-100 BTC realized price level appears to be a great market cycle bottom catcher

- That level contains many coins that were mined between 2009-2012 and never moved, incl. Satoshi's coins

- The levels are not necessarily ordered by wallet size

- The 10-100 BTC realized price level appears to be a great market cycle bottom catcher

- That level contains many coins that were mined between 2009-2012 and never moved, incl. Satoshi's coins

- The levels are not necessarily ordered by wallet size

6/6 Some ideas for future work:

- Create an alternative version that excludes unspent miner coins; might hold more 'pure' market participant behavior?

- Calculate ratio's between these price levels to see if the diverging or converging of levels holds market (cycle) information

- Create an alternative version that excludes unspent miner coins; might hold more 'pure' market participant behavior?

- Calculate ratio's between these price levels to see if the diverging or converging of levels holds market (cycle) information

Read on Twitter

Read on Twitter