Lemme tell you a story you may not know by heart but will definitely recognize.

Here’s why you should never feel bad for Wall Street...

Here’s why you should never feel bad for Wall Street...

We’ll start in the 1930s.

Following the Great Depression, public confidence in the few banks that had survived bottomed out.

To combat this sentiment, consumer protection regulatory laws like the Glass-Steagall Act were codified.

Following the Great Depression, public confidence in the few banks that had survived bottomed out.

To combat this sentiment, consumer protection regulatory laws like the Glass-Steagall Act were codified.

The intention was to separate commercial bank activity from that of investment banks and protect consumers from the damaging bank runs that defined the era.

These runs were only possible because of the commingling of these bank processes to begin with.

These runs were only possible because of the commingling of these bank processes to begin with.

Anyway, the direct result of this *unwanted* (from wall streets perspective) regulation was to put a squeeze on publicly available credit lines. For example, in many cases 50% down payments were required for mortgages.

The public needed access to capital and lenders weren’t budging so the race to deregulation was on.

The first domino to fall was the creation of the federal housing administration and subsequent implementation of FHA loans.

The first domino to fall was the creation of the federal housing administration and subsequent implementation of FHA loans.

Not long afterward, in 1938, Fannie Mae was created. A government backed enterprise, or GSE, Mae’s initial purpose was to insure these loans on the secondary mortgage market. In essence, it helped subsidize lender risk exposure.

Credit became slightly more attainable.

Credit became slightly more attainable.

Then came WW2 & the creation of the VA loan system in 1944. Under this system, *some* vets became eligible for low interest, govt insured, loans to buy homes

*some because practices like redlining were rampant & barred minorities from equal access

Banks softened requirements

*some because practices like redlining were rampant & barred minorities from equal access

Banks softened requirements

In the early 1950s, Fannie Mae started to reorganize its business model & began dabbling in commercial loans in addition to its previous obligations insuring FHA & VA loans. In 1954 Fannie Mae became partially privatized, yet still retained its tax exempt status.

In 1968, Fannie became fully privatized by the HUD Act & the creation of Ginnie Mae introduced the use of Mortgage Backed Securities [MBSs] (a tool to be used later to compile & resell groups of loans on the secondary mortgage market).

Lending became even easier.

Lending became even easier.

Two years later, in 1970, Freddie Mac was created for the purpose of extending this loan insurance to commercial mortgagees on a wide scale.

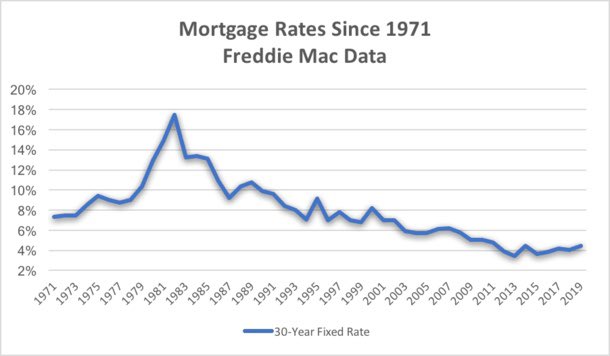

In the years that followed, only soaring interest rates provided any reason for pause for lenders looking to strike it rich-er.

In the years that followed, only soaring interest rates provided any reason for pause for lenders looking to strike it rich-er.

After reaching its zenith in the early 1980s interest rates began to steadily decrease, credit became more accessible, and more and more Americans became homeowners.

This in turn would drive up property values nationwide as demand increased with fewer people locked out of loans

This in turn would drive up property values nationwide as demand increased with fewer people locked out of loans

Wall Street’s response was to continue to lower the requirements for attaining mortgages and to create private financial institutions called Private Label Securities (PLSs) that intended to mirror the mortgage “insurance” models earlier introduced by Fannie, Freddie, and Ginnie.

In 1999, the repeal of the Glass-Steagall Act recreated conditions for the financial Wild West.

As this was the proverbial other shoe dropping sign long awaited for by PSLs they now had the green light to buy up MBSs rapidly. And they did in droves.

As this was the proverbial other shoe dropping sign long awaited for by PSLs they now had the green light to buy up MBSs rapidly. And they did in droves.

Once purchased, MBSs (groups of 1000s of loans) would be repackaged into other financial instruments like collateralized mortgage obligations (CMOs) that had fewer restrictions. These would then be resold & repackaged multiple times to different investors in this secondary market

The result was a need for more mortgages to be packaged into these lucrative investments, and lenders were all too happy to provide them by any means necessary. Predatory Adjustable Rate Mortgages & NINJA loans were advertised and issued to people without proper underwriting.

As long as home values continued to soar there was no issue to be had as refinancing was easily done.

But as the housing bubble burst & residential property inventory outpaced demand - prices fell & people began to default.

But as the housing bubble burst & residential property inventory outpaced demand - prices fell & people began to default.

Private investors and PLSs that had insured these now defaulting mortgages were left holding the bag as their previously lucrative (high interest rate driven) investments began to be called in & the collapse of 2008 known as the Great Recession kicked off.

Those who had only experienced the 1-2 year teaser rates of their adjustable rate mortgages realized the new rates were untenable followed suit and the pain deepened for secondary market investors.

So who bore the responsibility of these shady lending practices & secondary mortgage market profiteering you might ask?

Why, the ones making the risky investments of course. The hedge funds, insurance companies, and secondary mkt institutions that leveraged 10x right?

Why, the ones making the risky investments of course. The hedge funds, insurance companies, and secondary mkt institutions that leveraged 10x right?

WRONG! According to this article from MITs Sloan School of management ( https://mitsloan.mit.edu/ideas-made-to-matter/heres-how-much-2008-bailouts-really-cost) YOU, the American taxpayer did through the highly publicized bailouts of Fannie, Freddie, AIG, Banks & businesses run by Wall Street

So, in summary:

Banks wouldn’t lend because they were afraid they might lose money.

So the government deregulated again, and again, and again, and again

Until Wall Street took full advantage and tanked the system and lobbied to have...

YOU pick up the tab.

Banks wouldn’t lend because they were afraid they might lose money.

So the government deregulated again, and again, and again, and again

Until Wall Street took full advantage and tanked the system and lobbied to have...

YOU pick up the tab.

This latest uproar over $GME and the call for regulation is just the latest example of a grift as old as time

I urge you to recognize that this isn’t even the most egregious showing of the difference between the haves and have nots in the last 20 years.

Robinhood isn’t unique

I urge you to recognize that this isn’t even the most egregious showing of the difference between the haves and have nots in the last 20 years.

Robinhood isn’t unique

Don’t continue to normalize this kind of behavior.

Take a stand for your future and the future of those dear to you. Because they damn well won’t.

Take a stand for your future and the future of those dear to you. Because they damn well won’t.

Read on Twitter

Read on Twitter